254x Filetype XLSX File size 0.07 MB Source: www.nj.gov

Sheet 1: SUMMARY

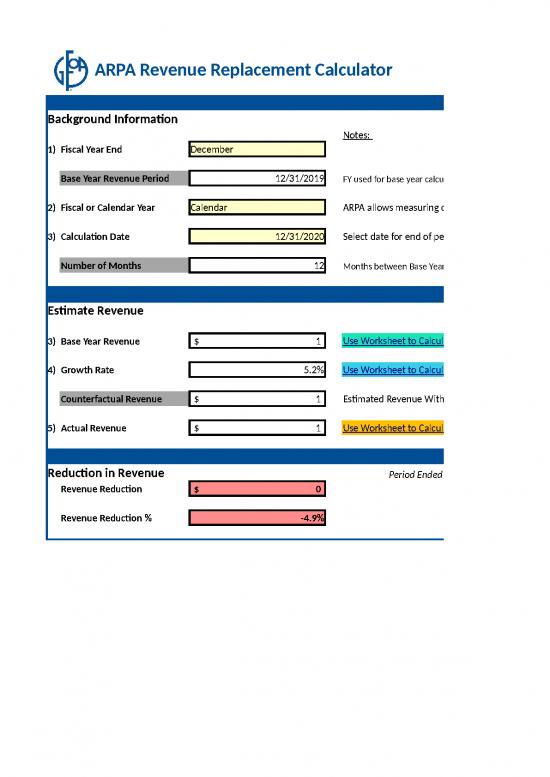

| ARPA Revenue Replacement Calculator | ||||||||||||

| Adapted for New Jersey Municipalities by | ||||||||||||

| Background Information | ||||||||||||

| Notes: | ||||||||||||

| 1) | Fiscal Year End | December | ||||||||||

| Base Year Revenue Period | 12/31/2019 | FY used for base year calculation | ||||||||||

| 2) | Fiscal or Calendar Year | Calendar | ARPA allows measuring calendar or fiscal year | |||||||||

| 3) | Calculation Date | 12/31/2020 | Select date for end of period to calculate loss | |||||||||

| Number of Months | 12 | Months between Base Year and Calculation Date | ||||||||||

| Estimate Revenue | ||||||||||||

| 3) | Base Year Revenue | $1 | Use Worksheet to Calculate | |||||||||

| 4) | Growth Rate | 5.2% | Use Worksheet to Calculate | |||||||||

| Counterfactual Revenue | $1 | Estimated Revenue Without Pandemic | ||||||||||

| 5) | Actual Revenue | $1 | Use Worksheet to Calculate | |||||||||

| Reduction in Revenue | Period Ended | 12/31/2020 | ||||||||||

| Revenue Reduction | $0 | |||||||||||

| Revenue Reduction % | -4.9% | |||||||||||

| Base Year Revenue Worksheet | Summary | Adapted for New Jersey Municipalities by | ||||||

| Fiscal Year Ended | 12/31/2019 | |||||||

| FCOA Code | Revenue Source | Base Revenue (Yes/No) | Amount | |||||

| Surplus Anticipated | Prior year surplus used as revenue in the budget | |||||||

| Surplus Anticipated | ||||||||

| 08-101 | Surplus Anticipated | Yes | $1 | |||||

| 08-102 | Surplus Anticipated with Prior Written Consent of Dir of Local Gov. Services | Yes | ||||||

| Municipal Taxes | Municipal property taxes and receipts from delinquent taxes | |||||||

| Municipal Taxes | ||||||||

| Municipal Tax Levy | Yes | |||||||

| Receipts from Delinquent Taxes | Yes | |||||||

| Local Revenues | Locally generated revenues | |||||||

| 08-103 | Licenses: Alcoholic Beverages | Yes | ||||||

| 08-104 | Licenses: Other | Yes | ||||||

| 08-105 | County Clerk, Sheriff, Surrogate, and Other Fees and Permits | Yes | ||||||

| 08-107 | Hotel Occupancy Tax (Section A & G) | Yes | ||||||

| 08-108 | Beach Fees | Yes | ||||||

| 08-109 | Other Fines and Costs | Yes | ||||||

| 08-110 | Municipal/County Court Fines and Costs | Yes | ||||||

| 08-111 | Parking Meter Revenue | Yes | ||||||

| 08-112 | Interest and Costs on Taxes | Yes | ||||||

| 08-113 | Interest on Investments | Yes | ||||||

| 08-114 | Anticipated Utility Operating Surplus | Yes | ||||||

| 08-115 | Interest and Costs on Assessments | Yes | ||||||

| 08-118 | Rental of Municipally Owned Property | Yes | ||||||

| 08-120 | Rental Registration Fees | Yes | ||||||

| 08-123 | Sewer Service Fees (No Sewer Utility) | Yes | ||||||

| 08-125 | Board of Health Fees | Yes | ||||||

| 08-129 | Foreclosed Property Registration Fees | Yes | ||||||

| 08-134 | Other Fees | Yes | ||||||

| 08-146 | Planning & Zoning Fees | Yes | ||||||

| 08-210 | Payments in Lieu of Taxes (PILOT) (Local Revenues) | Yes | ||||||

| 08-229 | Other Local Revenue | Yes | ||||||

| Intergovernmental Revenue | Amount of revenue in the form of grants or reimbursement for services | |||||||

| Public and Private Programs Offset by Revenues | ||||||||

| 10-500 - 10-690 | State Grants | Yes | ||||||

| 10-691 - 10-869 | Federal Grants (including State Grants financed from Federal Grants) | No | ||||||

| 12-501 - 12-890 | Public and Private Contributions | Yes | ||||||

| 10-870 - 10-890 | All Other Grants | Yes | ||||||

| Shared Services Revenue | ||||||||

| 11-102 | Shared Services - Tax Assessor | Yes | ||||||

| 11-103 | Shared Services - Tax Collector | Yes | ||||||

| 11-104 | Shared Services - Chief Financial Officer | Yes | ||||||

| 11-105 | Shared Services - Public Works Department | Yes | ||||||

| 11-106 | Shared Services - Police Department | Yes | ||||||

| 11-107 | Shared Services - Trash and Recycling Collection | Yes | ||||||

| 11-108 | Shared Services - Municipal Court | Yes | ||||||

| 11-109 | Shared Services - Fire Department/District | Yes | ||||||

| 11-110 | Shared Services - Board of Education | Yes | ||||||

| 11-111 | Shared Services - Social Service Functions | Yes | ||||||

| 11-112 | Shared Services - Purchasing | Yes | ||||||

| 11-113 | Shared Services - Animal Control Services | Yes | ||||||

| 11-114 | Shared Services - Health Services | Yes | ||||||

| 11-115 | Shared Services - Dispatch / 911 | Yes | ||||||

| 11-116 | Shared Services - County | Yes | ||||||

| 11-117 | Shared Services - Transportation Services | Yes | ||||||

| 11-118 | Shared Services - Construction Office | Yes | ||||||

| 11-119 | Other Shared Services | Yes | ||||||

| Uniform Construction Code Revenue | Uniform Construction Code revenue | |||||||

| Uniform Construction Code Revenue | ||||||||

| 08-160 | Uniform Construction Code Fees | Yes | ||||||

| 08-161 | Additional Uniform Construction Code Fees | Yes | ||||||

| 08-162 | Other Uniform Construction Code Revenue | Yes | ||||||

| Additional Revenues Offset by Appropriations | Other revenues offset by appropriations | |||||||

| Uniform Construction Code Revenue | ||||||||

| 09-235 | Supplemental Social Security Income | Yes | ||||||

| 09-240 | Division of Developmental Disabilities (DDD) Assessment Program | Yes | ||||||

| 09-245 | State Assumption of Costs of County Social & Welfare Services & Psychiatric Facilities - Other | Yes | ||||||

| Other Special Items of Revenue | Amount of other special items of revenue | |||||||

| Other Special Items of Revenue | ||||||||

| 08-100 | Other Special Items | Yes | ||||||

| 08-106 | Uniform Fire Safety Act | Yes | ||||||

| 08-116 | Utility Operating Surplus of Prior Year | Yes | ||||||

| 08-117 | Cable TV Franchise Fee | Yes | ||||||

| 08-122 | Water & Sewer Utility Operating Fund - Management Fee | Yes | ||||||

| 08-124 | Reserve for Sale of Municipal Assets | Yes | ||||||

| 08-126 | School Resource Officer Revenue | Yes | ||||||

| 08-130 | Payments in Lieu of Taxes (PILOT) (Section G) | Yes | ||||||

| 08-132 | Host Benefit Fee | Yes | ||||||

| 08-133 | Off-Duty Police Administrative Fees | Yes | ||||||

| 08-225 | Open Space Trust Fund - Debt Service | Yes | ||||||

| 08-227 | Reserve for Payment of Debt | Yes | ||||||

| 08-228 | General Capital Fund Balance | Yes | ||||||

| Proceeds from Issuance of Debt | No | |||||||

| Trust Revenue | No | |||||||

| Refunds and Other Correcting Transactions | No | |||||||

| 08-240 | Unspecified Other Special Items | Yes | ||||||

| Total | $1 | |||||||

| Total Included in Base Revenue | $1 | |||||||

| * "116 The interim final rule would define tax revenue in a manner consistent with the Census Bureau’s definition of tax revenue, with certain changes (i.e., inclusion of revenue from liquor stores and certain intergovernmental transfers)." GFOA confirmed with Treasury that “Liquor Store Revenue” refers to gross receipts, which includes revenue and any applicable taxes. The Footnote is intended to clarify that “Liquor Store Revenue” is treated as “Tax Revenue” and would be included in Base Revenue. | ||||||||

| Growth Rate Calculation | Summary | Adapted for New Jersey Municipalities by | ||||||||

| NOTE: This form is only required if annual revenue growth prior to the pandemic exceeds 5.2%. If not, 5.2% rate of growth will be used | ||||||||||

| Base Revenue | FY Ended | FY Ended | FY Ended | FY Ended | ||||||

| FCOA Code | Revenue Source | (Yes/No) | 12/31/2016 | 12/31/2017 | 12/31/2018 | 12/31/2019 | ||||

| Surplus Anticipated | Prior year surplus used as revenue in the budget | |||||||||

| Surplus Anticipated | ||||||||||

| 08-101 | Surplus Anticipated | Yes | $- | $- | $- | $1 | ||||

| 08-102 | Surplus Anticipated with Prior Written Consent of Dir of Local Gov. Services | Yes | $- | |||||||

| Municipal Taxes | Municipal property taxes and receipts from delinquent taxes | |||||||||

| Municipal Taxes | ||||||||||

| Municipal Tax Levy | Yes | $- | ||||||||

| Receipts from Delinquent Taxes | Yes | $- | ||||||||

| Local Revenues | Locally generated revenues | |||||||||

| 08-103 | Licenses: Alcoholic Beverages | Yes | $- | |||||||

| 08-104 | Licenses: Other | Yes | $- | |||||||

| 08-105 | County Clerk, Sheriff, Surrogate, and Other Fees and Permits | Yes | $- | |||||||

| 08-107 | Hotel Occupancy Tax (Section A & G) | Yes | $- | |||||||

| 08-108 | Beach Fees | Yes | $- | |||||||

| 08-109 | Other Fines and Costs | Yes | $- | |||||||

| 08-110 | Municipal/County Court Fines and Costs | Yes | $- | |||||||

| 08-111 | Parking Meter Revenue | Yes | $- | |||||||

| 08-112 | Interest and Costs on Taxes | Yes | $- | |||||||

| 08-113 | Interest on Investments | Yes | $- | |||||||

| 08-114 | Anticipated Utility Operating Surplus | Yes | $- | |||||||

| 08-115 | Interest and Costs on Assessments | Yes | $- | |||||||

| 08-118 | Rental of Municipally Owned Property | Yes | $- | |||||||

| 08-120 | Rental Registration Fees | Yes | $- | |||||||

| 08-123 | Sewer Service Fees (No Sewer Utility) | Yes | $- | |||||||

| 08-125 | Board of Health Fees | Yes | $- | |||||||

| 08-129 | Foreclosed Property Registration Fees | Yes | $- | |||||||

| 08-134 | Other Fees | Yes | $- | |||||||

| 08-146 | Planning & Zoning Fees | Yes | $- | |||||||

| 08-210 | Payments in Lieu of Taxes (PILOT) (Local Revenues) | Yes | $- | |||||||

| 08-229 | Other Local Revenue | Yes | $- | |||||||

| Intergovernmental Revenue | Amount of revenue in the form of grants or reimbursement for services | |||||||||

| Public and Private Programs Offset by Revenues | ||||||||||

| 10-500 - 10-690 | State Grants | Yes | $- | |||||||

| 10-691 - 10-869 | Federal Grants (including State Grants financed from Federal Grants) | No | $- | |||||||

| 12-501 - 12-890 | Public and Private Contributions | Yes | $- | |||||||

| 10-870 - 10-890 | All Other Grants | Yes | $- | |||||||

| Shared Services Revenue | ||||||||||

| 11-102 | Shared Services - Tax Assessor | Yes | $- | |||||||

| 11-103 | Shared Services - Tax Collector | Yes | $- | |||||||

| 11-104 | Shared Services - Chief Financial Officer | Yes | $- | |||||||

| 11-105 | Shared Services - Public Works Department | Yes | $- | |||||||

| 11-106 | Shared Services - Police Department | Yes | $- | |||||||

| 11-107 | Shared Services - Trash and Recycling Collection | Yes | $- | |||||||

| 11-108 | Shared Services - Municipal Court | Yes | $- | |||||||

| 11-109 | Shared Services - Fire Department/District | Yes | $- | |||||||

| 11-110 | Shared Services - Board of Education | Yes | $- | |||||||

| 11-111 | Shared Services - Social Service Functions | Yes | $- | |||||||

| 11-112 | Shared Services - Purchasing | Yes | $- | |||||||

| 11-113 | Shared Services - Animal Control Services | Yes | $- | |||||||

| 11-114 | Shared Services - Health Services | Yes | $- | |||||||

| 11-115 | Shared Services - Dispatch / 911 | Yes | $- | |||||||

| 11-116 | Shared Services - County | Yes | $- | |||||||

| 11-117 | Shared Services - Transportation Services | Yes | $- | |||||||

| 11-118 | Shared Services - Construction Office | Yes | $- | |||||||

| 11-119 | Other Shared Services | Yes | $- | |||||||

| Uniform Construction Code Revenue | Uniform Construction Code revenue | |||||||||

| Uniform Construction Code Revenue | ||||||||||

| 08-160 | Uniform Construction Code Fees | Yes | $- | |||||||

| 08-161 | Additional Uniform Construction Code Fees | Yes | $- | |||||||

| 08-162 | Other Uniform Construction Code Revenue | Yes | $- | |||||||

| Additional Revenues Offset by Appropriations | Other revenues offset by appropriations | |||||||||

| Uniform Construction Code Revenue | ||||||||||

| 09-235 | Supplemental Social Security Income | Yes | $- | |||||||

| 09-240 | Division of Developmental Disabilities (DDD) Assessment Program | Yes | $- | |||||||

| 09-245 | State Assumption of Costs of County Social & Welfare Services & Psychiatric Facilities - Other | Yes | $- | |||||||

| Other Special Items of Revenue | Amount of other special items of revenue | |||||||||

| Other Special Items of Revenue | ||||||||||

| 08-100 | Other Special Items | Yes | $- | |||||||

| 08-106 | Uniform Fire Safety Act | Yes | $- | |||||||

| 08-116 | Utility Operating Surplus of Prior Year | Yes | $- | |||||||

| 08-117 | Cable TV Franchise Fee | Yes | $- | |||||||

| 08-122 | Water & Sewer Utility Operating Fund - Management Fee | Yes | $- | |||||||

| 08-124 | Reserve for Sale of Municipal Assets | Yes | $- | |||||||

| 08-126 | School Resource Officer Revenue | Yes | $- | |||||||

| 08-130 | Payments in Lieu of Taxes (PILOT) (Section G) | Yes | $- | |||||||

| 08-132 | Host Benefit Fee | Yes | $- | |||||||

| 08-133 | Off-Duty Police Administrative Fees | Yes | $- | |||||||

| 08-225 | Open Space Trust Fund - Debt Service | Yes | $- | |||||||

| 08-227 | Reserve for Payment of Debt | Yes | $- | |||||||

| 08-228 | General Capital Fund Balance | Yes | $- | |||||||

| Proceeds from Issuance of Debt | No | $- | ||||||||

| Trust Revenue | No | $- | ||||||||

| Refunds and Other Correcting Transactions | No | $- | ||||||||

| 08-241 | Unspecified Other Special Items | Yes | $- | |||||||

| Total | $- | $- | $- | $1 | ||||||

| Total Included in Base Revenue | $- | $- | $- | $1 | ||||||

| Growth Rate | NA | NA | NA | |||||||

| Average Growth Rate | NA | |||||||||

| Growth Rate Used for Calculation | 5.2% | |||||||||

no reviews yet

Please Login to review.