344x Filetype XLSX File size 0.18 MB Source: www.postnord.se

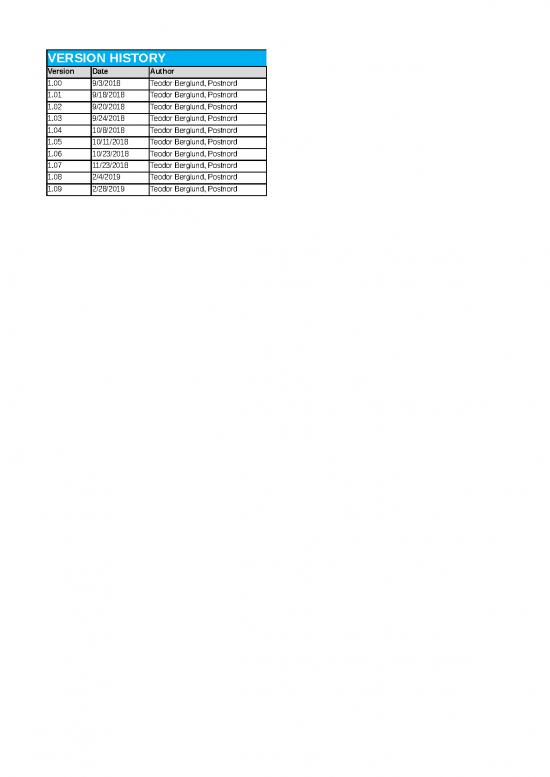

Sheet 1: Version

| INPUT DESCRIPTION | OUTPUT FILE (SVEFAKTURA 1.0) | ||||||

| Card. | Description | SAP Source | Comment | Example data in | XML Element | Attribute | Example data |

| 1..1 | Document ID | Invoice number (TD) | 9000001802 | ID | 9000001802 | ||

| 1..1 | Issue Date | Payer invoice freq (MD->TD) | 2017-09-28 | IssueDate | 2017-09-28 | ||

| 1..1 | Invoice Type Code | New Print Solution (CD) | 381 when credit invoice | 380 [OR] 381 | InvoiceTypeCode | 380 [OR] 381 | |

| 0..1 | Invoice Header Note | Invoice (TD) | Note | ||||

| 1..1 | Document currency code | Sold-to curr (MD->TD) | EUR | InvoiceCurrencyCode | EUR | ||

| 0..1 | Company code currency | Company curr (CD) | SEK | TaxCurrencyCode | SEK | ||

| 1..1 | Line count | Invoice items (TD) | 1 | LineItemCountNumeric | 1 | ||

| 0..1 | Additional document reference ACD | Invoice payer (MD) | Depends on conversion | Payer reference [OR] Payer number [OR] blank | AdditionalDocumentReference.ID | Payer reference | |

| 0..1 | Additional document reference ACD | Invoice payer (MD) | Depends on conversion | Payer reference [OR] Payer number [OR] blank | AdditionalDocumentReference.ID | identificationSchemeID | ACD |

| 0..1 | Additional document reference CT | Invoice payer (MD) | Depends on conversion | Payer number [OR] blank | AdditionalDocumentReference.ID | Payer number [OR] payer reference | |

| 0..1 | Additional document reference CT | Invoice payer (MD) | Depends on conversion | Payer number [OR] blank | AdditionalDocumentReference.ID | identificationSchemeID | CT |

| 1..1 | Recipient EDI id | Invoice payer (MD) | 5567115695 | BuyerParty.Party.PartyIdentification.ID | 5567115695 | ||

| 0..1 | Recipient EDI id scheme agency | Invoice payer (MD) | 9 when GLN | BuyerParty.Party.PartyIdentification.ID | identificationSchemeAgencyID | ||

| 0..1 | Recipient Name 1 | Invoice bill-to (MD) | Customer name 1 | BuyerParty.Party.PartyName.Name | Customer name 1 | ||

| 0..1 | Recipient Name 2 | Invoice bill-to (MD) | Customer name 2 | BuyerParty.Party.PartyName.Name | Customer name 2 | ||

| 0..1 | Recipient Name 3 | Invoice bill-to (MD) | Customer name 3 | BuyerParty.Party.PartyName.Name | Customer name 3 | ||

| 0..1 | Recipient Name 4 | Invoice bill-to (MD) | Customer name 4 | BuyerParty.Party.PartyName.Name | Customer name 4 | ||

| 0..1 | Recipient Name co | Invoice bill-to (MD) | Customer name co | BuyerParty.Party.PartyName.Name | Customer name co | ||

| 0..1 | Recipient Street 2 | Invoice bill-to (MD) | Customer street 2 | BuyerParty.Party.PartyName.Name | Customer street 2 | ||

| 0..1 | Recipient Street 3 | Invoice bill-to (MD) | Customer street 3 | BuyerParty.Party.PartyName.Name | Customer street 3 | ||

| 0..1 | Recipient Street 4 | Invoice bill-to (MD) | Customer street 4 | BuyerParty.Party.PartyName.Name | Customer street 4 | ||

| 0..1 | Recipient Street 5 | Invoice bill-to (MD) | Customer street 5 | BuyerParty.Party.PartyName.Name | Customer street 5 | ||

| 0..1 | Recipient Post Box | Invoice bill-to (MD) | 123 | BuyerParty.Party.PartyName.Address.Postbox | Box 123 | ||

| 0..1 | Recipient Street | Invoice bill-to (MD) | Customer street 1 | BuyerParty.Party.PartyName.Address.StreetName | Customer street 1 | ||

| 0..1 | Recipient City | Invoice bill-to (MD) | Stockholm | BuyerParty.Party.PartyName.Address.CityName | |||

| 0..1 | Recipient City Box | Invoice bill-to (MD) | Stockholm | BuyerParty.Party.PartyName.Address.CityName | Stockholm | ||

| 0..1 | Recipient Post Code | Invoice bill-to (MD) | 11218 | BuyerParty.Party.PartyName.Address.PostalZone | |||

| 0..1 | Recipient Post Code Box | Invoice bill-to (MD) | 10500 | BuyerParty.Party.PartyName.Address.PostalZone | 10500 | ||

| 1..1 | Recipient Country Code | Invoice bill-to (MD) | SE | BuyerParty.Party.PartyName.Address.Country.IdentificationCode | SE | ||

| 1..1 | Recipient payer registration name | Invoice payer (MD) | Customer name 1 | BuyerParty.Party.PartyTaxScheme.RegistrationName | Customer name 1 | ||

| 1..1 | Recipient ORGNR | Invoice payer (MD) | 5567115695 | BuyerParty.Party.PartyTaxScheme.CompanyID | 5567115695 | ||

| 1..1 | Recipient ORGNR TaxSchemeID | Invoice payer (MD) | SWT | BuyerParty.Party.PartyTaxScheme.TaxScheme.ID | SWT | ||

| 0..1 | Recipient VATNR | Invoice payer (MD) | SE556711569501 | BuyerParty.Party.PartyTaxScheme.CompanyID | SE556711569501 | ||

| 0..1 | Recipient VATNR TaxSchemeID | Invoice payer (MD) | VAT | BuyerParty.Party.PartyTaxScheme.TaxScheme.ID | VAT | ||

| 1..1 | Sender EDI id | New Print Solution (CD) | Depends on conversion | 7321540000019 | SellerParty.Party.PartyIdentification.ID | 7321540000019 | |

| 1..1 | Sender EDI id scheme agency | New Print Solution (CD) | Depends on conversion | 9 | SellerParty.Party.PartyIdentification.ID | identificationSchemeAgencyID | 9 |

| 0..1 | Sender Name 1 | Invoice company (CD) | PostNord Sverige AB | SellerParty.Party.PartyName.Name | PostNord Sverige AB | ||

| 0..1 | Sender Name 2 | Invoice company (CD) | SellerParty.Party.PartyName.Name | ||||

| 0..1 | Sender Name 3 | Invoice company (CD) | SellerParty.Party.PartyName.Name | ||||

| 0..1 | Sender Name 4 | Invoice company (CD) | SellerParty.Party.PartyName.Name | ||||

| 0..1 | Sender Name co | Invoice company (CD) | SellerParty.Party.PartyName.Name | ||||

| 0..1 | Sender Post Box | Invoice company (CD) | SellerParty.Party.PartyName.Address.Postbox | ||||

| 0..1 | Sender Street | Invoice company (CD) | Kundservice Faktura | SellerParty.Party.PartyName.Address.StreetName | Kundservice Faktura | ||

| 0..1 | Sender City | Invoice company (CD) | Malmö | SellerParty.Party.PartyName.Address.CityName | Malmö | ||

| 0..1 | Sender City Box | Invoice company (CD) | SellerParty.Party.PartyName.Address.CityName | ||||

| 0..1 | Sender Post Code | Invoice company (CD) | 20005 | SellerParty.Party.PartyName.Address.PostalZone | 20005 | ||

| 0..1 | Sender Post Code Box | Invoice company (CD) | SellerParty.Party.PartyName.Address.PostalZone | ||||

| 1..1 | Sender Country | Invoice company (CD) | SE | SellerParty.Party.PartyName.Address.Country.IdentificationCode | SE | ||

| 1..1 | Company name | New Print Solution (CD) | PostNord Sverige AB | SellerParty.Party.PartyTaxScheme.RegistrationName | PostNord Sverige AB | ||

| 1..1 | Sender ORGNR | Invoice company (CD) | 5567115695 | SellerParty.Party.PartyTaxScheme.CompanyID | 5567115695 | ||

| 1..1 | Sender ExemptionReason | New Print Solution (CD) | F-tax certificate is available | SellerParty.Party.PartyTaxScheme.ExemptionReason | F-tax certificate is available | ||

| 1..1 | Reg office | New Print Solution (CD) | Solna | SellerParty.Party.PartyTaxScheme.RegistrationAddress.CityName | Solna | ||

| 1..1 | Sender Country | Invoice company (CD) | SE | SellerParty.Party.PartyTaxScheme.RegistrationAddress.Country.IdentificationCode | SE | ||

| 1..1 | Sender ORGNR TaxSchemeID | New Print Solution (CD) | SWT | SellerParty.Party.PartyTaxScheme.TaxScheme.ID | SWT | ||

| 1..1 | Sender VATNR | Invoice company (CD) | SE556711569501 | SellerParty.Party.PartyTaxScheme.CompanyID | SE556711569501 | ||

| 1..1 | Sender VATNR TaxSchemeID | New Print Solution (CD) | VAT | SellerParty.Party.PartyTaxScheme.TaxScheme.ID | VAT | ||

| 1..1 | Our reference (name of contact) | New Print Solution (CD) | PostNord Customer Service | SellerParty.Party.PartyName.Contact.Name | PostNord Customer Service | ||

| 1..1 | Sender Phone | New Print Solution (CD) | 0771333310 | SellerParty.Party.PartyName.Contact.Telephone | 0771333310 | ||

| 1..1 | Sender Email | New Print Solution (CD) | faktura.se@postnord.com | SellerParty.Party.PartyName.Contact.ElectronicMail | faktura.se@postnord.com | ||

| 0..1 | Payment means type code | New Print Solution + SAP-FI (CD) | 1 | PaymentMeans.PaymentMeansTypeCode | 1 | ||

| 1..1 | Due Date | Payer payment terms (MD->TD) | 2017-10-28 | PaymentMeans.DuePaymentDate | 2017-10-28 | ||

| 0..1 | Account | New Print Solution + SAP-FI (CD) | If SEK and SE customer, for example 52494309 |

PaymentMeans.PayeeFinancialAccount.ID | |||

| 0..1 | IBAN | New Print Solution + SAP-FI (CD) | IF not SEK or not SE customer | DE64514206000011928009 | PaymentMeans.PayeeFinancialAccount.ID | DE64514206000011928009 | |

| 0..1 | Payment payee identification scheme | New Print Solution + SAP-FI (CD) | IBAN | PaymentMeans.PayeeFinancialAccount.ID | identificationSchemeName | IBAN | |

| 0..1 | Account Swift | New Print Solution + SAP-FI (CD) | If SEK and SE customer for example BGABSESS |

PaymentMeans.PayeeFinancialAccount.FinancialInstitutionBranch.FinancialInstitution.ID | |||

| 0..1 | IBAN Swift | New Print Solution + SAP-FI (CD) | IF not SEK or not SE customer | HANDDEFFXXX | PaymentMeans.PayeeFinancialAccount.FinancialInstitutionBranch.FinancialInstitution.ID | HANDDEFFXXX | |

| 1..1 | Payment Reference | Invoice (TD) | 900000180225 | PaymentMeans.PayeeFinancialAccount.PaymentInstructionID | 900000180225 | ||

| 0..1 | Direct debit payment instruction | Invoice payer (MD) | Only if direct debit is used | PaymentTerms.Note | |||

| 1..1 | TABLE_ALLOWANCE_CHARGE | New Print Solution (CD) | Table of allowance charges aggregated on header level |

||||

| 1..n | Table Allowance Charge Line | New Print Solution (CD) | Line of allowance charge | ||||

| 1..1 | Surcharge Indicator | New Print Solution (CD) | true | AllowanceCharge.ChargeIndicator | true | ||

| 1..1 | Surcharge Code | New Print Solution (CD) | ZZZ | AllowanceCharge.ReasonCode | ZZZ | ||

| 1..1 | Surcharge Description | New Print Solution (CD) | Credit surcharge (VAT rate applied 25%) | AllowanceCharge.ReasonCode | name | Credit surcharge (VAT rate applied 25%) | |

| 1..1 | Surcharge Amount | Invoice (TD) | 20.00 | AllowanceCharge.Amount | 20.00 | ||

| 1..1 | Document currency code | Sold-to curr (MD->TD) | EUR | AllowanceCharge.Amount | amountCurrencyID | EUR | |

| 1..1 | VAT Id | New Print Solution (CD) | E if vat rate = 0 | S [OR] E | AllowanceCharge.TaxCategory.ID | S [OR] E | |

| 1..1 | VAT Rate | Invoice (TD) + payer (MD) | 25 [OR] 0 [OR] 6 [OR] 12 | AllowanceCharge.TaxCategory.Percent | 25 [OR] 0 [OR] 6 [OR] 12 | ||

| 1..1 | VAT Scheme Id | New Print Solution (CD) | VAT | AllowanceCharge.TaxCategory.TaxScheme.ID | VAT | ||

| 0..1 | Document currency code | Sold-to curr (MD->TD) | EUR | ExchangeRate.SourceCurrencyCode | EUR | ||

| 0..1 | Company code currency | Company curr (CD) | SEK | ExchangeRate.TargetCurrencyCode | SEK | ||

| 0..1 | VAT exchange rate | Invoice (TD) | IF Doc curr <> VAT curr (TD) | 10.00000 | ExchangeRate.CalculationRate | 10.00000 | |

| 0..1 | Exchange rate date | Invoice (TD) | 2017-09-28 | ExchangeRate.Date | 2017-09-28 | ||

| 1..1 | VAT amount in document currency | Invoice items (TD) | 250.00 | TaxTotal.TotalTaxAmount | 250.00 | ||

| 1..1 | Document currency code | Sold-to curr (MD->TD) | EUR | TaxTotal.TotalTaxAmount | amountCurrencyID | EUR | |

| 1..1 | TABLE_VAT | New Print Solution (CD) | Table of aggregated VAT aggregated on header level |

||||

| 1..n | Table VAT Line | New Print Solution (CD) | Line of aggregated VAT | ||||

| 1..1 | VAT Base Amount | Invoice (TD) | 1000.00 | TaxTotal.TaxSubTotal.TaxableAmount | 1000.00 | ||

| 1..1 | Document currency code | Sold-to curr (MD->TD) | EUR | TaxTotal.TaxSubTotal.TaxableAmount | amountCurrencyID | EUR | |

| 1..1 | VAT Amount | Invoice (TD) | 250.00 | TaxTotal.TaxSubTotal.TaxAmount | 250.00 | ||

| 1..1 | Document currency code | Sold-to curr (MD->TD) | EUR | TaxTotal.TaxSubTotal.TaxAmount | amountCurrencyID | EUR | |

| 1..1 | VAT Id | New Print Solution (CD) | E if vat rate = 0 | S [OR] E | TaxTotal.TaxSubTotal.TaxCategory.ID | S [OR] E | |

| 1..1 | VAT Rate | Invoice (TD) + payer (MD) | 25 [OR] 0 [OR] 6 [OR] 12 | TaxTotal.TaxSubTotal.TaxCategory.Percent | 25 [OR] 0 [OR] 6 [OR] 12 | ||

| 0..1 | VAT Exemption Reason | New Print Solution (CD) | Only when VAT rate = 0 | No VAT applied [OR] Reverse Charge - Art. 196 VAT Directive |

TaxTotal.TaxSubTotal.TaxCategory.ExemptionReason | No VAT applied [OR] Reverse Charge - Art. 196 VAT Directive |

|

| 1..1 | VAT Scheme Id | New Print Solution (CD) | VAT | TaxTotal.TaxSubTotal.TaxCategory.TaxScheme.ID | VAT | ||

| 0..1 | VAT Amount Local | Invoice (TD) | IF Doc curr <> VAT curr (TD) | 2500.00 | TaxTotal.TaxSubTotal.TaxCurrencyTaxAmount | 2500.00 | |

| 0..1 | Company code currency | Company curr (CD) | SEK | TaxTotal.TaxSubTotal.TaxCurrencyTaxAmount | amountCurrencyID | SEK | |

| 1..1 | Total amount of line items | Invoice items (TD) | 980.00 | LegalTotal.LineExtensionTotalAmount | 980.00 | ||

| 1..1 | Document currency code | Sold-to curr (MD->TD) | EUR | LegalTotal.LineExtensionTotalAmount | amountCurrencyID | EUR | |

| 1..1 | Total amount excluding VAT | Invoice items (TD) | 1000.00 | LegalTotal.TaxExclusiveTotalAmount | 1000.00 | ||

| 1..1 | Document currency code | Sold-to curr (MD->TD) | EUR | LegalTotal.TaxExclusiveTotalAmount | amountCurrencyID | EUR | |

| 1..1 | Total amount including VAT | Invoice items (TD) | 1250.00 | LegalTotal.TaxInclusiveTotalAmount | 1250.00 | ||

| 1..1 | Document currency code | Sold-to curr (MD->TD) | EUR | LegalTotal.TaxInclusiveTotalAmount | amountCurrencyID | EUR | |

| 1..1 | TABLE_DETAIL | New Print Solution (CD) | Table of invoice items | ||||

| 1..n | Table Detail Line | New Print Solution (CD) | Line of invoice item | ||||

| 1..1 | Invoice item counter (1..n) | Invoice (TD) | 1 | InvoiceLine.ID | 1 | ||

| 1..1 | Price Parameter Quantity | Invoice (TD) | 1 | InvoiceLine.InvoicedQuantity | 1 | ||

| 0..1 | Price Parameter Quantity UOM | New Print Solution (CD) | PCE | InvoiceLine.InvoicedQuantity | quantityUnitCode | PCE | |

| 1..1 | Amount after discount excl surcharges | Invoice (TD) | 980.00 | InvoiceLine.LineExtensionAmount | 980.00 | ||

| 1..1 | Document currency code | Sold-to curr (MD->TD) | EUR | InvoiceLine.LineExtensionAmount | amountCurrencyID | EUR | |

| 0..1 | Reference Customer | Invoice (TD) | Customer order ref | InvoiceLine.DespatchLineReference.DocumentReference.ID | Customer order reference | ||

| 1..1 | Price Parameter Date Delivery | Invoice (TD) | 2017-09-12 | InvoiceLine.Delivery.ActualDeliveryDateTime | 2017-09-12T00:00:00 | ||

| 1..1 | Price Parameter Material description | Invoice (TD) | MyPack | InvoiceLine.Item.Description | MyPack | ||

| 1..1 | Price Parameter Material number | Invoice (TD) | 2001290 | InvoiceLine.Item.SellersItemIdentification.ID | 2001290 | ||

| 1..1 | VAT Id | New Print Solution (CD) | E if vat rate = 0 | S [OR] E | InvoiceLine.Item.TaxCategory.ID | S [OR] E | |

| 1..1 | VAT Rate | Invoice (TD) + payer (MD) | 25 [OR] 0 [OR] 6 [OR] 12 | InvoiceLine.Item.TaxCategory.Percent | 25 [OR] 0 [OR] 6 [OR] 12 | ||

| 1..1 | VAT Scheme Id | New Print Solution (CD) | VAT | InvoiceLine.Item.TaxCategory.TaxScheme.ID | VAT | ||

| 1..1 | Amount per piece | Invoice (TD) | 980.00 | InvoiceLine.Item.BasePrice.PriceAmount | 980.00 | ||

| 1..1 | Document currency code | Sold-to curr (MD->TD) | EUR | InvoiceLine.Item.BasePrice.PriceAmount | amountCurrencyID | EUR | |

| 0..1 | Amount per piece base quantity | Invoice (TD) | If amount per piece decimals are not sufficient | InvoiceLine.Item.BasePrice.BaseQuantity | |||

| 0..1 | Price Parameter Quantity UOM | New Print Solution (CD) | PCE | InvoiceLine.Item.BasePrice.BaseQuantity | quantityUnitCode | PCE | |

| 1..1 | Note | Depends on parameter | JSON is used to define parameter and value pairs. The Note element is specified last in both the input and output file, but actually occurrs after the LineExtensionAmount element. |

"Parameter1_Name":"Parameter1_Value" , "Parameter2_Name":"Parameter2_Value" etc. |

InvoiceLine.Note | "Parameter1_Name":"Parameter1_Value" , "Parameter2_Name":"Parameter2_Value" etc. |

|

| 0..1 | Reference SAP Specification Number | Invoice (TD) | Part of InvoiceLine.Note | "Reference_Spec_Number":"8000005834" | "Reference_Spec_Number":"8000005834" | ||

| 0..1 | Reference Customer Number | Invoice sold-to (MD) | Part of InvoiceLine.Note | "Reference_Customer_Number":"20735710" | "Reference_Customer_Number":"20735710" | ||

| 0..1 | Reference Customer Name | Invoice sold-to (MD) | Part of InvoiceLine.Note | "Reference_Customer_Name":"Customer name" | "Reference_Customer_Name":"Customer name" | ||

| 0..1 | Reference Customer Invoice Reference | Invoice sold-to (MD) | Part of InvoiceLine.Note | "Reference_Customer_Invoice_Reference":"Ref" | "Reference_Customer_Invoice_Reference":"Ref" | ||

| 0..1 | Reference SAP Billing Plan Number | Invoice (TD) | Part of InvoiceLine.Note | "Reference_Billing_Plan":"7500012345" | "Reference_Billing_Plan":"7500012345" | ||

| 0..1 | Reference SAP Order Number | Invoice (TD) | Part of InvoiceLine.Note | "Reference_Order_Number":"1234567890" | "Reference_Order_Number":"1234567890" | ||

| 0..1 | Reference SAP Contract Number | Invoice (TD) | Part of InvoiceLine.Note | "Reference_Contract_Number":"7500123456" | "Reference_Contract_Number":"7500123456" | ||

| 0..1 | Reference SAP Credited Invoice | Invoice (TD) | Part of InvoiceLine.Note | "Reference_Credited_Invoice":"9000003665" | "Reference_Credited_Invoice":"9000003665" | ||

| 0..1 | Reference Customer | Invoice (TD) | Part of InvoiceLine.Note | "Reference_Customer":"Customer order ref" | "Reference_Customer":"Customer order ref" | ||

| 0..1 | Information Cash on Delivery Value | Invoice (TD) | Part of InvoiceLine.Note | "Value_Cash_On_Delivery":"100 SEK" | "Value_Cash_On_Delivery":"100 SEK" | ||

| 0..1 | Information Import VAT value | Invoice (TD) | Part of InvoiceLine.Note | "Value_Import_Vat":"100 SEK" | "Value_Import_Vat":"100 SEK" | ||

| 0..1 | Information Customs Id | Invoice (TD) | Part of InvoiceLine.Note | "Customs_Id":"NOD8925767" | "Customs_Id":"NOD8925767" | ||

| 0..1 | Information Parcel ID | Invoice (TD) | Part of InvoiceLine.Note | "Parcel_Id":"SE123456789012349" | "Parcel_Id":"SE123456789012349" | ||

| 0..1 | Information Shipment Id | Invoice (TD) | Part of InvoiceLine.Note | "Shipment_Id":"70726203781069158" | "Shipment_Id":"70726203781069158" | ||

| 0..1 | Partner Consignor id (ZC) | Invoice (TD) | Part of InvoiceLine.Note | "Consignor_Id":"20001234" | "Consignor_Id":"20001234" | ||

| 0..1 | Partner Consignor name (ZC) | Invoice (TD) | Part of InvoiceLine.Note | "Consignor_Name":"Sender name" | "Consignor_Name":"Sender name" | ||

| 0..1 | Partner Drop point id (ZI) | Invoice (TD) | Part of InvoiceLine.Note | "Drop_Point_Id":"P123456" | "Drop_Point_Id":"P123456" | ||

| 0..1 | Partner Drop point name (ZI) | Invoice (TD) | Part of InvoiceLine.Note | "Drop_Point_Name":"Årsta brevterminal" | "Drop_Point_Name":"Årsta brevterminal" | ||

| 0..1 | Period Start FPA/BOX - Note | Invoice (TD) | Part of InvoiceLine.Note | "Period_Start":"2016-09-13" | "Period_Start":"2016-09-13" | ||

| 0..1 | Period End FPA/BOX - Note | Invoice (TD) | Part of InvoiceLine.Note | "Period_End":"2017-09-12" | "Period_End":"2017-09-12" | ||

| 0..1 | Price 1 currencies | Invoice (TD) | Part of InvoiceLine.Note | "Price_1_Currency_From_To":"SEK-EUR" | "Price_1_Currency_From_To":"SEK-EUR" | ||

| 0..1 | Price 1 exchange rate | Invoice (TD) | Part of InvoiceLine.Note | "Price_1_Exchange_Rate":"0.10000" | "Price_1_Exchange_Rate":"0.10000" | ||

| 0..1 | Price 2 currencies | Invoice (TD) | Part of InvoiceLine.Note | "Price_2_Currency_From_To":"SEK-USD" | "Price_2_Currency_From_To":"SEK-USD" | ||

| 0..1 | Price 2 exchange rate | Invoice (TD) | Part of InvoiceLine.Note | "Price_2_Exchange_Rate":"0.12000" | "Price_2_Exchange_Rate":"0.12000" | ||

| 0..1 | VAT currencies | Invoice (TD) | Part of InvoiceLine.Note | "VAT_Currency_From_To":"SEK-EUR" | "VAT_Currency_From_To":"SEK-EUR" | ||

| 0..1 | VAT exchange rate | Invoice (TD) | Part of InvoiceLine.Note | "VAT_Exchange_Rate":"0.10000" | "VAT_Exchange_Rate":"0.10000" | ||

| 0..1 | Price Parameter Collective | Invoice (TD) | Part of InvoiceLine.Note | "Collective_Price":"true" | "Collective_Price":"true" | ||

| 0..1 | Price Parameter Distance | Invoice (TD) | Part of InvoiceLine.Note | "Distance":"123" | "Distance":"123" | ||

| 0..1 | Price Parameter Freight weight | Invoice (TD) | Part of InvoiceLine.Note | "Freight_Weight":"10.00" | "Freight_Weight":"10.00" | ||

| 0..1 | Price Parameter Freight weight customer | Invoice (TD) | Part of InvoiceLine.Note | "Freight_Weight_Customer":"5.00" | "Freight_Weight_Customer":"5.00" | ||

| 0..1 | Price Parameter Gross weight | Invoice (TD) | Part of InvoiceLine.Note | "Weight":"10.00" | "Weight":"10.00" | ||

| 0..1 | Price Parameter Length | Invoice (TD) | Part of InvoiceLine.Note | "Length":"0.1" | "Length":"0.1" | ||

| 0..1 | Price Parameter Width | Invoice (TD) | Part of InvoiceLine.Note | "Width":"0.1" | "Width":"0.1" | ||

| 0..1 | Price Parameter Height | Invoice (TD) | Part of InvoiceLine.Note | "Height":"0.1" | "Height":"0.1" | ||

| 0..1 | Price Parameter Item Type | Invoice (TD) | Part of InvoiceLine.Note | "Item_Type_Code":"PC" | "Item_Type_Code":"PC" | ||

| 0..1 | Price Parameter Item Type Description | Invoice (TD) | Part of InvoiceLine.Note | "Item_Type_Description":"Parcel" | "Item_Type_Description":"Parcel" | ||

| 0..1 | Price Parameter Item weight | Invoice (TD) | Part of InvoiceLine.Note | "Item_Weight":"100" | "Item_Weight":"100" | ||

| 0..1 | Price Parameter Item weight unit | New Print Solution (CD) | Part of InvoiceLine.Note | "Item_Weight_Uom":"g" | "Item_Weight_Uom":"g" | ||

| 0..1 | Price Parameter Volume | Invoice (TD) | Part of InvoiceLine.Note | "Volume":"0.001" | "Volume":"0.001" | ||

| 0..1 | Price Parameter Sending country | Invoice (TD) | Part of InvoiceLine.Note | "Sending_Country":"SE" | "Sending_Country":"SE" | ||

| 0..1 | Price Parameter Sending post code | Invoice (TD) | Part of InvoiceLine.Note | "Sending_Postcode":"10500" | "Sending_Postcode":"10500" | ||

| 0..1 | Price Parameter Receiving country | Invoice (TD) | Part of InvoiceLine.Note | "Receiving_Country":"SE" | "Receiving_Country":"SE" | ||

| 0..1 | Price Parameter Receiving post code | Invoice (TD) | Part of InvoiceLine.Note | "Receiving_Postcode":"11218" | "Receiving_Postcode":"11218" | ||

| 0..1 | Price Parameter Receiving city | Invoice (TD) | Part of InvoiceLine.Note | "Receiving_City":"Stockholm" | "Receiving_City":"Stockholm" | ||

| 0..1 | Surcharge Advertising tax amount | Invoice (TD) | Part of InvoiceLine.Note | "Advertising_Tax":"9.80" | "Advertising_Tax":"9.80" | ||

| 0..1 | Surcharge Advertising tax rate | Invoice (TD) | Part of InvoiceLine.Note | "Advertising_Tax_Rate":"1.00" | "Advertising_Tax_Rate":"1.00" | ||

| 0..1 | Surcharge Fuel | Invoice (TD) | Part of InvoiceLine.Note | "Fuel_Surcharge":"10.00" | "Fuel_Surcharge":"10.00" | ||

| 0..1 | Surcharge Sulfur | Invoice (TD) | Part of InvoiceLine.Note | "Sulfur_Surcharge":"10.00" | "Sulfur_Surcharge":"10.00" | ||

| 0..1 | Surcharge Minimum amount fee | Invoice (TD) | Part of InvoiceLine.Note | "Minimum_Amount_Fee":"60.00" | "Minimum_Amount_Fee":"60.00" | ||

| 0..1 | Surcharge Multi item | Invoice (TD) | Part of InvoiceLine.Note | "Multi_Item_Surcharge":"9.80" | "Multi_Item_Surcharge":"9.80" | ||

| 0..1 | Price per piece | Invoice (TD) | Part of InvoiceLine.Note | "Price_Per_Piece":"980.00" | "Price_Per_Piece":"980.00" | ||

| 0..1 | Price per weight | Invoice (TD) | Part of InvoiceLine.Note | "Price_Per_Weight":"10.00" | "Price_Per_Weight":"10.00" | ||

| 0..1 | Price low apply | Invoice (TD) | Part of InvoiceLine.Note | "Price_Low_Apply":"980.00" | "Price_Low_Apply":"980.00" | ||

| 0..1 | Discount rate | Invoice (TD) | Part of InvoiceLine.Note | "Discount_Rate":"10.00" | "Discount_Rate":"10.00" | ||

| 0..1 | Text 1 Item | Invoice (TD) | Part of InvoiceLine.Note | "Item_Text_1":"item text 1" | "Item_Text_1":"item text 1" | ||

| 0..1 | Text 2 Item | Invoice (TD) | Part of InvoiceLine.Note | "Item_Text_2":"item text 2" | "Item_Text_2":"item text 2" | ||

| 0..1 | Text 3 Item | Invoice (TD) | Part of InvoiceLine.Note | "Item_Text_3":"item text 3" | "Item_Text_3":"item text 3" | ||

| 0..1 | Text 4 Item | Invoice (TD) | Part of InvoiceLine.Note | "Item_Text_4":"item text 4" | "Item_Text_4":"item text 4" | ||

| 0..1 | Text 1 Order | Invoice (TD) | Part of InvoiceLine.Note | "Text_1":"header text 1" | "Text_1":"header text 1" | ||

| 0..1 | Text 2 Order | Invoice (TD) | Part of InvoiceLine.Note | "Text_2":"new customer 20001235" | "Text_2":"new customer 20001235" | ||

| 0..1 | Requisitionist document reference | Invoice payer (MD) [OR] Invoice bill-to (MD) |

Depends on conversion | Payer reference [OR] bill-to street | RequisitionistDocumentReference | Payer reference [OR] bill-to street | |

| 0..1 | TABLE_REFERENCE_DOCUMENT_CREDIT | New Print Solution (CD) | Table of credited invoices aggregated on header level |

||||

| 1..n | Table Reference Document Credit Line | New Print Solution (CD) | Line of credited invoice | ||||

| 1..1 | Credited invoice(s) | Invoice (TD) | Only for credit invoices | 9000003665 | InitialInvoiceDocumentReference.ID | 9000003665 | |

| 1..1 | DOCUMENTS | New Print Solution (CD) | |||||

| 1..1 | Documents Global Unique ID | Generated (TD) | 005056AC3F361ED8AEE8753A58F69DC4 | ||||

| 1..1 | DOCUMENT | New Print Solution (CD) | |||||

| 1..1 | Document Global Unique ID | Generated (TD) | 005056AC3F361ED8AEE8753A58F6BDC4 | ||||

| 1..1 | CONTROL RECORD | New Print Solution (CD) | |||||

| 1..1 | Document type | New Print Solution (CD) | OTI_INV_DEBIT [OR] OTI_INV_CREDIT | ||||

| 1..1 | Assignment | New Print Solution (CD) | Postnord internal use | PNOT01 [OR] PNOT02 etc. | |||

| 1..1 | Test | New Print Solution (CD) | Test flag | true [OR] false | |||

| 1..1 | Distribution method name | New Print Solution (CD) | EDI | ||||

| 1..1 | RECIPIENT | New Print Solution (CD) | |||||

| 0..1 | Recipient Mail Back | Invoice bill-to (MD) | test@postnord.com | Email sent to test@postnord.com | |||

| 1..1 | RECIPIENT Generics | New Print Solution (CD) | n/a | ||||

| 1..1 | Recipient EDI Format | Invoice payer (MD) | SVEFAKTURA_1.0 | n/a | |||

| 0..1 | Recipient EDI Peppol id including prefix | Invoice payer (MD) | 0007:5567115695 | n/a | |||

| 1..1 | Recipient EDI Routing id | Invoice payer (MD) | 3000001 | n/a | |||

| 1..1 | SENDER | New Print Solution (CD) | |||||

| 1..1 | SENDER Generics | New Print Solution (CD) | |||||

| 0..1 | Sender EDI Peppol id including prefix | New Print Solution (CD) | 0088:7321540000019 | ||||

| 1..1 | HEADER | New Print Solution (CD) | |||||

| 1..1 | FOOTER | New Print Solution (CD) | |||||

| 1..1 | BODY | New Print Solution (CD) | |||||

no reviews yet

Please Login to review.