217x Filetype XLS File size 1.94 MB Source: consult.justice.gov.uk

Sheet 1: Portfolio Summaries

| Contents | ||||||||||||||||||||||||||||||||||||||||

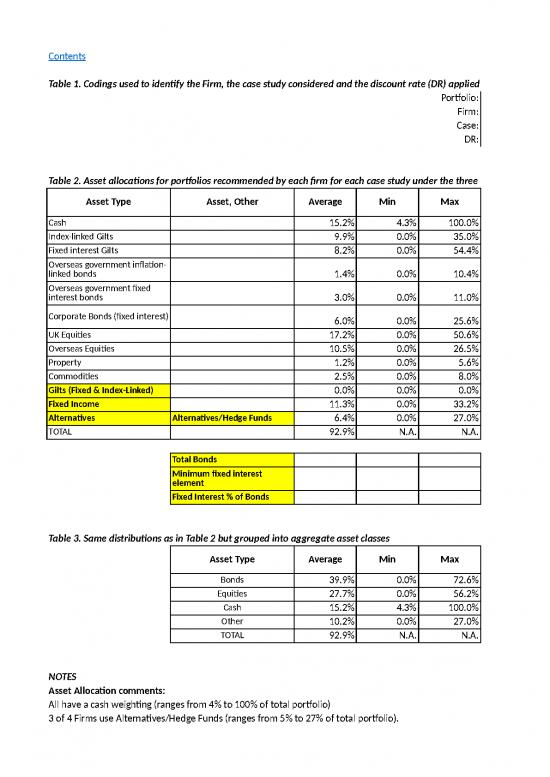

| Table 1. Codings used to identify the Firm, the case study considered and the discount rate (DR) applied to the award in the case study. See 'Data & Notes' for further details. | ||||||||||||||||||||||||||||||||||||||||

| Portfolio: | port_1_1_A | port_1_2_A | port_1_3_A | port_2_1_A | port_2_2_A | port_2_3_A | port_3_1_A | port_3_2_A | port_3_3_A | port_1_1_B | port_1_2_B | port_1_3_B | port_2_1_B | port_2_2_B | port_2_3_B | port_3_1_B | port_3_2_B | port_3_3_B | port_1_1_C | port_1_2_C | port_1_3_C | port_2_1_C | port_2_2_C | port_2_3_C | port_3_1_C | port_3_2_C | port_3_3_C | port_1_1_D | port_1_2_D | port_1_3_D | port_2_1_D | port_2_2_D | port_2_3_D | port_3_1_D | port_3_2_D | port_3_3_D | ||||

| Firm: | A | A | A | A | A | A | A | A | A | B | B | B | B | B | B | B | B | B | C | C | C | C | C | C | C | C | C | D | D | D | D | D | D | D | D | D | ||||

| Case: | 1 | 1 | 1 | 2 | 2 | 2 | 3 | 3 | 3 | 1 | 1 | 1 | 2 | 2 | 2 | 3 | 3 | 3 | 1 | 1 | 1 | 2 | 2 | 2 | 3 | 3 | 3 | 1 | 1 | 1 | 2 | 2 | 2 | 3 | 3 | 3 | ||||

| DR: | 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | ||||

| Table 2. Asset allocations for portfolios recommended by each firm for each case study under the three example discount rates. See Table 1 for corresponding firm, case study and discount rate. | ||||||||||||||||||||||||||||||||||||||||

| Asset Type | Asset, Other | Average | Min | Max | Portfolio port_1_1_A | Portfolio port_1_2_A | Portfolio port_1_3_A | Portfolio port_2_1_A | Portfolio port_2_2_A | Portfolio port_2_3_A | Portfolio port_3_1_A | Portfolio port_3_2_A | Portfolio port_3_3_A | Portfolio port_1_1_B | Portfolio port_1_2_B | Portfolio port_1_3_B | Portfolio port_2_1_B | Portfolio port_2_2_B | Portfolio port_2_3_B | Portfolio port_3_1_B | Portfolio port_3_2_B | Portfolio port_3_3_B | Portfolio port_1_1_C | Portfolio port_1_2_C | Portfolio port_1_3_C | Portfolio port_2_1_C | Portfolio port_2_2_C | Portfolio port_2_3_C | Portfolio port_3_1_C | Portfolio port_3_2_C | Portfolio port_3_3_C | Portfolio port_1_1_D | Portfolio port_1_2_D | Portfolio port_1_3_D | Portfolio port_2_1_D | Portfolio port_2_2_D | Portfolio port_2_3_D | Portfolio port_3_1_D | Portfolio port_3_2_D | Portfolio port_3_3_D |

| Cash | 15.2% | 4.3% | 100.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 8.6% | 8.6% | 7.1% | 4.3% | 8.6% | 7.1% | 4.3% | 4.3% | 4.3% | 13.3% | 19.8% | 28.8% | 8.4% | 12.5% | 17.7% | 100.0% | 100.0% | 100.0% | |

| Index-linked Gilts | 9.9% | 0.0% | 35.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 35.0% | 35.0% | 11.5% | 35.0% | 35.0% | 11.5% | 35.0% | 35.0% | 35.0% | 9.1% | 9.1% | 8.8% | 6.1% | 9.1% | 8.8% | 6.1% | 6.1% | 6.1% | 5.1% | 4.8% | 0.0% | 5.4% | 5.2% | 0.0% | 0.0% | 0.0% | 0.0% | |

| Fixed interest Gilts | 8.2% | 0.0% | 54.4% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.0% | 2.0% | 1.8% | 8.1% | 2.0% | 1.8% | 8.1% | 8.1% | 8.1% | 51.5% | 47.7% | 22.5% | 54.4% | 52.0% | 26.0% | 0.0% | 0.0% | 0.0% | |

| Overseas government inflation-linked bonds | 1.4% | 0.0% | 10.4% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.0% | 2.0% | 1.9% | 10.4% | 2.0% | 1.9% | 10.4% | 10.4% | 10.4% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | |

| Overseas government fixed interest bonds | 3.0% | 0.0% | 11.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 10.0% | 10.0% | 11.0% | 10.0% | 10.0% | 11.0% | 10.0% | 10.0% | 10.0% | 0.0% | 0.0% | 0.0% | 4.2% | 0.0% | 0.0% | 4.2% | 4.2% | 4.2% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | |

| Corporate Bonds (fixed interest) | 6.0% | 0.0% | 25.6% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 23.2% | 23.2% | 11.4% | 25.6% | 23.2% | 11.4% | 25.6% | 25.6% | 25.6% | 5.1% | 4.8% | 0.2% | 5.4% | 5.2% | 0.3% | 0.0% | 0.0% | 0.0% | |

| UK Equities | 17.2% | 0.0% | 50.6% | 20.5% | 20.5% | 35.7% | 20.5% | 20.5% | 35.7% | 20.5% | 20.5% | 20.5% | 9.0% | 9.0% | 22.0% | 9.0% | 9.0% | 22.0% | 9.0% | 9.0% | 9.0% | 16.4% | 16.4% | 25.8% | 5.2% | 16.4% | 25.8% | 5.2% | 5.2% | 5.2% | 20.3% | 18.8% | 43.8% | 21.5% | 20.6% | 50.6% | 0.0% | 0.0% | 0.0% | |

| Overseas Equities | 10.5% | 0.0% | 26.5% | 14.3% | 14.3% | 20.5% | 14.3% | 14.3% | 20.5% | 14.3% | 14.3% | 14.3% | 8.0% | 8.0% | 5.0% | 8.0% | 8.0% | 5.0% | 8.0% | 8.0% | 8.0% | 17.6% | 17.6% | 26.5% | 8.8% | 17.6% | 26.5% | 8.8% | 8.8% | 8.8% | 4.6% | 4.3% | 4.7% | 4.9% | 4.6% | 5.4% | 0.0% | 0.0% | 0.0% | |

| Property | 1.2% | 0.0% | 5.6% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 5.0% | 5.0% | 3.5% | 5.6% | 5.0% | 3.5% | 5.6% | 5.6% | 5.6% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | |

| Commodities | 2.5% | 0.0% | 8.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 8.0% | 8.0% | 5.0% | 8.0% | 8.0% | 5.0% | 8.0% | 8.0% | 8.0% | 2.0% | 2.0% | 2.0% | 3.5% | 2.0% | 2.0% | 3.5% | 3.5% | 3.5% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | |

| Gilts (Fixed & Index-Linked) | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | |

| Fixed Income | 11.3% | 0.0% | 33.2% | 33.2% | 33.2% | 17.8% | 33.2% | 33.2% | 17.8% | 33.2% | 33.2% | 33.2% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 14.2% | 14.2% | 11.2% | 18.2% | 14.2% | 11.2% | 18.2% | 18.2% | 18.2% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | |

| Alternatives | Alternatives/Hedge Funds | 6.4% | 0.0% | 27.0% | 27.0% | 27.0% | 21.0% | 27.0% | 27.0% | 21.0% | 27.0% | 27.0% | 27.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

| TOTAL | 92.9% | N.A. | N.A. | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 75.0% | 75.0% | 59.5% | 75.0% | 75.0% | 59.5% | 75.0% | 75.0% | 75.0% | 100.1% | 100.1% | 100.0% | 100.0% | 100.1% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | |

| Total Bonds | 33.2% | 33.2% | 17.8% | 33.2% | 33.2% | 17.8% | 33.2% | 33.2% | 33.2% | 45.0% | 45.0% | 22.5% | 45.0% | 45.0% | 22.5% | 45.0% | 45.0% | 45.0% | 50.5% | 50.5% | 35.1% | 72.6% | 50.5% | 35.1% | 72.6% | 72.6% | 72.6% | 61.7% | 57.2% | 22.7% | 65.2% | 62.4% | 26.3% | 0.0% | 0.0% | 0.0% | ||||

| Minimum fixed interest element | 33.2% | 33.2% | 17.8% | 33.2% | 33.2% | 17.8% | 33.2% | 33.2% | 33.2% | 10.0% | 10.0% | 11.0% | 10.0% | 10.0% | 11.0% | 10.0% | 10.0% | 10.0% | 39.4% | 39.4% | 24.4% | 56.1% | 39.4% | 24.4% | 56.1% | 56.1% | 56.1% | 56.6% | 52.4% | 22.7% | 59.8% | 57.2% | 26.3% | 0.0% | 0.0% | 0.0% | ||||

| Fixed Interest % of Bonds | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 78.0% | 78.0% | 69.5% | 77.3% | 78.0% | 69.5% | 77.3% | 77.3% | 77.3% | 91.7% | 91.7% | 100.0% | 91.7% | 91.7% | 100.0% | ||||||||||||||||

| Table 3. Same distributions as in Table 2 but grouped into aggregate asset classes | ||||||||||||||||||||||||||||||||||||||||

| Asset Type | Average | Min | Max | Portfolio port_1_1_A | Portfolio port_1_2_A | Portfolio port_1_3_A | Portfolio port_2_1_A | Portfolio port_2_2_A | Portfolio port_2_3_A | Portfolio port_3_1_A | Portfolio port_3_2_A | Portfolio port_3_3_A | Portfolio port_1_1_B | Portfolio port_1_2_B | Portfolio port_1_3_B | Portfolio port_2_1_B | Portfolio port_2_2_B | Portfolio port_2_3_B | Portfolio port_3_1_B | Portfolio port_3_2_B | Portfolio port_3_3_B | Portfolio port_1_1_C | Portfolio port_1_2_C | Portfolio port_1_3_C | Portfolio port_2_1_C | Portfolio port_2_2_C | Portfolio port_2_3_C | Portfolio port_3_1_C | Portfolio port_3_2_C | Portfolio port_3_3_C | Portfolio port_1_1_D | Portfolio port_1_2_D | Portfolio port_1_3_D | Portfolio port_2_1_D | Portfolio port_2_2_D | Portfolio port_2_3_D | Portfolio port_3_1_D | Portfolio port_3_2_D | Portfolio port_3_3_D | |

| Bonds | 39.9% | 0.0% | 72.6% | 33.2% | 33.2% | 17.8% | 33.2% | 33.2% | 17.8% | 33.2% | 33.2% | 33.2% | 45.0% | 45.0% | 22.5% | 45.0% | 45.0% | 22.5% | 45.0% | 45.0% | 45.0% | 50.5% | 50.5% | 35.1% | 72.6% | 50.5% | 35.1% | 72.6% | 72.6% | 72.6% | 61.7% | 57.2% | 22.7% | 65.2% | 62.4% | 26.3% | 0.0% | 0.0% | 0.0% | |

| Equities | 27.7% | 0.0% | 56.2% | 34.8% | 34.8% | 56.2% | 34.8% | 34.8% | 56.2% | 34.8% | 34.8% | 34.8% | 17.0% | 17.0% | 27.0% | 17.0% | 17.0% | 27.0% | 17.0% | 17.0% | 17.0% | 34.0% | 34.0% | 52.3% | 14.0% | 34.0% | 52.3% | 14.0% | 14.0% | 14.0% | 24.9% | 23.1% | 48.5% | 26.3% | 25.2% | 56.1% | 0.0% | 0.0% | 0.0% | |

| Cash | 15.2% | 4.3% | 100.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 8.6% | 8.6% | 7.1% | 4.3% | 8.6% | 7.1% | 4.3% | 4.3% | 4.3% | 13.3% | 19.8% | 28.8% | 8.4% | 12.5% | 17.7% | 100.0% | 100.0% | 100.0% | |

| Other | 10.2% | 0.0% | 27.0% | 27.0% | 27.0% | 21.0% | 27.0% | 27.0% | 21.0% | 27.0% | 27.0% | 27.0% | 8.0% | 8.0% | 5.0% | 8.0% | 8.0% | 5.0% | 8.0% | 8.0% | 8.0% | 7.0% | 7.0% | 5.5% | 9.1% | 7.0% | 5.5% | 9.1% | 9.1% | 9.1% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | |

| TOTAL | 92.9% | N.A. | N.A. | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 75.0% | 75.0% | 59.5% | 75.0% | 75.0% | 59.5% | 75.0% | 75.0% | 75.0% | 100.1% | 100.1% | 100.0% | 100.0% | 100.1% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | |

| NOTES | ||||||||||||||||||||||||||||||||||||||||

| Asset Allocation comments: | ||||||||||||||||||||||||||||||||||||||||

| All have a cash weighting (ranges from 4% to 100% of total portfolio) | ||||||||||||||||||||||||||||||||||||||||

| 3 of 4 Firms use Alternatives/Hedge Funds (ranges from 5% to 27% of total portfolio). | ||||||||||||||||||||||||||||||||||||||||

| All have a UK Equity Weighting, apart from 1 case for 1 firm where 100% cash is recommended (ranges from 5% to 51% of total portfolio) | ||||||||||||||||||||||||||||||||||||||||

| All have an Overseas Equity Weighting, apart from 1 case for 1 firm where 100% cash is recommended (ranges from 4% to 27% of total portfolio) | ||||||||||||||||||||||||||||||||||||||||

| 2 firms recommend a small property weighting (3% to 8% of portfolio) | ||||||||||||||||||||||||||||||||||||||||

| 1 firm recommends a small commodity weighting (2% to 4% of portfolio) | ||||||||||||||||||||||||||||||||||||||||

| All have a bond weighting, apart from 1 case for 1 firm where 100% cash is recommended (ranges from 18% to 65% of total portfolio) | ||||||||||||||||||||||||||||||||||||||||

| Bond weightings are split and categorised differently by different firms, but the following observations hold: | ||||||||||||||||||||||||||||||||||||||||

| 1 firm has all bond weightings in fixed interest (i.e. no index-linked bonds). Shown as 'Fixed Income' in asset allocation and referred to as Conventional Gilts /Government Stock in accompanying material. | ||||||||||||||||||||||||||||||||||||||||

| 1 firm has a single weighting to Gilts (both fixed interest and index-linked), so can't tell the mix between fixed interest and index-linked | ||||||||||||||||||||||||||||||||||||||||

| Where an explicit split of bonds between fixed interest and index-linked is provided, the fixed interest portion of the bond allocation is dominant (fixed interest portion between 55% and 100% of bond element) | ||||||||||||||||||||||||||||||||||||||||

| Further breakdowns on asset classes invested and is provided in accompanying material for Firm A | ||||||||||||||||||||||||||||||||||||||||

| Firm-specific comments: | ||||||||||||||||||||||||||||||||||||||||

| Firm A only recommended 2 different portfolios across the 9 combinations. The riskier of the 2 is in relation to DR3 for 2 cases (i.e. lower compensation amount has led to needing to take more risk to meet needs) | ||||||||||||||||||||||||||||||||||||||||

| Firm B only recommended 2 different portfolios across the 9 combinations. The riskier of the 2 is in relation to DR3 for 2 cases (i.e. lower compensation amount has led to needing to take more risk to meet needs) | ||||||||||||||||||||||||||||||||||||||||

| Firm C only recommended 3 different portfolios across the 9 combinations. For given cases, if the lowest risk portfolio can provide for income needs then it is chosen. If not, the middle risk is chosen, unless this doesn't meet their income needs, at which the highest risk option is chosen | ||||||||||||||||||||||||||||||||||||||||

| Firm D recommends bespoke portfolios for each of 9 combinations. For Case 3 this has led to 100% cash for each option (since it is assumed that the compensation amount is enough to meet their future income requirements without investing under all 3 DR scenarios). | ||||||||||||||||||||||||||||||||||||||||

| For Firm D, the higher the compensation amount the lower the risk assumed in the portfolio. So when compensation is lowered more risk is needed to be taken in order to meet the claimant's needs. | ||||||||||||||||||||||||||||||||||||||||

| Firm B notes for some scenarios that only a portion of the compensation would be invested in the recommended portfolio, with the remainder left in cash – adjustments would be required to reflect this, but does not affect the broad portfolio analysis above |

| Controls & AQA Log | ||||||||

| Overview | ||||||||

| Analyst(s) | XXXX | |||||||

| Commissioner/Customer | XXXX | |||||||

| Purpose | Summary of WMA questionnaire responses during Personal Injury Discount Rate Consultation. | |||||||

| Latest Agreed Version | ||||||||

| Version | Date of Sign-Off | |||||||

| 20170523 - WMA questionnaire - aggregate responses - v1.xls | 31-May-17 | |||||||

| Version Control | ||||||||

| Version | Date | Analyst | Description of changes | |||||

| 20170523 - WMA questionnaire - aggregate responses - v1.xls | 5/23/2017 | XXXX | Original version. | |||||

| Checks Complete? | Yes | Relates to completed checks where no issues have been identified | ||||||

| Recommendation | Relates to checks which have been carried out where no major issues have been identified but where there are recommendations for improvement | |||||||

| Issue | Relates to checks which have identified major issues in the analysis which require action. | |||||||

| Outstanding | Relates to checks which have not been completed due to time or resource constraints. | |||||||

| AQA Log - Developer Testing | ||||||||

| Version | Item / Worksheet | Checks Completed? | Details of Checks Performed | Comments / Issues | Follow-up Action Complete? | Related Documentation | ||

| 20170523 - WMA questionnaire - aggregate responses - v1.xls | Portfolio summaries | Yes | Reviewed worksheet for presentation. | I don't really understand what the summaries for total bonds and minimum fixed interest are for. RESPONSE: This was used to sense-check broad asset allocations. Some respondents provided various bonds separately while others only fixed income as a general group. This allows fixed income to be compared across all portfolios. |

Yes | |||

| 20170523 - WMA questionnaire - aggregate responses - v1.xls | Portfolio summaries | Recommendation | Internal formulas of averages, min, max, summation draw from the correct data and give correct results. | Some portfolio summations come to greater than 100%. This is an issue with the raw data. RESPONSE: This is just a rounding issue - so has not been followed up. |

Yes | |||

| 20170523 - WMA questionnaire - aggregate responses - v1.xls | Portfolio summaries | Yes | Spot checked that data in this sheet matches up with raw data. | Results from Portfolio summaries spot checked against raw input data and no errors found. It can be assumed that the formulas in Portfolio Summaries draw from the correct tabs and that data has been inputted correctly. | Yes | |||

| 20170523 - WMA questionnaire - aggregate responses - v1.xls | Portfolio source sheets | Yes | 1. Checked that the portfolio tables all correspond to named ranges as used on the Portfolio Summaries sheet. 2. Checked that the portfolio tables are as in the material provided by each firm. 3. Checked that the totals in the sources sum to 100% |

All fine. | Yes | |||

| 20170523 - WMA questionnaire - aggregate responses - v1.xls | Portfolio source sheets | Yes | Checked that other tables source the correct material from the original workbooks and documents provided. | All numbers correct. | Yes | |||

no reviews yet

Please Login to review.