253x Filetype XLS File size 0.10 MB Source: assets.publishing.service.gov.uk

Sheet 1: Q&A Guidance

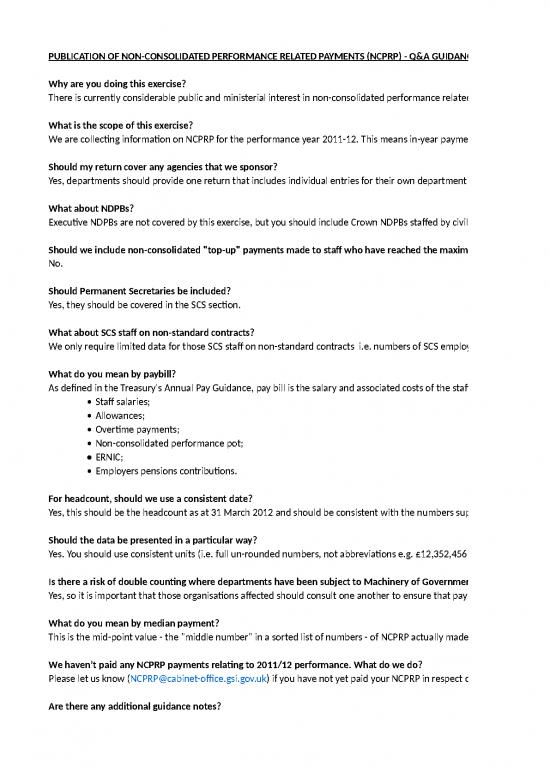

| PUBLICATION OF NON-CONSOLIDATED PERFORMANCE RELATED PAYMENTS (NCPRP) - Q&A GUIDANCE FOR COMPLETING THE SPREADSHEET | |

| Why are you doing this exercise? | |

| There is currently considerable public and ministerial interest in non-consolidated performance related payments. In the interests of transparency and continued openness across Government it has been decided to publish this data in a co-ordinated and consistent way. | |

| What is the scope of this exercise? | |

| We are collecting information on NCPRP for the performance year 2011-12. This means in-year payments made in 2011-12 and end-year payments made after 1 April 2012. Do not include payments that relate to the 2012-13 performance year. | |

| Should my return cover any agencies that we sponsor? | |

| Yes, departments should provide one return that includes individual entries for their own department and each agency that they sponsor. Agencies should liaise with their sponsor departments accordingly. | |

| What about NDPBs? | |

| Executive NDPBs are not covered by this exercise, but you should include Crown NDPBs staffed by civil servants. | |

| Should we include non-consolidated "top-up" payments made to staff who have reached the maximum of their pay range? | |

| No. | |

| Should Permanent Secretaries be included? | |

| Yes, they should be covered in the SCS section. | |

| What about SCS staff on non-standard contracts? | |

| We only require limited data for those SCS staff on non-standard contracts i.e. numbers of SCS employed on non-standard terms and the highest NCPRP paid. Please refer to the template for further information. | |

| What do you mean by paybill? | |

| As defined in the Treasury's Annual Pay Guidance, pay bill is the salary and associated costs of the staff employed by the organisation, including: | |

| • | Staff salaries; |

| • | Allowances; |

| • | Overtime payments; |

| • | Non-consolidated performance pot; |

| • | ERNIC; |

| • | Employers pensions contributions. |

| For headcount, should we use a consistent date? | |

| Yes, this should be the headcount as at 31 March 2012 and should be consistent with the numbers supplied to Cabinet Office in the monthly workforce management information exercise and other related data commissions and statistics. | |

| Should the data be presented in a particular way? | |

| Yes. You should use consistent units (i.e. full un-rounded numbers, not abbreviations e.g. £12,352,456 not £12.3M). | |

| Is there a risk of double counting where departments have been subject to Machinery of Government changes? | |

| Yes, so it is important that those organisations affected should consult one another to ensure that payments to staff are only covered by one return/entry. | |

| What do you mean by median payment? | |

| This is the mid-point value - the "middle number" in a sorted list of numbers - of NCPRP actually made to staff. You should not include £nil payments to calculate the median. | |

| We haven’t paid any NCPRP payments relating to 2011/12 performance. What do we do? | |

| Please let us know (NCPRP@cabinet-office.gsi.gov.uk) if you have not yet paid your NCPRP in respect of the 2011-12 performance year. We appreciate that some departments have exited the pay freeze this year and may still be in wider pay deal negotiations with their trades union. | |

| Are there any additional guidance notes? | |

| Yes - the spreadsheet contains further information in the form of comments in relevant cells | |

| Where will the data be published? | |

| The data will be published on departmental websites, linked to the data.gov.uk website. Further information will be provided on the publication date and process. | |

| I have an existing Freedom of Information request for this (or some of this) information. Can we use the Section 22 (information intended for future publication) exemption? | |

| We believe you can, but you should seek confirmation from your own FOI advisers. | |

| Will we be able to refer to this information to answer future FOI requests and Parliamentary Questions? | |

| Again, we believe you can, subject to your own internal advice (and this will very much depend on the specific information requested). | |

| When is the deadline for sending in returns? | |

| The latest we can receive each departments summary return is Thursday 25 October. | |

| Who do we send our returns to? | |

| All returns should be sent to NCPRP@cabinet-office.gsi.gov.uk |

no reviews yet

Please Login to review.