245x Filetype PPTX File size 0.23 MB Source: russellinvestments.com

Six month roadmap

YOUR FIRM LOGO

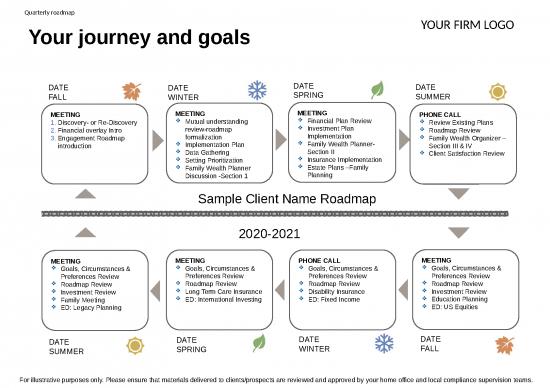

Your journey and goals

DATE DATE

FALL SPRING

MEETING MEETING

1. Discovery- or Re-Discovery Mutual understanding review

2. Financial overlay Intro Implementation Plan

3. Engagement Roadmap Review Data Gathering

Setting Prioritization

Family Wealth Planner Discussion begin -Section 1

Sample Client Name Roadmap

2020-2021

MEETING MEETING

Goals, Circumstances & Preferences Review Goals, Circumstances & Preferences Review

Roadmap Review Roadmap Review

Investment Review Investment Review

Family Meeting Education Planning

ED: Legacy Planning ED: US Equities

DATE DATE

SPRING FALL

For illustrative purposes only. Please ensure that materials delivered to clients/prospects are reviewed and approved by your home office and local compliance supervision teams.

Wealth Management Topics – Wealth Wellness Wheel

Below is a list of topics you can use as a guide when building your client’s roadmap. The topics should always align with their

goals and desired outcomes.

FAMILY AND RELATIONSHIPS HEALTH AND WELLNESS LIFESTYLE AND LEISURE CAREER AND WORK

Create/Update my Will Maintain/start a health and active Plan vacations and travel Take a sabbatical

Concerned about protecting lifestyle Maintain my current lifestyle Change/advance my career

Plan for unexpected events Plan for my long-term care Plan for my retirement lifestyle Plan for maternity/paternal leave

Plan for a wedding Plan for incapacity Move, relocate or downsize Start a business

Fund education expenses Maintained activities, club Protect or invest in collectibles Sell or transfer my business

Organize family meeting to discuss memberships Purchase a second home/cottage Expand my business

my plan Purchase an investment property Protect my business

Educate my children on wealth SUB TOPICS: Buy something special Incorporate my business/practice

matters Lifestyle Insurance Review

Prepare my heirs for wealth DISABILITY INSURANCE PLANNING SUB TOPICS SUB TOPICS

transfer Disability income goals Investment Management BUSINESS PLANNING

Plan my funeral/celebration of life Disability income sources Risk tolerance assessment Start or Expand my business:

Create/update my Power of Disability planning implementation Asset allocation review Business planning goals

Attorney LTC education and review Asset location & Sources of capital Owner benefits

Care for children or dependents review Owner needs assessment

Care for parents/elders Asset transfer implementation Owners meeting

Start or grow my family IRA accounts/rollovers

Investment review Sell or transfer my business

Taxable accounts review Business succession choices

Investment implementation Owner benefits – retirement

SUB TOPICS Portfolio rebalancing

Financial needs assessment Annuity review & Education Protect my business

Liquidity analysis COMMUNITY AND GIVING Saving strategy implementation Risk management assessment

Insurance review Support a worthy cause/charity Retirement income investing Property and casualty/liability

Life insurance trusts review Set-up a foundation review

Planning for special needs Join a non-profit board Income Planning Overhead expense coverage

Equitable distribution planning Volunteer Sources of survivor income assessment

Estate Planning goals Survivor income solutions Key person review

Survivor income goals SUB TOPICS: Distribution strategies Employee benefits Assessment &

College/Education goal plan Charitable giving plan creation and Sources of retirement income Review

implementation implementation Retirement Benefits review Employee benefits review

Family Planner creation Essential Expense Review – group health, Life,

Child care directives Contingency income Education Disability, LTC

Health Care directives and Planning Owner benefits review

– life. Disability, LTC

OTHER

Pursue my next life passion

Other

For illustrative purposes only. Please ensure that materials delivered to clients/prospects are reviewed and approved by your home office and local compliance supervision teams.

Important Information

Russell Investments’ ownership is composed of a majority stake held by funds managed

by TA Associates with minority stakes held by funds managed by Reverence Capital

Partners and Russell Investments’ management.

Copyright © 2020 Russell Investments Group, LLC. All rights reserved.

Frank Russell Company is the owner of the Russell trademarks contained in this material

and all trademark rights related to the Russell trademarks, which the members of the

Russell Investments group of companies are permitted to use under license from Frank

Russell Company. The members of the Russell Investments group of companies are not

affiliated in any manner with Frank Russell Company or any entity operating under the

“FTSE RUSSELL” brand.

Russell Investments Financial Services, LLC, member of FINRA, part of Russell

Investments.

Created: February 2020. Expiration: 12/31/2022

RIFIS 22408 CAR # 0820-03673

For illustrative purposes only. Please ensure that materials delivered to clients/prospects are reviewed and approved by your home office and local compliance supervision teams.

no reviews yet

Please Login to review.