226x Filetype XLSX File size 0.08 MB Source: www.mgic.com

Sheet 1: Instructions

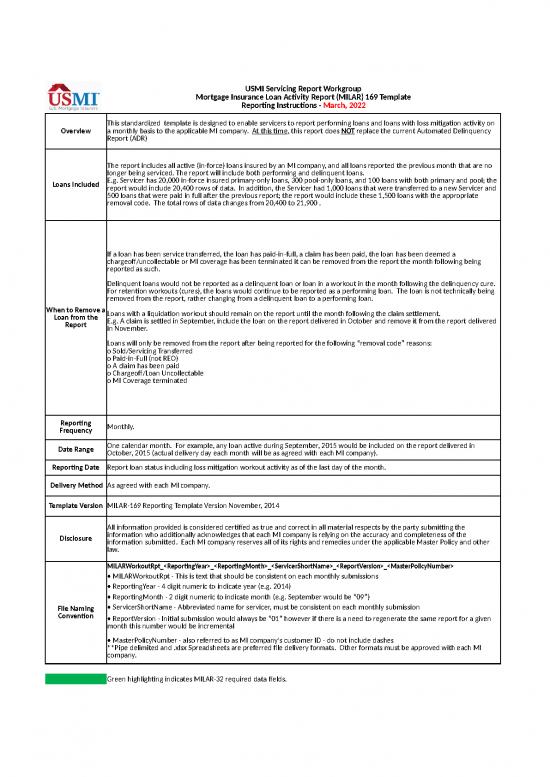

| USMI Servicing Report Workgroup Mortgage Insurance Loan Activity Report (MILAR) 169 Template Reporting Instructions - March, 2022 |

|

| Overview | This standardized template is designed to enable servicers to report performing loans and loans with loss mitigation activity on a monthly basis to the applicable MI company. At this time, this report does NOT replace the current Automated Delinquency Report (ADR) |

| Loans Included | The report includes all active (in-force) loans insured by an MI company, and all loans reported the previous month that are no longer being serviced. The report will include both performing and delinquent loans. E.g. Servicer has 20,000 in-force insured primary-only loans, 300 pool-only loans, and 100 loans with both primary and pool; the report would include 20,400 rows of data. In addition, the Servicer had 1,000 loans that were transferred to a new Servicer and 500 loans that were paid in full after the previous report; the report would include these 1,500 loans with the appropriate removal code. The total rows of data changes from 20,400 to 21,900 . |

| When to Remove a Loan from the Report | If a loan has been service transferred, the loan has paid-in-full, a claim has been paid, the loan has been deemed a chargeoff/uncollectable or MI coverage has been terminated it can be removed from the report the month following being reported as such. Delinquent loans would not be reported as a delinquent loan or loan in a workout in the month following the delinquency cure. For retention workouts (cures), the loans would continue to be reported as a performing loan. The loan is not technically being removed from the report, rather changing from a delinquent loan to a performing loan. Loans with a liquidation workout should remain on the report until the month following the claim settlement. E.g. A claim is settled in September, include the loan on the report delivered in October and remove it from the report delivered in November. Loans will only be removed from the report after being reported for the following “removal code” reasons: o Sold/Servicing Transferred o Paid-in-Full (not REO) o A claim has been paid o Chargeoff/Loan Uncollectable o MI Coverage terminated |

| Reporting Frequency | Monthly. |

| Date Range | One calendar month. For example, any loan active during September, 2015 would be included on the report delivered in October, 2015 (actual delivery day each month will be as agreed with each MI company). |

| Reporting Date | Report loan status including loss mitigation workout activity as of the last day of the month. |

| Delivery Method | As agreed with each MI company. |

| Template Version | MILAR-169 Reporting Template Version November, 2014 |

| Disclosure | All information provided is considered certified as true and correct in all material respects by the party submitting the information who additionally acknowledges that each MI company is relying on the accuracy and completeness of the information submitted. Each MI company reserves all of its rights and remedies under the applicable Master Policy and other law. |

| File Naming Convention | MILARWorkoutRpt_<ReportingYear>_<ReportingMonth>_<ServicerShortName>_<ReportVersion>_<MasterPolicyNumber> |

| • MILARWorkoutRpt - This is text that should be consistent on each monthly submissions | |

| • ReportingYear - 4 digit numeric to indicate year (e.g. 2014) | |

| • ReportingMonth - 2 digit numeric to indicate month (e.g. September would be “09”) | |

| • ServicerShortName - Abbreviated name for servicer, must be consistent on each monthly submission | |

| • ReportVersion - Initial submission would always be “01” however if there is a need to regenerate the same report for a given month this number would be incremental | |

| • MasterPolicyNumber - also referred to as MI company's customer ID - do not include dashes **Pipe delimited and .xlsx Spreadsheets are preferred file delivery formats. Other formats must be approved with each MI company. |

|

| Green highlighting indicates MILAR-32 required data fields. |

| The current total unpaid principal balance as of the cutoff date (Reporting Date). Including any principal forbearance from any previous modifications on this loan | USMI Servicing Report Workgroup MILAR-169 Reporting Template *MILAR-32 data requirements highlighted in green |

||||

| Flat File Column | Field Name | MISMO/MILAR Description | Sub-Category Description | Format | |

| 1 | A | Reporting Date | Cutoff date for the data being reported. Report loan status including loss mitigation workout activity as of the last day of the month. (May not be a future date.) | Submission Info | MM/DD/YYYY |

| 2 | B | MI Company Code | Drop down list from existing ADR specifications for the respective MI company: 038 = Arch MI 043 = Essent 001 = Genworth 003 = MGIC 004 = PMI 033 = Radian 011 = RMIC 019 = Triad 013 = United Guaranty 044 = NMI |

MI Insurance / Guaranty | Numeric (3 digits) |

| 3 | C | Primary Certificate Number | The number assigned by the private mortgage insurance company to track the primary insurance coverage on the loan. | MI Insurance / Guaranty | Alpha - Numeric with 0 decimal places, 10 digits. Begin with 0s if actual Cert # has fewer than 10 digits |

| 4 | D | Contract ID | PMI Pool Contract ID, only applicable if certificate is a pool loan | MI Insurance / Guaranty | Numeric |

| 5 | E | Pool Certificate Number | MI company certificate number for pool coverage on the loan. | MI Insurance / Guaranty | Alpha - Numeric with 0 decimal places, 10 digits. Begin with 0s if actual Cert # has fewer than 10 digits |

| 6 | F | Current Principal Balance | The current total unpaid principal balance as of the cutoff date (Reporting Date). Including any principal forbearance or payment deferral amount on this loan. This should include both interest bearing UPB and non-interest bearing UPB. | Loan Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 7 | G | Payoff Amount | The total amount owed which includes unpaid principal balance, accrued interest, and fees at the most recent month end. | Loan Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 8 | H | P&I Payment | The scheduled principal plus interest that is part of the total monthly payment being reported (the P&I of the mortgage prior to the calculation of any new workout payment under consideration). | Loan Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 9 | I | Other Charges | All other currently scheduled amounts owed monthly (other than principal & interest) that are part of the total monthly payment being reported. Includes monthly taxes, insurance (including private mortgage insurance), Homeowner Association fees, and other scheduled monthly expenses related to the mortgage. | Loan Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 10 | J | Total Monthly Payment | Total payment of principal plus interest ("P&I Payment") plus "Other Charges" (see definition of "Other Charges" above). | Loan Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 11 | K | Lien Position | Specifies the priority of the lien against the subject property. 1=1st, 2=2nd, 3=3rd, etc. |

Loan Info | Numeric with 0 decimal |

| 12 | L | 12 Month Payment History | A representation of the history of last twelve payments based on a rolling 12 month history: 0=unpaid installment (30 days late) 1 =paid as agreed |

Loan Info | Numeric with 0 decimal points (1 or 0) |

| 13 | M | Removal Code | Indicate the loan status, loan status change or reason for removal from the report Space = Performing Loan (STATUS) 00 = Delinquent Loan (STATUS) 01 = Reinstated - Loan brought current (STATUS change from Delinquent) Codes 02 through 99 should only be used when a loan is being removed from the MI Portfolio 02 = Assumed 03 = Sold (or Servicing Transfer) 04 = Paid in Full – NOT REO 05 = Claim Paid 06 = Chargeoff/Loan Uncollectable 99 = MI coverage terminated |

Loan Info | Numeric (2 digits) |

| Borrower Info | |||||

| Flat File Column | Field Name | MISMO/MILAR Description | Sub-Category Description | Format | |

| 14 | N | Primary Borrower Name | The unparsed name of either an individual or a legal entity listed as primary borrower | Borrower Info | Text |

| 15 | O | Borrowers Mailing Address | The address for the primary borrower with the address number, pre-directional, street name, post-directional, address unit designators and address unit value. | Borrower Info | Text and numeric |

| 16 | P | Borrowers Mailing Address Line 2 | Primary borrower address information that cannot be contained in the Address Line Text. | Borrower Info | Text and numeric |

| 17 | Q | Borrowers Mailing City | The name of the city. | Borrower Info | Text |

| 18 | R | Borrowers Mailing State | The two-character representation of the US state Territory. | Borrower Info | Text (2 characters) |

| 19 | S | Borrowers Mailing Address Zip Code | The postal code (zip code in the US) for the address. Zip code may be either 5 or 9 digits. | Borrower Info | Text, 0 decimal points, 5-9 digits, no hyphens e.g. 123450000, no special characters e.g. hyphens, decimal places |

| 20 | T | Borrowers Social Security Number | The value of the taxpayer identifier as assigned by the US IRS to the individual or legal entity. |

Borrower Info | Numeric, 0 decimal points, 9 digits, no hyphens |

| 21 | U | Borrowers 1st Phone Number | The telephone number for the contact. | Borrower Info | Numeric, 0 decimal points, 10 digits, no hyphens |

| 22 | V | Borrowers 2nd Phone Number | A second telephone number for the contact. | Borrower Info | Numeric, 0 decimal points, 10 digits, no hyphens |

| 23 | W | Borrowers 3rd Phone Number | A third telephone number for the contact. | Borrower Info | Numeric, 0 decimal points, 10 digits, no hyphens |

| 24 | X | Co-Borrowers Name | The unparsed name of either an individual or a legal entity listed as co-borrower | Borrower Info | Text |

| 25 | Y | Co-Borrowers Mailing Address | The address for the co-borrower with the address number, pre-directional, street name, post-directional, address unit designators and address unit value. | Borrower Info | Text and Numeric |

| 26 | Z | Co-Borrowers Mailing Address Line 2 | Co-borrower address information that cannot be contained in the Address Line Text. | Borrower Info | Text and Numeric |

| 27 | AA | Co-Borrowers Mailing City | The name of the city. | Borrower Info | Text |

| 28 | AB | Co-Borrowers Mailing State | The two-character representation of the US state Territory. | Borrower Info | Text (2 characters) |

| 29 | AC | Co-Borrowers Mailing Address Zip Code | The postal code (zip code in the US) for the address. Zip code may be either 5 or 9 digits. | Borrower Info | Text, 0 decimal points, 5-9 digits, no hyphens e.g. 123450000, no special characters e.g. hyphens, decimal places |

| 30 | AD | Co-Borrowers Social Security Number | The value of the taxpayer identifier as assigned by the US IRS to the individual or legal entity. |

Borrower Info | Numeric, 0 decimal points, 9 digits, no hyphens |

| 31 | AE | Co-Borrowers 1st Phone Number | The telephone number for the contact. | Borrower Info | Numeric, 0 decimal points, 10 digits, no hyphens |

| 32 | AF | Co-Borrowers 2nd Phone Number | A second telephone number for the contact. | Borrower Info | Numeric, 0 decimal points, 10 digits, no hyphens |

| 33 | AG | Co-Borrowers 3rd Phone Number | A third telephone number for the contact. | Borrower Info | Numeric, 0 decimal points, 10 digits, no hyphens |

| 34 | AH | Total Current Income | Current combined monthly income of all borrowers on the mortgage note. If unavailable leave blank. | Borrower Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 35 | AI | Total Non-1st Lien Mortgage Debt | Current combined total debt excluding 1st lien mortgage debt for all borrowers on the mortgage note | Borrower Info | Numeric, 2 decimal points, no commas, no dollar sign |

| Servicer Info | |||||

| Flat File Column | Field Name | MISMO/MILAR Description | Sub-Category Description | Format | |

| 36 | AJ | Servicers Loan Number | A unique identifier assigned by the servicer to identify the loan. | Servicer Info | Numeric and Text |

| 37 | AK | Servicer Name | Official name of servicer (the servicer responsible for reporting) | Servicer Info | Text |

| 38 | AL | Client Number | The servicer's "client number" with applicable service bureau. | Servicer Info | Numeric and Text |

| 39 | AM | Servicer Address | The address for the servicer with the address number, pre-directional, street name, post-directional, address unit designators and address unit value. | Servicer Info | Numeric and Text |

| 40 | AN | Servicer State | The two-character representation of the US state Territory. | Servicer Info | Text (2 characters) |

| 41 | AO | Servicer Zip Code | The postal code (zip code in the US) for the address. | Servicer Info | Text, 0 decimal points, 5-9 digits, no hyphens e.g. 123450000, no special characters e.g. hyphens, decimal places |

| 42 | AP | Servicing Contact | The unparsed name of an individual for a representative of the MI company to contact with questions. | Servicer Info | Text |

| 43 | AQ | Servicing Contact Phone Number | The telephone number for the contact at the servicer that handles this report | Servicer Info | Numeric, 0 decimal points, 10 digits, no hyphens |

| 44 | AR | Service Bureau Code | The identifying code for the service bureau used (Use current numeric ADR Codes): See Enumerations Tab for Complete List |

Servicer Info | Numeric (Use most updated ADR Codes) |

| 45 | AS | Servicing Type | Servicing type of the servicer submitting the report. Drop down menu with numeric code: 1= Primary 2 = Sub-servicer 3 = Special Servicer |

Servicer Info | Numeric |

| 46 | AT | Sub-Servicer Name | Name of sub-servicer | Servicer Info | Text |

| 47 | AU | Sub-Servicer Address | The address with the address number, pre-directional, street name, post-directional, address unit designators and address unit value. | Servicer Info | Numeric and Text |

| 48 | AV | Sub-Servicer State | The two-character representation of the US state Territory. | Servicer Info | Text |

| 49 | AW | Sub-Servicer Zip Code | The postal code (zip code in the US) for the address. | Servicer Info | Text, 0 decimal points, 5-9 digits, no hyphens e.g. 123450000, no special characters e.g. hyphens, decimal places |

| 50 | AX | Sub-Servicing Contact | The unparsed name of either an individual or a legal entity. | Servicer Info | Text and Numeric |

| 51 | AY | Sub-Servicing Contact Phone Number | The telephone number for the contact | Servicer Info | Numeric, 0 decimal points, 10 digits, no hyphens |

| 52 | AZ | Sub-Servicers Loan Number | A unique identifier assigned by the sub-servicer to identify the loan | Servicer Info | Numeric and Text |

| 53 | BA | Sub-Servicer Service Bureau Code | The identifying code for the service bureau used for that sub-servicer | Servicer Info | Numeric and Text |

| Investor Info | |||||

| Flat File Column | Field Name | MISMO/MILAR Description | Sub-Category Description | Format | |

| 54 | BB | Investor Name | The name of the entity that currently owns the mortgage note and/or is the issuer of a security that includes the loan or mortgage note. If the servicer or a bank affiliated with the servicer owns the note in its portfolio, the Investor Name will be blank | Investor Info | Text and Numeric |

| 55 | BC | Investor Address | The address with the address number, pre-directional, street name, post-directional, address unit designators and address unit value. | Investor Info | Text and Numeric |

| 56 | BD | Investor Address Line 2 | Address information that cannot be contained in the Address Line Text. | Investor Info | Text and Numeric |

| 57 | BE | Investor Address City | The name of the city. | Investor Info | Text |

| 58 | BF | Investor Address State | The two-character representation of the US state Territory. | Investor Info | Text (2 characters) |

| 59 | BG | Investor Address Zip Code | The postal code (zip code in the US) for the address. | Investor Info | Text, 0 decimal points, 5-9 digits, no hyphens e.g. 123450000, no special characters e.g. hyphens, decimal places |

| 60 | BH | Investor Loan Number | A unique identifier assigned by the Investor to identify the loan. If the servicer or a bank affiliated with the servicer owns the note in its portfolio, the Investor Loan Number will be blank | Investor Info | Numeric and Text |

| Property Info | |||||

| Flat File Column | Field Name | MISMO/MILAR Description | Sub-Category Description | Format | |

| 61 | BI | Subject Property Street Address 1 | The address with the address number, pre-directional, street name, post-directional, address unit designators and address unit value. | Property Info | Numeric and Text |

| 62 | BJ | Subject Property Street Address 2 | Address information that cannot be contained in the Address Line Text | Property Info | Numeric and Text |

| 63 | BK | Subject Property City | The name of the city. | Property Info | Text |

| 64 | BL | Subject Property State | The two-character representation of the US state Territory. | Property Info | Text (2 characters) |

| 65 | BM | Subject Property Zip Code | The postal code (zip code in the US) for the address. | Property Info | Text, 0 decimal points, 5-9 digits, no hyphens e.g. 123450000, no special characters e.g. hyphens, decimal places |

| 66 | BN | Occupancy Code | Specifies the property occupancy status of a subject property (Use numeric code): 1 = Owner Occupied 2= Tenant Occupied (Occupied by tenant or unknown party) 3 = Vacant (Abandoned or otherwise unoccupied) |

Property Info | Numeric |

| 67 | BO | Last Property Inspection Date | Date most recent property inspection was completed (May not be a future date.) | Property Info | MM/DD/YYYY |

| 68 | BP | Last Property Condition | Condition of the property as of the last inspection date (Use numeric code): 1 = Excellent 2 = Good 3 = Fair 4 = Poor |

Property Info | Numeric |

| 69 | BQ | Current Property Value | Last known statement of value of the property from a valid property valuation source (Full Appraisal, Interior BPO, Exterior BPO, AVM) Provide this value on all loans reported regardless of workout status. (May not be a future date.) | Property Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 70 | BR | Current Property Value Date | Date which current property value was determined. | Property Info | MM/DD/YYYY |

| 71 | BS | Current Property Value Type | Specifies the method by which the property value was assessed (Use numeric code): 1 = Full Appraisal 2= Interior BPO 3 = Exterior BPO 4 = AVM 5 = Other |

Property Info | Numeric |

| 72 | BT | As-Is Property Value | Applies to liquidation workouts or foreclosures only. Value of the property in current "as is" condition. Prior to any repairs or other activities that need to be performed. | Property Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 73 | BU | As Repaired Property Value | Applies to liquidation workouts or foreclosures only. Value of property after all repairs or improvements are completed. | Property Info | Numeric, 2 decimal points, no commas, no dollar sign |

| Delinquency Info | |||||

| Flat File Column | Field Name | MISMO/MILAR Description | Sub-Category Description | Format | |

| 74 | BV | Loan Delinquent (Y/N) | Indicate whether the loan is currently 30+ days delinquent: Y=Loan is currently delinquent N=loan is current. |

Delinquency Info | Text |

| 75 | BW | Due Date of First Unpaid Installment | The due date of first installment that was not paid which caused this default; leave blank for performing loans. | Delinquency Info | MM/DD/YYYY |

| 76 | BX | Date Last Installment Received | The actual date the last payment by the borrower was received by the lender | Delinquency Info | MM/DD/YYYY |

| 77 | BY | Next Payment Due Date | Date in which the next payment is due | Delinquency Info | MM/DD/YYYY |

| 78 | BZ | Months Delinquent | Number of installments that are past due. | Delinquency Info | Numeric, 0 decimal points, no commas |

| 79 | CA | Reason for Delinquency | The reason why the Borrower has become delinquent on the loan (Use numeric code): See Enumerations Tab for Complete List | Delinquency Info | Numeric (01 - 28) |

| 80 | CB | Total Arrearage | The sum of all past due principal, interest, taxes, insurance (including mortgage insurance), and other monthly mortgage related obligations. Does not include late fees. Provide the same information as the "Delinquent Payment Amount" in the ADR report. | Delinquency Info | Numeric with 2 decimal points |

| 81 | CC | Collection Comments | Provide the most recent collection comments. Provide the prior 10 collection comments in columns ET - FC. | Delinquency Info | Text and Numeric - Most recent comments. Maximum of 255 characters |

| Bankruptcy Info | |||||

| Flat File Column | Field Name | MISMO/MILAR Description | Sub-Category Description | Format | |

| 82 | CD | Bankruptcy Code | Chapter under which bankruptcy has been filed; only active bankruptcies should be included (Use numeric code): 07; 11; or 13 |

Bankruptcy Info | Numeric |

| 83 | CE | Bankruptcy Filed Date | Date bankruptcy petition was filed; only active bankruptcies should be included. | Bankruptcy Info | MM/DD/YYYY |

| 84 | CF | Bankruptcy Relief Date | Date court granted relief from the bankruptcy stay against foreclosure; only active bankruptcies should be included. | Bankruptcy Info | MM/DD/YYYY |

| Foreclosure Info | |||||

| Flat File Column | Field Name | MISMO/MILAR Description | Sub-Category Description | Format | |

| 85 | CG | Date Foreclosure Began | Date the loan was referred to foreclosure; only active foreclosures should be included. May not be a future date. (This is a legacy field from the existing ADR report.) | Foreclosure Info | MM/DD/YYYY |

| 86 | CH | Date Foreclosure Sale Scheduled | Date on which the foreclosure sale is scheduled to be held; only active foreclosures should be included. (This is a legacy field from the existing ADR report.) | Foreclosure Info | MM/DD/YYYY |

| 87 | CI | Date Foreclosure Sale Held | Date on which the foreclosure sale was actually held; only active foreclosures should be included. May not be a future date.(This is a legacy field from the existing ADR report.) | Foreclosure Info | MM/DD/YYYY |

| 88 | CJ | Date Redemption Period Ends | Date redemption period expires in applicable states; only active foreclosures should be included. (This is a legacy field from the existing ADR report.) | Foreclosure Info | MM/DD/YYYY |

| 89 | CK | Date Property Sold | Date on which title to subject REO was transferred; only active foreclosures should be included. May not be a future date.(This is a legacy field from the existing ADR report.) | Foreclosure Info | MM/DD/YYYY |

| Claim Info | |||||

| Flat File Column | Field Name | MISMO/MILAR Description | Sub-Category Description | Format | |

| 90 | CL | Date Claim Submitted | Date the claim submission was submitted to the MI. May not be a future date. | Claim Info | MM/DD/YYYY |

| 91 | CM | Date Claim Paid | Date on which the MI claim was paid. May not be a future date. | Claim Info | MM/DD/YYYY |

| Master Workout Info - Populate this section for all loans with an active Workout Type (column CO). Loans with a Workout Status (column CP) of 1 or 2 will remain on the report until the workout status changes. Loans in Workout Status 3, 4, 5 or 6 will remain on the report for 30 days after the Workout Status Date (column CP). Otherwise, for loans with no active workout this section will be blank. Please see instructions tab for details regarding removing loans from the report. | |||||

| Flat File Column | Field Name | MISMO/MILAR Description | Sub-Category Description | Format | |

| 92 | CN | Date of Workout Submission | Date on which the most recent initial workout information was submitted by the borrower and received by the servicer. May not be a future date. | Workout Info | MM/DD/YYYY |

| 93 | CO | Workout Type | Select from one of the following values (Use numeric code): 1 = Standard Forbearance (Traditional or Standard Forbearance, including unemployment forbearance programs) 2 = Trial Modification Forbearance (Trial Period Forbearance for HAMP or other Modification with a Trial Period) 3 = Payment Plan 4 = Loan Modification (Post Trial Period) 5 = Pre-Foreclosure Sale 6 = Deed-in-Lieu 7 = Promise to Pay (Optional) 8 = Payment Deferral |

Workout Info | Numeric |

| 94 | CP | Workout Status | Select from one of the following values (Use numeric code): 1 = Under Review (The servicer has received a request for a workout and is evaluating the request.) 2 = Approved (The servicer has approved a request for a workout; the workout has not yet been executed.) 3 = Closed (All documents have been signed, executed and/or recorded, and all requirements have been fulfilled.) 4 = Denied (The servicer has denied a request for a workout.) 5 = Failed (The borrower has failed to comply with the terms of a previously closed retention workout.) 6 = Cancelled (The servicer and/or borrower have cancelled the request for a workout.) |

Workout Info | Numeric |

| 95 | CQ | Workout Status Date | Date of most recent change in Workout Status. May not be a future date. | Workout Info | MM/DD/YYYY |

| 96 | CR | Workout Review Start Date | Date servicer began to review the subject workout. May not be a future date. (e.g. When the servicer has entered initial borrower information in the servicer's workout waterfall tool, or has initiated a review of the borrower's situation and possible workout solutions) | Workout Info | MM/DD/YYYY |

| 97 | CS | Workout Program Name | The following numeric program codes apply to all servicers. For custom program codes, please contact the applicable MI Company. Select from one of the values in the Enumerations Tab - (Use numeric code): |

Workout Info | Numeric |

| 98 | CT | Workout Approved Date | Date on which the subject workout was approved by all parties (e.g. Servicer, Investor, Primary Mortgage Insurance Company, Pool Insurance Company [if applicable]) | Workout Info | MM/DD/YYYY |

| 99 | CU | Workout Denied Date | Date on which the subject workout was denied. | Workout Info | MM/DD/YYYY |

| 100 | CV | Workout Failed Date | Date on which an approved workout ultimately failed or became inactive (Note: Only approved workouts can fail) | Workout Info | MM/DD/YYYY |

| 101 | CW | Workout Close Date | Date on which all required documents have been signed, executed and/or recorded in order to finalize, or make the subject workout official. May not be a future date. | Workout Info | MM/DD/YYYY |

| 102 | CX | Workout Effective Date | Effective date of the workout, if different from "Workout Close Date." May be a future date. • Standard Forbearance - 1st skipped or partial payment due date under the plan • Trial Modification Forbearance - 1st payment of trial period • Repayment Plan - First payment due under the plan • Loan Modification - 1st payment date of the newly modified loan (could be a future date). This would also be the date in which any change in the mortgage insurance coverage under the terms of the modification would go into effect. • Pre-foreclosure Sale - Date the real estate sale closed • Deed-in-Lieu - Date on which the borrower executes the Deed NOTE: This Workout Effective Date is NOT the date on which the servicer has completed the execution of all other longer term internal securitization, legal or accounting related activities not directly related to the borrower's direct mortgage obligations to all parties. |

Workout Info | MM/DD/YYYY |

| 103 | CY | Borrower Cash Contribution Amount | Amount borrower will (or has) contributed to the workout transaction. Applies to all workout types. | Workout Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 104 | CZ | Promissory Note Amount | Amount of Pre-foreclosure or Deed-in-lieu promissory note | Workout Info | Numeric, 2 decimal points, no commas, no dollar sign |

| Liquidation Workout Info - Populate this section for all loans with an active workout with a Workout Type of 5 or 6 as noted in column CO. | |||||

| Flat File Column | Field Name | MISMO/MILAR Description | Sub-Category Description | Format | |

| 105 | DA | Property Listing Date | Date property listing became effective. May not be a future date. | Liquidation Workout Info | MM/DD/YYYY |

| 106 | DB | Property Listing Price | Current price the property the property is listed for sale | Liquidation Workout Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 107 | DC | Pre-foreclosure Sale Purchase Price | Contract sale price for pre-foreclosure sale | Liquidation Workout Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 108 | DD | Net Proceeds | Proceeds available from sale after all closing costs. | Liquidation Workout Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 109 | DE | Pre-foreclosure Sale Closing Date | Date of pre-foreclosure sale (i.e. Close of Escrow) May not be a future date. | Liquidation Workout Info | MM/DD/YYYY |

| 110 | DF | Date Voluntary Conveyance Accepted | Date on which the servicer accepted title to the subject property. May not be a future date. | DIL Detail | MM/DD/YYYY |

| Modification Info - Populate this section for all loans with an active workout with a Workout Type of 2 or 4 or 8 as noted in column CO. | |||||

| Flat File Column | Field Name | MISMO/MILAR Description | Sub-Category Description | Format | |

| 111 | DG | Pre-Mod UPB | Unpaid principal balance of the loan prior to modification | Modification Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 112 | DH | Pre-Mod P&I | Principal and interest payment prior to modification | Modification Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 113 | DI | Pre-Mod Interest Rate | Interest rate of the mortgage prior to modification. | Modification Info | Numeric, 5 decimal points, no commas, no percentage sign |

| 114 | DJ | Pre-Mod Full Mortgage Payment | Total pre-mod mortgage obligation (including PITI, HOA, Private Mortgage Insurance and Other Exp). | Modification Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 115 | DK | Pre-Mod Loan Type | Existing loan type prior to modification. Select from one of the following values (Use numeric code): 1 = Fixed Rate / Fixed Payment 2 = 10/1 ARM 3 = 15/1 ARM 4 = 3/1 ARM 5 = 3/3 ARM 6 = 5/1 ARM 7 = 5+ Year ARM 8 = 7/1 ARM 9 = ARM Pos. Am. 10 = Interest Only 11 = Step Rate 12 = ARM Neg. Am. |

Modification Info | Numeric only, do not include description |

| 116 | DL | Total Capitalized Amount | The dollar amount of any delinquent interest, claimable fees and costs which increases the loan balance as part of the workout. | Modification Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 117 | DM | Initial Principal Forgiveness | The Initial or Current amount of principal being forgiven (post capitalization) at the particular point in time of modification execution or subsequent anniversary date associated with the earned forgiveness. Does not include any future scheduled (not yet earned) forgiveness. Servicer must include this loan in future workout reports upon any additional principal forgiveness at the anniversary dates. | Modification Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 118 | DN | Gross Modified UPB | The unpaid principal balance of a loan after the loan modification or the payment deferral, including any applicable forbearance amount, as well as any remaining Scheduled Principal Forgiveness. It can also be referred to as Gross UPB Amount and should include both interest bearing UPB and non-interest bearing UPB. | Modification/Payment Deferral Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 119 | DO | Net Modified UPB | The unpaid principal balance of a loan after the loan modification or the payment deferral, excluding deferred or forgiven principal; can also be referred to as Amortizing Modified UPB Amount. This should be the interest bearing UPB only. | Modification/Payment Deferral Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 120 | DP | Balloon Payment | The unpaid, principal amount of a mortgage loan that is due on a specified date, and paid in a lump sum at the end of the term. | Modification Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 121 | DQ | Starting Modified Interest Rate | The new initial interest rate after modification | Modification Info | Numeric, 5 decimal points, no commas, no percentage sign |

| 122 | DR | Modified Term | Number of remaining monthly payments due under the loan modification plan. | Modification Info | Numeric, 0 decimal points, no commas |

| 123 | DS | Modified Loan Maturity Date | Date the modified Loan matures. | Modification Info | MM/DD/YYYY |

| 124 | DT | Post Mod P&I | The new principal and interest payment after modification. | Modification Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 125 | DU | Post Mod Full Mortgage Payment | Total post-mod monthly mortgage payment (including PITI, HOA, Private Mortgage Insurance, and Other Expenses - Also known as PITIA) | Modification Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 126 | DV | Modified Loan Type | Select from one of the following values (Use numeric code): 1 = Fixed Rate / Fixed Payment 2 = 10/1 ARM 3 = 15/1 ARM 4 = 3/1 ARM 5 = 3/3 ARM 6 = 5/1 ARM 7 = 5+ Year ARM 8 = 7/1 ARM 9 = ARM Pos. Am. 10 = Interest Only 11 = Step Rate |

Modification Info | Numeric |

| 127 | DW | Index Name | Specifies the type and source of index to be used to determine the interest rate at each adjustment | Modification Info | Text |

| 128 | DX | Margin | The number of percentage points to be added to the index to arrive at the new interest rate |

Modification Info | Numeric, 5 decimal points, no commas, no percentage sign |

| 129 | DY | ARM Cap per adjustment | If the modified loan is an ARM or step rate, enter the per adjustment Interest Rate Cap | Modification Info | Numeric, 5 decimal points, no commas, no percentage sign |

| 130 | DZ | ARM Change Date | If the modified loan is an ARM or step rate, enter the date of the first interest rate adjustment | Modification Info | MM/DD/YYYY |

| 131 | EA | Months to First Interest Rate Adjustment | If the modified loan is an ARM, enter the number of months to the first interest rate adjustment (e.g. 36, 60, etc) | Modification Info | Numeric |

| 132 | EB | Months between interest rate adjustments | If the modified loan is an ARM or step rate, enter the number of months between adjustments (e.g. 12) | Modification Info | Numeric |

| 133 | EC | Interest rate cap per adjustment | If the modified loan is an ARM or step rate, enter the maximum percent that the interest rate can adjust for each individual adjustment period. | Modification Info | Numeric |

| 134 | ED | Max Interest Rate (Life Cap) | If the modified loan is an ARM or step rate, enter the maximum percent that the interest rate can adjust over the life of the loan | Modification Info | Numeric |

| 135 | EE | IO Term | Term (in months) of interest-only payments under the modified loan | Modification Info | Numeric, 0 decimal points, no commas |

| 136 | EF | Deferred Principal Amount | For a Modification, the amount of principal forbearance granted as part of this modification. For a Payment Deferral, the total deferred amount (not including prior forbearance or deferrals) | Modification/Payment Deferral Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 137 | EG | Trial Period begin date | Date on which the modification trial period began. May not be a future date. | Modification Info | MM/DD/YYYY |

| 138 | EH | Total Scheduled Principal Forgiveness | Amount of principal that is scheduled to be forgiven in the future (does not include all "initial" forgiveness as defined in field "DM") | Modification Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 139 | EI | Trial Period End Date | Last installment due date under the modification trial period | Modification Info | MM/DD/YYYY |

| 140 | EJ | Borrower current on trial payment (Y/N) | Y=Yes, N=No. | Modification Info | Text (1 character) |

| Repayment/Forbearance Plan Info - Populate this section for all loans with an active workout with a Workout Type of 1 or 3 as noted in column CO. | |||||

| Flat File Column | Field Name | MISMO/MILAR Description | Sub-Category Description | Format | |

| 141 | EK | Monthly Payment Under Plan | Scheduled monthly payment under the repayment or forbearance plan. | Payment Plan Info | Numeric, 2 decimal points, no commas, no dollar sign |

| 142 | EL | Plan Term | Number of monthly installments under the repayment or forbearance plan | Payment Plan Info | Numeric, 0 decimal points, no commas |

| 143 | EM | Plan Start Date | First payment due date under the repayment or forbearance plan. May not be a future date. | Payment Plan Info | MM/DD/YYYY |

| 144 | EN | Plan End Date | The last installment due date under the repayment or forbearance plan. | Payment Plan Info | MM/DD/YYYY |

| Additions | |||||

| Flat File Column | Field Name | MISMO/MILAR Description | Sub-Category Description | Format | |

| 145 | EO | First Payment Default | If borrower missed the first payment of the mortgage that was due per the note Y=Yes, N=No. | Legacy Field | Text (1 Character) |

| 146 | EP | Other Coverage Company Code | Drop down list from existing ADR specifications for the respective MI company (Use numeric code): 038 = CMG 043 = Essent 001 = Genworth 003 = MGIC 004 = PMI 033 = Radian 011 = RMIC 019 = Triad 013 = United Guaranty 044 = NMI 999 = Other |

Legacy Field | Numeric (3 digits) |

| 147 | EQ | Other Coverage Certificate or MBS Loan No. | Other coverage provide account number for the subject loan. NOTE: Use this for any other supplemental coverage other than the pool coverage identified in field # 4 | Legacy Field | Numeric and Text |

| 148 | ER | Servicer City | The name of the servicer's city. | Servicer Info | Text |

| 149 | ES | Sub-servicer City | The name of the sub-servicer's city. | Servicer Info | Text |

| 150 | ET | Collection_Comments_2 | The second most recent collection comment. | Delinquency Info | Text and Numeric - Most recent comments. Maximum of 255 characters |

| 151 | EU | Collection_Comments_3 | The third most recent collection comment. | Delinquency Info | Text and Numeric - Most recent comments. Maximum of 255 characters |

| 152 | EV | Collection_Comments_4 | The fourth most recent collection comment. | Delinquency Info | Text and Numeric - Most recent comments. Maximum of 255 characters |

| 153 | EW | Collection_Comments_5 | The fifth most recent collection comment. | Delinquency Info | Text and Numeric - Most recent comments. Maximum of 255 characters |

| 154 | EX | Collection_Comments_6 | The sixth most recent collection comment. | Delinquency Info | Text and Numeric - Most recent comments. Maximum of 255 characters |

| 155 | EY | Collection_Comments_7 | The seventh most recent collection comment. | Delinquency Info | Text and Numeric - Most recent comments. Maximum of 255 characters |

| 156 | EZ | Collection_Comments_8 | The eigthth most recent collection comment. | Delinquency Info | Text and Numeric - Most recent comments. Maximum of 255 characters |

| 157 | FA | Collection_Comments_9 | The nineth most recent collection comment. | Delinquency Info | Text and Numeric - Most recent comments. Maximum of 255 characters |

| 158 | FB | Collection_Comments_10 | The tenth most recent collection comment. | Delinquency Info | Text and Numeric - Most recent comments. Maximum of 255 characters |

| 159 | FC | Collection_Comments_11 | The eleventh most recent collection comment. Max look-back is five years. | Delinquency Info | Text and Numeric - Most recent comments. Maximum of 255 characters |

| 160 | FD | Curr_Int_Rate | The current payment interest rate on the loan at the time of reporting. | Loan Info | Numeric, 5 decimal points, no commas, no percentage sign |

| 161 | FE | Orig_Closing_Date | Date the borrower executed the closing documents | Loan Info | MM/DD/YYYY |

| 162 | FF | Eviction_Prcdg | Is an eviction proceeding in progress (Y/N) | Appropriate Proceedings | Text |

| 163 | FG | Eviction_Prcdg_Start_Date | Date eviction proceeding was filed. Eviction is the legal action taken to remove an adverse occupant from a foreclosed property. | Appropriate Proceedings | MM/DD/YYYY |

| 164 | FH | Eviction_Prcdg_End_Date | Date eviction proceeding ended | Appropriate Proceedings | MM/DD/YYYY |

| 165 | FI | Pending_Bwr_Prcdg | Has a borrower proceeding been filed? (Y/N) | Borrower Proceedings | Text |

| 166 | FJ | Bwr_Prcdg_Start_Date | Date borrower proceeding was filed. Any administrative, judicial or non-judicial action or proceeding brought or claim asserted by a Borrower that has affected, or has the potential to affect, a Loan or the Borrower’s, Servicer’s, Beneficiary’s or lender’s rights or obligations under the Loan. The Borrower Proceedings Start Date would be the initiation date of this type of event. | Borrower Proceedings | MM/DD/YYYY |

| 167 | FK | Bwr_Prcdg_End_Date | Date borrower proceeding ended. | Borrower Proceedings | MM/DD/YYYY |

| 168 | FL | Servicing_Transferee | Name of Servicer purchasing the MSR. (Removal code should reflect 03) | Servicer Info | Text |

| 169 | FM | Interest_Accrual_Rate | The Accrual Rate is the "contract rate" or the "note rate" that is specified in the loan documents. The current interest rate, which is the Payment Rate, will generally be the same as the Accrual Rate unless there is some special feature, like negative amortization, that causes the payment to be calculated using a different rate. | Loan Info | Numeric, 5 decimal points, no commas, no percentage sign |

| Reporting Date | MI Company Code | Primary Certificate Number | Contract ID | Pool Certificate Number | Current Principal Balance | Payoff Amount | P&I Payment | Other Charges | Total Monthly Payment | Lien Position | 12 Month Payment History | Removal Code | Primary Borrower Name | Borrowers Mailing Address | Borrowers Mailing Address Line 2 | Borrowers Mailing City | Borrowers Mailing State | Borrowers Mailing Address Zip Code | Borrowers Social Security Number | Borrowers 1st Phone Number | Borrowers 2nd Phone Number | Borrowers 3rd Phone Number | Co-Borrowers Name | Co-Borrowers Mailing Address | Co-Borrowers Mailing Address Line 2 | Co-Borrowers Mailing City | Co-Borrowers Mailing State | Co-Borrowers Mailing Address Zip Code | Co-Borrowers Social Security Number | Co-Borrowers 1st Phone Number | Co-Borrowers 2nd Phone Number | Co-Borrowers 3rd Phone Number | Total Current Income | Total Non-1st Lien Mortgage Debt | Servicers Loan Number | Servicer Name | Client Number | Servicer Address | Servicer State | Servicer Zip Code | Servicing Contact | Servicing Contact Phone Number | Service Bureau Code | Servicing Type | Sub-Servicer Name | Sub-Servicer Address | Sub-Servicer State | Sub-Servicer Zip Code | Sub-Servicing Contact | Sub-Servicing Contact Phone Number | Sub-Servicers Loan Number | Sub-Servicer Service Bureau Code | Investor Name | Investor Address | Investor Address Line 2 | Investor Address City | Investor Address State | Investor Address Zip Code | Investor Loan Number | Subject Property Street Address 1 | Subject Property Street Address 2 | Subject Property City | Subject Property State | Subject Property Zip Code | Occupancy Code | Last Property Inspection Date | Last Property Condition | Current Property Value | Current Property Value Date | Current Property Value Type | As-Is Property Value | As Repaired Property Value | Loan Delinquent (Y/N) | Due Date of First Unpaid Installment | Date Last Installment Received | Next Payment Due Date | Months Delinquent | Reason for Delinquency | Total Arrearage | Collection Comments | Bankruptcy Code | Bankruptcy Filed Date | Bankruptcy Relief Date | Date Foreclosure Began | Date Foreclosure Sale Scheduled | Date Foreclosure Sale Held | Date Redemption Period Ends | Date Property Sold | Date Claim Submitted | Date Claim Paid | Date of Workout Submission | Workout Type | Workout Status | Workout Status Date | Workout Review Start Date | Workout Program Name | Workout Approved Date | Workout Denied Date | Workout Failed Date | Workout Close Date | Workout Effective Date | Borrower Cash Contribution Amount | Promissory Note Amount | Property Listing Date | Property Listing Price | Pre-foreclosure Sale Purchase Price | Net Proceeds | Pre-foreclosure Sale Closing Date | Date Voluntary Conveyance Accepted | Pre-Mod UPB | Pre-Mod P&I | Pre-Mod Interest Rate | Pre-Mod Full Mortgage Payment | Pre-Mod Loan Type | Total Capitalized Amount | Initial Principal Forgiveness | Gross Modified UPB | Net Modified UPB | Balloon Payment | Starting Modified Interest Rate | Modified Term | Modified Loan Maturity Date | Post Mod P&I | Post Mod Full Mortgage Payment | Modified Loan Type | Index Name | Margin | ARM Cap per adjustment | ARM Change Date | Months to First Interest Rate Adjustment | Months between interest rate adjustments | Interest rate cap per adjustment | Max Interest Rate (Life Cap) | IO Term | Deferred Principal Amount | Trial Period begin date | Total Scheduled Principal Forgiveness | Trial Period End Date | Borrower current on trial payment (Y/N) | Monthly Payment Under Plan | Plan Term | Plan Start Date | Plan End Date | First Payment Default | Other Coverage Company Code | Other Coverage Certificate or MBS Loan No. | Servicer City | Sub-servicer City | Collection_Comments_2 | Collection_Comments_3 | Collection_Comments_4 | Collection_Comments_5 | Collection_Comments_6 | Collection_Comments_7 | Collection_Comments_8 | Collection_Comments_9 | Collection_Comments_10 | Collection_Comments_11 | Curr_Int_Rate | Orig_Closing_Date | Eviction_Prcdg | Eviction_Prcdg_Start_Date | Eviction_Prcdg_End_Date | Pending_Bwr_Prcdg | Bwr_Prcdg_Start_Date | Bwr_Prcdg_End_Date | Servicing_Transferee | Interest_Accrual_Rate |

no reviews yet

Please Login to review.