357x Filetype XLSX File size 0.05 MB Source: your.yale.edu

Sheet 1: SOA LAs - Open to ALL

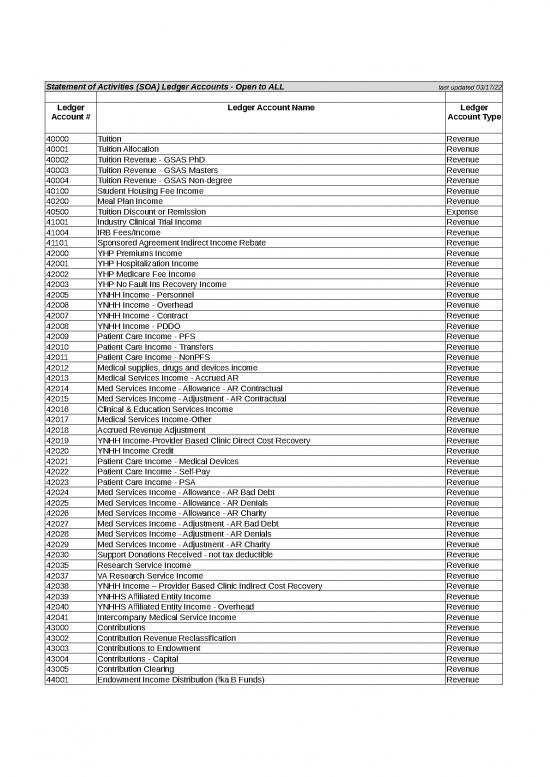

| Statement of Activities (SOA) Ledger Accounts - Open to ALL | last updated 03/17/22 | |

| Ledger Account # | Ledger Account Name | Ledger Account Type |

| 40000 | Tuition | Revenue |

| 40001 | Tuition Allocation | Revenue |

| 40002 | Tuition Revenue - GSAS PhD | Revenue |

| 40003 | Tuition Revenue - GSAS Masters | Revenue |

| 40004 | Tuition Revenue - GSAS Non-degree | Revenue |

| 40100 | Student Housing Fee Income | Revenue |

| 40200 | Meal Plan Income | Revenue |

| 40500 | Tuition Discount or Remission | Expense |

| 41001 | Industry Clinical Trial Income | Revenue |

| 41004 | IRB Fees/Income | Revenue |

| 41101 | Sponsored Agreement Indirect Income Rebate | Revenue |

| 42000 | YHP Premiums Income | Revenue |

| 42001 | YHP Hospitalization Income | Revenue |

| 42002 | YHP Medicare Fee Income | Revenue |

| 42003 | YHP No Fault Ins Recovery Income | Revenue |

| 42005 | YNHH Income - Personnel | Revenue |

| 42006 | YNHH Income - Overhead | Revenue |

| 42007 | YNHH Income - Contract | Revenue |

| 42008 | YNHH Income - PDDO | Revenue |

| 42009 | Patient Care Income - PFS | Revenue |

| 42010 | Patient Care Income - Transfers | Revenue |

| 42011 | Patient Care Income - NonPFS | Revenue |

| 42012 | Medical supplies, drugs and devices income | Revenue |

| 42013 | Medical Services Income - Accrued AR | Revenue |

| 42014 | Med Services Income - Allowance - AR Contractual | Revenue |

| 42015 | Med Services Income - Adjustment - AR Contractual | Revenue |

| 42016 | Clinical & Education Services Income | Revenue |

| 42017 | Medical Services Income-Other | Revenue |

| 42018 | Accrued Revenue Adjustment | Revenue |

| 42019 | YNHH Income-Provider Based Clinic Direct Cost Recovery | Revenue |

| 42020 | YNHH Income Credit | Revenue |

| 42021 | Patient Care Income - Medical Devices | Revenue |

| 42022 | Patient Care Income - Self-Pay | Revenue |

| 42023 | Patient Care Income - PSA | Revenue |

| 42024 | Med Services Income - Allowance - AR Bad Debt | Revenue |

| 42025 | Med Services Income - Allowance - AR Denials | Revenue |

| 42026 | Med Services Income - Allowance - AR Charity | Revenue |

| 42027 | Med Services Income - Adjustment - AR Bad Debt | Revenue |

| 42028 | Med Services Income - Adjustment - AR Denials | Revenue |

| 42029 | Med Services Income - Adjustment - AR Charity | Revenue |

| 42030 | Support Donations Received - not tax deductible | Revenue |

| 42035 | Research Service Income | Revenue |

| 42037 | VA Research Service Income | Revenue |

| 42038 | YNHH Income – Provider Based Clinic Indirect Cost Recovery | Revenue |

| 42039 | YNHHS Affiliated Entity Income | Revenue |

| 42040 | YNHHS Affiliated Entity Income - Overhead | Revenue |

| 42041 | Intercompany Medical Service Income | Revenue |

| 43000 | Contributions | Revenue |

| 43002 | Contribution Revenue Reclassification | Revenue |

| 43003 | Contributions to Endowment | Revenue |

| 43004 | Contributions - Capital | Revenue |

| 43005 | Contribution Clearing | Revenue |

| 44001 | Endowment Income Distribution (fka B Funds) | Revenue |

| 44006 | Endowment Income Reclassification | Revenue |

| 45000 | Investment Income | Revenue |

| 45003 | Rental and Occupancy Income - Investment Properties | Revenue |

| 45004 | Investment Income - Fiduciary | Revenue |

| 45005 | Cash Management Income | Revenue |

| 45006 | Student Fees Income | Revenue |

| 45008 | Food Services Income | Revenue |

| 45009 | Income from Utilities | Revenue |

| 45010 | Royalty Income | Revenue |

| 45011 | Other Fee / Service Income | Revenue |

| 45012 | Parking Income | Revenue |

| 45013 | Events, Tickets, Exec Ed and Other Programs | Revenue |

| 45014 | Publishing Licensing | Revenue |

| 45015 | Publishing Income - Returns | Revenue |

| 45016 | Income-Other | Revenue |

| 45017 | Premium on External USP sales | Revenue |

| 45018 | Discount on External USP sales | Revenue |

| 45019 | External Tuition Support Received | Revenue |

| 45022 | Other Income - non-operating | Revenue |

| 45024 | Realized Gain/Loss on Investments | Revenue |

| 45025 | Unrealized Gain/Loss on Investments | Revenue |

| 45027 | Income from Credit Card Sales - Holding Account | Revenue |

| 45028 | Taxes on Investment Income | Revenue |

| 45039 | Publishing Income | Revenue |

| 45041 | Rental and Occupancy Income | Revenue |

| 45042 | Realized Gain/Loss on Investments - nonoperating nonEndow | Revenue |

| 45043 | YNHH Income - Research and Education Services | Revenue |

| 45047 | PSA Malpractice Reimbursement | Revenue |

| 45048 | Intercompany Administrative Income | Revenue |

| 50000 | Internal Service Credit- ITS/Telecom - ITS FTE Billing | Revenue |

| 50001 | Internal Service Credit - ITS/Telecom - Telecom Infrastructure Bundle | Revenue |

| 50002 | Internal Service Credit | Revenue |

| 50003 | Internal Service Credit - Utilities | Revenue |

| 50004 | Internal Service Credit - Building Services | Revenue |

| 50005 | Allocation Credit - Share of Carbon Return | Revenue |

| 50006 | Internal Service Credit - Health Premiums | Revenue |

| 50007 | Internal Service Credit - Facilities Services | Revenue |

| 50008 | Internal Service Credit - Transfers of Renovation/Alteration Costs | Revenue |

| 51000 | Assessment Debit - Administration of Spendable Gifts | Revenue |

| 51002 | Allocation Credit - Malpractice and other General Liab | Revenue |

| 51003 | Assessment Rebate - Administration of Spendable Gifts | Revenue |

| 51005 | Interest Credit - Internal | Revenue |

| 51008 | Allocation Credit - University Services | Revenue |

| 51009 | Allocation Credit - Security Points | Revenue |

| 51010 | Allocation Credit - Parking | Revenue |

| 51011 | Allocation Credit - Student Health | Revenue |

| 51012 | Allocation Credit - Clinical Space | Revenue |

| 51013 | Allocation Credit - Dining and Dorm | Revenue |

| 51014 | Allocation Credit - Occupancy | Revenue |

| 51015 | Allocation Credit - Other | Revenue |

| 51016 | Allocation Credit - University Unrestricted Funding | Revenue |

| 51018 | Allocation Credit - Departmental | Revenue |

| 51019 | Allocation Credit - Planning Unit Level | Revenue |

| 51020 | Allocation Credit - Planning Unit Funding | Revenue |

| 51021 | Allocation Credit - Med Library | Revenue |

| 51022 | Assessment Income-Plan Unit Level - YM Administration Adjustment | Revenue |

| 51023 | Assessment Income-Plan Unit Level - Rebates | Revenue |

| 51024 | Allocation Credit - Planning Unit Funding - GA Allocation | Revenue |

| 51025 | Assessment Income-Plan Unit Level - PFS Operations | Revenue |

| 51026 | Assessment Income-Plan Unit Level - Clinical Other | Revenue |

| 51027 | Assessment Income-Plan Unit Level - non-clinical | Revenue |

| 51028 | Assessment Income-Plan Unit Level - YM Administration | Revenue |

| 51029 | Assessment Income-Plan Unit Level - YM YNHH Shared Services Contracts | Revenue |

| 51030 | Assessment Income-Plan Unit Level - Dean's Patient Care Adjustment | Revenue |

| 51031 | Assessment Income-Plan Unit Level - Dean's Patient Care | Revenue |

| 51032 | Assessment Income-Plan Unit Level - YNHH PDDO | Revenue |

| 51033 | Assessment Income-Plan Unit Level - Constructive Receipt | Revenue |

| 51034 | Assessment Income-Plan Unit Level - YNHH Shared Service Contracts | Revenue |

| 51035 | Assessment Income-Plan Unit Level - Affiliated Hospital | Revenue |

| 51036 | Assessment Income-Plan Unit Level - Clinical Drug Trial | Revenue |

| 51037 | Assessment Income-Plan Unit Level - Contractual Services | Revenue |

| 51038 | Allocation Credit - Planning Unit Academic Program Support | Revenue |

| 51039 | Assessment Income-Plan Unit Level - PFS Operations Adjustment | Revenue |

| 51040 | Allocation Credit - Clinical Admin Space | Revenue |

| 51050 | Allocation Credit - Plan Unit HRG Support | Revenue |

| 51051 | Allocation Credit - Plan Unit Level - YSM Child Rearing Leave | Revenue |

| 51052 | Allocation Credit-Reallocation of System F&A Credits | Revenue |

| 51055 | Allocation Credit - CRC Interest Earnings | Revenue |

| 71000 | Faculty Salary - tenured | Expense |

| 71001 | Faculty Salary - non-tenured | Expense |

| 71002 | Faculty Salaries - non-ladder | Expense |

| 71003 | Faculty Salaries - LOA - tenured | Expense |

| 71004 | Faculty Salaries - LOA - non-tenured | Expense |

| 71005 | Faculty Salaries - LOA - non-ladder | Expense |

| 71006 | Faculty Salaries-Other | Expense |

| 71007 | Faculty - Extra Compensation | Expense |

| 71008 | Postdoctoral Associate Salaries | Expense |

| 71009 | Faculty Incentive Compensation - Variable - Clinical Bonus | Expense |

| 71010 | Special Compensation - Faculty | Expense |

| 71011 | Faculty Salaries - Summer | Expense |

| 71012 | Faculty Incentive Compensation - Recurring | Expense |

| 71013 | Faculty Salaries Over Pension Cap | Expense |

| 71014 | Faculty Salaries - Special | Expense |

| 72000 | Managerial/Professional Salaries | Expense |

| 72001 | Tech/Admin Staff Wages | Expense |

| 72002 | Tech/Admin Staff Overtime Wages | Expense |

| 72003 | Service Worker Wages | Expense |

| 72004 | Service Worker Overtime Wages | Expense |

| 72005 | Salary & Compensation-Other | Expense |

| 72006 | Casual/Temp Employee Wages | Expense |

| 72007 | Student Compensation | Expense |

| 72008 | Student Compensation - Provost portion | Expense |

| 72009 | Managerial/Professional Other Compensation | Expense |

| 72010 | Salary Expense - Unassigned | Expense |

| 72011 | Student Compensation - Fellowship Teaching | Expense |

| 72012 | Student Compensation - Student Teaching Assist | Expense |

| 72013 | Student Compensation - Research Assistant | Expense |

| 72014 | Agency Staff Compensation | Expense |

| 72015 | Recovery of Staffing Provided to Agencies | Expense |

| 72016 | Managerial/Professional Salaries Over Pension Cap | Expense |

| 73000 | Employee Benefits - Medical & Dental | Expense |

| 73001 | Employee Benefits - Termination | Expense |

| 73002 | Employee Benefits - Retirement Costs | Expense |

| 73003 | Employee Benefits - Workers Compensation | Expense |

| 73004 | Employee Benefits - Education | Expense |

| 73005 | Employee Benefits - Other | Expense |

| 73006 | Employee Benefits - Unassigned | Expense |

| 80000 | Stipend and Fellowship Expense | Expense |

| 80001 | Health and Dental Expense - Student aid | Expense |

| 81000 | Medical Services Expense by YNHH | Expense |

| 81001 | Medical Services Inpatient Expense | Expense |

| 81002 | Medical Services Outpatient Expense | Expense |

| 81003 | Medical Supplies Expense | Expense |

| 81004 | Drugs and Pharmaceuticals Expense | Expense |

| 81005 | Medical Services Expense - Lab | Expense |

| 81006 | Medical Retainer Fees Paid | Expense |

| 81007 | Clinical Practice Service Costs | Expense |

| 81008 | Provider-based Clinic Payments | Expense |

| 81009 | Utilities Expense - External | Expense |

| 81010 | Utilities Hedges - Realized gain (loss) | Expense |

| 81011 | Collections Art & Museum Acquisition | Expense |

| 81012 | Collections Materials Non-Rare | Expense |

| 81013 | Collections Resources-Electronic | Expense |

| 81014 | Collections Materials-Rare | Expense |

| 81015 | Collections Related Services | Expense |

| 81016 | Insurance Expense | Expense |

| 81017 | Taxes | Expense |

| 81018 | Supplies and Materials Expense | Expense |

| 81020 | Supplies - Animal and related services | Expense |

| 81021 | Supplies - Dining and Food Service | Expense |

| 81023 | Software Products | Expense |

| 81024 | Theatrical Production Materials | Expense |

| 81025 | Services - ITS/Telecom Expenses | Expense |

| 81027 | Services - Printing and Publishing Expense | Expense |

| 81029 | Services - Advertising and Promotion Expense | Expense |

| 81030 | Services - Subaward Expense | Expense |

| 81031 | Services - Research Expense | Expense |

| 81033 | Services - Contractor Expense | Expense |

| 81034 | Services Expense | Expense |

| 81035 | Group Meals and Food (Business Meals - not individual travel) | Expense |

| 81036 | Travel Expenses | Expense |

| 81037 | Entertainment and Alcohol Expense | Expense |

| 81039 | Equipment Maint & Repair | Expense |

| 81040 | Equipment Rental | Expense |

| 81041 | Fee Expenses | Expense |

| 81043 | Dues and Membership Expenses | Expense |

| 81044 | Insurance - Malpractice | Expense |

| 81045 | Building Renovations | Expense |

| 81046 | Rental of Building and Other Space | Expense |

| 81047 | Conferences and Admission Expense | Expense |

| 81048 | Losses and writeoffs | Expense |

| 81049 | Prizes & Awards | Expense |

| 81050 | Subsidies and Community Support | Expense |

| 81051 | Other Expenses | Expense |

| 81052 | G&C Program Income | Expense |

| 81057 | Interest Expense - External | Expense |

| 81058 | Debt Financing Fees | Expense |

| 81063 | Medical Services Expense - Insurer-paid Supplemental | Expense |

| 81064 | Medical Services Expense - Insurer-paid Supplemental-Pharmacy Claims | Expense |

| 81065 | Drugs and Pharmaceuticals Expense - Retail Pharmacy | Expense |

| 81071 | Wind Power Operating Costs | Expense |

| 81074 | Discounts Taken - Central Use Only | Expense |

| 81075 | P-Card Clearing Expense - Central Procurement Only | Expense |

| 81076 | Interest Expense - External on Swaps | Expense |

| 81079 | Recovered Costs Billed to Capital Projects | Expense |

| 81091 | G&A Award and Grant Closeout - OSP ONLY | Expense |

| 81092 | Intercompany Medical Service Expense | Expense |

| 81093 | Intercompany Administrative Expense | Expense |

| 90000 | Internal Expense - ITS/Telecom - ITS FTE Billing | Expense |

| 90001 | Internal Expense - ITS/Telecom - Telecom Infrastructure Bundle | Expense |

| 90002 | Internal Expense - Facilities Services | Expense |

| 90003 | Internal Expense - Utilities | Expense |

| 90004 | Internal Expense - Building Services | Expense |

| 90005 | Internal Expense - Transfers of Renovation/Alteration Costs | Expense |

| 90007 | Allocation Expense - Utilities Carbon Charge | Expense |

| 91001 | Allocation Expense - Fringe Benefits | Expense |

| 91002 | Allocation Expense - Malpractice and other General Liab | Expense |

| 91003 | Capital Allocation | Expense |

| 91008 | Allocation Expense - University Services | Expense |

| 91009 | Allocation Expense - Security Points | Expense |

| 91010 | Allocation Expense - Parking | Expense |

| 91011 | Allocation Expense - Student Health | Expense |

| 91012 | Allocation Expense - Clinical Space | Expense |

| 91013 | Allocation Expense - Dining and Dorm | Expense |

| 91014 | Allocation Expense - Occupancy | Expense |

| 91015 | Allocation Expense - Other | Expense |

| 91016 | Allocation Expense - University Unrestricted Funding | Expense |

| 91018 | Allocation Expense - Departmental | Expense |

| 91019 | Allocation Expense - Planning Unit Level | Expense |

| 91020 | Allocation Expense - Planning Unit Funding | Expense |

| 91025 | Assessment Expense-Plan Unit Level - PFS Operations | Expense |

| 91026 | Assessment Expense-Plan Unit Level - Clinical Other | Expense |

| 91027 | Assessment Expense-Plan Unit Level - Non-Clinical | Expense |

| 91028 | Assessment Expense-Plan Unit Level - YM Administration | Expense |

| 91029 | Assessment Expense-Plan Unit Level - YM YNHH Shared Services Contracts | Expense |

| 91030 | Assessment Expense-Plan Unit Level - Dean's Patient Care Adjustment | Expense |

| 91031 | Assessment Expense-Plan Unit Level - Dean's Patient Care | Expense |

| 91032 | Assessment Expense-Plan Unit Level - YNHH PDDO | Expense |

| 91033 | Assessment Expense-Plan Unit Level - Constructive Receipt | Expense |

| 91034 | Assessment Expense-Plan Unit Level - YNHH Shared Service Contracts | Expense |

| 91035 | Assessment Expense-Plan Unit Level - Affiliated Hospital | Expense |

| 91036 | Assessment Expense-Plan Unit Level - Clinical Drug Trial | Expense |

| 91037 | Assessment Expense-Plan Unit Level - Contractual Services | Expense |

| 91038 | Allocation Expense - Sabbatical Credit | Expense |

| 91039 | Allocation Expense - Med Library | Expense |

| 91040 | Allocation Expense - Clinical Admin Space | Expense |

| 91041 | Assessment Expense-Plan Unit Level - YM Administration Adjustment | Expense |

| 91042 | Allocation Expense - Planning Unit Funding - GA Allocation | Expense |

| 91043 | Allocation Expense - Planning Unit Academic Program Support | Expense |

| 91044 | Assessment Expense-Plan Unit Level - Rebates | Expense |

| 91045 | Allocation Expense - Student Health - Grad School Reallocation | Expense |

| 91046 | Assessment - YSM Sabbatical | Expense |

| 91047 | Assessment - YSM Fringe | Expense |

| 91049 | Assessment Expense-Plan Unit Level - PFS Operations Adjustment | Expense |

| 91050 | Allocation Expense - Plan Unit HRG Support | Expense |

| 91051 | Allocation Expense-Central Only - Allocate Admin to Missions for Management Reporting | Expense |

| 91054 | Assessment - YSM Child-Rearing Leave | Expense |

| 91055 | Allocation Expense - CRC Interest Earnings | Expense |

| 92000 | Internal Program Support - From Provost | Expense |

| 92001 | Internal Program Support - Between Planning Units | Expense |

| 92003 | Use of / Add to Unrestricted Reserves - School/Division | Expense |

| 92004 | Use of / Add to Unrestricted Reserves - University | Expense |

| 92005 | Transfers between Non-Operating Funds | Expense |

| 92007 | Student Loan Writeoffs | Expense |

| 92008 | Student Loan Cancellation | Expense |

| 92010 | Internal Program Support - Within Planning Unit | Expense |

| 92011 | Internal Program Support - Within Department | Expense |

| 92012 | Allocation - 9-over-9 Tenured | Expense |

| 92013 | Allocation - 9-over-9 Non-Tenured | Expense |

| 92014 | Allocation - 9-over-9 Fringe Benefits | Expense |

| 92020 | Transfers between Operating Funds | Expense |

| 92023 | Funding for Cost Share on Grants | Expense |

| Balance Sheet Ledger Accounts - Open to ALL | last updated 03/17/22 | |

| Ledger Account # | Ledger Account Name | Ledger Account Type |

| 10005 | Cash - Petty - Boxes | Asset |

| 10014 | Cash - BOA Elm Campus Security Deposits | Asset |

| 10015 | Cash - BOA Elm Security Deposit Refunds | Asset |

| 10018 | Cash - BOA JNF Legal | Asset |

| 10032 | Cash - Clearing Account for Wires | Asset |

| 11001 | Receivable - Unbilled | Asset |

| 11004 | Receivable - Medical Services | Asset |

| 11005 | ADA - Medical - Bad Debts | Asset |

| 11006 | Receivable from Affiliated Organizations | Asset |

| 11007 | Receivables - Other | Asset |

| 11008 | Receivable - Publications | Asset |

| 11009 | ADA - non-medical | Asset |

| 11010 | Receivable - Unapplied Payments | Asset |

| 11011 | ADA - Medical - Contractual Adjustments | Asset |

| 11012 | ADA - Medical - Denials | Asset |

| 11013 | ADA - Medical - Charity | Asset |

| 11014 | Receivable - Clinical Trials (Grants & Contracts) | Asset |

| 11015 | Receivable - Expense Advance & Personal Expenses | Asset |

| 11017 | Receivable - Unbilled - Clinical Trials (Grants & Contracts) | Asset |

| 11018 | Receivable - Clinical Contractual Services | Asset |

| 11019 | Receivable - Research Services | Asset |

| 11020 | Receivable - VA Research Services | Asset |

| 11021 | Conversion Only - Receivable - YSM AR | Asset |

| 11022 | Clearing - Student Financial Services | Asset |

| 11023 | Clearing - YSM Patient AR | Asset |

| 11025 | Intercompany Receivable | Asset |

| 12001 | Contributions Receivable Gross - Operating Programs | Asset |

| 12002 | Contributions Receivable Gross - Endowment | Asset |

| 12003 | Contributions Receivable Gross - Capital Purposes | Asset |

| 12004 | Contributions Receivable Allowance for Doubtful Accounts - Operating Programs | Asset |

| 12006 | Contributions Receivable Allowance for Doubtful Accounts - Endowment | Asset |

| 12008 | Contributions Receivable Allowance for Doubtful Accounts - Capital Purposes | Asset |

| 13001 | Notes Receivable - Federally-sponsored student loans | Asset |

| 13002 | Notes Receivable - Institutional student loans | Asset |

| 13003 | ADA - Notes Receivable | Asset |

| 13004 | Notes Receivable - Other | Asset |

| 13005 | Receivable - Accrued Interest | Asset |

| 13006 | Notes Receivable - Reserve | Asset |

| 15001 | Investment - Market Value | Asset |

| 15005 | Investments - Mortgages | Asset |

| 15007 | Investments - Programmatic | Asset |

| 15009 | Investments - Retirement Funds | Asset |

| 15010 | Investments - Wind Energy | Asset |

| 15011 | Renewable Energy Credits | Asset |

| 15012 | Deposits - Bond Indentures | Asset |

| 17001 | Deferred Expenses | Asset |

| 17002 | Inventories | Asset |

| 17004 | Software Costs | Asset |

| 17005 | Inventory - Publishing WIP Plant | Asset |

| 17006 | Inventory - Publishing WIP Inventory | Asset |

| 17007 | Malpractice Asset | Asset |

| 17008 | Prepaid Expenses | Asset |

| 17009 | Provision for Advances Writeoff | Asset |

| 20004 | Deferred Revenue | Liability |

| 20005 | Accruals | Liability |

| 20006 | Accruals - Swap | Liability |

| 20007 | Accruals - Self Insurance Claims | Liability |

| 20008 | Other Payables | Liability |

| 20009 | Malpractice Liability | Liability |

| 20011 | Accrued Wages & Salaries Payable | Liability |

| 20014 | FICA Payable | Liability |

| 20015 | Federal Withholding Payable | Liability |

| 20016 | State/City Withholding Payable | Liability |

| 20017 | CT State Sales Tax Payable | Liability |

| 20018 | Pension Liability | Liability |

| 20019 | Dental Liability | Liability |

| 20020 | Group Life Insurance Liability | Liability |

| 20021 | Retiree-Medical Liability | Liability |

| 20022 | Active Employee-Medical Liability | Liability |

| 20023 | Payroll Deductions Payable | Liability |

| 20024 | Other Benefits Payable | Liability |

| 20029 | PCard Liability | Liability |

| 20030 | Liability for Medical Service Refunds | Liability |

| 20034 | Liability for Cash Escheatment | Liability |

| 20035 | Accruals - Receipt Accrual | Liability |

| 20037 | G&C Program Income Holding Account | Liability |

| 20038 | Payroll Deductions - Default/Unassigned | Liability |

| 20039 | SUA Clearing Liability | Liability |

| 20041 | Federal Withholding Payable - foreign only | Liability |

| 20042 | Federal Withholding Payable - backup withholding | Liability |

| 20043 | Federal Withholding Payable - 1042S prepayment | Liability |

| 20044 | CT State Withholding Payable - CT A&E | Liability |

| 20045 | Accrued Royalties to Authors | Liability |

| 20046 | Accrued Permission Income | Liability |

| 20047 | Clearing for Payroll Tax Liability | Liability |

| 20048 | HYPO Withholding Payable | Liability |

| 20050 | Intercompany Liability | Liability |

| 21002 | Advances on Tuition, Room & Board | Liability |

| 21003 | Advances - Other | Liability |

| 21004 | Advances - Royalties Payable | Liability |

| 22002 | Compensated Absences | Liability |

| 22005 | Other Long Term Liabilities | Liability |

| 22006 | Payroll Clearing - Special/Con | Liability |

| 22007 | Liability for 457b | Liability |

| 24002 | Other Notes Payable | Liability |

| 26001 | Advances from Federal government for student loans | Liability |

| Office of Sponsored Projects (OSP)-only Ledger Accounts | last updated 03/17/22 | |

| Ledger Account # | Ledger Account Name | Ledger Account Type |

| 11002 | Receivable - Grants & Contracts | Asset |

| 11003 | ADA - Grants & Contracts Receivable | Asset |

| 11016 | Receivable - Unbilled - Grants & Contracts | Asset |

| 21001 | Advances under grants and contracts | Liability |

| 29999 | Conversion Only Grant ITD Liability | Liability |

| 41000 | Sponsored Agreement Income | Revenue |

| 41003 | Interest on Non-Federal Grants | Revenue |

| 51017 | Allocation Credit - F&A Indirect Costs | Revenue |

| 91017 | Allocation Expense - F&A Indirect Costs | Expense |

| 92026 | Transfer of Residual Grant Balances - OSP ONLY | Expense |

| For OSP-only ledger accounts requiring entry by an OSP Accountant, please contact your OSP Accountant or email osp.financial@yale.edu. | ||

no reviews yet

Please Login to review.