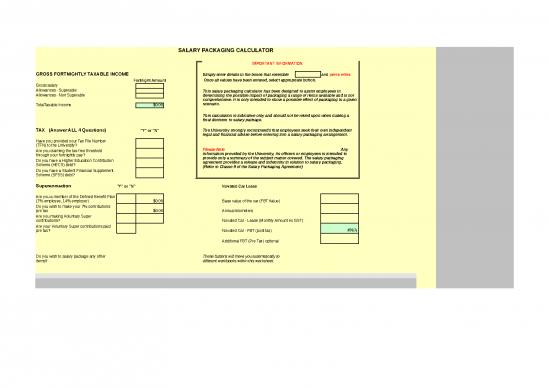

| SALARY PACKAGING CALCULATOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS FORTNIGHTLY TAXABLE INCOME |

|

|

|

|

Simply enter details in the boxes that resemble |

|

|

and press enter. |

|

|

|

|

|

|

|

|

|

|

Fortnight Amount |

|

|

Once all values have been entered, select appropriate button. |

|

|

|

|

|

|

|

|

|

|

|

| Gross salary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowances - Superable |

|

SUPERABLE ALLOWANCES INCLUDE:

Clinical Loading

Supplementary Clinical Loading

Attraction & Retention(Superable)

Special (Superable)

Professional Fellow

Security Based Loading

|

|

|

This salary packaging calculator has been designed to assist employees in determining the possible impact of packaging a range of items available and is not comprehensive. It is only intended to show a possible effect of packaging in a given scenario. |

|

|

|

|

|

|

|

|

| Allowances - Non Superable |

|

NON SUPERABLE ALLOWANCES INCLUDE:

First Aid

3% Award Plus Salary Loading

Head of Department

Higher Duties

Attraction & Retention(Non Superable)

Special (Non Superable)

Commuted Overtime

Salary Progression

Market Loading

Additional responsibility

Discretionary Loading

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TotalTaxable Income |

|

$0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This calculation is indicative only and should not be relied upon when making a final decision to salary package. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TAX (Answer ALL 4 Questions) |

|

"Y" or "N" |

|

|

The University strongly recommends that employees seek their own independent legal and financial advise before entering into a salary packaging arrangement. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Have you provided your Tax File Number (TFN) to the University? |

|

|

|

|

Please Note Any information provided by the University, its officers or employees is intended to provide only a summary of the subject matter covered. The salary packaging agreement provides a release and indemnity in relation to salary packaging. (Refer to Clause 9 of the Salary Packaging Agreement) |

|

|

|

|

|

|

|

|

| Are you claiming the tax-free threshold through your fortnightly pay? |

|

|

|

|

|

|

|

|

|

|

|

|

| Do you have a Higher Education Contribution Scheme (HECS) debt? |

|

|

|

|

|

|

|

|

|

|

|

|

| Do you have a Student Financial Supplement Scheme (SFSS) debt? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Superannuation |

"Y" or "N" |

|

|

|

|

PLEASE NOTE:

Novated Lease figures are as per quote from Easifleet.

To obtain a quote go to http://www.novatedcalculator.com.au/

Novated Car Lease |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Are you a member of the Defined Benefit Plan (7% employee, 14% employer) |

|

This field is auto calculated

$0.00 |

|

|

|

Base value of the car (FBT Value) |

|

|

|

|

|

|

|

|

|

|

| Do you wish to make your 7% contributions pre tax |

|

This field is auto calculated

$0.00 |

|

|

|

Annual kilometers |

|

|

|

|

|

|

|

|

|

|

| Are you making Voluntary Super contributions? |

|

If making Voluntary Contributions, enter fortnightly amount

|

|

|

|

Novated Car - Lease (Monthly Amount ex GST) |

|

|

|

|

|

|

|

|

|

|

| Are your Voluntary Super contributions paid pre tax? |

|

|

|

|

|

Novated Car - FBT (post tax) |

|

This field is auto calculated

#N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional FBT (Pre Tax) optional |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

These buttons will move you automatically to different workbooks within this worksheet. |

|

Y |

|

|

|

|

|

|

|

|

| Do you wish to salary package any other items? |

|

|

N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FORTNIGHTLY DEDUCTIONS |

|

|

|

|

|

|

|

|

|

| DEDUCTIONS |

|

|

|

|

|

|

|

|

|

|

|

| Car Parking |

Fortnightly Amounts |

|

Otherwise Deductible Items |

Fortnightly Amounts |

|

| Parking UWA -( $16.65 FT, $12.46 PT or $24.96 Reserved Bay) |

|

|

Union Fees - ALHMW |

|

|

| Parking QEII - ($4.10 per day, $41.00 per Fortnight) |

|

|

Union Fees - ASA |

|

|

| Parking PMH - ($34.00 per fortnight) |

|

|

Union Fees - CPSU |

|

|

| Parking Fremantle Hospital - ($41.00 per fortnight) |

|

|

Union Fees - NTEU |

|

|

| Parking RPH - MRF ($41.00 per fortnight) |

|

|

Financial Advice |

|

|

| Parking RPH - ($41.00 per fortnight) |

|

|

Income Protection |

|

|

|

|

|

|

|

|

| ChildCare |

|

|

In House Benefits |

|

|

| Child Care - UniCare |

|

|

UniClub - ( Founder Members $ 6.92 ftn Non Founders $10.38 Ftn) |

|

|

| Child Care - UWA Employee's Child Care |

|

|

Perth International Arts Festival Tickets |

|

|

| Child Care - After School Care |

|

|

Robin Winkler Clinic |

|

|

| Child Care - Vacation Care |

|

|

UWA Podiatry Clinic |

|

|

| Child Care - UniSports for Kids |

|

|

|

|

|

|

|

|

|

|

|

| Work Related Benefits |

|

|

Other Packaging Items |

|

|

| Briefcases |

|

|

Fitness Centre Membership |

|

|

| Laptop Computers |

|

|

Fitness Centre Membership (Corporate) |

|

|

| Mobile Phones |

|

|

Uni Swim |

|

|

| PDAs, Electronic Diaries, Portable Printers |

|

|

Airport Lounge Membership |

|

|

| Professional Expenses |

|

|

Relocation Expenses |

|

|

| Self Education Expenses |

|

|

|

|

|

| Tools of Trade & Protective Clothing |

|

|

|

|

|

|

|

|

|

|

|

| Deductions Not Packaged |

|

|

|

|

|

|

|

|

|

|

|

| Private Health Insurance |

|

|

|

|

|

| HBF |

|

|

|

|

|

| Medibank Private |

|

|

|

|

|

|

|

|

|

|

|

| UWA Social Club |

|

|

|

|

|

| Tea Money |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Calculate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|