237x Filetype XLSX File size 0.07 MB Source: www.lift-fund.org

Sheet 1: Instructions and Checklist

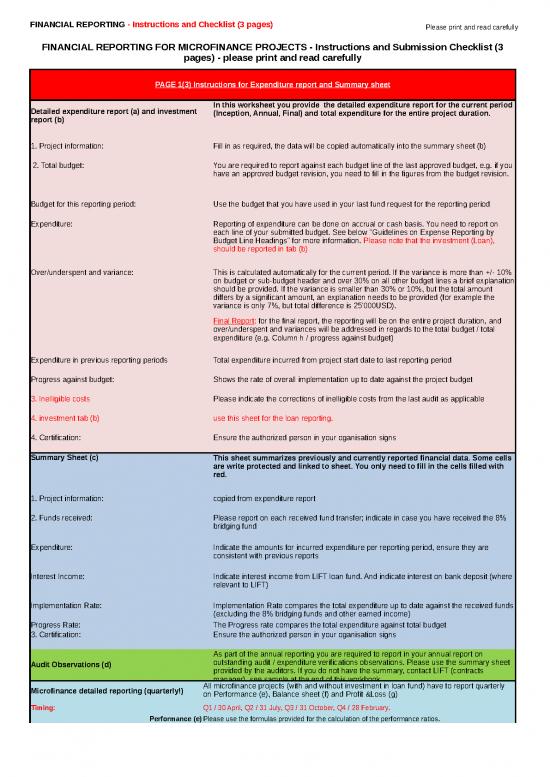

| FINANCIAL REPORTING FOR MICROFINANCE PROJECTS - Instructions and Submission Checklist (3 pages) - please print and read carefully | ||

| PAGE 1(3) Instructions for Expenditure report and Summary sheet | ||

| Detailed expenditure report (a) and investment report (b) | In this worksheet you provide the detailed expenditure report for the current period (Inception, Annual, Final) and total expenditure for the entire project duration. | |

| 1. Project information: | Fill in as required, the data will be copied automatically into the summary sheet (b) | |

| 2. Total budget: | You are required to report against each budget line of the last approved budget, e.g. if you have an approved budget revision, you need to fill in the figures from the budget revision. | |

| Budget for this reporting period: | Use the budget that you have used in your last fund request for the reporting period | |

| Expenditure: | Reporting of expenditure can be done on accrual or cash basis. You need to report on each line of your submitted budget. See below "Guidelines on Expense Reporting by Budget Line Headings" for more information. Please note that the investment (Loan), should be reported in tab (b) | |

| Over/underspent and variance: | This is calculated automatically for the current period. If the variance is more than +/- 10% on budget or sub-budget header and over 30% on all other budget lines a brief explanation should be provided. If the variance is smaller than 30% or 10%, but the total amount differs by a significant amount, an explanation needs to be provided (for example the variance is only 7%, but total difference is 25'000USD). | |

| Final Report: for the final report, the reporting will be on the entire project duration, and over/underspent and variances will be addressed in regards to the total budget / total expenditure (e.g. Column h / progress against budget) | ||

| Expenditure in previous reporting periods | Total expenditure incurred from project start date to last reporting period | |

| Progress against budget: | Shows the rate of overall implementation up to date against the project budget | |

| 3. Inelligible costs | Please indicate the corrections of inelligible costs from the last audit as applicable | |

| 4. investment tab (b) | use this sheet for the loan reporting. | |

| 4. Certification: | Ensure the authorized person in your oganisation signs | |

| Summary Sheet (c) | This sheet summarizes previously and currently reported financial data. Some cells are write protected and linked to sheet. You only need to fill in the cells filled with red. | |

| 1. Project information: | copied from expenditure report | |

| 2. Funds received: | Please report on each received fund transfer; indicate in case you have received the 8% bridging fund | |

| Expenditure: | Indicate the amounts for incurred expenditure per reporting period, ensure they are consistent with previous reports | |

| Interest Income: | Indicate interest income from LIFT loan fund. And indicate interest on bank deposit (where relevant to LIFT) | |

| Implementation Rate: | Implementation Rate compares the total expenditure up to date against the received funds (excluding the 8% bridging funds and other earned income) | |

| Progress Rate: | The Progress rate compares the total expenditure against total budget | |

| 3. Certification: | Ensure the authorized person in your oganisation signs | |

| Audit Observations (d) | As part of the annual reporting you are required to report in your annual report on outstanding audit / expenditure verifications observations. Please use the summary sheet provided by the auditors. If you do not have the summary, contact LIFT (contracts manager). see sample at the end of this workbook. | |

| Microfinance detailed reporting (quarterly!) | All microfinance projects (with and without investment in loan fund) have to report quarterly on Performance (e), Balance sheet (f) and Profit &Loss (g) | |

| Timing: | Q1 / 30 April, Q2 / 31 July, Q3 / 31 October, Q4 / 28 February. | |

| Performance (e) | Please use the formulas provided for the calculation of the performance ratios. | |

| Balance sheet (f) | For the MFI operating microfinance with fund from LIFT only, 100% net interest can be accounted as liable to LIFT. For the MFI operating microfinance with funds from LIFT and others, pro-rated net income must be reported according to the formula described in the P&L accountt (sheet - g) |

|

| Profit and Loss (g) | Quarterly P&L must be cummulative, and annual P&L should cover the calender year. (for whole MFI) | |

| PAGE 2(3) Guidelines on Expense Reporting, Details | ||

| Please also refer to the Operational Guidelines if required | ||

| 1. Human Resources | ||

| 1.1 Salaries International Staff | Salaries refer to actual total employment costs for international staff funded under the agreement. This may include actual salaries, allowances, bonuses, social security charges and other remuneration related costs (including provisions such as pension, home leave, separation pay, etc.). Salaries and other costs will not exceed those normally borne by the organization. | |

| 1.1.1 Technical Staff | International Staff in Technical roles directly supporting the project activities such as Programme Coordinators and Project Managers | |

| 1.1.2 Administrative Staff | International Staff in Administrative or Management positions such as Country Director, Administrative and Finance | |

| 1.2 Salaries National Staff | Salaries refer to actual total employment costs for national staff funded under the agreement. This may include actual salaries, allowances, bonuses, social security charges and other remuneration – related costs (including provisions such as pension, separation pay, etc.). Salaries and other costs will not exceed those normally borne by the organization. | |

| 1.2.1 Technical Staff | National Staff in Technical roles directly supporting the project activities such as Programme Coordinators and Project Managers | |

| 1.2.2 Administrative Staff | National Staff in Administrative or Management positions such as Country Director, Administrative and Finance Staff | |

| 1.3 Short Term Technical Assistance | Consultancy costs per day or per month should be specified. | |

| Total costs of engaging the consultant are eligible including recruitment costs, travel and accommodation relevant to the assignment. Costs for Field Trips should also be included for Consultants. | - | |

| 1.4 Missions/ Per Diem and other | Mission related costs refers to actual payment for the local air tickets, local transportation, board and lodging, etc. for official trips of project personnel, and the government appointed Liaison Officer taking part in the monitoring of implementation of the project activities, in accordance with the policy of the organization. | |

| Missions costs related to formal evaluation and audit activities must be reported under Section 2 | ||

| 2. Office, Equipment and Supplies | ||

| 2.1 Transport Rental and Running Costs | All Transport related costs for rental, maintenance and repair, fuel and running costs. Includes car, motor cycle, boat, bicycle etc. | |

| Where transport vehicles are shared across multiple projects please specify in Expenditure Analysis column the % to be utilized and charged with LIFT Funds. | - | |

| 2.2 Purchase of Transport Vehicles, Equipment, Furniture and Others | Purchases and procurements by the project for the management and operations for the programme should be included in this section. All items to be included on the inventory list must be included here plus items under $500 value. | |

| Where assets are shared across multiple projects please specify in Expenditure Analysis column the % to be utilized and charged with LIFT Funds. Audit processes may require verifiable documentation on sharing of assets. | - | |

| 2.3 Office Rental and Running Costs and Others | a. Office Rental - actual lease payment or proportionately allocated cost of renting premises for office facilities or houses for project personnel performing activities/services directly attributable to the project. | |

| b. Communication costs - actual payments for communication costs like phone, internet, courrier etc | ||

| c. Stationary and Consumables | ||

| d. Utilities - actual payments for electricity, water, generator fuel, etc. | ||

| e. Audits - actual payments for audits (only applicable if there has been an agreement with LIFT on such audit costs, e.g. for internal audits on sub-IPs) | ||

| f. Evaluations Missions - actual payments for Fund Manager required Evaluations | ||

| g. Workshops, Seminars and Trainings refer to actual payment related to the organization of staff development activities and of trainings, seminars, workshops & meetings. Examples are cost of meeting room, cost of conference kits, cost of meeting package, field testing and development of IEC materials and other tools. Staff Mission costs or per diems should be included under Missions and Per diems 1.4. Workshops and training with beneficiaries and target groups should be included under Programme Costs 3. | ||

| 3. Programme Costs | ||

| 3.1 LIFT OUTPUT Specific | Programme Activities that directly benefit the target groups should be included as separate budget lines under the relevant LIFT OUTPUT. All costs incurred in direct implementation of activities should be included under Programme Costs. | |

| PAGE 3(3) Checklist for Financial Report | YES / NO | |

| Detailed expenditure report (a) | ||

| Project information | Project information filled out ? | |

| Updated dates in case there was an amendment (e.g. duration / total budget)? | ||

| Column (a), Total Budget | Correct amount, e.g. as per your submitted budget OR latest budget revision? | |

| Column (b), Budget for this reporting period | Correct amount, e.g. as per your submitted fund request for this period OR latest budget revision for the same period? | |

| Column (c), Expenditure in this reporting period | reported against each line? | |

| Columns (d) and (e), Variance and over/underspent | have you explained in the last column any variances of more than +/- 10% for heading/sub-headings | |

| have you explained +/-30% for all other budget lines? | ||

| have you explained any other over/underspent which may be within the 10% / 30% but in monetary value significant? | ||

| Column (f) Expenditure in previous reporting periods | Is this corresponding with last submitted report? | |

| Formulas: | ||

| sums and variances | have you checked whether all sums and variances are calculated correctly? | |

| indirect fee | have you calculated the fee correctly on all columns? | |

| Ineligible costs | have you checked your audit report for ineligible costs? | |

| if applicable, have you addressed correction of ineligible costs? | ||

| Certification | Name of the signatory reflected? | |

| Signed? | ||

| Dated? | ||

| Summary sheet (b) | ||

| Project information | same as on Detailed expenditure report? | |

| Total funds received | checked against last years report? | |

| Are they the same figures for the previous year? | ||

| if 8% bridging fund was received, is it reflected correctly? | ||

| fund request etc. to be mentioned with received date? | ||

| Total expenditure per reporting period | Expenditure corresonding with expenditure report? | |

| Other income | reflected for entire period? | |

| Certification | Same as on Detailed expenditure report? | |

| Submission to LIFT | do you have a signed hard copy? | |

| if you don't send a hard copy, but a scan, verify that the scan big enough to read? | ||

| do you have the Excel version for submission? | ||

| is it the same as the hard copy? | ||

| Check submission dates in your Grant agreement | ||

| Expenditure Report | |||||||||||||

| Fill in. This will be copied to the summary sheet | |||||||||||||

| 1 | Project Information: | ||||||||||||

| Implementing Partner: | refer to GSA, first page | ||||||||||||

| Memorandum of Agreement Number: | refer to GSA, first page | ||||||||||||

| Project Title: | refer to GSA, first page | ||||||||||||

| Contract Period: | indicate duration of project, e.g. 1/1/2016-31/12/2018 | ||||||||||||

| Contract Amount: | refer to GSA budget | ||||||||||||

| Reporting Period: | indicate duration of reporting period, e.g. 1/1/2017-31/12/2017 | ||||||||||||

| Type of report: | Choose drop down menu | ||||||||||||

| Version | 8/9/2022 | ||||||||||||

| 2 | Budget description | Total Budget |

Budget for this reporting period | Expenditure in this Reporting Period | over/under spent | Variance | Expenditure in previous reporting periods | Total Expenditure |

Progress against budget | Provide comment on over and under variation of expenditure if variance is more than 10% in column (e) | |||

| Dates | indicate duration of project, e.g. 1/1/2016-31/12/2018 | indicate duration of reporting period, e.g. 1/1/2017-31/12/2017 | cummulative performance start date of project to current reporting period |

||||||||||

| calculation | a | b | c | d=b-c | e=c/b | f | g=f+c | h=g/a | |||||

| 1. HUMAN RESOURCES | - | - | - | - | #DIV/0! | - | - | #DIV/0! | |||||

| 1.1 … please fill in details as per your last approved budget | - | - | |||||||||||

| 2. OFFICE COSTS, EQUIPMENT AND SUPPLIES | - | - | - | - | #DIV/0! | - | - | #DIV/0! | |||||

| 2.1 …please fill in details as per your last approved budget | - | - | |||||||||||

| 3. PROGRAMME COSTS | - | - | - | - | #DIV/0! | - | - | #DIV/0! | |||||

| 3.1…..please fill in details as per your last approved budget | - | - | |||||||||||

| Do not report disbursement for loan fund here | |||||||||||||

| 4. TOTAL DIRECT COSTS | - | - | - | - | #DIV/0! | - | - | #DIV/0! | |||||

| 5. INDIRECT COST (6% of Direct Costs) | - | - | - | - | #DIV/0! | - | - | #DIV/0! | |||||

| 6. Grand Total | - | - | - | - | #DIV/0! | - | - | #DIV/0! | |||||

| fill in as required | |||||||||||||

| From investment tab (b) | - | - | - | - | #DIV/0! | - | - | #DIV/0! | |||||

| Total direct/indirect and investment | - | - | - | - | #DIV/0! | - | - | #DIV/0! | |||||

| 3 | Inelligible costs as identified in the audit/verification reports have been corrected as follows: | ||||||||||||

| 4 | I certify that, in all material respects, the total expenditure incurred and reported herein are strictly for purposes of the project or activity, as agreed by the LIFT Fund Manager - UNOPS. | ||||||||||||

| Implementing Partner's Approval: | |||||||||||||

| Name & Signature of Authorized Official | |||||||||||||

| Title: | |||||||||||||

| Date: | |||||||||||||

| Investment in loan fund Report | |||||||||||||

| Fill in. This will be copied to the summary sheet | |||||||||||||

| 1 | Project Information: | ||||||||||||

| Implementing Partner: | refer to MOA, first page | ||||||||||||

| Memorandum of Agreement Number: | refer to MOA, first page | ||||||||||||

| Project Title: | refer to MOA, first page | ||||||||||||

| Contract Period: | indicate duration of project, e.g. 1/1/2016-31/12/2018 | ||||||||||||

| Contract Amount: | refer to MOA budget | ||||||||||||

| Reporting Period: | indicate duration of reporting period, e.g. 1/1/2017-31/12/2017 | ||||||||||||

| Type of report: | Choose drop down menu | ||||||||||||

| Version | 8/9/2022 | ||||||||||||

| 2 | Budget description | Total Budget |

Budget for this reporting period | Investment in this Reporting Period | over/under spent | Variance | Investment in previous reporting periods | Total Investment |

Progress against budget | Provide comment on over and under variation of investment if variance is more than 10% in column (e) | |||

| Dates | indicate duration of project, e.g. 1/1/2016-31/12/2018 | indicate duration of reporting period, e.g. 1/1/2017-31/12/2017 | cummulative performance start date of project to current reporting period |

||||||||||

| calculation | a | b | c | d=b-c | e=c/b | f | g=f+c | h=g/a | |||||

| 3. Program Cost | |||||||||||||

| Investment in loan fund | - | - | - | - | #DIV/0! | - | - | #DIV/0! | |||||

| 4. TOTAL Investment | - | - | - | - | #DIV/0! | - | - | #DIV/0! | |||||

| 3 | Inelligible costs as identified in the audit/verification reports have been corrected as follows: | ||||||||||||

| 4 | I certify that, in all material respects, the total expenditure incurred and reported herein are strictly for purposes of the project or activity, as agreed by the LIFT Fund Manager - UNOPS. | ||||||||||||

| Implementing Partner's Approval: | |||||||||||||

| Name & Signature of Authorized Official | |||||||||||||

| Title: | |||||||||||||

| Date: | |||||||||||||

no reviews yet

Please Login to review.