239x Filetype PDF File size 0.50 MB Source: www.vaishlaw.com

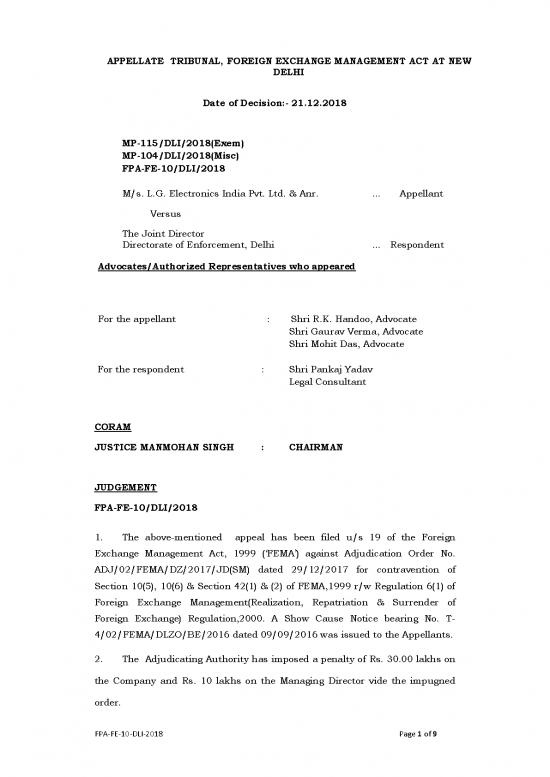

APPELLATE TRIBUNAL, FOREIGN EXCHANGE MANAGEMENT ACT AT NEW

DELHI

Date of Decision:- 21.12.2018

MP-115/DLI/2018(Exem)

MP-104/DLI/2018(Misc)

FPA-FE-10/DLI/2018

M/s. L.G. Electronics India Pvt. Ltd. & Anr. … Appellant

Versus

The Joint Director

Directorate of Enforcement, Delhi … Respondent

Advocates/Authorized Representatives who appeared

For the appellant : Shri R.K. Handoo, Advocate

Shri Gaurav Verma, Advocate

Shri Mohit Das, Advocate

For the respondent : Shri Pankaj Yadav

Legal Consultant

CORAM

JUSTICE MANMOHAN SINGH : CHAIRMAN

JUDGEMENT

FPA-FE-10/DLI/2018

1. The above-mentioned appeal has been filed u/s 19 of the Foreign

Exchange Management Act, 1999 („FEMA‟) against Adjudication Order No.

ADJ/02/FEMA/DZ/2017/JD(SM) dated 29/12/2017 for contravention of

Section 10(5), 10(6) & Section 42(1) & (2) of FEMA,1999 r/w Regulation 6(1) of

Foreign Exchange Management(Realization, Repatriation & Surrender of

Foreign Exchange) Regulation,2000. A Show Cause Notice bearing No. T-

4/02/FEMA/DLZO/BE/2016 dated 09/09/2016 was issued to the Appellants.

2. The Adjudicating Authority has imposed a penalty of Rs. 30.00 lakhs on

the Company and Rs. 10 lakhs on the Managing Director vide the impugned

order.

FPA-FE-10-DLI-2018 Page 1 of 9

3. The brief facts are that after investigations, a Show Cause Notice was

issued against the Appellant Company and its Managing Director for alleged

violation of Section 10 (5) and 10 (6) of FEMA, 1999, r/w Regulation 6 (1) of the

Foreign Exchange Management (Realisation, Repatriation, and Surrender of

Foreign Exchange) Regulations, 2000 alleging that the Appellant Company has

failed to submit (Bill of entry) documentary evidence for import of goods in

respect of the advance remittance of US $433661.76 through HSBC Bank. In

terms of Section 42 of FEMA, 1999, the Managing Director of the Company was

arraigned as a noticee.

4. The RBI gave information to Enforcement Directorate, by communication

dated 08/08/2002 that certain Bill of Entries have not been submitted in

respect of remittances made through Citi Bank and State Bank of India for

period prior to 08.02.2002, however, it was contented by the Company that it

had produced documents for such remittances, as would be evident from Para

2.3 and 2.4 and 2.5 of the Show Cause Notice.

5. It was submitted that in respect to the remittance of US $ 433661.76

clarification was sought from the M/s. L.G. Electronics Pvt. Ltd. and they have

replied that they have made a request to the RBI through HSBC Bank vide

letter dated 12/01/2016 for exemption from submitting import documents. To

check veracity of company‟s claim made to RBI, a letter dated 04/04/2016 was

written to RBI. In reply, RBI, vide its letter forwarded a letter copy of No

Objection dated 15/04/2016 issued to HSBC Bank.

6. With regard to the Show Cause Notice in respect of the remittance of

US$433661.76, after exchanging correspondence, the RBI has granted no

objection to the bankers, HSBC Bank by communication dated 15/04/2016

intimating that the RBI has no objection and advised the Authorised Dealer not

to insist for Bill of Entry against the advance remittance of US$433661.76

made by the Appellant Company.

FPA-FE-10-DLI-2018 Page 2 of 9

7. The said factual position is not denied by the respondent and despite

the ex-post facto exemption/permission granted by Reserve Bank of India, as

aforesaid, the complaint was preferred under FEMA, 1999 before the

Adjudicating Authority for alleged non-submission of Bill of Entry in respect of

the said advance remittance of US$433661.76.

8. It is submitted by the respondent that the appellants relied upon the

selected portion of the RBI letter dated 15/04/2016 and the Appellants cannot

be allowed to read selectively as the RBI uses the word “without prejudice” and

that thus has not clearly raised no objection to the action to be taken by the

enforcement authorities under FEMA. It is stated that RBI has no objection

with the investigation conducted by the ED otherwise RBI in its letter ought to

have objected the ED‟s investigation and also even direct the ED to close the

SCN.

“After receiving the RBI letter dated 15/04/2016, ED

wrote a letter to Sh. Vikas Jaiswal(Asst. General Manager,

RBI) vide F. No. T-3/FEMA/BE-1861/DZ/2002 dated 27/04/2016

for clarifying the content of letter dated 15/04/2016. In

response to ED’s letter, RBI vide letter dated 13/05/2016

clarified that the RBI does not debar the Directorate of

Enforcement from carrying on with the investigation already

initiated against them.”

9. It is submitted by the respondent that as alleged by the appellants (took

all reasonable steps to repatriate it), the foreign exchange is merely an eye

wash as it is clear from the adjudication order itself that the Appellants had

paid the advance amount in October 2008 to their regular supplier of computer

monitor screen. The shipment was expected in November 2008, however, due

to financial crisis, the vendor could not fulfil its commitment and also did not

refund the advance amount. Also the vendor was declared bankrupt and as

such the advance amount could not be recovered from the vendor. It is also

found that the Appellants failed to respond to the query regarding filing of any

claim before the competent court during the course of bankruptcy proceedings,

FPA-FE-10-DLI-2018 Page 3 of 9

thereby leading to formation of a belief that no such claim was filed by the

Appellants.”

10. Lastly, it is stated on behalf of respondent that since the Appellants

failed to respond to the query regarding filing of any claim before the competent

court during the course of bankruptcy proceedings, thereby leading to

formation of a belief that no such claim was filed by the Appellants. It is

alleged that the Civil Judgment dated 29/03/2012 of the competent court in

China ordering bankruptcy of the Chinese vendor shows that the vendor had

suffered huge losses in a row from 2006 to 2008 and stopped production

entirely in October 2008 i.e. the same month when the advance amount was

paid by the Appellants to the vendor. It has been further mentioned in the said

judgment that the vendor resumed part of the production from February to

April 2009. Having failed to apply any due diligence and then having failed to

recover its advance or procure supplies against the advance when the

production resumed for three months, it cannot be said that the Appellants

acted in a bona-fide manner.

11. The adjudicating authority rejected the contention raised by the company

regarding receipt of material worth US $ 58,746.24 in respect of remittance

US $ 433661.76 in Jan.2009 for the reason that the supporting documents

provided by the company i.e. Invoice no. LPDSG091IL dated 14/01/2009 who

stated that the said supplies are with the reference to a separate contract

LPD081204 dated 28/11/2008 and are for a different product i.e.

6318L15015H and at a different price i.e. US $ 29.14 per piece.

12. There is no denial that the Appellant Company was making regular

imports from 2006 onwards from the said foreign company and the impugned

amount is just 1.4% of the total imports made from the said exporter and

0.05% of the total imports for the year 2008.

FPA-FE-10-DLI-2018 Page 4 of 9

no reviews yet

Please Login to review.