216x Filetype XLSX File size 0.03 MB Source: www.journalofaccountancy.com

Sheet 1: Foot & Crossfoot

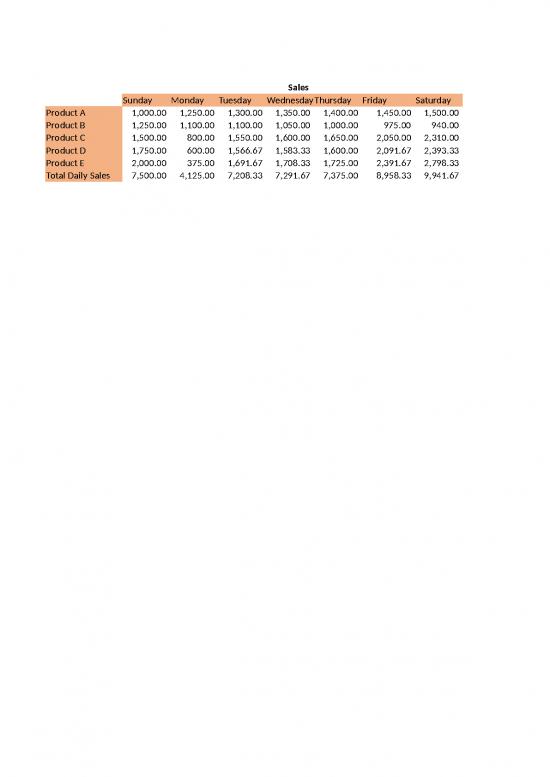

| Sales | ||||||||

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday | Total Weekly Sales | |

| Product A | 1,000.00 | 1,250.00 | 1,300.00 | 1,350.00 | 1,400.00 | 1,450.00 | 1,500.00 | 9,250.00 |

| Product B | 1,250.00 | 1,100.00 | 1,100.00 | 1,050.00 | 1,000.00 | 975.00 | 940.00 | 7,415.00 |

| Product C | 1,500.00 | 800.00 | 1,550.00 | 1,600.00 | 1,650.00 | 2,050.00 | 2,310.00 | 11,460.00 |

| Product D | 1,750.00 | 600.00 | 1,566.67 | 1,583.33 | 1,600.00 | 2,091.67 | 2,393.33 | 11,585.00 |

| Product E | 2,000.00 | 375.00 | 1,691.67 | 1,708.33 | 1,725.00 | 2,391.67 | 2,798.33 | 12,690.00 |

| Total Daily Sales | 7,500.00 | 4,125.00 | 7,208.33 | 7,291.67 | 7,375.00 | 8,958.33 | 9,941.67 | 52,400.00 |

| JONES COLLEGE COMPANY | |||||||||||||

| YEAR-END WORKSHEET | |||||||||||||

| December 31, 2018 | |||||||||||||

| 12/31/2017 | 12/31/2018 | ||||||||||||

| ACCT | ACCOUNT | POST CLOSING | UNADJUSTED | ADJUSTMENTS | ADJUSTED | INCOME | BALANCE | ||||||

| NO. | TITLE | TRIAL BALANCE | TRIAL BALANCE | TRIAL BALANCE | STATEMENT | SHEET | |||||||

| DEBIT | CREDIT | DEBIT | CREDIT | DEBIT | CREDIT | DEBIT | CREDIT | DEBIT | CREDIT | DEBIT | CREDIT | ||

| ASSETS | |||||||||||||

| 10100 | Cash | 11,025.19 | 109,403.09 | 109,403.09 | 109,403.09 | ||||||||

| 10200 | Accounts receivable | 11,065.00 | 45,972.00 | 45,972.00 | 45,972.00 | ||||||||

| 10300 | Allowance for doubtful accounts | 3,250.81 | 1,149.19 | 3,781.26 | 2,632.07 | 2,632.07 | |||||||

| 10400 | Inventory | 101,681.00 | 101,681.00 | 95,700.00 | 0.00 | 197,381.00 | 197,381.00 | ||||||

| 10600 | Marketable securities | 24,000.00 | 24,000.00 | 24,000.00 | |||||||||

| 10800 | Fixed assets | 320,665.00 | 332,590.00 | 332,590.00 | 332,590.00 | ||||||||

| 10900 | Accumulated depreciation | 81,559.50 | 81,559.50 | 35,109.50 | 116,669.00 | 116,669.00 | |||||||

| LIABILITIES | |||||||||||||

| 20100 | Accounts payable | 11,279.35 | 8,767.15 | 8,767.15 | 8,767.15 | ||||||||

| 20300 | Federal income taxes withheld | 1,326.76 | 1,706.65 | 1,706.65 | 1,706.65 | ||||||||

| 20400 | State unemployment taxes payable | 281.17 | 87.93 | 87.93 | 87.93 | ||||||||

| 20500 | Federal unemployment taxes payable | 83.31 | 26.05 | 26.05 | 26.05 | ||||||||

| 20600 | F.I.C.A. taxes payable | 1,593.30 | 2,236.66 | 2,236.66 | 2,236.66 | ||||||||

| 20700 | Federal incomes taxes payable | 29,797.00 | 52,183.00 | 52,183.00 | 52,183.00 | ||||||||

| 20900 | Interest payable | 0.00 | 197.26 | 197.26 | 197.26 | ||||||||

| 21000 | Notes payable | 80,000.00 | 80,000.00 | 80,000.00 | |||||||||

| STOCKHOLDERS' EQUITY | |||||||||||||

| 26000 | Common stock | 225,000.00 | 225,000.00 | 225,000.00 | 225,000.00 | ||||||||

| 29000 | Retained earnings | 90,264.99 | 90,264.99 | 90,264.99 | 90,264.99 | ||||||||

| REVENUE AND GROSS PROFIT | |||||||||||||

| 30100 | Sales | 1,589,021.00 | 1,589,021.00 | 1,589,021.00 | |||||||||

| 30200 | Sales returns and allowances | 61,111.00 | 61,111.00 | 61,111.00 | |||||||||

| 30300 | Sales discounts taken | 15,405.82 | 15,405.82 | 15,405.82 | |||||||||

| 30400 | Cost of goods sold | 1,025,341.69 | 1,025,341.69 | 1,025,341.69 | |||||||||

| 30500 | Purchases | 1,132,485.00 | 1,132,485.00 | ||||||||||

| 30600 | Purchases returns and allowances | 19,445.00 | 19,445.00 | ||||||||||

| 30700 | Purchases discounts taken | 16,641.00 | 16,641.00 | ||||||||||

| 30800 | Freight-in | 24,642.69 | 24,642.69 | ||||||||||

| 31200 | Miscellaneous revenue | 825.00 | 825.00 | 825.00 | |||||||||

| EXPENSES | |||||||||||||

| 40100 | Rent expense | 57,600.00 | 57,600.00 | 57,600.00 | |||||||||

| 40200 | Advertising expense | 21,905.00 | 21,905.00 | 21,905.00 | |||||||||

| 40300 | Office supplies expense | 5,621.45 | 5,621.45 | 5,621.45 | |||||||||

| 40400 | Depreciation expense | 35,109.50 | 35,109.50 | 35,109.50 | |||||||||

| 40500 | Wages and salaries expense | 141,198.14 | 141,198.14 | 141,198.14 | |||||||||

| 40600 | Payroll tax expense | 11,528.80 | 11,528.80 | 11,528.80 | |||||||||

| 40700 | Federal income tax expense | 52,183.00 | 52,183.00 | 52,183.00 | |||||||||

| 40800 | Interest expense | 197.26 | 197.26 | 197.26 | |||||||||

| 40900 | Bad debt expense | 3,781.26 | 3,781.26 | 3,781.26 | |||||||||

| 41000 | Other operating expense | 29,287.75 | 29,287.75 | 29,287.75 | |||||||||

| Sub-totals | 1,460,270.67 | 1,589,846.00 | 709,346.09 | 579,770.76 | |||||||||

| Net Income (Loss) | -------------------- | -------------------- | -------------------- | -------------------- | -------------------- | -------------------- | -------------------- | -------------------- | 129,575.33 | 129,575.33 | |||

| TOTALS | 444,436.19 | 444,436.19 | 2,115,580.93 | 2,115,580.93 | 1,248,398.71 | 1,248,398.71 | 2,169,616.76 | 2,169,616.76 | 1,589,846.00 | 1,589,846.00 | 709,346.09 | 709,346.09 | |

| 0.00 | |||||||||||||

| JONES COLLEGE COMPANY | ||

| STATEMENT OF INCOME AND RETAINED EARNINGS | ||

| For the Year Ended December 31, 2018 | ||

| REVENUE | ||

| Sales | ||

| Less: Sales returns and allowances | ||

| Sales discounts taken | ||

| Net sales | ||

| COST OF GOODS SOLD | ||

| Beginning inventory | ||

| Net purchases | ||

| Freight-in | ||

| Goods available for sale | ||

| Less: Ending inventory | ||

| Cost of goods sold | ||

| GROSS MARGIN | ||

| OPERATING EXPENSES | ||

| Rent expense | ||

| Advertising expense | ||

| Office supplies expense | ||

| Depreciation expense | ||

| Wages and salaries | ||

| Payroll taxes | ||

| Bad debt expense | ||

| Other operating expense | ||

| Total operating expenses | ||

| Operating income | ||

| OTHER INCOME - Miscellaneous income | ||

| OTHER EXPENSE - Interest expense | ||

| INCOME BEFORE TAXES | ||

| FEDERAL INCOME TAXES | ||

| NET INCOME | ||

| RETAINED EARNINGS - Beginning of year | ||

| RETAINED EARNINGS - End of year | ||

| Federal income tax | equals | 52183 |

| =========== | ||

| 181,758.33 | ||

| 50000 | 0.15 | 7500 |

| 131758.33 | ||

| 25000 | 0.25 | 6250 |

| 106758.33 | 0.36 | 38432.9988 |

no reviews yet

Please Login to review.