328x Filetype PDF File size 0.58 MB Source: dmia.danareksaonline.com

Equity Research

Company Update

Tuesday,13 April 2021 Indocement Tunggal Prakarsa(INTP IJ)

BUY

Maintain Strong monthly sales

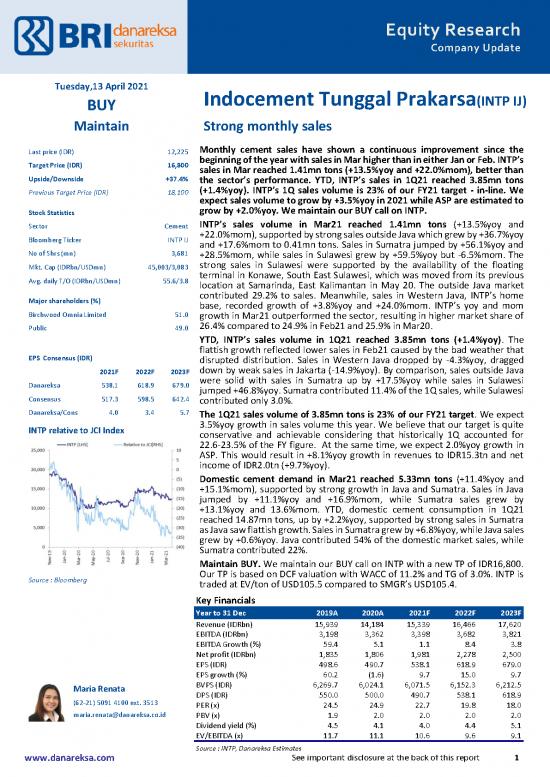

Last price (IDR) 12,225 Monthly cement sales have shown a continuous improvement since the

Target Price (IDR) 16,800 beginning of the year with sales in Mar higher than in either Jan or Feb. INTP’s

sales in Mar reached 1.41mn tons (+13.5%yoy and +22.0%mom), better than

Upside/Downside +37.4% the sector’s performance. YTD, INTP’s sales in 1Q21 reached 3.85mn tons

Previous Target Price (IDR) 18,100 (+1.4%yoy). INTP’s 1Q sales volume is 23% of our FY21 target - in-line. We

expect sales volume to grow by +3.5%yoy in 2021 while ASP are estimated to

Stock Statistics grow by +2.0%yoy. We maintain our BUY call on INTP.

Sector Cement INTP’s sales volume in Mar21 reached 1.41mn tons (+13.5%yoy and

Bloomberg Ticker INTP IJ +22.0%mom), supported by strong sales outside Java which grew by +36.7%yoy

and +17.6%mom to 0.41mn tons. Sales in Sumatra jumped by +56.1%yoy and

No of Shrs (mn) 3,681 +28.5%mom, while sales in Sulawesi grew by +59.5%yoy but -6.5%mom. The

Mkt. Cap (IDRbn/USDmn) 45,003/3,083 strong sales in Sulawesi were supported by the availability of the floating

Avg. daily T/O (IDRbn/USDmn) 55.6/3.8 terminal in Konawe, South East Sulawesi, which was moved from its previous

location at Samarinda, East Kalimantan in May 20. The outside Java market

Major shareholders (%) contributed 29.2% to sales. Meanwhile, sales in Western Java, INTP’s home

base, recorded growth of +3.8%yoy and +24.0%mom. INTP’s yoy and mom

Birchwood Omnia Limited 51.0 growth in Mar21 outperformed the sector, resulting in higher market share of

Public 49.0 26.4% compared to 24.9% in Feb21 and 25.9% in Mar20.

YTD, INTP’s sales volume in 1Q21 reached 3.85mn tons (+1.4%yoy). The

flattish growth reflected lower sales in Feb21 caused by the bad weather that

EPS Consensus (IDR) disrupted distribution. Sales in Western Java dropped by -4.3%yoy, dragged

2021F 2022F 2023F down by weak sales in Jakarta (-14.9%yoy). By comparison, sales outside Java

Danareksa 538.1 618.9 679.0 were solid with sales in Sumatra up by +17.5%yoy while sales in Sulawesi

jumped +46.8%yoy. Sumatra contributed 11.4% of the 1Q sales, while Sulawesi

Consensus 517.3 598.5 642.4 contributed only 3.0%.

Danareksa/Cons 4.0 3.4 5.7 The 1Q21 sales volume of 3.85mn tons is 23% of our FY21 target. We expect

3.5%yoy growth in sales volume this year. We believe that our target is quite

INTP relative to JCI Index conservative and achievable considering that historically 1Q accounted for

22.6-23.5% of the FY figure. At the same time, we expect 2.0%yoy growth in

ASP. This would result in +8.1%yoy growth in revenues to IDR15.3tn and net

income of IDR2.0tn (+9.7%yoy).

Domestic cement demand in Mar21 reached 5.33mn tons (+11.4%yoy and

+15.1%mom), supported by strong growth in Java and Sumatra. Sales in Java

jumped by +11.1%yoy and +16.9%mom, while Sumatra sales grew by

+13.1%yoy and 13.6%mom. YTD, domestic cement consumption in 1Q21

reached 14.87mn tons, up by +2.2%yoy, supported by strong sales in Sumatra

as Java saw flattish growth. Sales in Sumatra grew by +6.8%yoy, while Java sales

grew by +0.6%yoy. Java contributed 54% of the domestic market sales, while

Sumatra contributed 22%.

Maintain BUY. We maintain our BUY call on INTP with a new TP of IDR16,800.

Our TP is based on DCF valuation with WACC of 11.2% and TG of 3.0%. INTP is

Source : Bloomberg traded at EV/ton of USD105.5 compared to SMGR’s USD105.4.

Key Financials

Year to 31 Dec 2019A 2020A 2021F 2022F 2023F

Revenue (IDRbn) 15,939 14,184 15,339 16,466 17,620

EBITDA (IDRbn) 3,198 3,362 3,398 3,682 3,821

EBITDA Growth (%) 59.4 5.1 1.1 8.4 3.8

Net profit (IDRbn) 1,835 1,806 1,981 2,278 2,500

EPS (IDR) 498.6 490.7 538.1 618.9 679.0

EPS growth (%) 60.2 (1.6) 9.7 15.0 9.7

x Maria Renata BVPS (IDR) 6,269.7 6,024.1 6,071.5 6,152.3 6,212.5

DPS (IDR) 550.0 500.0 490.7 538.1 618.9

(62-21) 5091 4100 ext. 3513

PER (x) 24.5 24.9 22.7 19.8 18.0

maria.renata@danareksa.co.id

PBV (x) 1.9 2.0 2.0 2.0 2.0

Dividend yield (%) 4.5 4.1 4.0 4.4 5.1

EV/EBITDA (x) 11.7 11.1 10.6 9.6 9.1

Source : INTP, Danareksa Estimates

www.danareksa.com See important disclosure at the back of this report 1

Exhibit 1. Revenues and Growth Exhibit 2. Net Profits and Growth

Source: Company, BRI Danareksa Sekuritas estimates Source: Company, BRI Danareksa Sekuritas estimates

Exhibit 3. Margins Exhibit 4. G earing Level

Source: Company, BRI Danareksa Sekuritas estimates Source: Company, BRI Danareksa Sekuritas estimates

Exhibit 5. PE Band Chart Exhibit 6. Share Price Chart

80 IDR Tn

70 250.0

60 +2SD: 58.8x 200.0

50 +1SD: 47.5x

40 150.0

Avg.: 36.2x 60.0X

30 -1SD: 24.9x 100.0 50.0X

20 40.0X

-2SD: 13.6x 50.0 30.0X

10 20.0X

0 8 9 0 - 8 9 0

18n-r-18y-1 ul-18p-18ov-18n-19r-19y-1ul-19p-19ov-19n-20r-20y-2ul-20p-20ov-20n-21r-21 -18 r-18y-1 ul-18p-18v-18-19r-19y-1 ul-19p-19v-19-20r-20 -2 ul-20p-20v-20-21r-21

aJ Ma Ma J Se N Ja Ma Ma J Se N Ja Ma Ma J Se N Ja Ma Jan Ma Ma J Se No Jan Ma Ma J Se No Jan Ma May J Se No Jan Ma

Source: Bloomberg, Danareksa Sekuritas estimates Source: Bloomberg, BRI Danareksa Sekuritas estimates

www.danareksa.com See important disclosure at the back of this report 2

Exhibit 7. INTP cement sales breakdown

Mn tons Mar-20 Feb-21 Mar-21 % yoy % mom % 3M20 3M21 % yoy %

Jakarta 0.15 0.11 0.13 -9.7% 15.2% 9.3% 0.43 0.36 -14.9% 9.4%

Banten 0.12 0.10 0.12 0.9% 20.4% 8.8% 0.35 0.34 -4.7% 8.7%

West Java 0.36 0.31 0.40 10.3% 28.5% 28.3% 1.09 1.09 0.0% 28.2%

Ctrl Java 0.22 0.20 0.25 16.7% 27.7% 18.0% 0.64 0.69 7.8% 18.0%

Yogya. 0.02 0.01 0.02 6.7% 23.5% 1.3% 0.05 0.05 -1.2% 1.3%

E.Java 0.08 0.06 0.07 -7.6% 13.2% 5.2% 0.24 0.21 -12.3% 5.5%

W. Java 0.63 0.53 0.65 3.8% 24.0% 46.4% 1.87 1.79 -4.3% 46.4%

C. Java 0.23 0.21 0.27 16.0% 27.4% 19.3% 0.69 0.74 7.2% 19.3%

Java 0.94 0.80 1.00 5.7% 23.9% 70.8% 2.80 2.74 -2.2% 71.2%

Sumatra 0.10 0.13 0.16 56.1% 28.5% 11.6% 0.37 0.44 17.5% 11.4%

Kalimantan 0.05 0.07 0.08 48.4% 10.3% 5.5% 0.20 0.21 5.3% 5.5%

Sulawesi 0.03 0.05 0.04 59.5% -6.5% 3.0% 0.08 0.12 46.8% 3.0%

Nusa Tgg. 0.11 0.09 0.11 1.0% 23.5% 8.0% 0.31 0.30 -1.4% 7.9%

East Ind. 0.00 0.01 0.01 211.0% -4.2% 0.9% 0.04 0.04 12.9% 1.1%

INTP - total 1.24 1.15 1.41 13.5% 22.0% 100.0% 3.80 3.85 1.4% 100.0%

Market sh 25.9% 24.9% 26.4% 26.1% 25.9%

Source: Company

Exhibit 8. Domestic cement consumption

Mar- Mar- %

Mn tons 20 Feb-21 21 % yoy mom % 3M20 3M21 % yoy %

- -

Jakarta 0.27 0.21 0.24 12.1% 13.7% 4.5% 0.82 0.66 19.3% 4.5%

Banten 0.23 0.25 0.28 19.2% 11.5% 5.3% 0.68 0.78 14.0% 5.2%

West Java 0.82 0.76 0.89 9.5% 18.4% 16.3% 2.46 2.53 3.0% 17.0%

Ctrl Java 0.54 0.56 0.69 27.2% 23.9% 12.0% 1.72 1.90 10.2% 12.8%

Yogya. 0.07 0.08 0.10 42.3% 24.8% 1.7% 0.23 0.26 15.7% 1.8%

E.Java 0.61 0.57 0.63 2.7% 10.3% 12.3% 2.01 1.84 -8.5% 12.4%

W. Java 1.32 1.21 1.41 6.8% 16.2% 26.1% 3.96 3.97 0.3% 26.7%

C. Java 0.61 0.64 0.79 29.0% 24.0% 13.7% 1.95 2.16 10.8% 14.5%

Java 2.54 2.42 2.82 11.1% 16.9% 52.2% 7.92 7.97 0.6% 53.6%

Sumatra 1.04 1.04 1.18 13.1% 13.6% 22.4% 3.11 3.32 6.8% 22.3%

Kalimanta

n 0.30 0.29 0.34 13.9% 18.5% 6.2% 0.97 0.91 -5.6% 6.1%

Sulawesi 0.45 0.49 0.51 14.8% 6.1% 10.5% 1.24 1.42 14.6% 9.6%

Nusa Tgg. 0.30 0.24 0.29 -2.1% 18.4% 5.3% 0.83 0.75 -9.7% 5.1%

East Ind. 0.16 0.16 0.18 13.9% 13.3% 3.5% 0.48 0.49 2.5% 3.3%

100.0 100.0

Indonesia 4.79 4.63 5.33 11.4% 15.1% % 14.55 14.87 2.2% %

Source: Company

www.danareksa.com See important disclosure at the back of this report 3

Exhibit 9. Quarterly sales analysis

1Q 2Q 3Q 4Q FY

Sales vol.

2018 4.10 3.77 5.02 4.91 17.80

2019 4.03 3.69 4.90 5.25 17.86

2020 3.80 3.27 4.55 4.57 16.19

2021 3.85 16.75

Avg. monthly sales

2018 1.37 1.26 1.67 1.64 5.93

2019 1.34 1.23 1.63 1.75 5.95

2020 1.27 1.09 1.52 1.52 5.40

2021 1.28

%yoy

2019 -1.7% -2.3% -2.4% 6.9% 0.3%

2020 -5.7% -11.4% -7.1% -12.9% -9.4%

2021 1.4%

%qoq

2019 -17.9% -8.5% 32.9% 7.0%

2020 -27.6% -14.0% 39.5% 0.4%

2021 -15.7%

% contribution

2018 23.0% 21.2% 28.2% 27.6% 100.0%

2019 22.6% 20.6% 27.4% 29.4% 100.0%

2020 23.5% 20.2% 28.1% 28.2% 100.0%

2021 23.0%

Source: BRI Danareksa Sekuritas

Exhibit 10. Changes in our forecast

New Old Chg. (%) YoY (%)

2020 2021 2022 2021 2022 2021 2022 2021 2022

ASP growth (YoY%) 2.2% 2.0% 3.0% 2.0% 3.0% nm nm nm nm

Sales vol growth (%YoY) -9.7% 3.5% 4.0% 3.6% 4.2% nm nm nm nm

Revenues 14,184 15,339 16,466 15,031 16,160 2.0% 1.9% 8.1% 7.3%

Gross profit 5,114 5,535 6,035 5,119 5,804 8.1% 4.0% 8.2% 9.0%

Operating profit 1,960 2,227 2,547 1,880 2,395 18.4% 6.4% 13.6% 14.4%

Net income 1,806 1,981 2,278 1,727 2,157 14.7% 5.6% 9.7% 15.0%

GPM (%) 36.1% 36.1% 36.7% 34.1% 35.9% 6.0% 2.0%

OPM (%) 13.8% 14.5% 15.5% 12.5% 14.8% 16.1% 4.4%

NPM (%) 12.7% 12.9% 13.8% 11.5% 13.3% 12.4% 3.6%

Source: BRI Danareksa Sekuritas estimates

www.danareksa.com See important disclosure at the back of this report 4

no reviews yet

Please Login to review.