259x Filetype XLS File size 0.06 MB Source: www.yorku.ca

Sheet 1: Two-asset portfolios

| Column1 | Column2 | |||||||||||

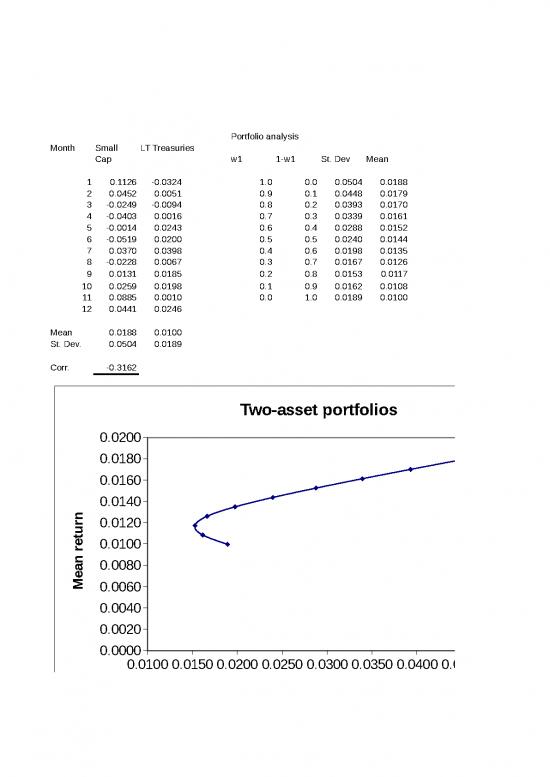

| Portfolio analysis | Mean | 0.018758333333333 | Mean | 0.009966666666667 | ||||||||

| Month | Small | LT Treasuries | Standard Error | 0.0145506662262 | Standard Error | 0.005459594464534 | ||||||

| Cap | w1 | 1-w1 | St. Dev | Mean | Median | 0.0195 | Median | 0.0126 | ||||

| Mode | #N/A | Mode | #N/A | |||||||||

| 1 | 0.1126 | -0.0324 | 1.0 | 0.0 | 0.0504 | 0.0188 | Standard Deviation | 0.050404986375508 | Standard Deviation | 0.01891259000259 | ||

| 2 | 0.0452 | 0.0051 | 0.9 | 0.1 | 0.0448 | 0.0179 | Sample Variance | 0.002540662651515 | Sample Variance | 0.000357686060606 | ||

| 3 | -0.0249 | -0.0094 | 0.8 | 0.2 | 0.0393 | 0.0170 | Kurtosis | -0.466909670529446 | Kurtosis | 1.23749114745566 | ||

| 4 | -0.0403 | 0.0016 | 0.7 | 0.3 | 0.0339 | 0.0161 | Skewness | 0.412884277888127 | Skewness | -0.79910787402517 | ||

| 5 | -0.0014 | 0.0243 | 0.6 | 0.4 | 0.0288 | 0.0152 | Range | 0.1645 | Range | 0.0722 | ||

| 6 | -0.0519 | 0.0200 | 0.5 | 0.5 | 0.0240 | 0.0144 | Minimum | -0.0519 | Minimum | -0.0324 | ||

| 7 | 0.0370 | 0.0398 | 0.4 | 0.6 | 0.0198 | 0.0135 | Maximum | 0.1126 | Maximum | 0.0398 | ||

| 8 | -0.0228 | 0.0067 | 0.3 | 0.7 | 0.0167 | 0.0126 | Sum | 0.2251 | Sum | 0.1196 | ||

| 9 | 0.0131 | 0.0185 | 0.2 | 0.8 | 0.0153 | 0.0117 | Count | 12 | Count | 12 | ||

| 10 | 0.0259 | 0.0198 | 0.1 | 0.9 | 0.0162 | 0.0108 | ||||||

| 11 | 0.0885 | 0.0010 | 0.0 | 1.0 | 0.0189 | 0.0100 | Column 1 | Column 2 | ||||

| 12 | 0.0441 | 0.0246 | Column 1 | 1 | ||||||||

| Column 2 | -0.316157793817396 | 1 | ||||||||||

| Mean | 0.0188 | 0.0100 | ||||||||||

| St. Dev. | 0.0504 | 0.0189 | ||||||||||

| Corr. | -0.3162 | |||||||||||

| Three-asset portfolios with known expected return and variance-covariance matrix: | ||||||||||||||||||||

| Mean, St. Dev | Correlation Coefficients | |||||||||||||||||||

| Stock 1 | Stock 2 | Stock 3 | Stock 1 | Stock 2 | Stock 3 | |||||||||||||||

| Return | 0.14 | 0.08 | 0.2 | Stock 1 | 1 | 0.5 | 0.2 | |||||||||||||

| St. dev | 0.2 | 0.12 | 0.3 | Stock 2 | 1 | 0.4 | ||||||||||||||

| Stock 3 | 1 | |||||||||||||||||||

| Portfolio weight | Portfolio | Portfolio | ||||||||||||||||||

| Stock 1 | Stock 2 | Stock 3 | St. Dev | Return | ||||||||||||||||

| 0 | 0 | 1 | 0.3 | 0.2 | ||||||||||||||||

| Stocks | 0 | 0.2 | 0.8 | 0.250567356213853 | 0.176 | |||||||||||||||

| 2 and 3 | 0 | 0.4 | 0.6 | 0.204 | 0.152 | |||||||||||||||

| 0 | 0.6 | 0.4 | 0.162775919595006 | 0.128 | ||||||||||||||||

| 0 | 0.8 | 0.2 | 0.132 | 0.104 | ||||||||||||||||

| 0 | 1 | 0 | 0.12 | 0.08 | ||||||||||||||||

| 0 | 0 | 1 | 0.3 | 0.2 | ||||||||||||||||

| Stocks | 0.2 | 0 | 0.8 | 0.251077677223603 | 0.188 | |||||||||||||||

| 1 and 3 | 0.4 | 0 | 0.6 | 0.21109239683134 | 0.176 | |||||||||||||||

| 0.6 | 0 | 0.4 | 0.185903200617956 | 0.164 | ||||||||||||||||

| 0.8 | 0 | 0.2 | 0.181769084280028 | 0.152 | ||||||||||||||||

| 1 | 0 | 0 | 0.2 | 0.14 | ||||||||||||||||

| 0 | 1 | 0 | 0.12 | 0.08 | ||||||||||||||||

| Stocks | 0.2 | 0.8 | 0 | 0.121061967603372 | 0.092 | |||||||||||||||

| 1 and 2 | 0.4 | 0.6 | 0 | 0.131696621065235 | 0.104 | |||||||||||||||

| 0.6 | 0.4 | 0 | 0.149879951961562 | 0.116 | ||||||||||||||||

| 0.8 | 0.2 | 0 | 0.173251262621662 | 0.128 | ||||||||||||||||

| 1 | 0 | 0 | 0.2 | 0.14 | ||||||||||||||||

| 0.2 | 0.2 | 0.6 | 0.204626488998859 | 0.164 | ||||||||||||||||

| Mixed | 0.2 | 0.4 | 0.4 | 0.163560386402087 | 0.14 | |||||||||||||||

| weights | 0.2 | 0.6 | 0.2 | 0.132966161108757 | 0.116 | |||||||||||||||

| 0.4 | 0.2 | 0.4 | 0.171580884716218 | 0.152 | ||||||||||||||||

| 0.4 | 0.4 | 0.2 | 0.14271650219929 | 0.128 | ||||||||||||||||

| 0.6 | 0.2 | 0.2 | 0.159649616347801 | 0.14 | ||||||||||||||||

| A. Inputs on three stocks: mean, standard deviation, and correlation matrix | ||||||||||||||||

| Standard | Expected | |||||||||||||||

| Stock | Deviation | Return | ||||||||||||||

| A | 0.2 | 0.14 | ||||||||||||||

| B | 0.12 | 0.08 | ||||||||||||||

| C | 0.3 | 0.2 | ||||||||||||||

| A | B | C | ||||||||||||||

| St. Dev | 0.2 | 0.12 | 0.3 | |||||||||||||

| Mean | 0.14 | 0.08 | 0.2 | |||||||||||||

| Correlation Matrix | ||||||||||||||||

| A | B | C | ||||||||||||||

| A | 1 | 0.5 | 0.2 | |||||||||||||

| B | 0.5 | 1 | 0.4 | |||||||||||||

| C | 0.2 | 0.4 | 1 | |||||||||||||

| B. Covariance Matrix | ||||||||||||||||

| A | B | C | ||||||||||||||

| A | 0.04 | 0.012 | 0.012 | |||||||||||||

| B | 0.012 | 0.0144 | 0.0144 | |||||||||||||

| C | 0.012 | 0.0144 | 0.09 | |||||||||||||

| C. Equally-Weighted Portfolio | ||||||||||||||||

| A | B | C | ||||||||||||||

| Weights | 0.3333 | 0.3333 | 0.3333 | |||||||||||||

| 0.3333 | 0.004444444444444 | 0.001333333333333 | 0.001333333333333 | |||||||||||||

| 0.3333 | 0.001333333333333 | 0.0016 | 0.0016 | |||||||||||||

| 0.3333 | 0.001333333333333 | 0.0016 | 0.01 | |||||||||||||

| 1.0000 | 0.0071 | 0.0045 | 0.0129 | |||||||||||||

| Variance | 0.0246 | |||||||||||||||

| St. Dev | 0.156773013550731 | |||||||||||||||

| R * weight | 0.046666666666667 | 0.026666666666667 | 0.066666666666667 | |||||||||||||

| Mean | 0.14 | |||||||||||||||

| D. Minimize Portfolio Variance, Given Portfolio Mean | ||||||||||||||||

| Use Excel Solver (under Tools) to minimize portfolio variance, subject to: | ||||||||||||||||

| 1. Portfolio weights sum to 1 (a50=1); | ||||||||||||||||

| 2. A specified portfolio mean (b54=?); | ||||||||||||||||

| 3. Optional: portfolio weights>=0 | ||||||||||||||||

| Portfolio | A | B | C | |||||||||||||

| Weight | -0.7819 | 2.4743 | -0.6924 | |||||||||||||

| -0.78193365079586 | 0.024456809369878 | -0.023216862675381 | 0.006496616054868 | |||||||||||||

| 2.47430015873159 | -0.023216862675381 | 0.088159122367188 | -0.024668964870996 | |||||||||||||

| -0.692366507935734 | 0.006496616054868 | -0.024668964870996 | 0.043143424318001 | |||||||||||||

| 1.0000 | 0.0077 | 0.0403 | 0.0250 | |||||||||||||

| Variance | 0.0730 | |||||||||||||||

| St. Dev | 0.270149834484584 | |||||||||||||||

| R * weight | -0.10947071111142 | 0.197944012698528 | -0.138473301587147 | |||||||||||||

| Mean | -0.05000000000004 | |||||||||||||||

| E. Unrestricted Efficient Frontier | ||||||||||||||||

| Portfolio Weights | ||||||||||||||||

| Mean | St. Dev | A | B | C | ||||||||||||

| -0.05 | 0.270149834484584 | -0.78194726166354 | 2.47430696416543 | -0.692359702501894 | ||||||||||||

| -0.02 | 0.222987278946538 | -0.590263686941401 | 2.1284651768037 | -0.538201489862302 | ||||||||||||

| 0 | 0.193534436453269 | -0.462474645030171 | 1.89790398918142 | -0.43542934415125 | ||||||||||||

| 0.02 | 0.166665138772147 | -0.334679207790395 | 1.66733127056186 | -0.332652062771469 | ||||||||||||

| 0.04 | 0.143837983580411 | -0.206890162271805 | 1.4367700811359 | -0.229879918864097 | ||||||||||||

| 0.06 | 0.127245120028976 | -0.079101113665536 | 1.2062088901661 | -0.127107776500565 | ||||||||||||

| 0.08 | 0.119512193102635 | 0.048681541588545 | 0.975659229205396 | -0.024340770793941 | ||||||||||||

| 0.1 | 0.122330314649954 | 0.17647058933309 | 0.745098038666457 | 0.078431372000453 | ||||||||||||

| 0.12 | 0.135041125131134 | 0.304259634888692 | 0.51453684922199 | 0.181203515889318 | ||||||||||||

| 0.14 | 0.155233253793053 | 0.432048681541836 | 0.283975659228751 | 0.283975659229413 | ||||||||||||

| 0.16 | 0.18041196939739 | 0.559837728194979 | 0.053414469235513 | 0.386747802569508 | ||||||||||||

| 0.18 | 0.208780871567971 | 0.687626774848123 | -0.177146720757726 | 0.489519945909603 | ||||||||||||

| 0.2 | 0.239207616884766 | 0.815415819167406 | -0.407707909584034 | 0.592292090416628 | ||||||||||||

| 0.22 | 0.270999951348458 | 0.943204868155365 | -0.63826910074468 | 0.695064232589315 | ||||||||||||

| 0.25 | 0.320357709303102 | 1.13489482758621 | -0.984122413793103 | 0.849227586206897 | ||||||||||||

| F. Restricted Efficient Frontier (No short sales) | ||||||||||||||||

| Portfolio Weights | ||||||||||||||||

| Mean | St. Dev | A | B | C | ||||||||||||

| 0.08 | 0.119999989131562 | 5.43423724285592E-07 | 0.999999456576276 | 0 | ||||||||||||

| 0.09 | 0.119583455565413 | 0.112565787696112 | 0.86038377281828 | 0.027050439485609 | ||||||||||||

| 0.1 | 0.122330314649954 | 0.176470588235548 | 0.745098039215228 | 0.078431372549224 | ||||||||||||

| 0.11 | 0.127580066734574 | 0.240365110446049 | 0.629817444776645 | 0.129817444777307 | ||||||||||||

| 0.12 | 0.135041125131134 | 0.304259634888692 | 0.51453684922199 | 0.181203515889318 | ||||||||||||

| 0.13 | 0.144371056754494 | 0.368154158215263 | 0.399256254225371 | 0.232589587559366 | ||||||||||||

| 0.14 | 0.155233253793053 | 0.432048681541836 | 0.283975659228751 | 0.283975659229413 | ||||||||||||

| 0.15 | 0.1673295808905 | 0.495943204868408 | 0.168695064232132 | 0.33536173089946 | ||||||||||||

| 0.16 | 0.180411969397283 | 0.559837725827047 | 0.053414470420141 | 0.386747803752812 | ||||||||||||

| 0.17 | 0.19621416870357 | 0.499999999999337 | 0 | 0.500000000000663 | ||||||||||||

| 0.18 | 0.223109340409213 | 0.333333333332671 | 0 | 0.666666666667329 | ||||||||||||

| 0.19 | 0.258736244937821 | 0.166666666666005 | 0 | 0.833333333333995 | ||||||||||||

| 0.2 | 0.3 | 0 | 0 | 1 | ||||||||||||

no reviews yet

Please Login to review.