251x Filetype XLSX File size 0.10 MB Source: www.apra.gov.au

Sheet 1: ABC 550 Cover

| ABC Superannuation | ||||||||||

| Reporting of ABC Balanced investment option | ||||||||||

| Strategic Asset Allocation | ||||||||||

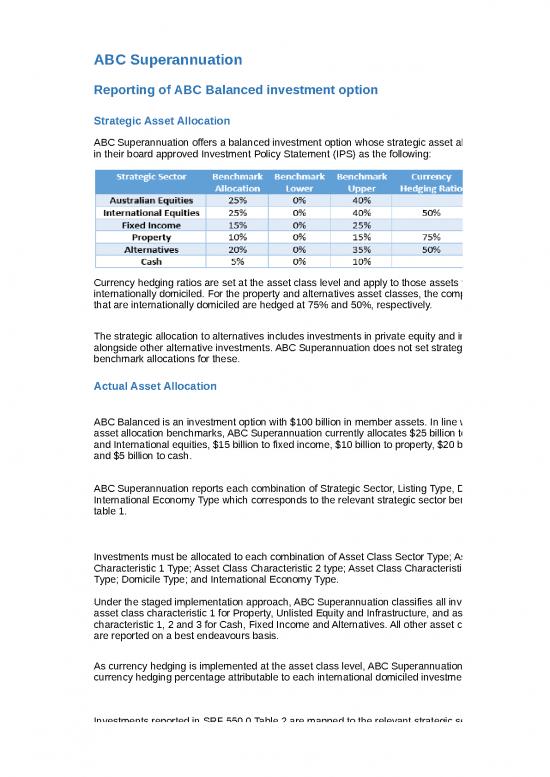

| ABC Superannuation offers a balanced investment option whose strategic asset allocation is outlined in their board approved Investment Policy Statement (IPS) as the following: | ||||||||||

| The strategic allocation to alternatives includes investments in private equity and infrastructure, alongside other alternative investments. ABC Superannuation does not set strategic subsector benchmark allocations for these. | ||||||||||

| Actual Asset Allocation | ||||||||||

| ABC Balanced is an investment option with $100 billion in member assets. In line with their strategic asset allocation benchmarks, ABC Superannuation currently allocates $25 billion to both Australian and International equities, $15 billion to fixed income, $10 billion to property, $20 billion to alternatives and $5 billion to cash. | ||||||||||

| ABC Superannuation reports each combination of Strategic Sector, Listing Type, Domicile Type and International Economy Type which corresponds to the relevant strategic sector benchmark provided in table 1. | ||||||||||

| Investments must be allocated to each combination of Asset Class Sector Type; Asset Class Characteristic 1 Type; Asset Class Characteristic 2 type; Asset Class Characteristic 3 Type; Listing Type; Domicile Type; and International Economy Type. Under the staged implementation approach, ABC Superannuation classifies all investments using asset class characteristic 1 for Property, Unlisted Equity and Infrastructure, and asset class characteristic 1, 2 and 3 for Cash, Fixed Income and Alternatives. All other asset class characteristics are reported on a best endeavours basis. |

||||||||||

| As currency hedging is implemented at the asset class level, ABC Superannuation reports the currency hedging percentage attributable to each international domiciled investment. | ||||||||||

| Investments reported in SRF 550.0 Table 2 are mapped to the relevant strategic sector. For example, in meeting their benchmark allocation to Australian equities, ABC Superannuation make investments in listed property trusts. These investments are classified with an Asset Sector type of 'Property', Listing type of 'Listed' and Domicile type of 'Australian Domicile', under the Strategic Sector type of 'Equity', Listing type of 'Listed' and Domicile type of 'Australian Domicile'. | ||||||||||

| Table 1: Superannuation products | ||||||||||||

| Investment Option Identifier | Investment Strategic Sector Type | Investment Strategic Sector Listing Type | Investment Strategic Sector Domicile Type | Investment Strategic Sector International Economy Type | Investment Strategic Subsector Type | Investment Strategic Subsector Listing Type | Investment Strategic Subsector Domicile Type | Investment Strategic Subsector International Economy Type | Investment Benchmark Allocation Percent | Investment Benchmark Allocation Lower Percent | Investment Benchmark Allocation Upper Percent | Investment Currency Hedging Ratio Percent |

| (-21) | (-22) | (-23) | (-24) | (-25) | (-26) | (-27) | (-28) | (-29) | (-210) | (-211) | (-212) | (-213) |

| ABCBALANCED | Equity | Listed | Australian Domicile | Not Specified | Not Applicable | Not Applicable | Not Applicable | Not Applicable | 0.2500 | 0.0000 | 0.4000 | |

| ABCBALANCED | Equity | Listed | International Domicile | Not Specified | Not Applicable | Not Applicable | Not Applicable | Not Applicable | 0.2500 | 0.0000 | 0.4000 | 0.5000 |

| ABCBALANCED | Fixed Income | Not Specified | Not Specified | Not Specified | Not Applicable | Not Applicable | Not Applicable | Not Applicable | 0.1500 | 0.0000 | 0.2500 | |

| ABCBALANCED | Property | Not Specified | Not Specified | Not Specified | Not Applicable | Not Applicable | Not Applicable | Not Applicable | 0.1000 | 0.0000 | 0.1500 | 0.7500 |

| ABCBALANCED | Alternatives | Not Specified | Not Specified | Not Specified | Not Applicable | Not Applicable | Not Applicable | Not Applicable | 0.2000 | 0.0000 | 0.3500 | 0.5000 |

| ABCBALANCED | Cash | Not Applicable | Australian Domicile | Not Specified | Not Applicable | Not Applicable | Not Applicable | Not Applicable | 0.0500 | 0.0000 | 0.1000 |

| Table 1: Superannuation products | ||||||||||||||||

| Investment Option Identifier | Investment Strategic Sector Type | Investment Strategic Sector Listing Type | Investment Strategic Sector Domicile Type | Investment Strategic Sector International Economy Type | Investment Asset Class Sector Type | Investment Asset Class Characteristic 1 Type | Investment Asset Class Characteristic 2 Type | Investment Asset Class Characteristic 3 Type | Investment Listing Type | Investment Domicile Type | Investment International Economy Type | Investment Option Value Amount | Investment Option Synthetic Exposure Amount | Investment Currency Hedged Percent | Investment Gearing Proportion Percent | Investment Modified Duration Number |

| (-21) | (-22) | (-23) | (-24) | (-25) | (-26) | (-27) | (-28) | (-29) | (-210) | (-211) | (-212) | (-213) | (-214) | (-215) | (-216) | (-217) |

| ABCBALANCED | Equity | Listed | Australian Domicile | Not Specified | Equity | Equity Listed Large Cap | Equity Listed Active | Not Applicable | Listed | Australian Domicile | Not Applicable | 7000000000 | 1000000000 | |||

| ABCBALANCED | Equity | Listed | Australian Domicile | Not Specified | Equity | Equity Listed Mid Cap | Equity Listed Active | Not Applicable | Listed | Australian Domicile | Not Applicable | 5000000000 | ||||

| ABCBALANCED | Equity | Listed | Australian Domicile | Not Specified | Equity | Equity Listed Small Cap | Equity Listed Active | Not Applicable | Listed | Australian Domicile | Not Applicable | 5000000000 | ||||

| ABCBALANCED | Equity | Listed | Australian Domicile | Not Specified | Equity | Equity Listed Large Cap | Equity Listed Passive | Not Applicable | Listed | Australian Domicile | Not Applicable | 3000000000 | ||||

| ABCBALANCED | Equity | Listed | Australian Domicile | Not Specified | Cash | Not Applicable | Cash Cash At Bank | Not Applicable | Not Applicable | Australian Domicile | Not Applicable | 1000000000 | ||||

| ABCBALANCED | Equity | Listed | Australian Domicile | Not Specified | Property | Property Established | Not Applicable | Not Applicable | Listed | Australian Domicile | Not Applicable | 4000000000 | ||||

| ABCBALANCED | Equity | Listed | International Domicile | Not Specified | Equity | Equity Listed Large Cap | Equity Listed Active | Not Applicable | Listed | International Domicile | Developed Markets | 6000000000 | 2000000000 | 0.5000 | ||

| ABCBALANCED | Equity | Listed | International Domicile | Not Specified | Equity | Equity Listed Mid Cap | Equity Listed Active | Not Applicable | Listed | International Domicile | Developed Markets | 5000000000 | 0.5000 | |||

| ABCBALANCED | Equity | Listed | International Domicile | Not Specified | Equity | Equity Listed Small Cap | Equity Listed Active | Not Applicable | Listed | International Domicile | Developed Markets | 2000000000 | 0.5000 | |||

| ABCBALANCED | Equity | Listed | International Domicile | Not Specified | Equity | Equity Listed Large Cap | Equity Listed Active | Not Applicable | Listed | International Domicile | Emerging Markets | 2500000000 | 0.5000 | |||

| ABCBALANCED | Equity | Listed | International Domicile | Not Specified | Equity | Equity Listed Large Cap | Equity Listed Passive | Not Applicable | Listed | International Domicile | Developed Markets | 7500000000 | 0.5000 | |||

| ABCBALANCED | Equity | Listed | International Domicile | Not Specified | Cash | Not Applicable | Cash Cash At Bank | Not Applicable | Not Applicable | International Domicile | Not Applicable | 2000000000 | 0.5000 | |||

| ABCBALANCED | Fixed Income | Not Specified | Not Specified | Not Specified | Fixed Income | Fixed Income Investment Grade | Fixed Income Bonds Government Coupon | Fixed Income Long Term | Unlisted | Australian Domicile | Not Applicable | 2000000000 | 4.25 | |||

| ABCBALANCED | Fixed Income | Not Specified | Not Specified | Not Specified | Fixed Income | Fixed Income Investment Grade | Fixed Income Bonds Government Other | Fixed Income Long Term | Unlisted | Australian Domicile | Not Applicable | 3500000000 | 6.50 | |||

| ABCBALANCED | Fixed Income | Not Specified | Not Specified | Not Specified | Fixed Income | Fixed Income Non Investment Grade | Fixed Income Bonds Corporate | Fixed Income Long Term | Unlisted | Australian Domicile | Not Applicable | 5000000000 | 3.25 | |||

| ABCBALANCED | Fixed Income | Not Specified | Not Specified | Not Specified | Fixed Income | Fixed Income Non Investment Grade | Fixed Income Asset Backed Commercial Mortgage | Fixed Income Long Term | Unlisted | Australian Domicile | Not Applicable | 4500000000 | 5.10 | |||

| ABCBALANCED | Property | Not Specified | Not Specified | Not Specified | Property | Property Established | Not Applicable | Not Applicable | Listed | Australian Domicile | Not Applicable | 3000000000 | ||||

| ABCBALANCED | Property | Not Specified | Not Specified | Not Specified | Property | Property Development | Property Commercial | Not Applicable | Unlisted | Australian Domicile | Not Applicable | 2000000000 | ||||

| ABCBALANCED | Property | Not Specified | Not Specified | Not Specified | Property | Property Established | Property Commercial | Not Applicable | Unlisted | Australian Domicile | Not Applicable | 1000000000 | ||||

| ABCBALANCED | Property | Not Specified | Not Specified | Not Specified | Property | Property Established | Property Retail | Not Applicable | Unlisted | Australian Domicile | Not Applicable | 1500000000 | ||||

| ABCBALANCED | Property | Not Specified | Not Specified | Not Specified | Property | Property Established | Property Residential | Not Applicable | Unlisted | Australian Domicile | Not Applicable | 2000000000 | ||||

| ABCBALANCED | Property | Not Specified | Not Specified | Not Specified | Property | Property Established | Property Commercial | Not Applicable | Unlisted | International Domicile | Developed Markets | 500000000 | 0.7500 | |||

| ABCBALANCED | Alternatives | Not Specified | Not Specified | Not Specified | Alternatives | Not Applicable | Alternatives Real Return Multi Asset Strategies | Not Applicable | Unlisted | Australian Domicile | Not Applicable | 500000000 | ||||

| ABCBALANCED | Alternatives | Not Specified | Not Specified | Not Specified | Alternatives | Not Applicable | Alternatives Commodities | Not Applicable | Unlisted | Australian Domicile | Not Applicable | 2000000000 | ||||

| ABCBALANCED | Alternatives | Not Specified | Not Specified | Not Specified | Alternatives | Not Applicable | Alternatives Long Or Short Equity | Not Applicable | Unlisted | International Domicile | Developed Markets | 5000000000 | 0.5000 | |||

| ABCBALANCED | Alternatives | Not Specified | Not Specified | Not Specified | Alternatives | Not Applicable | Alternatives Global Macro | Not Applicable | Unlisted | International Domicile | Developed Markets | 1000000000 | 0.5000 | |||

| ABCBALANCED | Alternatives | Not Specified | Not Specified | Not Specified | Equity | Equity Unlisted Development Or Early Stage | Equity Unlisted Venture Capital | Not Applicable | Unlisted | Australian Domicile | Not Applicable | 1500000000 | ||||

| ABCBALANCED | Alternatives | Not Specified | Not Specified | Not Specified | Equity | Equity Unlisted Established Or Late Stage | Equity Unlisted Venture Capital | Not Applicable | Unlisted | Australian Domicile | Not Applicable | 2500000000 | ||||

| ABCBALANCED | Alternatives | Not Specified | Not Specified | Not Specified | Equity | Equity Unlisted Development Or Early Stage | Equity Unlisted Growth Equity | Not Applicable | Unlisted | Australian Domicile | Not Applicable | 1000000000 | ||||

| ABCBALANCED | Alternatives | Not Specified | Not Specified | Not Specified | Infrastructure | Infrastructure Development | Infrastructure Social Availability | Infrastructure Non Government | Unlisted | Australian Domicile | Not Applicable | 2000000000 | ||||

| ABCBALANCED | Alternatives | Not Specified | Not Specified | Not Specified | Infrastructure | Infrastructure Established | Infrastructure Toll Roads | Infrastructure Non Government | Unlisted | Australian Domicile | Not Applicable | 1500000000 | ||||

| ABCBALANCED | Alternatives | Not Specified | Not Specified | Not Specified | Infrastructure | Infrastructure Established | Infrastructure Airports | Infrastructure Non Government | Unlisted | Australian Domicile | Not Applicable | 2500000000 | ||||

| ABCBALANCED | Alternatives | Not Specified | Not Specified | Not Specified | Infrastructure | Infrastructure Established | Infrastructure Ports | Infrastructure Non Government | Unlisted | International Domicile | Developed Markets | 500000000 | 0.5000 | |||

| ABCBALANCED | Cash | Not Applicable | Australian Domicile | Not Specified | Cash | Not Applicable | Cash Cash At Bank | Not Applicable | Unlisted | Australian Domicile | Not Applicable | 4000000000 | ||||

| ABCBALANCED | Cash | Not Applicable | Australian Domicile | Not Specified | Cash | Not Applicable | Cash Cash Management Trust | Not Applicable | Unlisted | Australian Domicile | Not Applicable | 1000000000 |

no reviews yet

Please Login to review.