346x Filetype XLSX File size 0.05 MB Source: annualreport.dsm.com

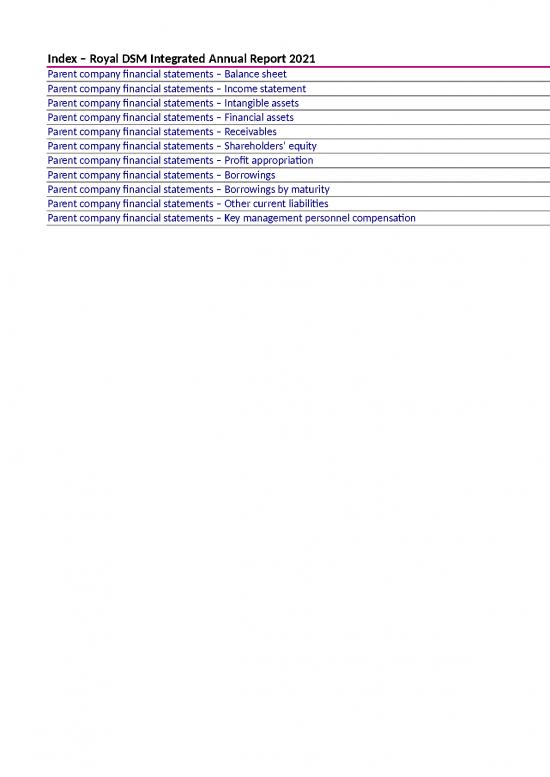

Sheet 1: Index

| Back to index | |||

| Royal DSM Integrated Annual Report 2021 | |||

| Balance sheet | |||

| x € million | Note | 2021 | 2020 |

| Assets | |||

| Intangible assets | 2 | 464 | 825 |

| Financial assets | 3 | 13,789 | 12,016 |

| Deferred tax assets | 4 | 97 | 132 |

| Other deferred items | 2 | 2 | |

| Non-current assets | 14,352 | 12,975 | |

| Receivables | 5 | 77 | 63 |

| Cash and cash equivalents | 1 | - | |

| Current assets | 78 | 63 | |

| Total | 14,430 | 13,038 | |

| Shareholders’ equity and liabilities | |||

| Share capital | 6 | 328 | 338 |

| Share premium | 6 | 471 | 489 |

| Treasury shares | 6 | (177) | (976) |

| Legal reserves | 6 | 460 | (14) |

| Other reserves, incl. retained earnings | 6 | 6,700 | 7,196 |

| Undistributed results: | 6 | ||

| - Net profit for the year | 6 | 1,676 | 506 |

| - Less: interim dividend | 6 | (140) | (140) |

| Shareholders’ equity | 6 | 9,318 | 7,399 |

| Borrowings | 7 | 2,739 | 3,237 |

| Other non-current liabilities | 8 | 8 | |

| Non-current liabilities | 2,747 | 3,245 | |

| Current liabilities | |||

| Other current liabilities | 8 | 2,365 | 2,394 |

| Current liabilities | 2,365 | 2,394 | |

| Total | 14,430 | 13,038 | |

| Back to index | |||

| Royal DSM Integrated Annual Report 2021 | |||

| Income statement | |||

| x € million | Note | 2021 | 2020 |

| Other income | 1 | 18 | 20 |

| Cost of outsourced work and other external costs | (21) | (17) | |

| Wages and salaries | 10 | (5) | (9) |

| Other movements in the value of intangible assets | (5) | - | |

| Other operating expense | (1) | (2) | |

| Total operating expenses | (32) | (28) | |

| Operating profit | (14) | (8) | |

| Financial expense | 11 | (106) | (95) |

| Profit before income tax | (120) | (103) | |

| Income tax | 4 | (3) | 24 |

| Share of the profit of subsidiaries | 3 | 1,784 | 585 |

| Profit after income tax | 1,661 | 506 | |

| Income from receivables attributable to non-current assets and from investments | 15 | - | |

| Net profit available to equity holders of Koninklijke DSM N.V. | 1,676 | 506 | |

no reviews yet

Please Login to review.