285x Filetype XLSX File size 0.09 MB Source: centurypacific.com.ph

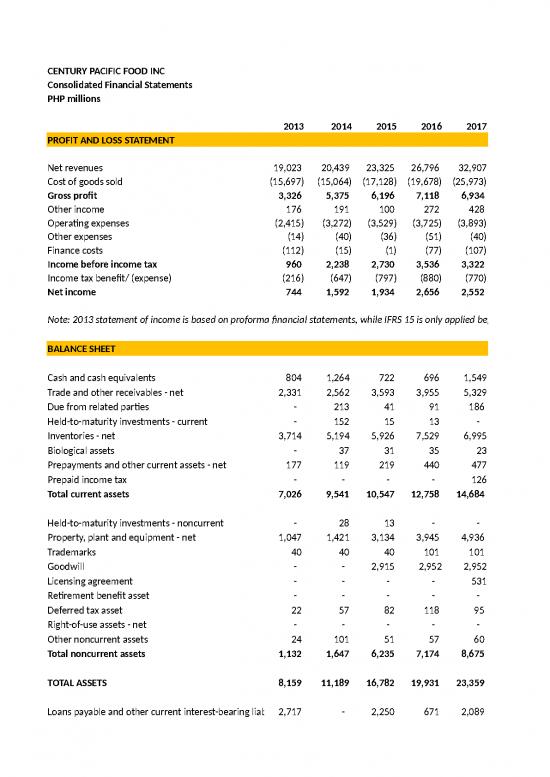

CENTURY PACIFIC FOOD INC

Consolidated Financial Statements

PHP millions

2013 2014 2015 2016 2017

PROFIT AND LOSS STATEMENT

Net revenues 19,023 20,439 23,325 26,796 32,907

Cost of goods sold (15,697) (15,064) (17,128) (19,678) (25,973)

Gross profit 3,326 5,375 6,196 7,118 6,934

Other income 176 191 100 272 428

Operating expenses (2,415) (3,272) (3,529) (3,725) (3,893)

Other expenses (14) (40) (36) (51) (40)

Finance costs (112) (15) (1) (77) (107)

Income before income tax 960 2,238 2,730 3,536 3,322

Income tax benefit/ (expense) (216) (647) (797) (880) (770)

Net income 744 1,592 1,934 2,656 2,552

Note: 2013 statement of income is based on proforma financial statements, while IFRS 15 is only applied beginning 2016.

BALANCE SHEET

Cash and cash equivalents 804 1,264 722 696 1,549

Trade and other receivables - net 2,331 2,562 3,593 3,955 5,329

Due from related parties - 213 41 91 186

Held-to-maturity investments - current - 152 15 13 -

Inventories - net 3,714 5,194 5,926 7,529 6,995

Biological assets - 37 31 35 23

Prepayments and other current assets - net 177 119 219 440 477

Prepaid income tax - - - - 126

Total current assets 7,026 9,541 10,547 12,758 14,684

Held-to-maturity investments - noncurrent - 28 13 - -

Property, plant and equipment - net 1,047 1,421 3,134 3,945 4,936

Trademarks 40 40 40 101 101

Goodwill - - 2,915 2,952 2,952

Licensing agreement - - - - 531

Retirement benefit asset - - - - -

Deferred tax asset 22 57 82 118 95

Right-of-use assets - net - - - - -

Other noncurrent assets 24 101 51 57 60

Total noncurrent assets 1,132 1,647 6,235 7,174 8,675

TOTAL ASSETS 8,159 11,189 16,782 19,931 23,359

Loans payable and other current interest-bearing liabi 2,717 - 2,250 671 2,089

Trade and other payables 2,535 4,099 3,864 4,730 5,031

Income tax payable 52 128 147 149 -

Due to related parties - 286 14 90 22

Lease liabilities - current portion - - - - -

Total current liabilities 5,305 4,514 6,274 5,639 7,142

Long-term debt - - - 1,634 1,620

Retirement benefit obligation 14 94 157 118 108

Lease liabilities - net of current portion - - - - -

Deferred tax liability 1 0 4 3 8

Total noncurrent liabilities 15 94 161 1,754 1,735

Share capital 1,500 2,231 2,361 3,541 3,542

Share premium - 2,769 4,912 4,912 4,928

Share-based compensation reserve - 3 5 5 8

Other reserves - 31 31 31 31

Currency translation adjustment 19 19 49 35 40

Retained earnings (deficit) 1,319 1,526 2,990 4,015 5,934

Total equity 2,839 6,580 10,347 12,539 14,483

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 8,159 11,189 16,782 19,932 23,359

Note: 2013 balance sheet is based on proforma financial statements.

STATEMENT OF CASH FLOWS

Cash flows from operating activities

Income before income tax 960 2,238 2,730 3,535 3,322

Adjustments for:

Depreciation 193 153 152 359 525

Finance costs 112 15 1 77 107

Doubtful accounts expense/ provisions - 30 13 94 8

Reversal of impairment/writeoff of accruals (17) - - (76) (111)

Reversal of allowance for doubtful accounts - - - - (33)

Loss on inventory obsolescence 4 71 22 26 23

Loss (gain) on disposal of PPE and sale of scrap 3 (0) 4 (9) (161)

Retirement benefit expense 9 18 58 34 40

Impairment loss on trade and other receivables/ VAT 4 - 13 5 1

Loss on impairment of PPE - - - - 2

Loss on impairment of trademark - - - -

Loss on transfer of retirement benefit obligation - 16 - - -

Loss on impairment of goodwill - - - - -

Share-based compensation expense - 3 2 3

Unrealized forex gain - (0) 11 (5) (130)

Amortization of premiums from HTM investments - - - - -

Interest income (10) (9) (8) (6) (5)

Operating cash flows before WC changes 1,260 2,535 2,999 4,035 3,592

Decrease (increase) in:

Trade and other receivables (1,057) (1,560) (780) (313) (1,213)

Due from related parties - (904) 171 (50) (95)

Inventories 2,057 (3,663) (537) (1,548) 725

Biological assets - (37) 6 (3) 12

Prepayments and other current assets - net 144 25 1 (225) (33)

Other noncurrent assets 5 (79) 99 (7) (2)

Increase (decrease) in:

Trade and other payables (1,136) 4,009 (405) 808 353

Due to related parties - 501 (1,378) (21) (68)

Financial lease obligation - - - - -

Other noncurrent liabilities (65) - - - -

Exchange differences on translating operating A&L 7 2 (66) - -

Cash generated from operations 1,215 827 110 2,676 3,271

Contribution to retirement fund (8) (31) (31) (41) (44)

Income tax paid (221) (535) (783) (924) (1,019)

Interest received - - 6 5 4

Net cash from (used in) operating activities 985 262 (698) 1,715 2,212

Cash flows from investing activities

Acquisition of PPE (342) (540) (1,068) (1,559) (1,532)

Proceeds from sale of PPE 80 5 364 358 19

Acquisition of HTM investments/trademark - (183) 151 14 13

Acquisition of intangible assets - - - (61) (538)

Acquisition of subdidiaries (net of cash acquired) - - (3,371) (11) -

Interest income received 10 11 3 1 0

Net cash used in investing activities (252) (706) (3,921) (1,259) (2,038)

Cash flows from financing activities

Proceeds from issuance of share capital - 3,500 2,272 - 17

Net receipts from related parties - - - - -

Net proceeds from (repayments of) loans (556) (2,215) 2,250 54 1404

Finance costs paid (112) (15) - (65) (105)

Dividends paid - (446) (472) (638)

Payment of lease liabilities - - - - -

Net cash from (used in) financing activities (668) 1,270 4,076 (483) 679

65 826 (542) (27) 853

Net increase (decrease) in cash and cash equ

Cash, beginning 739 438 1,264 722 696

Cash, ending 804 1,264 722 696 1,549

Free Cash Flow 643 (278) (1,765) 156 680

Note: 2013 statement of cash flows is based on proforma financial statements.

2018 2019 2020

37,885 40,560 48,302

(29,738) (30,836) (36,374)

8,147 9,724 11,928

536 536 616

(4,720) (5,333) (6,351)

(164) (520) (804)

(197) (369) (261)

3,602 4,039 5,128

(768) (890) (1,248)

2,834 3,149 3,879

Note: 2013 statement of income is based on proforma financial statements, while IFRS 15 is only applied beginning 2016.

1,676 1,608 1,229

7,076 7,001 7,600

123 262 281

- - -

11,656 11,782 14,313

43 33 66

467 830 484

- - -

21,041 21,515 23,973

- - -

5,458 6,415 7,291

101 101 67

2,915 2,915 2,915

509 488 466

- - -

219 360 752

- 705 678

92 90 133

9,295 11,074 12,303

30,336 32,589 36,276

3,210 2,434 3,533

no reviews yet

Please Login to review.