237x Filetype XLSX File size 0.06 MB Source: cbic-gst.gov.in

Sheet 1: Top Sheet

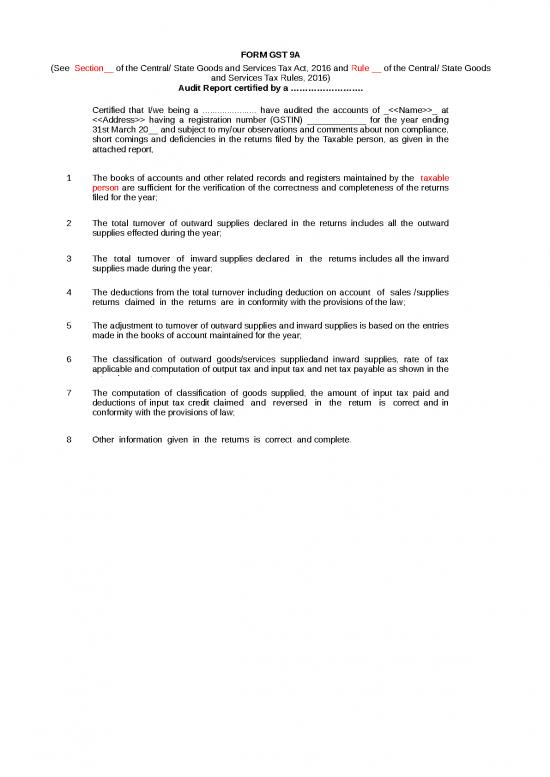

| FORM GST 9A | |||||||||

| (See Section__ of the Central/ State Goods and Services Tax Act, 2016 and Rule __ of the Central/ State Goods and Services Tax Rules, 2016) | |||||||||

| Audit Report certified by a ……………………. | |||||||||

| Certified that I/we being a ...................... have audited the accounts of _<<Name>>_ at <<Address>> having a registration number (GSTIN) ____________ for the year ending 31st March 20__ and subject to my/our observations and comments about non compliance, short comings and deficiencies in the returns filed by the Taxable person, as given in the attached report, | |||||||||

| 1 | The books of accounts and other related records and registers maintained by the taxable person are sufficient for the verification of the correctness and completeness of the returns filed for the year; | ||||||||

| 2 | The total turnover of outward supplies declared in the returns includes all the outward supplies effected during the year; | ||||||||

| 3 | The total turnover of inward supplies declared in the returns includes all the inward supplies made during the year; | ||||||||

| 4 | The deductions from the total turnover including deduction on account of sales /supplies returns claimed in the returns are in conformity with the provisions of the law; | ||||||||

| 5 | The adjustment to turnover of outward supplies and inward supplies is based on the entries made in the books of account maintained for the year; | ||||||||

| 6 | The classification of outward goods/services suppliedand inward supplies, rate of tax applicable and computation of output tax and input tax and net tax payable as shown in the return is correct; | ||||||||

| 7 | The computation of classification of goods supplied, the amount of input tax paid and deductions of input tax credit claimed and reversed in the return is correct and in conformity with the provisions of law; | ||||||||

| 8 | Other information given in the returns is correct and complete. | ||||||||

| (A) | GENERAL INFORMATION | |

| 1 | Name of the taxable person | |

| 2 | GSTIN | |

| 3 | Address | |

| 3(a) | Principal place of business | |

| 3(b) | Additional place of business | <<to be given only if there is change in the address during the period as compared to the registration certificate>> |

| 4(a) | Details of any branch or unit in the State having a different registration number (GSTIN) | |

| 4(b) | Details of any branch or unit in other State having different registration number (GSTIN) | |

| 5 | Nature of business | |

| 6(a) | Description of 10 major goods sold/ services provided | |

| 6(b) | New business activity | |

| 7 | Constitution of the business | |

| 8 | Names and address of the Propreitor/Partners/ Directors as on date of filing of Audit Report | |

| 9 | Details of Registration with other departments | |

| 9(a) | - Income Tax Permanent Account Number | |

| 9(b) | - Importer Export Code Number | |

| 9(c) | - Corporate Identity Number | |

| 10 | Particulars of all bank accounts of the taxable person | |

| 10(a) | Name of the bank and branch | |

| 10(b) | Account number | |

| 11 | List of books of accounts maintained | |

| 12 | List of books of accounts examined | |

| 13(a) | Name and version of accounting software used (if electronic records being maintained) | |

| 13(b) | Change in accounting software, if any | |

| 14(a) | Method of valuation of opening and closing stocks | |

| 14(b) | Change in method of valuation of stock, if any | |

| (B) | OTHER INFORMATION | |

| 1(a) | Taxable person has filed all the returns as per given periodicity | Yes/No |

| 1(b) | Please state exceptions along with details of interest, late fee and penalty paid, if any | |

| 2 | Taxable person has maintained stock register | Yes/No |

| 3 | Returns applicable to the Taxable person | |

| GSTR 1 | Yes/No | |

| GSTR 2 | Yes/No | |

| GSTR 3 | Yes/No | |

| GSTR 4 | Yes/No | |

| GSTR 5 | Yes/No | |

| GSTR 6 | Yes/No | |

| GSTR 7 | Yes/No | |

| GSTR 8 | Yes/No | |

| Other returns, please select | Yes/No | |

| Reconciliation Statement | |||||

| S.No. | Particulars | Consolidated amount as per annual return |

Amount as per audited financial statements (for the GSTIN) | Difference | Reference |

| A) Details of supplies and corresponding taxes | |||||

| 1 | Total outward supplies | Annex 1 | |||

| 2 | Total inward supplies | Annex 2 | |||

| 3 | Total tax liability on output supply and supplies liable to reverse charge | Annex 3 | |||

| 4 | Input tax credit availed during the year | Annex 4 | |||

| B) Payment of tax liability on output supply and supplies liable to reverse charge | |||||

| 5 | By utilising cash in cash ledger | Annex 5 | |||

| 6 | By utilising input tax credit ledger | Annex 5 | |||

| 7 | By utilising TDS in cash ledger | Annex 5 | |||

| C) Other details | |||||

| 8 | Deposit by challans | Annex 6 | |||

| 9 | Transfer of TDS from deductors | Annex 7 | |||

| 10 | Refunds | Annex 8 | |||

| 11 | Amounts paid under protest/ as pre-deposit against demand | Annex 9 | |||

| 12 | Balances as on date of financial statements (GST payable) | Annex 10 | |||

| 13 | Balances as on date of financial statements (ITC) | Annex 11 | |||

| 14 | TDS deducted | Annex 12 | |||

no reviews yet

Please Login to review.