260x Filetype XLSX File size 0.02 MB Source: www.businessguide.ebrd.com

Sheet 1: Inventory by product

| Instructions | |||||

| Note that highlighted numbers are used as an example and should be replaced by your business's financial data. | |||||

| *TBD currency localisation | |||||

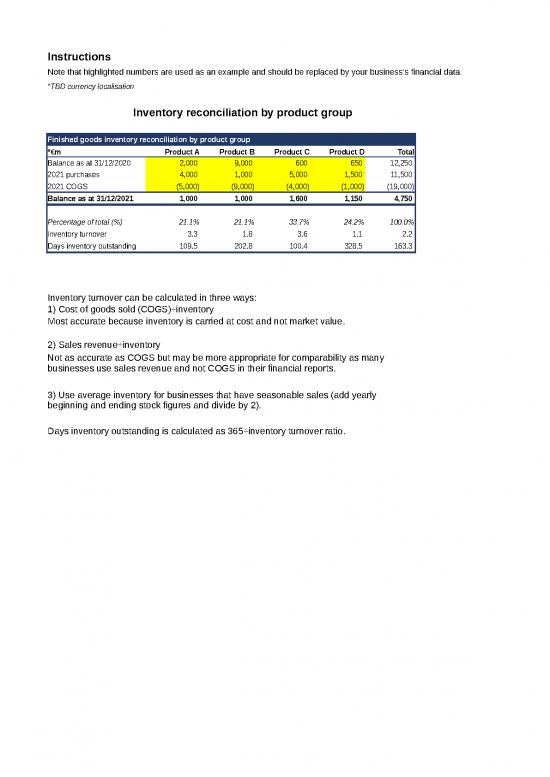

| Inventory reconciliation by product group | |||||

| Finished goods inventory reconciliation by product group | |||||

| *€m | Product A | Product B | Product C | Product D | Total |

| Balance as at 31/12/2020 | 2,000 | 9,000 | 600 | 650 | 12,250 |

| 2021 purchases | 4,000 | 1,000 | 5,000 | 1,500 | 11,500 |

| 2021 COGS | (5,000) | (9,000) | (4,000) | (1,000) | (19,000) |

| Balance as at 31/12/2021 | 1,000 | 1,000 | 1,600 | 1,150 | 4,750 |

| Percentage of total (%) | 21.1% | 21.1% | 33.7% | 24.2% | 100.0% |

| Inventory turnover | 3.3 | 1.8 | 3.6 | 1.1 | 2.2 |

| Days inventory outstanding | 109.5 | 202.8 | 100.4 | 328.5 | 163.3 |

| Inventory turnover can be calculated in three ways: | |||||

| 1) Cost of goods sold (COGS)÷inventory | |||||

| Most accurate because inventory is carried at cost and not market value. | |||||

| 2) Sales revenue÷inventory | |||||

| Not as accurate as COGS but may be more appropriate for comparability as many businesses use sales revenue and not COGS in their financial reports. | |||||

| 3) Use average inventory for businesses that have seasonable sales (add yearly beginning and ending stock figures and divide by 2). | |||||

| Days inventory outstanding is calculated as 365÷inventory turnover ratio. | |||||

| Instructions | ||||||

| Note that highlighted numbers are used as an example and should be replaced by your business's financial data. | ||||||

| *TBD currency localisation | ||||||

| Inventory analysis | ||||||

| Inventory analysis | ||||||

| *€'000 | 2017 | 2018 | 2019 | 2020 | 2021 | 6 months ended 30 Jun 2021 |

| Actual inventory | 3,200 | 4,800 | 3,400 | 3,672 | 3,601 | 3,602 |

| Average inventory | 4,000 | 4,100 | 3,536 | 3,637 | 3,602 | |

| Cost of goods sold | 14,607 | 14,085 | 14,100 | 15,034 | 18,621 | 10,016 |

| Inventory days outstanding | 104 | 106 | 86 | 71 | 66 | |

| Remember that if you do not have a full year period (i.e., 365 days) you need to alter the number of days in the sales calculation. | ||||||

| 2017 | 2018 | 2019 | 2020 | 2021 | 6 months ended 30 Jun 2021 | |

| Average inventory | 4000 | 4100 | 3536 | 3636.5 | 3601.5 | |

| Inventory days outstanding | 103.7 | 106.1 | 85.8 | 71.3 | 65.6 | |

| *Inventory days could be graphed against average inventory or COGS | ||||||

| Inventory turnover can be calculated in three ways: | ||||||

| 1) Cost of goods sold (COGS)÷inventory | ||||||

| Most accurate because inventory is carried at cost and not market value. | ||||||

| 2) Sales revenue inventory | ||||||

| Not as accurate as COGS but may be more appropriate for comparability as many financial reporting business use sales revenue and not COGS. | ||||||

| 3) Use average inventory for businesses that have seasonable sales (add yearly beginning and ending stock figures and divide by 2). | ||||||

| Days inventory outstanding is calculated as 365÷inventory turnover ratio. | ||||||

no reviews yet

Please Login to review.