456x Filetype XLSX File size 0.03 MB Source: www.payrollpedia.org

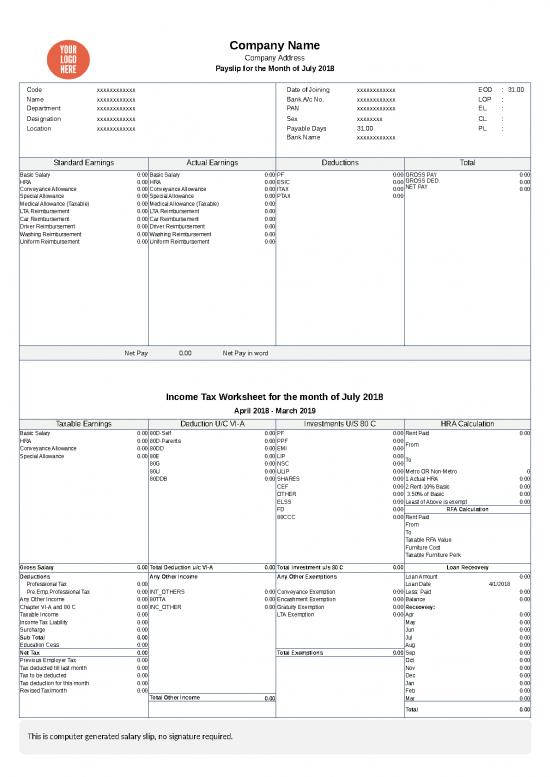

Company Name

Company Address

Payslip for the Month of July 2018

Code xxxxxxxxxxxx Date of Joining xxxxxxxxxxxx EOD : 31.00

Name xxxxxxxxxxxx Bank A/c No. xxxxxxxxxxxx LOP : 0.00

Department xxxxxxxxxxxx PAN xxxxxxxxxxxx EL :

Designation xxxxxxxxxxxx Sex xxxxxxxx CL : 0

Location xxxxxxxxxxxx Payable Days 31.00 PL : 0

Bank Name xxxxxxxxxxxx 0

Standard Earnings Actual Earnings Deductions Total

Basic Salary 0.00 Basic Salary 0.00 PF 0.00 GROSS PAY 0.00

HRA 0.00 HRA 0.00 ESIC 0.00 GROSS DED. 0.00

Conveyance Allowance 0.00 Conveyance Allowance 0.00 ITAX 0.00 NET PAY 0.00

(Taxable) (Taxable)

Special Allowance 0.00 Special Allowance 0.00 PTAX 0.00

Medical Allowance (Taxable) 0.00 Medical Allowance (Taxable) 0.00

LTA Reimbursement 0.00 LTA Reimbursement 0.00

Car Reimbursement 0.00 Car Reimbursement 0.00

Driver Reimbursement 0.00 Driver Reimbursement 0.00

Washing Reimbursement 0.00 Washing Reimbursement 0.00

Uniform Reimbursement 0.00 Uniform Reimbursement 0.00

Net Pay 0.00 Net Pay in word

Income Tax Worksheet for the month of July 2018

April 2018 - March 2019

Taxable Earnings Deduction U/C VI-A Investments U/S 80 C HRA Calculation

Basic Salary 0.00 80D-Self 0.00 PF 0.00 Rent Paid 0.00

HRA 0.00 80D-Parents 0.00 PPF 0.00 From 12/30/1899

Conveyance Allowance 0.00 80DD 0.00 EMI 0.00

(Taxable)

Special Allowance 0.00 80E 0.00 LIP 0.00 To 12/30/1899

80G 0.00 NSC 0.00

80U 0.00 ULIP 0.00 Metro OR Non-Metro 0

80DDB 0.00 SHARES 0.00 1.Actual HRA 0.00

CEF 0.00 2.Rent-10% Basic 0.00

OTHER 0.00 3.50% of Basic 0.00

ELSS 0.00 Least of Above is exempt 0.00

FD 0.00 RFA Calculation

80CCC 0.00 Rent Paid

From

To

Taxable RFA Value

Furniture Cost

Taxable Furniture Perk

Gross Salary 0.00 Total Deduction u/c VI-A 0.00 Total Investment u/s 80 C 0.00 Loan Receovery

Deductions Any Other Income Any Other Exemptions Loan Amount 0.00

Professional Tax 0.00 Loan Date 4/1/2018

Pre.Emp.Professional Tax 0.00 INT_OTHERS 0.00 Conveyance Exemption 0.00 Less: Paid 0.00

Any Other Income 0.00 80TTA 0.00 Encashment Exemption 0.00 Balance 0.00

Chapter VI-A and 80 C 0.00 INC_OTHER 0.00 Gratuity Exemption 0.00 Receovery:

Taxable Income 0.00 LTA Exemption 0.00 Apr 0.00

Income Tax Liability 0.00 May 0.00

Surcharge 0.00 Jun 0.00

Sub Total 0.00 Jul 0.00

Education Cess 0.00 Aug 0.00

Net Tax 0.00 Total Exemptions 0.00 Sep 0.00

Previous Employer Tax 0.00 Oct 0.00

Tax deducted till last month 0.00 Nov 0.00

Tax to be deducted 0.00 Dec 0.00

Tax deduction for this month 0.00 Jan 0.00

Revised Tax/month 0.00 Feb 0.00

Total Other Income 0.00 Mar 0.00

Total 0.00

This is computer generated salary slip, no signature required.

no reviews yet

Please Login to review.