356x Filetype PDF File size 0.36 MB Source: www.bangaloreicai.org

BIRD’S EYE VIEW OF FEMA

By CA D S Vivek & CA Chandra Shekar B D

Introduction

The Indian government has formulated the Foreign Exchange Management

Act (FEMA), which relates to the management of exchange in the country.

FEMA has assisted the country by managing the foreign exchange resources

of the country and international trade and investments .

The Government of India has changed its position from a controller to a

facilitator due to the requirement of WTO and International Monetary Fund

to participate in the global business system. One may not be wrong to state

that it was the appropriate and moderate regulations imposed under FEMA

and regulated by RBI, that saved India’s economy from the downturn being

experienced in others parts of the world.

Formulation

Foreign Exchange Regulation Act (FERA), 1947,

Foreign Exchange Regulation Act, 1973 (FERA)

Foreign Exchange Management Act, 1999 (FEMA) – superseded FERA

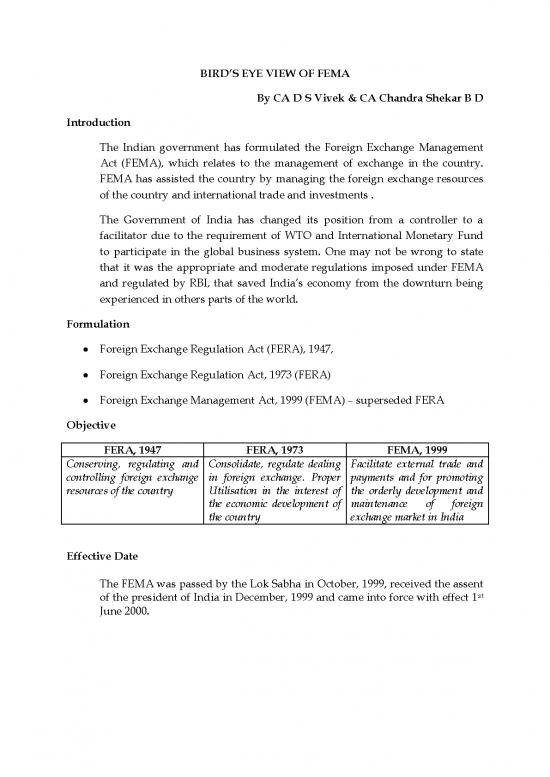

Objective

FERA, 1947 FERA, 1973 FEMA, 1999

Conserving, regulating and Consolidate, regulate dealing Facilitate external trade and

controlling foreign exchange in foreign exchange. Proper payments and for promoting

resources of the country Utilisation in the interest of the orderly development and

the economic development of maintenance of foreign

the country exchange market in India

Effective Date

The FEMA was passed by the Lok Sabha in October, 1999, received the assent

of the president of India in December, 1999 and came into force with effect 1st

June 2000.

Applicability

Extends to the whole of India

In addition it shall also applied to all branches offices, agencies outside

India owned or controlled by a person resident in India and to any

contravention there under committed outside India by any person to

whom this Act applies.

Features

This enactment is not an entirely self contained law. It is supported by various

Regulations and Circulars. As a General Practitioner in the field of

international consultancy, one needs to have a working knowledge of the

following –

o FEM(Realisation, Repatriation and Surrender of Foreign Exchange)

Regulations, 2000

o FEM(Possession and Retention of Foreign Currency) Regulations, 2000

o FEM(Permissible Capital Account Transactions) Regulations, 2000

o FEM(Transfer or Issue of Security By a Person Resident Outside India)

Regulations, 2000

o FEM(Issue of Security in India by a Branch Office or Agency of a

Person Resident Outside India ) Regulations, 2000

o FEM(Transfer or Issue of any Foreign Security) Regulations, 2000

o FEM(Establishment in India or Branch or Office or Other Place of

Business) Regulations, 2000

o FEM(Off Shore Banking Unit) Regulations, 2000

o FEM(Investment in Firm or Proprietary Concern In India) Regulations,

2000

o FEM(Acquisition and Transfer of Immovable Property in India)

Regulations, 2000

o FEM(Acquisition and Transfer of Immovable Property outside India)

Regulations, 2000

o FEM(Remittance of Assets) Regulations, 2000

o FEM(Borrowing or Lending in Foreign Exchange) Regulations, 2000

o FEM(Borrowing or Lending in Rupees) Regulations, 2000

o FEM(Deposit) Regulations, 2000

o FEM(Guarantees) Regulations, 2000

o FEM(Insurance) Regulations, 2000

o FEM(Foreign Exchange Derivate Contracts) Regulations, 2000,

o FEM(Foreign Currency Accounts By a Person Resident In India)

Regulations, 2000

o FEM(Manner of Receipt and Payment) Regulations, 2000

o FEM(Export and Import Currency) Regulations, 2000

o FEM(Withdrawal of General Permission to Overseas Corporate

Bodies(OCB’s) Regulations, 2000

o FEM(Adjudication Proceedings and Appeal) Rules, 2000

o FEM(Encashment of Draft, Cheque, Instrument and Payment of

Interest) Rules, 2000

o FEM(Authentication of Documents) Rules, 2000

o FEM(Compounding Proceedings) Rules, 2000

o FEM(Removal of Difficulties) Order, 2000

o FEM(Recruitment, Salary and Allowances and Other Conditions of

Services of Chairperson and Members)Rules, 2000

(All of the above as amended from time to time)

Also have to be aware of the following enactments/provisions-

o Income tax

o Property law

o Law relating to citizenship and domicile

o Foreign Contribution (Regulation) Act

o Code of Criminal Procedure

o Indian Penal Code

o Indian Evidence Act

o General Clauses Act

o Public Debt Act

o Company law

o Securities Law

o Customs Act

o Prevention of Money Laundering Act

o Antique and Art Treasure Act

o Conservation of Foreign Exchange and Prevention of Smuggling

Activities Act

Governed by

Reserve Bank of India

Year

th

RBI follows 1st July to 30 June as a financial year.

Regulation and Management

The RBI through its foreign exchange department central office regulates

FEMA through issue of –

o Notifications

o Circulars

AP(Dir) Series

o Forms

AP (Dir) Series

o Master Circulars

o DIPP Circulars (this is not by RBI)

These notifications, circulars including Master Circulars, issued by RBI is

available on its website www.rbi.org.in. The section is searchable on

functions, departments, date and period. This quick link has been created to

facilitate easy access to the Most Important Policy Documents released by the

Reserve Bank of India.

Master Circulars

Master Circulars are a one-point reference of instructions issued by the

Reserve Bank of India on a particular subject between July-June. These are

issued on July 1 every year and automatically expire on June 30 of the

following year. These will have the updated regulations till the issue of the

circular on that particular subject the circular deals with

Sl Master circular

No

1 Master circular on Direct investments by residents in Joint

venture(JV)/Wholly owned subsidiary(WOS) abroad ( Used for

investment made by Indian companies outside India )

2 Master circular on Foreign Investment in India (Used for Foreign

Companies or Foreign nationals investing in Indian business entities )

3 Master circular on Non-Resident Ordinary Rupee(NRO) Account

4 Master Circular on Remittance facilities for Non resident

Indians/Persons of Indian Origin/Foreign National (used to refer

what funds can be repatriated outside India from the funds or

transaction made in India)

5 Master circular on Misc remittances from India – facilities for residents

(Used to refer what type of transactions and what quantum of funds

can be remitted by residents outside India)

6 Master circular on Risk Management and Interbank dealings

7 Master circular External commercial borrowings and Trade Credits

(used to refer what type of borrowings can be taken by residents from

Non residents and on what terms)

8 Master circular on Import of goods and services

9 Master circular on export of goods and services

For detailed circulars login in to the blow mentioned website

http://www.rbi.org.in/scripts/BS_ViewMasterCirculardetails.aspx

no reviews yet

Please Login to review.