Authentication

339x Filetype XLSX File size 0.16 MB

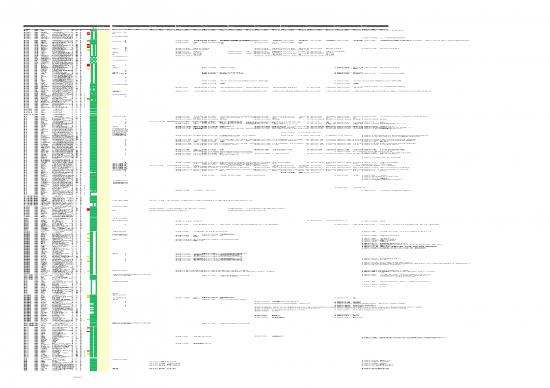

Comments from Stakeholder FINREP/COREP/Others AnaCredit ESMA Templates - Non-ABCP ESMA Templates - Resi ESMA Templates - CORP ESMA Templates - ABCP ESMA Templates - Auto ESMA Templates - Credit Card ESMA Templates - Consumer ESMA Templates - Leas ESMA Templates - CMBS

p d

r e

o r g

u n

C c i r

i / e o s e

s E E s t a h

e R M n u e t

Index Data Categories Borrower Type Field Description Field Type Importance Dynamic / Static Country specCifoicn f(iWdeonrtkia inli Progress) Reference Index Field Name Description Index Section Field Name Description Index Section Field Name Description Index Section Field Name Description Index Section Field Name Description Index Section Field Name Description Index Section Field Name Description Index Section Field Name Description Index Section Field Name Description Index Section Field Name Description

R C S U A L O

1.000 Portfolio Applicable to all Cut-off Date Reporting date of the data extract Date Critical Dynamic 1 1 1 1 1 1 1 DI6 Securitisation information section Data Cut-Off Date The data cut-off date for this data submissAR1 Loan/lease-level information section Data Cut-Off Date the data cut-off date for this data submissAS1 Loan/lease-level information section Data Cut-Off Date the data cut-off date for this data submissBE3 Underlying exposures section (compleData Cut-Off Date The data cut-off date for this data submissAA1 Loan/lease-level information section Data Cut-Off Date the data cut-off date for this data submissAT1 Loan/lease-level information section Data Cut-Off Date the data cut-off date for this data submissAN1 Loan/lease-level information section Data Cut-Off Date the data cut-off date for this data submissAL1 Loan/lease-level information section Data Cut-Off Date the data cut-off date for this data submissAC2 Loan/lease-level information section Data Cut-Off Date the data cut-off date for this data submission. This is the date at which the data within the report is referenced.

1.001 Portfolio Applicable to all Portfolio Identifier Institution's internal identifier for the Portfolio Text Critical Static 1 1 1 1 1 1 1

2.000 Counterparty Group Applicable to all Counterparty Group Identifier Institution's internal identifier for the Counterparty Group. Where Counterparty Group is de Text Critical Static 1 1 1 1 "Borrower Group" will be further defined in instructions and i10.7

2.001 Counterparty Group Applicable to all Name of Counterparty Group Name used to refer to the Counterparty Group Text Moderate Static 1 1 1 1 1

2.002 Counterparty Group Applicable to all Industry Segment of Counterparty Group Industry in which the Counterparty Group mainly operates Choice Critical Static 1 1 1 1 NACe codes

2.003 Counterparty Group Applicable to all Name of Sponsor Name used to refer to the main decision maker / key individual in relation to the CounterpaText Moderate Static 1 1 1 1 1

2.004 Counterparty Group Applicable to all Type of Sponsor Type of entity the sponsor is i.e. Listed Corporate, Unlisted Corporate, Listed Fund, Unlis Choice Important Static 1 1 1 1

2.005 Counterparty Group Applicable to all Description of Sponsor Description and related narrative on the Sponsor, e.g. the Sponsor is a high net worth ind Text Moderate Static 1 1 1 1

2.006 Counterparty Group Applicable to all Cross Default in Counterparty Group The indicator as to whether Contractual breach of any loans in the Counterparty Group wouCldh oice Critical Static 1 1 1 1 Default: as defined in Article 178 of Regulation (EU) No 575/2013 (CRR) a

2.007 Counterparty Group Applicable to all Description of Cross Default Description of cross default when "Partial" is selected in field "Cross Default in Borrower G Text Critical Static 1 1 1 1

2.008 Counterparty Group Applicable to all Cross Collateralisation in Counterparty Group Indicator as to whether all / some of the loans in the Counterparty Group are secured by allC hoice Critical Static 1 1 1 1 AC34 Loan/lease-level information section Cross-Collateralised Loan Indicate if this is a cross collateralised loan (Example: loans 1 and 44 are cross collateralised as are loans 4 and 47).

2.009 Counterparty Group Applicable to all Description of Cross Collateralisation Description of cross collateralisation when "Partial" is selected in field "Cross Collateralisa Text Critical Static 1 1 1 1

3.000 Counterparty Applicable to all Counterparty Identifier Unique internal identifier for the Counterparty. One or multiple Counterparties can be part Text Critical Static 1 1 1 1 1 1 1 9.3 AR4 Loan/lease-level information section Borrower Identifier AS4 Loan/lease-level information section Borrower Identifier AA4 Loan/lease-level information section Borrower Identifier AT5 Loan/lease-level information section Borrower Identifier AN4 Loan/lease-level information section Borrower Identifier AL4 Loan/lease-level information section Borrower Identifier AC4 Loan/lease-level information section Borrower Identifier

Unique identifier (ID) per borrower (not showing the real name) - to enable borrowers with multiple loans in the pool to be idenUtinfiieqdu e(e id.ge.n ftuifritehre (rI Dad) vpaenr cebos rr/o sewecor (nndo lti eshns owairneg sh thoew rne aals nsaempea)r a- tteo e enntaribels)e .b Tohrris owmeurss tw niotht chmualntigpele o lovearn ts hien ltihfee o pf otohle t ose bcue riditeisanttiifoiend. T(eh.eg .i dfuernthtiefire ra dmvaustnc bees d/ iseffecorenntd f rlioemns a anry e eshxtoewrnna la is desentpifaicaratteio ne nnturimes)be. rT, hinis o mrduestr tnoo et nchsuarneg aen oovneymr thitey loiffe t hoef tbhoer rseowceurr.itisUatnioiqnu. eT hidee indteifnietrif i(eIDr m) puestr bboer droifwfeerre n(nt ofrto shmo awniy nge xttheer nreaal li dneanmtifeica) - titoon e nnuamblbe ebro, irnro owrdeers r wtoi tehn msuurlteip alen olonaymns itiy n othf eth peo bool rtroo wbee ri.denUtinfiieqdu e( eid.ge.n futifritehre (rI Dad) vapenr cbeosr r/o sewecor (nndo lti eshnso warineg sh thoew rne aals nseampea)r a-t teo eenntaribels)e .b Tohrriso wmeursts wniotht chmualntigpele o lvoearn s thien ltihfee opfo thole t ose bceu riditeisnattiifoienUd. nT(eihq.eug .ei d fiuedrnethtnieftiiref irea mrd va(uIDstn)ce bpees rd /b isefofercorreownntde f rrl ioe(mnnos ta anshry eo ewshxtinoegwrn ntah lea is dreeseantlp ifnaicaaramttieeo )ne - nn ttouri emes)bnae. brT, lheini s boomrrdrueosrwt tenoro s et nwchsuitahrn emg aeun lotoivepnlymer tlohitaey n los iffe itn ho etfh tbeho epr roseoowlcu etorr. ibtisae itdioenn.t iTfiehUde n(ideiqe.ugn.et i ffiuideretrh nmetiruf ieastrd vb(IaeDn d)ce ipffes err /el esenst secofronem dto lai eennny s aebaxlretee l reshnsaseol widenes nawts ifitiscahe mptiaournlat itnpeule em nlebtaerisere,s) is n. ionTr hdthis eerm ptouo soetln ntsuoo tbr eche aiadnneognnetyi fmoieveidty .r Tothhf eits h leishf ebo oourfr ldtoh wnee osetr .chcuarintgisae tdiounri.n Tg htUeh neidi qleifuneet i ofiifde etrh nmet ifuseiestrcu b(IreDi td)isa ipffeetiror ebnno ttrr rfaronowsame ctra (ninoy onte. xshteorwnainl gid tehnet irfeicaalt inoanm neu)m - btoe re, nina borled ebro troro ewnesurs rew iatnh omnuymltipitly e olof athnes bino rtrhoew peor.ol to be identified (e.g. further advances / second liens are shown as separate entries). This must not change over the life of the securitisation. The identifier must be different from any external identification number, in order to ensure anonymity of the borrower where necessary to comply with data protection laws.

If more than one borrower list the Borrower ID's comma delimited with primary borrower (in terms of income and, if that is notI fp mreoseren tt,h aang eo)n feir sbt.orrower list the Borrower ID's comma delimited with primary borrower (in terms of income and, if that is not present, age) first. If more than one borrower list the Borrower ID's comma delimited with primary borrower (in terms of income and, if that is notI fp mreosreen tth, aagne o)n feir stbo. rrower list the Borrower ID's comma delimited with primary borrower (in terms of income and, if that is not preseIf mnto, raeg teh)a fnir sotn. e borrower list the Borrower ID's comma delimited with primary borrower (in terms of income and, if that is not preseIf mnto, raeg teh)a fnir sotn. e Lessee list the Lessee ID's comma delimited with primary Lessee first. If more than one borrower list the Borrower ID's comma delimited with primary borrower (in terms of income and, if that is not present, age) first.

3.001 Counterparty Applicable to all Name of Counterparty Name used to refer to the Counterparty Text Moderate Static 1 1 1 1 1 1 1 1 10.8 AS58 Loan/lease-level information section Large Enterprise Name If the obligor is classified as a large enterprise (i.e. not an SME) according to the 'Enterprise Size' field, enter the name of the obligor as reported in its audited financial statements. The identifier must be different from any external identification number, in order to ensure anonymity of the lessee.

3.002 Counterparty Applicable to all Counterparty Group Identifier Institution's internal identifier for the Counterparty Group. Where Counterparty Group is de Text Critical Static 1 1 1 1 1 1 1 "Borrower Group" will be further defined in instructions and i10.7

3.003 Counterparty Applicable to all Counterparty Role Type of the Counterparty i.e. Guarantor, Borrower, Tenant Choice Critical Static 1 1 1 1 1 1 1

3.004 Counterparty Applicable to all Legal Type of Counterparty Type of the Counterparty i.e. Private Individual, Listed Corporate, Unlisted Corporate and Choice Critical Static 1 1 1 1 1 1 1 10.14 AR6 Loan/lease-level information section Borrower Type The type of borrower AS10 Loan/lease-level information section Obligor Legal Form / Business Type Public Company (1) AA54 Loan/lease-level information section Customer Type Legal form of customer: AT12 Loan/lease-level information section Borrower Type The type of borrower

3.005 Counterparty Applicable to all Number of Joint Counterparties Number of joint Counterparties who jointly own parts of the Loan. Number Critical Static 1 1 1 1 1 1 1 Individual (1) Limited Company (2) Public Company (1) Individual (1)

Commercial (2) Partnership (3) Limited Company (2) Commercial (2)

3.006 Counterparty Private Individual Date of Birth Date of birth of the Private Individual Counterparty Date Moderate Static 1 1 1 1 1 Société Civile Immobilière (3) Individual (4) Partnership (3)

3.007 Counterparty Private Individual Personal Identity Number Unique external identifier assigned to the Private Individual Counterparty Text Moderate Static 1 1 1 1 1 Government Entity (5) Individual (4)

3.008 Counterparty Private Individual Type of Personal Identity Number Type of the personal identity number entered in field "Personal Identity Number", e.g. N Choice Moderate Static 1 1 1 1 Other (6) Government Entity (5)

Other (6)

3.009 Counterparty Private Individual Nationality of Counterparty Main nationality of the Private Individual Counterparty Choice Moderate Dynamic 2 1 1 1 1

3.010 Counterparty Private Individual Address of Residence Street address where the Private Individual Counterparty lives, including flat / house numb Text Moderate Static 1 1 1 1 1 10.9

3.011 Counterparty Private Individual City of Residence City where the Private Individual Counterparty lives Choice Critical Static 1 1 1 1 10.10

3.012 Counterparty Private Individual Geographic Region of Residence Province / Region where the Private Individual Counterparty lives Choice Important Static 1 1 1 1 NUTS-3 2013 Classification 10.12 AR55 Loan/lease-level information section Geographic Region The geographic region (NUTS3 classification) where the obligor is located. AA17 Loan/lease-level information section Geographic Region The geographic region (NUTS3 classificatAi T18 Loan/lease-level information section Geographic Region The geographic region (NUTS3 classificatAi N19 Loan/lease-level information section Geographic Region The geographic region (NUTS3 classification) where the obligor is located. AC76 Loan/lease-level information section Geographic Region The geographic region (NUTS3 classification) where the borrower is located as at underwriting.

3.013 Counterparty Private Individual Geographic Region Classification NUTS3 classification used for the field "Geographic Region of Residence", i.e. NUTS3 20 Choice Important Static 1 1 1 1 AR57 Loan/lease-level information section Geographic Region Classification Select the NUTS3 classification used for the Geographic Region fields: AA18 Loan/lease-level information section Geographic Region Classification Select the NUTS3 classification used for thAeT 1G9eogLroaapnh/ilc eaRseeg-iloenve fil einldfo: rmation section Geographic Region Classification Select the NUTS3 classification used for tAheN 2G0eographic Region field:

3.014 Counterparty Private Individual Postcode of Residence Postcode where the Private Individual Counterparty lives Text Moderate Static 2 1 1 1 1 10.11 NUTS3 2013 (1) NUTS3 2013 (1) NUTS3 2013 (1)

NUTS3 2010 (2) NUTS3 2010 (2) NUTS3 2010 (2)

3.015 Counterparty Private Individual Country of Residence Country where the Private Individual Counterparty resides Choice Moderate Static 1 1 1 1 10.13 NUTS3 2006 (3) NUTS3 2006 (3) NUTS3 2006 (3)

NUTS3 2003 (4) NUTS3 2003 (4) NUTS3 2003 (4)

3.016 Counterparty Private Individual Annual Income Total annual income of the Private Individual Counterparty Number Moderate Dynamic 1 1 1 1 AR9 Loan/lease-level information section Primary Income Primary borrower underwritten annual income. BE45 Underlying exposures section (complePrimary Income Weighted average, using the current balaAnA13 Loan/lease-level information section Primary Income Primary borrower underwritten annual incoAmT1e5. Loan/lease-level information section Primary Income Most recently recorded gross annual incoAmN16 Loan/lease-level information section Primary Income Primary borrower underwritten annual income. Should be rounded to the nearest 1000 units.

Other (5) Other (5) Other (5)

Should be rounded to the nearest 1000 units

3.017 Counterparty Private Individual Currency of Annual Income Currency that the annual income of the Private Individual Counterparty is expressed in Choice Moderate Dynamic 1 1 1 1 ISO 4217 Currency Codes AR11 Loan/lease-level information section Primary Income Currency The income currency denomination. AA14 Loan/lease-level information section Primary Income Currency The income currency denomination. AN17 Loan/lease-level information section Primary Income Currency The income currency denomination.

3.018 Counterparty Private Individual Income Self-Certified Indicator as to whether the Private Individual Counterparty has self-certified their annual i Boolean Important Dynamic 1 1 1 1

3.019 Counterparty Private Individual Employment Status Employment status of the Private Individual Counterparty i.e. Employed, Employed with parChoice Moderate Dynamic 1 1 1 1 AR7 Loan/lease-level information section Borrower's Employment Status BE44 Underlying exposures section (compleEmployment Status The total value of exposures of this type AA12 Loan/lease-level information section Borrower's Employment Status AT13 Loan/lease-level information section Borrower's Employment Status AN15 Loan/lease-level information section Borrower's Employment Status

Employment status of the primary applicant: Employment status of the primary applicant: Employment status of the primary applicant: Employment status of the primary applicant:

3.020 Counterparty Private Individual Occupation Type Main occupation of the Private Individual Counterparty, where (a), (b), (c) or (d) is selected Choice Moderate Dynamic 1 1 1 1 ISCO-08 Employed or full loan is guaranteed (1) Employed or full loan / lease is guaranteed (1) Employed (1) Employed or full loan is guaranteed (1)

Employed with partial support (company subsidy) (2) Employed with partial support (company subsidy) (2) Protected life-time employment (civil/government servant) (2) Employed with partial support (company subsidy) (2)

3.021 Counterparty Private Individual Occupation Description Description of the occupation of the Private Individual Counterparty, providing more detail Text Moderate Dynamic 1 1 1 1 Protected life-time employment (Civil/government servant) (3) Protected life-time employment (Civil/government servant) (3) Unemployed (3) Protected life-time employment (Civil/government servant) (3)

Unemployed (4) Unemployed (4) Self-employed (4) Unemployed (4)

3.022 Counterparty Private Individual Date of Verification for Personal Details Date that the personal details of the Private Individual Counterparty, i.e. nationality, resi Date Moderate Dynamic 1 1 1 1 AR10 Loan/lease-level information section Income Verification For Primary Incom AA16 Loan/lease-level information section Income Verification For Primary Incom AT17 Loan/lease-level information section Income Verification For Primary Incom AN18 Loan/lease-level information section Income Verification For Primary Incom

Income verification for primary income: Income verification for primary income: Income verification for primary income: Income verification for primary income:

Self-employed (5) Self-employed (5) No employment, borrower is legal entity (5) Self-employed (5)

3.023 Counterparty Applicable to all Internal Credit Rating at Origination Internal credit rating issued to the Counterparty applicable at the point in time when the Text Moderate Static 1 1 1 1 1 1 1 Internal scoring as referred to for table C08 in Part 2 of Annex II to Imp Self-certified no checks (1) Self-certified no checks (1) Bureau data (1) Self-certified no checks (1)

No employment, borrower is legal entity (6) No employment, borrower is legal entity (6) Student (6) No employment, borrower is legal entity (6)

Self-certified with affordability confirmation (2) Self-certified with affordability confirmation (2) Verified (2) Self-certified with affordability confirmation (2)

3.024 Counterparty Corporate External Credit Rating at Origination External credit rating issued to the Corporate Counterparty applicable at the point in tim Text Important Static 1 1 1 Student (7) Student (7) Pensioner (7) Student (7)

Verified (3) Verified (3) Partially verified (3) Verified (3)

Pensioner (8) Pensioner (8) Existing Customer, status not required (8) Pensioner (8)

3.025 Counterparty Corporate Source of External Credit Rating at Origination From which agency the external credit rating at the point in time when the Counterparty Text Important Static 1 1 1 Non-Verified Income / Fast Track (4) Non-Verified Income / Fast Track (4) Self-certified with affordability confirmation (4) Non-Verified Income / Fast Track (4)

Other (9) Other (9) Initial credit limit did not require this data (9) Other (9)

3.025 Counterparty Private Individual External Credit Scoring at Origination External credit scoring issued to the Private Individual Counterparty at loan origination and Text Important Static 1 1 1 1 Other (5) Credit Bureau Information / Scoring (5) Self-certified no checks (5) Credit Bureau Information / Scoring (5)

Other (10)

Other (6) Income was not required (6) Other (6)

3.026 Counterparty Private Individual Source of External Credit Scoring at Origination From which agency the external credit scoring at the point in time when the Counterparty Text Important Static 1 1 1 1 Other (7)

3.027 Counterparty Applicable to all Current Internal Credit Rating Internal credit rating issued to the Counterparty at the NPL Portfolio Cut-Off Date and ple Text Moderate Dynamic 1 1 1 1 1 1 1 Internal scoring as referred to for table C08 in Part 2 of Annex II to Imp

3.028 Counterparty Corporate Current External Credit Rating External credit rating issued to the Corporate Counterparty at NPL Portfolio Cut-Off Date Text Moderate Dynamic 1 1 1

3.029 Counterparty Corporate Source of Current External Credit Rating Agency which provided the external credit rating at cut-off date Text Moderate Dynamic 1 1 1

3.029 Counterparty Private Individual Current External Credit Scoring External credit scoring issued to the Private Individual Counterparty at cut-off date and choText Important Dynamic 1 1 1 1

3.030 Counterparty Private Individual Source of Current External Credit Scoring From which agency the external credit scoring at NPL Portfolio Cut-Off Date was obtained Text Important Dynamic 1 1 1 1

3.031 Counterparty Corporate Date of Incorporation Date that the Corporate Counterparty was incorporated as a company, partnership or fund,D aate Important Static 1 1 1 1

3.032 Counterparty Corporate Registration number Company registration number of the Corporate Counterparty according to the country speciTfiecxt Important Static 1 1 1 1 1

3.033 Counterparty Corporate Legal Entity Identifier Global standard 20-character corporate identifier of the Corporate Counterparty Choice Important Static 1 1 1 1 1 ISO 17442 10.3

3.034 Counterparty Corporate Address of Registered Location Address where the Corporate Counterparty is registered, including flat / house number Text Important Static 1 1 1 1 1

3.035 Counterparty Corporate City of Registered Location City where the Corporate Counterparty is registered Choice Critical Static 1 1 1 1

3.036 Counterparty Corporate Geographic Region of Registered Location Province or Region where the Corporate Counterparty is registered Choice Critical Static 1 1 1 1 NUTS-3 2013 Classification AS5 Loan/lease-level information section Geographic Region The geographic region (NUTS3 classification) where the obligor is located. AL6 Loan/lease-level information section Geographic Region The geographic region (NUTS3 classificatAi C76 Loan/lease-level information section Geographic Region The geographic region (NUTS3 classification) where the borrower is located as at underwriting.

3.037 Counterparty Corporate Geographic Region Classification NUTS3 classification used for the field "Geographic Region of Registered Location", i.e. Choice Critical Static 1 1 1 1 AS6 AL7 Loan/lease-level information section Geographic Region Classification AC77

Select the NUTS3 classification used for the Geographic Region fields:

3.038 Counterparty Corporate Postcode of Registered Location Postcode where the Corporate Counterparty is registered Text Moderate Static 2 1 1 1 1 NUTS3 2013 (1)

NUTS3 2010 (2)

3.039 Counterparty Corporate Country of Registered Location Country where the Corporate Counterparty is registered Choice Critical Static 1 1 1 1 NUTS3 2006 (3)

3.040 Counterparty Corporate Basis of Financial Statements Financial reporting practice the Corporate Counterparty has adopted i.e. IFRS, National GAChoice Critical Dynamic 1 1 1 1 10.24 NUTS3 2003 (4)

3.041 Counterparty Corporate Financial Statements Type Indicator as to whether the financial statements have been prepared at the Consolidated oCr hoice Critical Dynamic 1 1 1 1 Other (5)

3.042 Counterparty Corporate Date of Financial Statements Date of the latest available Financial Statements Date Critical Dynamic 1 1 1 1 10.20

3.043 Counterparty Corporate Currency of Financial Statements Currency that the latest available financial statements are expressed in Choice Critical Static 1 1 1 1 ISO 4217 Currency Codes AS62 Loan/lease-level information section Financial Statement Currency The reporting currency of the financial statements. See “Currency Codes” in taxonomy for relevant choices. AL52 Loan/lease-level information section Financial Statement Currency The reporting currency of the financial statements.

3.044 Counterparty Corporate Enterprise Size Classification of enterprises by size for the Corporate Counterparty i.e. Microenterprise, S Choice Moderate Dynamic 1 1 1 1 Annex to Commission Recommendation 2003/361/EC 10.19 AS57 Loan/lease-level information section Enterprise Size AL49 Loan/lease-level information section Enterprise Size AC78 Loan/lease-level information section Enterprise Size

Classification of enterprises by size, in accordance with the Annex to Commission Recommendation 2003/361/EC. Classification of enterprises by size, in accordance with the Annex to Commission Recommendation 2003/361/EC. Classification of enterprises by size, in accordance with the Annex to Commission Recommendation 2003/361/EC.

Microenterprise – i.e. Enterprise qualifying as a microenterprise (1) Microenterprise – i.e. Enterprise qualifying as a microenterprise (1) Microenterprise - i.e. Enterprise qualifying as a microenterprise (1)

3.045 Counterparty Corporate Industry Segment Industry in which the Corporate Counterparty mainly operates Choice Critical Static 1 1 1 1 NACe code 10.16 AS25 Loan/lease-level information section Nace Industry Code Borrower industry NACE Code. AL22 Loan/lease-level information section Nace Industry Code Lessee industry NACE Code.

Small enterprise – i.e. Enterprise qualifying as a small enterprise (2) Small enterprise – i.e. Enterprise qualifying as a small enterprise (2) Small enterprise - i.e. Enterprise qualifying as a small enterprise (2)

3.046 Counterparty Corporate Business Description Description of the business operations of the Corporate Counterparty, providing more detailText Important Static 1 1 1 1 Medium enterprise – i.e. Enterprise qualifying as an SME, but not as a small enterprise or as a microenterprise (3) Medium enterprise – i.e. Enterprise qualifying as an SME, but not as a small enterprise or as a microenterprise (3) Medium enterprise - i.e. Enterprise qualifying as an SME, but not as a small enterprise or as a microenterprise (3)

3.047 Counterparty Corporate Fixed Assets Amount of fixed assets held by the Corporate Counterparty as per the latest available fina Number Critical Dynamic 1 1 1 1 Large enterprise – i.e. Enterprise not qualifying as a micro, small or medium-sized enterprise (4) Large enterprise – i.e. Enterprise not qualifying as a micro, small or medium-sized enterprise (4) Large enterprise - i.e. Enterprise not qualifying as a micro, small or medium-sized enterprise (4)

3.048 Counterparty Corporate Current Assets Amount of current assets held by the Corporate Counterparty, excluding cash and cash equNiuvmber Critical Dynamic 1 1 1 1 Natural person (5) Natural person (5) Natural person (5)

Other (6) Other (6) Other (6)

3.049 Counterparty Corporate Cash and Cash Equivalent Items Amount of cash and cash equivalent items held by the Corporate Counterparty as per the Nl umber Critical Dynamic 1 1 1 1

3.050 Counterparty Corporate Total Assets Amount of total assets held by the Corporate Counterparty as per the latest available finanNumber Critical Dynamic 1 1 1 1 10.22

3.051 Counterparty Corporate Net Assets Amount of net assets held by the Corporate Counterparty as per the latest available financNumber Critical Dynamic 1 1 1 1

3.052 Counterparty Corporate Total Liabilities Amount of total liabilities held by the Corporate Counterparty on the balance sheet as defi Number Critical Dynamic 1 1 1 1

3.053 Counterparty Corporate Total Debt Amount of total debt held by the Corporate Counterparty as per the latest available financiNumber Critical Dynamic 1 1 1 1

3.054 Counterparty Corporate Market Capitalisation Market capitalisation of a listed Corporate Counterparty Number Moderate Dynamic 1 1 1 1

3.055 Counterparty Corporate Annual Revenue Amount of annual revenue held by the Corporate Counterparty as per the latest available fNumber Important Dynamic 1 1 1 1 10.23 AS60 Loan/lease-level information section Turnover Of Obligor Annual sales volume net of all discounts and sales taxes of the counterparty in accordance with Recommendation 2003/361/EC. Equivalent to the concept of ‘total annual sales’ in Article 153(4) of Regulation (EU) No 575/2013. AL50 Loan/lease-level information section Turnover Of Lessee Annual sales volume net of all discounts and sales taxes of the counterparty in accordance with Recommendation 2003/361/EC. Equivalent to the concept of ‘total annual sales’ in Article 153(4) of Regulation (EU) No 575/2013.

3.056 Counterparty Corporate Annual EBIT Amount of annual EBIT held by the Corporate Counterparty as per the latest available finaNumber Important Dynamic 1 1 1 1

3.057 Counterparty Corporate Financials Audited Indicator as to whether the financial statements have been audited or not by the Corporat Boolean Critical Dynamic 1 1 1 1

3.058 Counterparty Corporate Number of FTE Number of full-time employees (or equivalent) working for the Corporate Counterparty as at Nt umber Moderate Dynamic 1 1 1 1 AS61 Loan/lease-level information section Number Of Employees Number of Employees. AL51 Loan/lease-level information section Number Of Employees Number of Employees.

3.059 Counterparty Applicable to all Date of Last Contact Date of last direct contact with the Counterparty Date Critical Dynamic 1 1 1 1 1 1 1 Less than or equal to 10 (1) Less than or equal to 10 (1)

Greater than 10 but less than or equal to 50 (2) Greater than 10 but less than or equal to 50 (2)

3.060 Counterparty Applicable to all Cross Default for Counterparty Indicator as to whether contractual breach of any loans held by the Counterparty would trigChoice Critical Static 1 1 1 1 1 1 1 Default: as defined in Article 178 of Regulation (EU) No 575/2013 (CRR) a Greater than 50 but less than or equal to 250 (3) Greater than 50 but less than or equal to 250 (3)

3.061 Counterparty Applicable to all Description of Cross Default Description of cross default when "Partial" is selected in field "Cross Default for CounterparText Critical Static 1 1 1 1 1 1 1 Greater than 250 (4) Greater than 250 (4)

3.062 Counterparty Applicable to all Cross Collateralisation for Counterparty Indicator as to whether all / some of the loans held by the Counterparty are secured by all Choice Critical Static 1 1 1 1 1 1 All ‘No Data’ options may be used in this field AC34 Loan/lease-level information section Cross-Collateralised Loan Indicate if this is a cross collateralised loan (Example: loans 1 and 44 are cross collateralised as are loans 4 and 47).

All 'No Data' options may be used in this field

3.063 Counterparty Applicable to all Description of Cross Collateralisation Description of cross collateralisation when "Partial" is selected in field "Cross Collateralisat Text Critical Static 1 1 1 1 1 1

3.064 Counterparty Applicable to all Related Party Indicator as to whether the Counterparty is a related party to the Institution, e.g. CounterpaBoolean Critical Static 1 1 1 1 1 1 1 AR18 Loan/lease-level information section Employee Is the borrower an employee of the originAS14 Loan/lease-level information section Originator Affiliate? Is the borrower an affiliate of the originat BE43 Underlying exposures section (compleOriginator Affiliate? The total value of exposures of this type wAA83 Loan/lease-level information section Originator Affiliate? Is the borrower an employee of the originator? For corporate obligors, is the borrower an affiliate of the originator? AN45 Loan/lease-level information section Employee Is the borrower an employee of the originAL15 Loan/lease-level information section Originator Affiliate? Is the borrower an affiliate of the originator?

3.065 Counterparty Applicable to all Description of Related Party Further comments / details on the nature of the relation between the institution and the rel Text Important Static 1 1 1 1 1 1 1

3.066 Counterparty Applicable to all Other Products with Institution Other products that the Counterparty holds with the Institution that are not included in the Text Moderate Static 1 1 1 1

3.067 Counterparty Corporate Contingent Obligations Indicator as to whether the Corporate Counterparty has contingent obligations which will beBoolean Important Static 1 1 1 1

3.068 Counterparty Corporate Description of Contingent Obligations Description of contingent obligations when "Yes" is selected in field "Contingent Obligation Text Important Static 1 1 1 1

3.069 Counterparty Applicable to all Deposit Balance with Institution Deposit amount the Counterparty holds with the Institution as defined by annex II, Part t Number Critical Dynamic 1 1 1 1 1 1 1 Annex II, Part 2 of the ECB BSI Regulation AR16 Loan/lease-level information section Deposit Amount The sum of all borrower amounts held by AthSe2 o6rigiLnoaatonr/ loera sesel-lleerve thl aint faorrem paotitoenn tseialctly ioonff-seDettpaobsilet aAgmaoinustn tthe loan balance, exclTuhdien gsu thme obfe anlel bfito rorfo awney r naamtioounnatls dheeplodsi bty co thme poernigsainatiotonr scor hseemlleer. tThoa tp arereve pnot tednotuiabllley -cooffu-snetitntagb, lteh ias gsahinostul dth bee l ocaanp pbeadla antce th,e e lxclowuedr inogf ( t1h)e t hbee ndeefpito osif ta anmy onuantito, naanl dd (e2p)o tsihet cmAomaAxi6pm8enusamLo tpiaoonnte/ lschenatiaseel mo-leeff-ve. seTlo ti tnpafrboelrevem aanmtti oodnou unsetb alctet- iocothneu nbDtoienrprgoo,w sitheti rAs -lmeshveoouul n(ldti. eb.e ( ncoatp lpoeadn -alet vethel) lwoiwthTeihrn e ot hfsu e(1 mp) o tohofel . a dlel bpoorsriot wamero aumnto, uanntds (h2e)l dth bey mthaexi omriugmin aptootre onrt iseal olleffr- sethattta abrlee apmoteounntiat lalyt tohfef- sbeotrtraobwlee ar-gleaveinstl ( it.hee. (lnooatn l ooar nle-laeseve lb) awlaitnhcein ,t heexc plouodli.n g the benefit of any national dAeNp4o4sit compLeonasan/lteioanse s-chleeveml ein. fToorm paretiveonn set dctouiobnle-Dcoepunotsiint gA,m thoisu nsthould be capped at theT lhoew suer mof o(1f )a tllh beo drreopwoesirt aammoouunntts , ahnedld ( b2y ) tAthhLee2 mo3raigxiinmautomLr o oparo nsete/lenllateiaser l toh-laeff-tve sealr teitna pfboolretme anamttiiaoolnuly nseot factf-tse iothnteta bBboloerrr roaowgwaeeirnr st(Dn eothpt eolo silaotna A nom rb olaeulaansent ce) l,e evexcl lwuditihnigTn httheh eesu bpmeono eol.ff ita oll fb aonrry onwaetiro anmalo duenpts osihte lcod bmy ptehnesa ortiioginn asctohre omr ese. Ulleser t hthaet asarem peo cutenrrtieanllcyy o dffe-senotmtainbalet ioanga ains stth teh ree lceeaiseva,b leex bclauldainnceg t.h Teo b perneevefitn ot fd aonuy blnea-cotiounnatli ndge,p tohsiis t scohomuplde nbsae catiopnp sechd aetm thee. Tloow perer veof n(1t d) othueb ldee-copousintt ianmg,o tuhnis t, shanodu (ld2 )b teh eca mpapxiedm autm th peo ltoewnteiar lo of ff(-1se) tthtaeb dlee paomsiotu anmt aotu nthte, abnodr r(o2w) ethr e(n mota lxiomanu)m le pveolt ewnittihailn o tfhf-ese ptotaobl l(ew ahmicho uisn tb aatse thde ubpoorrno twheer h (ingohte lre aosef th)e le Cveulr rweintht iPnr itnhcei ppaolo Ol. utstanding Balance (AN26) and the Total Credit Limit (AN11)).

3.070 Counterparty Applicable to all Currency of Deposit Currency that the deposit held with the Institution is expressed in Choice Critical Static 1 1 1 1 1 1 1 ISO 4217 Currency Codes Use the same currency denomination as that used for this loan. Use the same currency denomination as that used for this loan. Use the same currency denomination as the receivable balance. Use the same currency denomination as the receivable balance. Use the same currency denomination as the receivable balance.

If a borrower has more than one loan outstanding in the pool, then AR50 should be completed for each loan/, and it is up to thIef ad ibscorrerotiwone ro hf athse m doartea tphraonvi odneer tloo adne cioudtest taon adlilnogc ainte t hthee p doeopl,o tsihet na mthois unfiet aldcr sohss ouleda bche coof mthpel eloteadn ,f osur bejaechct tloo athne, aanbdo veit is-m uepn ttoio tnheed d caiscrp eatniodn so of ltohneg d aas tat hper otovitdael re ntotr idees cifodre AtoR 5al0lo acacrtoess theth dee mpousiltitp alem loouann/tl eaacseross s aedadcs hu opf ttoh eth loe aanccu, surbatjeect a mtoo tuhnet .a Fboorv ee-xammenpItfli eoa,n bief odBr rocaorwrpoe war nehdra Ass ohm aloosnr edg e tahpsao nsth itoe bn taeol talaonla ceenn/ ltoerfaie €ses 1f0 oo0ru ,At staSna4dn4 dt waincrog oloinss a nthts eheo p umotsoutlla, tntiphdleeinn lg oA aiAnn 5/tlh9ee ash sepoos uollad od bfd: es L couoapmn t op1 l te€ht6ee0 da acfoncurd re Laaotchea na lmo2a o€nu7/nl5et.a. AFseRo,r5 a0en xacod miut lpids le bu,e pif cotBo omtrhrpeol ewdtieescrd A rae s htiaoes nit hdoeef rpt hoLeosi adt nab ta1al a-p n€rco6evi0 do aefn r€d 1t o0L o0d,ae anci n2dde - t tw€o4 oa0 ll,lo ooacrn aLs teoo autnhtest 1 ad -ne €pd2ion5sig at innad mt hLoeou apnnot o a2lcr o€of7:ss 5L o(eia.eanch. 1A Ro€5f6 t00h eais nlcaoda Lpnops/aelnde a 2ase t€ €7s,65 0.su AfobSrj4 eL4cto a coton u t1lhdI efa b anae dbb cooaovert rm€o-7pwm5leee rftnoe hrtdia o Las nos emadeno i catr2he ea ptrhn aLadno ntdah o neson 1se ul o-lmo n€a g6no 0a f o As aunRtthstd5e a0L tn oaodacrtiannlo g 2ess ni-n t€ Lrti4hoeea0s , n pfo oo1rr o aLAl,noA tdah5 neL9 no1a a A-crn N€ o224s 52s m astuhnhstedo umeLlqdouua ltbaniepl l 2€eco 1 €l0om70a5p)n .l(/eil.eteea.d sA efSosr4 a 4ed aids chs ca uloppa ptnoe/d ,t h aaent d€a c6itcu0 is froaurtp eL toaoam tnho e1u ndatinsc.I fdF a roae rtbt i€eooxr7nra 5oom wffo petrhlr eeL h, o daiafas nBtam o2 rpo arorrnoewdvi teh dtrhae Aenr hotsuoan ms ede dloeciefapd AseoeS si t4oot 4uba taaslllocrtaacnnoacessdtein Lotghof e i€an 1 dnt 0he1p0e , oa pasinodnto d alL ,mt owthaooenu n ln2e At a maAsecru5sts 9o ss osheuqtoeustauaalchld n€ db 1oie0nf g0tcoh) i.enm ltpohlaeen tpe, odsuo flob ojre fe:ct aL echtoa setlheea 1 sea €b,6o a0ven ad-n midt e iLs netuiaopsn teeo d2 t hca€e7 p5d .iasc AnAdre 5sot9io conlo onufgl dt ha bes e dt hcoaeta mt opptraloel tvieedndet rari estos e fidothereci Ard NLe4e t2ao se aacl lr1oo css - a€te6th0 te ha emn ddu elLtpipeoalesise tl oa a2mn -o/ l€ue4an0set ,a os crra oLdseds as seeuap ch1 t o- o €tfh2 the5 e aa cculnoda nLrs/aetaleese aasem 2o s,€u7 nsu5t. (bFij.eoecr. tAe txaAo 5tm9he pis lae cb, aoifpve Bpoe-mrdr eoanwt te€io6r n0Ae fdho arcas L dep eaapsenods 1 soit ab nalodlan angt ce a€s 7 o5tfh f€eo 1rt0 oL0tea,al aseennd t2r it weason d folo trah AneAs su5o9um tas ocrtaf onAssdAin5 tg9h eian cm trhouess lt ippoLleoe lla eoseaf:se L1os aaanndd d1 Ls €eu6ap0se tao n2 t dhm eLu oastaccu ne q2ru a€at7el 5 €a.1 mA0No0)u4.n2t .co Fuolrd e bxae mcopmlep, lief tBeod raros weeitrh Ae rh Laos adne 1p o-si €t6 b0a alanndce Lo oafn € 21 0- 0€,4 a0n, do rtw Loo alena 1se -s €o2u5t stanadn dLionagn i n2 t€h7e5 p (oi.oel .o Af:N L4e2a sis eca 1 p€p6e0d a antd € L6e0a fseor L2 o€a7n5 .1 A aAn5d9 a cot €u7l5d fboer Lcoomanp l2e taendd a ts hee isthuemr Loef aAseN4 12 -a cr€6o0ss anLdo aLne a1se an 2d -L €o4a0n, 2o rm Luestase eq 1u a- l€ €2150 a0n).d Lease 2 €75 (i.e. AA59 is capped at €60 for Lease 1 and at €75 for Lease 2 and the sum of AA59 acros s Lease 1 and Lease 2 must equal €100).

3.071 Counterparty Applicable to all Eligibility for Deposit to Offset Indicator as to whether the deposit held with the Institution can be used to pay down the l Boolean Critical Static 1 1 1 1 1 1 1

3.072 Counterparty Private Individual Counterparty deceased Indicator as to whether the Private Individual Counterparty has passed away Boolean Critical Dynamic Yes 1 1 1 1

3.073 Counterparty Applicable to all Legal status The type of legal status of the Counterparty Choice Critical Dynamic 1 1 1 1 1 1 1

3.074 Counterparty Applicable to all Legal Procedure Type Type of the insolvency process the Counterparty is currently in. Choice fields are provided Choice Critical Dynamic Yes 1 1 1 1 1 1 1 The field is partially similar to Annex A and Annex B of Counci10l r.e1g7ulation (EC) No 1346/2000 (http://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX:32000R1346)

3.075 Counterparty Applicable to all Current Status of the Legal Procedure Status of the legal proceeding (choice fields indicate country specifics features) Choice Critical Dynamic Yes 1 1 1 1 1 1 1

3.076 Counterparty Applicable to all Description of Current Status of Legal Procedure Description of the current status of legal procedure. Text Critical Dynamic Yes 1 1 1 1 1 1 1

3.077 Counterparty Applicable to all Date of Entering Into Current Legal Process Date that the Counterparty entered into their current legal status Date Critical Static Yes 1 1 1 1 1 1 1 10.18

3.078 Counterparty Applicable to all Insolvency Practitioner Appointed Indicator as to whether an insolvency practitioner has been appointed Boolean Critical Dynamic Yes 1 1 1 1 1 1 1

3.079 Counterparty Applicable to all Date of Appointment Date that the insolvency practitioner was appointed Date Critical Dynamic Yes 1 1 1 1 1 1 1

3.080 Counterparty Applicable to all Name of Insolvency Practitioner Name of the insolvency practitioner Text Important Static Yes 1 1 1 1 1 1 1 1

3.081 Counterparty Private Individual Number of Current Judgements Number of outstanding Court Enforcement Orders at the NPL Portfolio Cut-Off Date againstN umber Critical Dynamic Yes 1 1 1 1

3.082 Counterparty Private Individual Number of Discharged Judgements Number of discharged Court Enforcement Orders against the Private Individual CounterparNumber Critical Dynamic Yes 1 1 1 1

3.083 Counterparty Applicable to all Date of Internal Demand Issuance Date that a demand notice was sent by the Institution itself Date Important Dynamic Yes 1 1 1 1 1 1 1

3.084 Counterparty Applicable to all Date of External Demand Issuance Date that a demand notice was sent by solicitors who act on behalf of the Institution Date Critical Dynamic Yes 1 1 1 1 1 1 1

3.085 Counterparty Applicable to all Date when Reservation of Rights Letter Was Issued Date that the Reservation of Rights Letter was issued by the Institution Date Critical Dynamic Yes 1 1 1 1 1 1 1

3.086 Counterparty Applicable to all Jurisdiction of Court Location of the court where the case is being heard Choice Critical Static Yes 1 1 1 1 1 1 1

3.087 Counterparty Applicable to all Indicator of Counterparty Cooperation Indicator as to whether the Corporate or Private Individual Counterparty is cooperative or nBoolean Important Dynamic Yes 1 1 1 1 1 1 1

3.088 Counterparty Applicable to all Date of Obtaining Order for Possession Date that the Order for Possession is granted by the court Date Critical Dynamic Yes 1 1 1 1 1 1 1

3.089 Counterparty Applicable to all Eviction Date Date that the Counterparty is evicted Date Important Dynamic Yes 1 1 1 1 1 1 1

3.090 Counterparty Applicable to all Sheriff / Bailiff Acquisition Date Date that sheriff / bailiff is acquired by the court Date Important Dynamic Yes 1 1 1 1 1 1 1

3.091 Counterparty Applicable to all Legal Fees Accrued Total amount of legal fees accrued at the NPL Portfolio Cut-Off Date Number Important Dynamic Yes 1 1 1 1 1 1 1

3.092 Counterparty Applicable to all Comments on Other Litigation Related Process Further comments / details if there is other litigation processes in place Text Critical Static Yes 1 1 1 1 1 1 1

4.000 Relationship (Borrower - Loan) Applicable to all Contract Identifier Institutions internal identifier for the Loan Agreement Text Critical Static 1 1 1 1 1 1 1

4.001 Relationship (Borrower - Loan) Applicable to all Instrument Identifier Institutions internal identifier for the Loan part Text Critical Static 1 1 1 1 1 1 1

4.002 Relationship (Borrower - Loan) Applicable to all Counterparty Identifier unique internal identifier for the Counterparty Text Critical Static 1 1 1 1 1 1 1

5.000 Relationship (Tenant - Lease) Applicable to all Lease Identifier Institutions internal identifier for the Lessee Text Critical Static 1 1 1 1 1 1 1

5.001 Relationship (Tenant - Lease) Applicable to all Counterparty Identifier unique internal identifier for the Counterparty Text Critical Static 1 1 1 1 1 1 1

6.000 Relationship (Guarantor - Guarantee) Applicable to all Protection Identifier Institutions internal identifier for the Non-Property Collateral Text Critical Static 1 1 1 1 1 1 1

6.001 Relationship (Guarantor - Guarantee) Applicable to all Counterparty Identifier unique internal identifier for the Counterparty Text Critical Static 1 1 1 1 1 1 1

7.000 Loan Applicable to all Contract identifier Institution internal identifier for the Loan Agreement Text Critical Static 1 1 1 1 1 1 1 Loan: as defined in Part 1 in Annex V to Implementing Reg1.4 AR3 Loan/lease-level information section Loan/Lease Identifier Unique identifier (ID) for each loan/lease. ATShi3s ID Lshoaonul/dle naoset c-lehavenlg ien ftohrrmouagtiho nth see lctifeio onf tLhoea sen/cuLeraitseisa Itidoenn. tIiff iethre original loan/leUaseniq uIDe caidennntoifti ebre ( ImDa) ifnotra ienaecdh inlo athni/s lefiaeseld. e Tnhteis r ItDhe s ohroiugildna nl oIDt ch foallnogwee dth broy utghhe tnheew li fIeD o, fco thme mseacu deriltimisaitteiodn. If the original loan/lease ID cannot be maintained in this field eAnAte3r theL ooraigni/nleaal seID- lfeovellolw inefdo rbmy athtioen n esewct IDion, coLmomana/ Ldeealisemi tIeddentifier Unique identifier (ID) for each loan/lease. ATTh4is ID Lsohoaunl/dle naoset ch-leavengl ien ftohrrmouagtiho nth see lctifeio onf tAhccoe seucuntr Iitdisaenttioifine.r If the original loan/leUanseiq IuDe caidennntoiftie bre f omr aeianchtai naeccod inu ntht iis n ftiheeld p eAonoNtel3 wr thhiceh o mrigLuinostaa bln eI/Dl ed afiofsefellor-ewlenevetd f lr boiny mfot htrheme an aeticowtnu IaDsel ,a ctcoccoiomnumnLato ndauenmli/mLbeietaer sedto eIdnesuntriefie arnonymity of the bUonrriqouwee ird. entifier (ID) for each loan/lease. ATLhi3s ID shouLlod anno/tle cahsean-gleeve thl rionufogrhm tahteio lnif ese octf tiohen seLocuanri/tiLsaeatiseon .I dIfe thnetif ioerriginal loan/lease UIDn icaqunen iodte bneti fmiera (inIDta)i nfoerd e ianch th ils oafine/ldle eansete.r AT tChhie5s oIDri gshinaolu LIlDoda nfnoo/ltlle ochawseaend-g lbeey ve tthhl rieon ufnogerhmw t ahIDteio , lncoif ese moctfm tiohae nd seeLliomcuaitnrei/tidLsaeatiseon .I dIfe tnhetif ioerriginal loan/lease UIDn icaqunen iodte bneti fmiera (inIDta)i nfoerd e ianch th ils oafine/ldle aensete. rT thhies oIDri gshinaolu IlDd nfooltl ochweandg bey tthhreo ungehw t hIDe , lcifeo mofm thae d seelimcuitreitidsation. If the original loan/lease ID cannot be maintained in this field enter the original ID followed by the new ID, comma delimited

7.001 Loan Applicable to all Instrument Identifier Institution internal identifier for the Loan part Text Critical Static 1 1 1 1 1 1 1 Treat multiple loans/leases as additional line items. The identifier must be different from any external identification number, in Torredaetr mtou eltinpsule rleo aanns/onleymaseity s oasf t ahded bitoiorrnoawl elinr.e items. The identifier must be different from any external identification number, in order to ensure anonymity of the borrower. Treat multiple loans/leases as additional line items. The identifier must be different from any external identification number, in Torredaetr m tou eltinpsleu rcae ardns onayms aidtyd iotifo tnhael blinoerr oitwemers. . Treat multiple loans/leases as additional line items. The identifier must be different from any external identification number, in ordeTrr etoa et mnsuultriep laen loonaymns/litey aosef ts haes baodrrdoitwioenr.al line items. The identifier must be different from any external identification number, in ordeTrr etoa et mnsuultriep laen loonaymns/litey aosef ts haes baodrrdoiwtioenr.al line items. The identifier must be different from any external identification number, in order to ensure anonymity of the borrower.

This field must be completed for all loans/leases i.e. active and non-active. This field must be completed for all loans/leases i.e. active and non-active. This field must be completed for all loans/leases i.e. active and non-active. This field must be completed for all loans/leases i.e. active and non-active. This field must be completed for all loans/leases i.e. active and non-active. This field must be completed for all loans/leases i.e. active and non-active.

7.002 Loan Applicable to all Channel of Origination Channel through which the Loan was originated, i.e. Branch, Internet and Broker Choice Important Static 1 1 1 1 1 1 1 AR22 Loan/lease-level information section Origination Channel Origination channel of the loan: AS16 Loan/lease-level information section Origination Channel This is the origination channel of the loan BE9 Underlying exposures section (compleOrigination Channel Amount (in terms of current balance) of exAA53 Loan/lease-level information section Origination Channel Origination channel: AT40 Loan/lease-level information section Origination Channel Channel of origination: AN42 Loan/lease-level information section Origination Channel Channel of Origination: AL41 Loan/lease-level information section Origination Channel Office network (1)

7.003 Loan Applicable to all Details of Origination Channel Description of the origination channel when "Broker" or "Other" is selected in field "ChanneTl ext Moderate Static 1 1 1 1 1 1 1 Office / branch network (1) Office network (1) Auto dealer (1) Internet (1) Internet (1) Broker (2)

Central / Direct (2) Broker (2) Broker (2) Branch (2) Branch (2) Internet (3)

7.004 Loan Applicable to all Date of Origination Date that the Loan originated as per the Loan Agreement Date Critical Static 1 1 1 1 1 1 1 1.23 AR19 Loan/lease-level information section Loan/Lease Origination Date Date of original loan/lease advance. AS27 Loan/lease-level information section Loan/Lease Origination Date Date of original loan/lease advance. AA22 Loan/lease-level information section Loan/Lease Origination Date Date of original loan/lease advance. AN24 Loan/lease-level information section Loan/Lease Origination Date Date of original loan/lease advance. AL25 Loan/lease-level information section Loan/Lease Origination Date Date of original loan/lease advance. AC13 Loan/lease-level information section Whole Loan Origination Date Date of original loan advance.

Broker (3) Internet (3) Direct (3) Telesales (3) Telesales (3) Other (4)

7.005 Loan Applicable to all Country of Origination Country where the Loan was originated Choice Critical Static 1 1 1 1 1 1 1 Internet (4) Other (4) Indirect (4) Stands (4) Stands (4)

7.006 Loan Applicable to all Governing Law of Loan Agreement Governing law is the law of the country in which the Loan Agreement was entered into. ThiChoice Critical Static 1 1 1 1 1 1 1 Package (5) Other (5) Post (5) Post (5)

Third party channel but underwriting performed 100% by the Originator (6) White label (6) White label (6)

7.007 Loan Applicable to all Asset Class Asset class of the Loan, i.e. Resi, CRE, SME/Corp, etc. Choice Critical Static 1 1 1 1 1 1 1 DI3 Securitisation information section Underlying Exposure Type Enter in the type of underlying exposures of the securitisation. If multiple types from the list below are present, enter in 'Mixed' (with the exception of securitisations whose underlying exposures consist exclusively of a combination of consumer loans and auto loans/leases--for these securitisations the value corresponding to 'Consumer loans' must be entered): Magazine (7) Magazine (7)

7.008 Loan Applicable to all Loan Purpose ultimate financing purpose of the Loan, e.g. Residential real estate purchase for own use, Choice Critical Static 1 1 1 1 1 1 1 1.20 Auto loans/leases (1) AR23 Loan/lease-level information section Purpose AS17 Loan/lease-level information section Purpose BE10 Underlying exposures section (complePurpose Other (8) AN34 Loan/lease-level information section Purpose Auto dealer (8) AC20 Loan/lease-level information section Purpose

Consumer loans (2) What was the reason for the borrower taking out the loan? Loan purpose: For residential mortgage loans, enter The total value (in terms of current balance as at the data cut-off date) of loans whose purpose was either a residential property equity release, debt consolidation, remortgaging with equity release, or funding the borrower's business. Loan Purpose: Loan purpose:

Other (9)

Purchase (1) Overdraft / working capital (1) Tuition Fees (1) Acquisition for investment (1)

7.009 Loan Applicable to all Product Type Product type of the Loan, e.g. Loan and Overdraft Choice Critical Static 1 1 1 1 1 1 1 1.5 Commercial mortgages (3) AS15 Loan/lease-level information section Asset Type Loan (1) BE4 Underlying exposures section (compleExposure Type Select the type of exposure that exists in tAhiAs 3t4ranLsaocatnio/lne.a Isef th-leervee al irnef omrmulatitpiolen e sexpctoisuonres,Pr othdis uctse Tctypioen of the template must beP coromdupctle tTeypd feo:r each exposure type. AL38 Loan/lease-level information section Product Type The classification of the lease, per lessor's definitions:

Remortgage (2) New plant & equipment investment (2) For commercial mortgage loans, enter The total value (in terms of current balance as at the data cut-off date) of loans whose purpose was an acquisition for liquidation. Living Expenses (2) Acquisition for liquidation (2)

7.010 Loan Applicable to all Amortisation Type Description of the Amortisation type of the loan as per the latest Loan Agreement e.g. Full Choice Critical Static 1 1 1 1 1 1 1 1.7 Credit-card receivables (4) AR32 Loan/lease-level information section Repayment Type AS36 Loan/lease-level information section Amortisation Type Guarantee (2) BE51 Underlying exposures section (compleAmortisation Type Trade Receivables (1) AA15 Loan/lease-level information section Amortisation Type (Personal) Contract Purchase (1) AN32 Loan/lease-level information section Amortisation Type AL36 Loan/lease-level information section Amortisation Type (Personal) Contract Purchase (1) AC44 Loan/lease-level information section Whole Loan Amortisation Type

Principal payment type: Current type of amortisation, including principal and interest. The total value of exposures of this type where the amortisation is either bullet, balloon, or some other arrangement besides FCruernrchen,t Gtyeprem oafn a, moro rat ifsaixetiod na,m inocrltuisadintigo np rsinchciepdaul laen. dF oinr ttehree spt.urposes of this field: Current type of amortisation, including principal and interest. Current type of amortisation, including principal and interest. Type of amortisation of the whole loan including principal and interest.

Renovation (3) New information technology investment (3) Medical (3) Refinancing (3)

Leases (5) Promissory Notes (3) Auto Loans/Leases (2) (Personal) Contract Hire (2) (Personal) Contract Hire (2)

Annuity (1) French – i.e. Amortisation in which the total amount — principal plus interest — repaid in each instalment is the same. (1) - French Amortisation is defined as amortisation in which the total amount — principal plus interest — repaid in each instalmeFnrte is ncthh e- sai.em. Aem; ortisation in which the total amount — principal plus interest — repaid in each instalment is the same. (1) French - i.e. Amortisation in which the total amount — principal plus interest — repaid in each instalment is the same. (1) French - i.e. Amortisation in which the total amount — principal plus interest — repaid in each instalment is the same. (1) French - i.e. Amortisation in which the total amount — principal plus interest — repaid in each instalment is the same. (1)

7.011 Loan Applicable to all Description of Bespoke Repayment Description of the bespoke repayment profile when "Bespoke Repayment" is selected in fieText Critical Static 1 1 1 1 1 1 1 Equity release (4) Refurbishment of existing plant, equipment, or technology (4) For consumer loans, enter The total value (in terms of current balance as at the data cut-off date) of loans whose purpose was either tuition fees, living expenses, medical, travel, iome improvements, or debt consolidation. Home Improvements (4) Construction (4)

Residential mortgages (6) Participation Rights (4) Consumer Loans (3) Hire Purchase (3) Hire Purchase (3)

Linear (2) German – i.e. Amortisation in which the first instalment is interest-only and the remaining instalments are constant, including c- aGpeitraml aamn Aormtisaorttiisaont iaonnd is in dteerfienste.d (a2s ) amortisation in which the first instalment is interest-only and the remaining instalments aGree cormnasnta -n it.,e i.n Acmluodirntigsa catiopnit ainl awmhiochrti satheti ofinrs at ninds itnatlemreestnt; is interest-only and the remaining instalments are constant, including capital amortisation and interest. (2) German - i.e. Amortisation in which the first instalment is interest-only and the remaining instalments are constant, including capitaGl earmmoarnti sa- i.teio. nA manodr tiinstaetrieonst .i n( 2w)hich the first instalment is interest-only and the remaining instalments are constant, including capitaGl earmmoarnti sa- i.teio. nA manodr tiinstaetrioenst i.n ( 2w)hich the first instalment is interest-only and the remaining instalments are constant, including capital amortisation and interest. (2)

Construction (5) Merger & Acquisition (5) Appliance/Furniture (5) Redevelopment (5)

7.012 Loan Applicable to all Final Bullet Repayment Total amount of principal repayment to be paid at the maturity date of the loan Number Critical Static 1 1 1 1 1 1 1 SME loans (7) Overdraft (5) Equipment Leases (4) Lease Purchase (4) Lease Purchase (4)

Increasing instalments (3) Fixed amortisation schedule – i.e. Amortisation in which the principal amount repaid in each instalment is the same. (3) - Fixed Amortisation Schedule is defined as amortisation in which the principal amount repaid in each instalment is the same;Fixed amortisation schedule - i.e. Amortisation in which the principal amount repaid in each instalment is the same. (3) Fixed amortisation schedule - i.e. Amortisation in which the principal amount repaid in each instalment is the same. (3) Fixed amortisation schedule - i.e. Amortisation in which the principal amount repaid in each instalment is the same. (3) Fixed amortisation schedule - i.e. Amortisation in which the principal amount repaid in each instalment is the same. (3)

Debt consolidation (6) Other expansionary purpose (6) Travel (6) Other (6)

Mixed (8) Letter of Credit (6) Floorplan financed (5) Finance Lease (5) Finance Lease (5)

7.013 Loan Applicable to all Original Maturity Date Original contractual maturity date of the Loan Date Critical Static 1 1 1 1 1 1 1 Fixed instalments (changing maturity) with structural protection (4) Bullet – i.e. Amortisation in which the full principal amount is repaid in the last instalment. (4) - Bullet Amortisation is defined as amortisation in which the full principal amount is repaid in the last instalment; Bullet - i.e. Amortisation in which the full principal amount is repaid in the last instalment. (4) Bullet - i.e. Amortisation in which the full principal amount is repaid in the last instalment. (4) Bullet - i.e. Amortisation in which the full principal amount is repaid in the last instalment. (4) Bullet - i.e. Amortisation in which the full principal amount is repaid in the last instalment. (4)

Other (7) Other (7) Debt Consolidation (7)

Other (9) Working Capital Facility (7) Insurance Premiums (6) Operating Lease (6) Operating Lease (6)

Fixed instalments (changing maturity) without structural protection (5) Balloon (i.e. partial principal repayments followed by a larger final principal amount) (5) - Balloon Amortisation is defined as amortisation consisting of partial principal repayments followed by a larger final principal aBmalolouonnt; (ai.ned. partial principal repayments followed by a larger final principal amount) (5) Other - i.e. Other amortisation type not included in any of the categories listed above. (5) Balloon (i.e. partial principal repayments followed by a larger final principal amount) (5) Other - i.e. Other amortisation type not included in any of the categories listed above. (5)

Remortgage with Equity Release (8) New Car (8)

7.014 Loan Applicable to all Current Maturity Date Contractual maturity date of the Loan as at NPL Portfolio Cut-Off Date Date Critical Dynamic 1 1 1 1 1 1 1 1.16 AR20 Loan/lease-level information section Loan/Lease Maturity Date The expected date of maturity of the loanA S28 Loan/lease-level information section Loan/Lease Maturity Date The expected date of maturity of the loan or expiry of the lease. AA23 Loan/lease-level information section Loan/Lease Maturity Date The expected date of maturity of the loan or expiry of the lease. AN25 Loan/lease-level information section Loan/Lease Maturity Date The expected date of maturity of the loanA L26 Loan/lease-level information section Loan/Lease Maturity Date The expected date of maturity of the loanA C17 Loan/lease-level information section Loan/Lease Maturity Date The expected date of maturity of the loan or expiry of the lease.

Other (8) Credit Card Receivables (7) Other (7) Other (7)

Bullet (i.e. interest only until maturity) (6) Other – i.e. Other amortisation type not included in any of the categories listed above. (6) - Other Amortisation is defined as any other amortisation type not captured by any of the categories listed above. Other - i.e. Other amortisation type not included in any of the categories listed above. (6) Other - i.e. Other amortisation type not included in any of the categories listed above. (6)

To fund their business (9) Residential Mortgages (8) Loan - Amortising (8) Used Car (9)

7.015 Loan Applicable to all Loan Currency Currency which the Loan is expressed in as per latest Loan Agreement Choice Critical Static 1 1 1 1 1 1 1 ISO 4217 Currency Codes 1.8 AR27 Loan/lease-level information section Loan/Lease Currency Denomination The loan or lease currency denominationAS29 Loan/lease-level information section Loan/Lease Currency Denomination The loan or lease currency denomination. AA5 Loan/lease-level information section Loan/Lease Currency Denomination The loan or lease currency denominationAT6 Loan/lease-level information section Loan/Lease Currency Denomination The loan or lease currency denominationAN6 Loan/lease-level information section Loan/Lease Currency Denomination The loan or lease currency denominationAL5 Loan/lease-level information section Loan/Lease Currency Denomination The loan or lease currency denominationAC12 Loan/lease-level information section Whole Loan Currency Loan currency denomination.

Savings mortgage (7)

Combination Mortgage (10) Commercial Mortgages (9) Loan - Balloon (9) Other Vehicle (10)

Bullet with life insurance (8)

7.016 Loan Applicable to all Origination Amount Loan amount advanced to the Borrower / drawn down by the Borrower at the origination daNumber Critical Static 1 1 1 1 1 1 1 AR28 Loan/lease-level information section Original Principal Balance Original loan balance (inclusive of fees). AS30 Loan/lease-level information section Original Principal Balance Original total loan balance. AA26 Loan/lease-level information section Original Principal Balance Borrower's loan principal balance or discounted lease balance (inclusive of capitalised fees) at origination. AN28 Loan/lease-level information section Original Principal Balance Original loan principal balance (inclusive oAL29 Loan/lease-level information section Original Principal Balance Original Principal (or discounted) lease baAl C150 Loan/lease-level information section Whole Loan Principal Balance At OrigWhole loan balance at origination representing 100% full facility i.e. securitised and unsecuritised / owned and un-owned amount (in loan currency).

Investment Mortgage (11) SME loans/leases (10) Equipment (11)

Bullet with investment or endowment policy (9)

This is referring to the balance of the loan at the loan origination date, not the date of the loan’s sale to the SPV or the closing date of this RMBS. Can be rounded to the nearest 1000 units of currency

Right to Buy (12) Property (12)

7.017 Loan Applicable to all Principal Balance Current amount of outstanding principal as recognised on the balance sheet at Cut-Off DaNumber Critical Dynamic 1 1 1 1 1 1 1 Principal: as referred to for table F7 in Part 2 of Annex V 2.13 AR29 Loan/lease-level information section Current Principal Balance Amount of loan outstanding as of the dataA cuS3t-1off Ldaotaen, /Tlehais sesh-leoveuldl ininfclorumdaet iaonny seamctoiounnts Ctuhraret natr eP rseincciupraeld B bay latnhcee m ortgage anAd mwoilul bnet ocfl alosseand o aus tstparinndciinpgal ains tohfe t hsee cudarittBaisaE5tion. UFnodr eerxalyinmgp elexp ifo fesuers ehs asevect bioene n(co admdpeldeC tou rtrheen tl oParnin bciaplaaln Bcea laanndce a re part of theT hperi ntocitpaal val inlu tehe o sef ocuutstritaisandtiionng tphreinscie pshalo buAldA b2e7 adLdoeadn. /Ilet ashseou-leldve elxcl inufodrem aantioy nin setercteiston arrCeuarrrse onrt Pperinnacilpty aal mBaoluanntces. Borrower's loan or discounted lease balance outstanding as of the data cut-off date. This should include any amounts that are secured against the vehicle. For examApN29 Loan/lease-level information section Current Principal Balance The loan principal balance outstanding asAL30 Loan/lease-level information section Current Principal Balance Principal (or discounted) lease balance oAC151 Loan/lease-level information section Actual Principal Balance (Whole LoanA) ctual Principal Balance of the whole loan at the Securitisation Date as identified in the Offering Circular.

Hybrid (10) non-SME corporate loans/leases (11)

Government Sponsored Loan (13) Other (13)

7.018 Loan Applicable to all Accrued Interest Balance (On book) Current amount of outstanding interest as recognised on the balance sheet at the NPL PorNt umber Critical Dynamic 1 1 1 1 1 1 1 Accrued interest: as referred to in Part 1 of Annex V to Implementing Reg Current balance should include the principal arrears. However, savings amount should be deducted if a subparticipation exists. (i.e. loan balance = loan -/- subparticipation (0) if no subparticipation ). Future Flow (12)

Part & Part (11)

7.019 Loan Applicable to all Other Balances Current amount of other outstanding amounts, e.g. other charges, commissions, fees etc., Number Critical Dynamic 1 1 1 1 1 1 1 Offset mortgage (12) Leverage Fund (13)

Initially interest only before switching to repayment (13) CBO & CLO (14)

7.020 Loan Applicable to all Total Balance Total unpaid balance, i.e. Principal Balance + Accrued Interest Balance (On book) + Other Number Critical Dynamic 1 1 1 1 1 1 1 Balance: as referred to in Part 1 of Annex V to Implementing Regulation Other (14) Other (15)

7.021 Loan Applicable to all Accrued Interest Balance (Off book) Amount of interest that has been accrued but not capitalised to the Loan, as not recogni Number Critical Dynamic 1 1 1 1 1 1 1 These are accrued interest which would be any accrued not on the book as

7.022 Loan Applicable to all Legal Balance Total claim amount, i.e. Total Balance + Accrued Interest Balance (Off book) Number Critical Dynamic 1 1 1 1 1 1 1 AT26 Loan/lease-level information section Total Current Balance What is the total current amount owed by the borrower (including all fees and interest) on the account?

7.023 Loan Applicable to all Carrying Amount Carrying amount means the amount to be reported on the asset side of the balance sheet Ni umber Important Dynamic 1 1 1 1 1 1 1 Carrying Amount: as defined in Part 1 in Annex V to Imple 3.18

7.024 Loan Applicable to all Write-off Amount Cumulative amount of principal and accrued interest that the Institution has written-off Number Important Dynamic 1 1 1 1 1 1 1 Write-off: as defined for table F4 in Part 2 of Annex V to 3.7

7.025 Loan Applicable to all Provision Amount Cumulated provision amount, including impairments and negative changes in fair value dueN tumber Important Dynamic 1 1 1 1 1 1 1 3.8

Accumulated impairment: as defined for table F4 in Part 2 of Annex V to Implementing Regulation (EU) No 680/2014

(Accumulated) negative changes in fair value due to credit risk: as defined for table F4 in Part 2 of Annex V to Implementing Regulation (EU) No 680/2014 and as referred to in the definition of gross carrying amount in in Part 1 of Annex V to Implementing Regulation (EU) No 680/2014

7.026 Loan Applicable to all Accounting stages of Asset Quality Accounting stages of asset quality, i.e. IFRS Stage 1, IFRS Stage 2, IFRS Stage 3 (impai Choice Important Dynamic 1 1 1 1 1 1 1 Impairment stage: as defined in IFRS 9.5.5 3.9

7.027 Loan Applicable to all Loan Commitment Total available credit extended as at the NPL Portfolio Cut-Off Date Number Critical Dynamic 1 1 1 1 1 1 1 Loan commitment: as defined in Part 2 in Annex V to Imple 1.17 AR39 Loan/lease-level information section Maximum Principal Balance For loans with flexible re-draw facilities AS35 Loan/lease-level information section Maximum Principal Balance For loans with flexible re-draw facilities or where the maximum loan amount hasn’t been withdrawn in full – the maximum loan amount that could potentially be outstanding. AT27 Loan/lease-level information section Total Credit Limit What is the credit limit of the borrower o AN7 Loan/lease-level information section Total Credit Limit For loans with flexible re-draw / revolving characteristics – the maximum loan amount that could potentially be outstanding. AC159 Loan/lease-level information section Committed Undrawn Facility Loan BalThe total whole loan (senior debt) remaining facility/ Undrawn balance at the end of the period. The total whole loan (senior debt) remaining facility at the end of the Interest Payment Date that the borrower can still draw upon.

7.028 Loan Applicable to all Original Interest Rate Original total interest rate of the Loan as states in the Loan Agreement and as applicable Percentage Moderate Static 1 1 1 1 1 1 1 This field should only be populated for loans that have flexible or further drawing characteristics. AC122 Loan/lease-level information section Original (Whole) Loan Interest Rate Loan all-in interest rate at loan origination date. If multiple tranches with different interest rates then apply a weighted average rate using the original balances at the loan origination date.

This does is not intended to capture instances where the obligor may renegotiate an increased loan balance but rather where there is currently the contractual ability for the obligor to do this and for the lender to provide the additional funding.

7.029 Loan Applicable to all Original Interest Rate Type Original interest rate type as states in the Loan Agreement and as applicable as of Loan orCighoice Moderate Static 1 1 1 1 1 1 1

7.030 Loan Applicable to all Description of Original Interest Rate Type Description of original interest rate type when "Mixed" is selected in field "Original Interest Text Moderate Static 1 1 1 1 1 1 1

7.031 Loan Applicable to all Original Interest Base Rate Original base rate of the Loan when "Variable" is selected in field "Original Interest Rate T Percentage Moderate Static 1 1 1 1 1 1 1

7.032 Loan Applicable to all Original Interest Margin Original margin above the base rate at loan origination Percentage Moderate Static 1 1 1 1 1 1 1 1.14 AR44 Loan/lease-level information section Current Interest Rate Margin AS48 Loan/lease-level information section Current Interest Rate Margin AA41 Loan/lease-level information section Current Interest Rate Margin AN40 Loan/lease-level information section Current Interest Rate Margin Current interest rate (%) margin of the loaAL45 Loan/lease-level information section Current Interest Rate Margin Current interest rate margin of the lease. AC126 Loan/lease-level information section Current Margin Rate (Whole Loan) Margin used to determine the current whole loan interest rate. The margin being used to calculate the interest paid on the (Whole) Loan Payment Date in Field AC225.

Current interest rate margin (%, for fixed rate loans this is the same as the current interest rate, for floating rate loans this is thCeu mrreanrgt iinn toeveresr t( orar teun mdearr gifi nin (paus t aa s pear cneengtaatgivee )% t,h efo rin fdixeexd r raatete. loans this is the same as the current interest rate, for floating rate loans this is the margin over or under if input as a negative) the index rate. Current interest rate (%) margin of the loan or lease. For fixed-rate loans, this is the same as Current Interest or Discount Rate. For floating rate loans this is the margin over (or under, in which case input as a negative) the index rate.

7.033 Loan Applicable to all Original Interest Rate Reference Original interest rate base / reference of the Loan when "Variable" is selected in field "Orig Choice Moderate Static 1 1 1 1 1 1 1

7.034 Loan Applicable to all Current Interest Rate is the current total interest rate of the loan as stated in the Loan Agreement on and applic Percentage Critical Dynamic 1 1 1 1 1 1 1 2.5 AR43 Loan/lease-level information section Current Interest Rate AS43 Loan/lease-level information section Current Interest Rate BE52 Underlying exposures section (compleCurrent Interest Rate Weighted average, using the current balaAnAc39 Loan/lease-level information section Current Interest Or Discount Rate AN38 Loan/lease-level information section Current Interest Rate AL43 Loan/lease-level information section Current Interest Rate Or Discount RatTotal current interest rate (%) or discount AC127 Loan/lease-level information section Current Interest Rate (Whole Loan) The total interest rate being used to calculate the interest paid on the (Whole) Loan Payment Date in Field AC225 (sum of Field AC236 and AC237 for floating loans).

Current interest rate (%). Current interest rate (%) Total current interest or discount rate (%) applicable to the loan or lease (may be rounded to the nearest half a per cent). Total current interest rate (%) applicable to the loan.

7.035 Loan Applicable to all Current Interest Rate Type is the current interest rate type as per Loan Agreement and applicable at the NPL Portfolio CChoice Critical Dynamic 1 1 1 1 1 1 1 1.15 AR41 Loan/lease-level information section Interest Rate Type Interest rate type: AS46 Loan/lease-level information section Interest Rate Type Interest Rate Type. AC106 Loan/lease-level information section Interest Rate Type Type of interest rate applied to the loan:

7.036 Loan Applicable to all Description of Current Interest Rate Type Description of current interest rate type when "Mixed" is selected in field "Current Interest Text Critical Dynamic 1 1 1 1 1 1 1 Floating rate loan (for life) (1) Floating rate loan (for life) (1) Fixed (1)

Floating rate loan linked to one rate which will revert to another rate in the future (2) Floating rate loan linked to one index that will revert to another index in the future (2) Floating (2)

7.037 Loan Applicable to all Current Interest Base Rate Current base rate of the Loan as at NPL Portfolio Cut-Off Date when "Variable" is selected Pi ercentage Critical Dynamic 1 1 1 1 1 1 1 Fixed rate loan (for life) (3) Fixed rate loan (for life) (3) Step (3)

Fixed with future periodic resets (4) Fixed with future periodic resets (4) Mixed/Fixed Floating (4)

7.038 Loan Applicable to all Current Interest Margin is the current margin above the base rate as stated in the Loan Agreement and applicable Percentage Critical Dynamic 1 1 1 1 1 1 1 1.14 AR44 Loan/lease-level information section Current Interest Rate Margin Current interest rate margin (%, for fixed rAatSe4 l8oanLso tahnis/l eis atsehe- lesaveml ein afos rmthaet icuonr rseenctt iiontnereCstu rrraetnet, Ifnotre frleostat iRnga trea tMe alorgainns this is thCeu mrreanrgt iinn toeveresr t( orar teun mdearr gifi nin (paus t aa s pear cneengtaatgivee )% t,h efo rin fdixeexd r raatete. loans this is the same as the current interest rate, for floating rate loans this is the margin over or under iAf iAn4pu1t aLs oaa nn/elegaasetiv-ele) vethel ininfdoermx aratioten. section Current Interest Rate Margin Current interest rate (%) margin of the loan or lease. For fixed-rate loans, this is the same as Current Interest or Discount Rate. For floating rate loans this is the marginA Nove40r (or unLdoear,n i/nle wasehich-le cveasl ien finoprmuat atios na senectgiaotniveC) uthrree inntd Ienx terraetste. Rate Margin Current interest rate (%) margin of the loaAL45 Loan/lease-level information section Current Interest Rate Margin Current interest rate margin of the lease. AC126 Loan/lease-level information section Current Margin Rate (Whole Loan) Margin used to determine the current whole loan interest rate. The margin being used to calculate the interest paid on the (Whole) Loan Payment Date in Field AC225.

Fixed rate loan with compulsory future switch to floating (5) Fixed rate loan with compulsory future switch to floating (5) Other (5)

7.039 Loan Applicable to all Current Interest Rate Reference Current interest rate base or reference of the loan as stated in the Loan Agreement and apCphl oice Critical Dynamic 1 1 1 1 1 1 1 1.22 AR42 Loan/lease-level information section Current Interest Rate Index AS47 Loan/lease-level information section Current Interest Rate Index AA40 Loan/lease-level information section Current Interest Rate Index AN39 Loan/lease-level information section Current Interest Rate Index AL44 Loan/lease-level information section Current Interest Rate Index AC108 Loan/lease-level information section Current Interest Rate Index

Current interest rate index (the reference rate off which the mortgage interest rate is set): Current interest rate index (the reference rate off which the mortgage interest rate is set): Current interest rate index: Current interest rate index: Current interest rate index: Current interest rate index (the reference rate off which the mortgage interest rate is set):

Capped (6) Capped (6)

7.040 Loan Applicable to all Start Date of Interest Only Period Date that the interest repayment only period starts according to the most recent Loan Agr Date Critical Dynamic 1 1 1 1 1 1 1 1 month GBP LIBOR (1) 1 month GBP LIBOR (1) 1 month GBP LIBOR (1) 1 month GBP LIBOR (1) 1 month GBP LIBOR (1) 1 month GBP LIBOR (1)

Discount (7) Discount (7)

1 month EURIBOR (2) 1 month EURIBOR (2) 1 month EURIBOR (2) 1 month EURIBOR (2) 1 month EURIBOR (2) 1 month EURIBOR (2)

7.041 Loan Applicable to all End Date of Interest Only Period Date that the interest repayment only period ends according to the current Loan AgreemenDt ate Critical Dynamic 1 1 1 1 1 1 1 1.10 Floating rate loan with floor (8) Switch Optionality (8)

3 month GBP LIBOR (3) 3 month GBP LIBOR (3) 3 month GBP LIBOR (3) 3 month GBP LIBOR (3) 3 month GBP LIBOR (3) 3 month GBP LIBOR (3)

Modular (9) Borrower Swapped (9)

7.042 Loan Applicable to all Start Date of Current Fixed Interest Period Date that the current fixed interest period started according to the Loan Agreement and apDpate Critical Dynamic 1 1 1 1 1 1 1 3 month EURIBOR (4) 3 month EURIBOR (4) 3 month EURIBOR (4) 3 month EURIBOR (4) 3 month EURIBOR (4) 3 month EURIBOR (4)

Other (10) Other (10)