224x Filetype XLSX File size 0.03 MB Source: www.isda.org

Sheet 1: Introduction

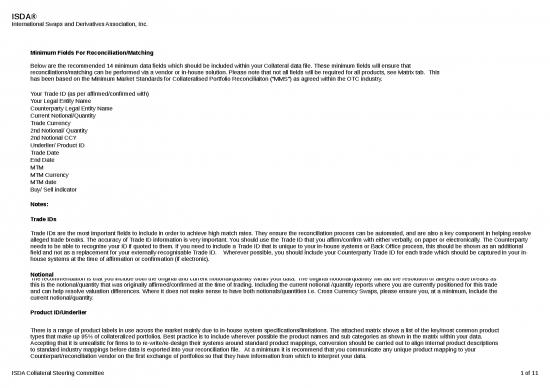

| Minimum Fields For Reconciliation/Matching | |||||||||||||||||

| Below are the recommended 14 minimum data fields which should be included within your Collateral data file. These minimum fields will ensure that reconciliations/matching can be performed via a vendor or in-house solution. Please note that not all fields will be required for all products, see Matrix tab. This has been based on the Minimum Market Standards for Collateralised Portfolio Reconciliaiton ("MMS") as agreed within the OTC industry. | |||||||||||||||||

| Your Trade ID (as per affirmed/confirmed with) | |||||||||||||||||

| Your Legal Entity Name | |||||||||||||||||

| Counterparty Legal Entity Name | |||||||||||||||||

| Current Notional/Quantity | |||||||||||||||||

| Trade Currency | |||||||||||||||||

| 2nd Notional/ Quantity | |||||||||||||||||

| 2nd Notional CCY | |||||||||||||||||

| Underlier/ Product ID | |||||||||||||||||

| Trade Date | |||||||||||||||||

| End Date | |||||||||||||||||

| MTM | |||||||||||||||||

| MTM Currency | |||||||||||||||||

| MTM date | |||||||||||||||||

| Buy/ Sell indicator | |||||||||||||||||

| Notes: | |||||||||||||||||

| Trade IDs | |||||||||||||||||

| Trade IDs are the most important fields to include in order to achieve high match rates. They ensure the reconciliation process can be automated, and are also a key component in helping resolve alleged trade breaks. The accuracy of Trade ID information is very important. You should use the Trade ID that you affirm/confirm with either verbally, on paper or electronically. The Counterparty needs to be able to recognise your ID if quoted to them. If you need to include a Trade ID that is unique to your in-house systems or Back Office process, this should be shown as an additional field and not as a replacement for your externally-recognisable Trade ID. Wherever possible, you should include your Counterparty Trade ID for each trade which should be captured in your in-house systems at the time of affirmation or confirmation (if electronic). | |||||||||||||||||

| Notional | |||||||||||||||||

| The recommendation is that you include both the original and current notional/quantity within your data. The original notional/quantity will aid the resolution of alleged trade breaks as this is the notional/quantity that was originally affirmed/confirmed at the time of trading. Including the current notional /quantity reports where you are currently positioned for this trade and can help resolve valuation differences. Where it does not make sense to have both notionals/quantities i.e. Cross Currency Swaps, please ensure you, at a minimum, include the current notional/quantity. | |||||||||||||||||

| Product ID/Underlier | |||||||||||||||||

| There is a range of product labels in use across the market mainly due to in-house system specifications/limitations. The attached matrix shows a list of the key/most common product types that make up 95% of collateralized portfolios. Best practice is to include wherever possible the product names and sub categories as shown in the matrix within your data. Accepting that it is unrealistic for firms to to re-write/re-design their systems around standard product mappings, conversion should be carried out to align internal product descriptions to standard industry mappings before data is exported into your reconciliation file. At a minimum it is recommend that you communicate any unique product mapping to your Counterpart/reconciliation vendor on the first exchange of portfolios so that they have information from which to interpret your data. | |||||||||||||||||

| Map your unique product ID/Name to both a "Parent Asset Class" and "Product Sub-Group". | |||||||||||||||||

| Parent Asset Class | |||||||||||||||||

| Commodities | |||||||||||||||||

| Equities | |||||||||||||||||

| Foreign Exchange | |||||||||||||||||

| Interest Rate Derivatives | |||||||||||||||||

| Credit Derivatives | |||||||||||||||||

| Product Sub-Group | |||||||||||||||||

| As per matrix | |||||||||||||||||

| Copyright © 2013 by International Swaps and Derivatives Association, Inc. | |||||||||||||||||

no reviews yet

Please Login to review.