220x Filetype XLSX File size 0.06 MB Source: www.mgic.com

Sheet 1: Instructions

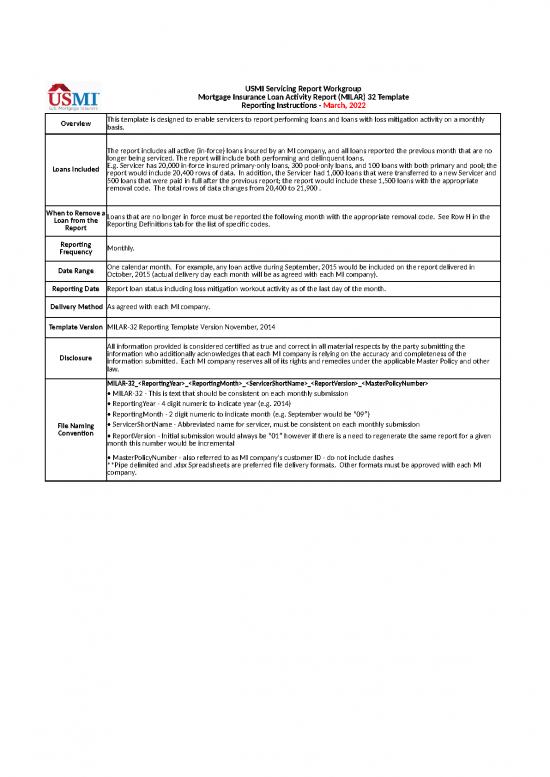

| USMI Servicing Report Workgroup Mortgage Insurance Loan Activity Report (MILAR) 32 Template Reporting Instructions - March, 2022 |

|

| Overview | This template is designed to enable servicers to report performing loans and loans with loss mitigation activity on a monthly basis. |

| Loans Included | The report includes all active (in-force) loans insured by an MI company, and all loans reported the previous month that are no longer being serviced. The report will include both performing and delinquent loans. E.g. Servicer has 20,000 in-force insured primary-only loans, 300 pool-only loans, and 100 loans with both primary and pool; the report would include 20,400 rows of data. In addition, the Servicer had 1,000 loans that were transferred to a new Servicer and 500 loans that were paid in full after the previous report; the report would include these 1,500 loans with the appropriate removal code. The total rows of data changes from 20,400 to 21,900 . |

| When to Remove a Loan from the Report | Loans that are no longer in force must be reported the following month with the appropriate removal code. See Row H in the Reporting Definitions tab for the list of specific codes. |

| Reporting Frequency | Monthly. |

| Date Range | One calendar month. For example, any loan active during September, 2015 would be included on the report delivered in October, 2015 (actual delivery day each month will be as agreed with each MI company). |

| Reporting Date | Report loan status including loss mitigation workout activity as of the last day of the month. |

| Delivery Method | As agreed with each MI company. |

| Template Version | MILAR-32 Reporting Template Version November, 2014 |

| Disclosure | All information provided is considered certified as true and correct in all material respects by the party submitting the information who additionally acknowledges that each MI company is relying on the accuracy and completeness of the information submitted. Each MI company reserves all of its rights and remedies under the applicable Master Policy and other law. |

| File Naming Convention | MILAR-32_<ReportingYear>_<ReportingMonth>_<ServicerShortName>_<ReportVersion>_<MasterPolicyNumber> |

| • MILAR-32 - This is text that should be consistent on each monthly submission | |

| • ReportingYear - 4 digit numeric to indicate year (e.g. 2014) | |

| • ReportingMonth - 2 digit numeric to indicate month (e.g. September would be “09”) | |

| • ServicerShortName - Abbreviated name for servicer, must be consistent on each monthly submission | |

| • ReportVersion - Initial submission would always be “01” however if there is a need to regenerate the same report for a given month this number would be incremental | |

| • MasterPolicyNumber - also referred to as MI company's customer ID - do not include dashes **Pipe delimited and .xlsx Spreadsheets are preferred file delivery formats. Other formats must be approved with each MI company. |

| USMI Servicing Report Workgroup MILAR-32 Reporting Template |

|||||

| MI and Loan Data | |||||

| Field Name | MISMO/MILAR Description | Sub-Category Description | Format | ||

| 1 | A | Reporting Date | Cutoff date for the data being reported. Report loan status including loss mitigation workout activity as of the last day of the month. (May not be a future date.) | Submission Info | MM/DD/YYYY |

| 2 | B | MI Company Code | Drop down list from existing ADR specifications for the respective MI company: 038 = Arch MI 043 = Essent 001 = Genworth 003 = MGIC 004 = PMI 033 = Radian 011 = RMIC 019 = Triad 013 = United Guaranty 044 = NMI |

MI Insurance / Guaranty | Numeric (3 digits) |

| 3 | C | Primary Certificate Number | The number assigned by the private mortgage insurance company to track the primary insurance coverage on the loan. | MI Insurance / Guaranty | Alpha - Numeric with 0 decimal places, 10 digits. Begin with 0s if actual Cert # has fewer than 10 digits |

| 4 | D | Contract ID | PMI Pool Contract ID, only applicable if certificate is a pool loan | MI Insurance / Guaranty | Numeric |

| 5 | E | Pool Certificate Number | MI company certificate number for pool coverage on the loan. | MI Insurance / Guaranty | Alpha - Numeric with 0 decimal places, 10 digits. Begin with 0s if actual Cert # has fewer than 10 digits |

| 6 | F | Current Principal Balance | The current total unpaid principal balance as of the cutoff date (Reporting Date). Including any principal forbearance or payment deferral amount on this loan. This should include both interest bearing UPB and non-interest bearing UPB. | Loan Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 7 | G | P&I Payment | The scheduled principal plus interest that is part of the total monthly payment being reported (the P&I of the mortgage prior to the calculation of any new workout payment under consideration). | Loan Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 8 | H | Removal Code | Indicate the loan status, loan status change or reason for removal from the report Space = Performing Loan (STATUS) 00 = Delinquent Loan (STATUS) 01 = Reinstated - Loan brought current (STATUS change from Delinquent) Codes 02 through 99 should only be used when a loan is being removed from the MI Portfolio 02 = Assumed 03 = Sold (or Servicing Transfer) 04 = Paid in Full – NOT REO 05 = Claim Paid 06 = Chargeoff/Loan Uncollectable 99 = MI coverage terminated |

Loan Info | Numeric (2 digits) |

| 9 | I | Primary Borrower Name | The unparsed name of either an individual or a legal entity listed as primary borrower | Borrower Info | Text |

| 10 | J | Servicers Loan Number | A unique identifier assigned by the servicer to identify the loan. | Servicer Info | Numeric and Text |

| 11 | K | Servicer Name | Official name of servicer (the servicer responsible for reporting) | Servicer Info | Text |

| 12 | L | Investor Name | The name of the entity that currently owns the mortgage note and/or is the issuer of a security that includes the loan or mortgage note. If the servicer or a bank affiliated with the servicer owns the note in its portfolio, the Investor Name will be blank | Investor Info | Text and Numeric |

| 13 | M | Investor Loan Number | A unique identifier assigned by the Investor to identify the loan. If the servicer or a bank affiliated with the servicer owns the note in its portfolio, the Investor Loan Number will be blank | Investor Info | Numeric and Text |

| 14 | N | Subject Property Street Address 1 | The address with the address number, pre-directional, street name, post-directional, address unit designators and address unit value. | Property Info | Numeric and Text |

| 15 | O | Subject Property City | The name of the city. | Property Info | Text |

| 16 | P | Subject Property State | The two-character representation of the US state Territory. | Property Info | Text (2 characters) |

| 17 | Q | Subject Property Zip Code | The postal code (zip code in the US) for the address. | Property Info | Text, 0 decimal points, 5-9 digits, no hyphens e.g. 123450000, no special characters e.g. hyphens, decimal places |

| 18 | R | Next Payment Due Date | Date in which the next payment is due | Delinquency Info | MM/DD/YYYY |

| Master Workout Info - Populate this section for all loans with an active Workout Type (column S). Loans with a Workout Status (column T) of 1 or 2 will remain on the report until the workout status changes. Loans in Workout Status 3, 4, 5 or 6 will remain on the report for 30 days after the Workout Status Date (column U). Otherwise, for loans with no active workout this section will be blank. Please see instructions tab for details regarding removing loans from the report. | |||||

| 19 | S | Workout Type | Select from one of the following values (Use numeric code): 1 = Standard Forbearance (Traditional or Standard Forbearance, including unemployment forbearance programs) 2 = Trial Modification Forbearance (Trial Period Forbearance for HAMP or other Modification with a Trial Period) 3 = Payment Plan 4 = Loan Modification (Post Trial Period) 5 = Pre-Foreclosure Sale 6 = Deed-in-Lieu 7 = Promise to Pay (Optional) 8 = Payment Deferral |

Workout Info | Numeric |

| 20 | T | Workout Status | Select from one of the following values (Use numeric code): 1 = Under Review (The servicer has received a request for a workout and is evaluating the request.) 2 = Approved (The servicer has approved a request for a workout; the workout has not yet been executed.) 3 = Closed (All documents have been signed, executed and/or recorded, and all requirements have been fulfilled.) 4 = Denied (The servicer has denied a request for a workout.) 5 = Failed (The borrower has failed to comply with the terms of a previously closed retention workout.) 6 = Cancelled (The servicer and/or borrower have cancelled the request for a workout.) |

Workout Info | Numeric |

| 21 | U | Workout Status Date | Date of most recent change in Workout Status. May not be a future date. | Workout Info | MM/DD/YYYY |

| 22 | V | Workout Program Name | The following numeric program codes apply to all servicers. For custom program codes, please contact the applicable MI Company. Select from one of the values in the Enumerations Tab - (Use numeric code): |

Workout Info | Numeric |

| 23 | W | Curr_Int_Rate | The current payment interest rate on the loan at the time of reporting. | Loan Info | Numeric, 5 decimal points, no commas, no percentage sign |

| 24 | X | Orig_Closing_Date | Date the borrower executed the closing documents | Loan Info | MM/DD/YYYY |

| 25 | Y | Eviction_Prcdg | Is an eviction proceeding in progress (Y/N) | Appropriate Proceedings | Text |

| 26 | Z | Eviction_Prcdg_Start_Date | Date eviction proceeding was filed. Eviction is the legal action taken to remove an adverse occupant from a foreclosed property. | Appropriate Proceedings | MM/DD/YYYY |

| 27 | AA | Eviction_Prcdg_End_Date | Date eviction proceeding ended | Appropriate Proceedings | MM/DD/YYYY |

| 28 | AB | Pending_Bwr_Prcdg | Has a borrower proceeding been filed? (Y/N) | Borrower Proceedings | Text |

| 29 | AC | Bwr_Prcdg_Start_Date | Date borrower proceeding was filed. Any administrative, judicial or non-judicial action or proceeding brought or claim asserted by a Borrower that has affected, or has the potential to affect, a Loan or the Borrower’s, Servicer’s, Beneficiary’s or lender’s rights or obligations under the Loan. The Borrower Proceedings Start Date would be the initiation date of this type of event. | Borrower Proceedings | MM/DD/YYYY |

| 30 | AD | Bwr_Prcdg_End_Date | Date borrower proceeding ended. | Borrower Proceedings | MM/DD/YYYY |

| 31 | AE | Servicing_Transferee | Name of Servicer purchasing the MSR. (Removal code should reflect 03) | Servicer Info | Text |

| 32 | AF | Interest_Accrual_Rate | The Accrual Rate is the "contract rate" or the "note rate" that is specified in the loan documents. The current interest rate, which is the Payment Rate, will generally be the same as the Accrual Rate unless there is some special feature, like negative amortization, that causes the payment to be calculated using a different rate. | Loan Info | Numeric, 5 decimal points, no commas, no percentage sign |

| Reporting Date |

MI Company Code | Primary Certificate Number | Contract ID | Pool Certificate Number | Current Principal Balance | P&I Payment | Removal Code | Primary Borrower Name | Servicers Loan Number | Servicer Name | Investor Name | Investor Loan Number | Subject Property Street Address 1 | Subject Property City | Subject Property State | Subject Property Zip Code | Next Payment Due Date | Workout Type | Workout Status | Workout Status Date | Workout Program Name | Curr_Int_Rate | Orig_Closing_Date | Eviction_Prcdg | Eviction_Prcdg_Start_Date | Eviction_Prcdg_End_Date | Pending_Bwr_Prcdg | Bwr_Prcdg_Start_Date | Bwr_Prcdg_End_Date | Servicing_Transferee | Interest_Accrual_Rate |

no reviews yet

Please Login to review.