192x Filetype XLS File size 0.13 MB Source: tax.iowa.gov

Sheet 1: 70-022a

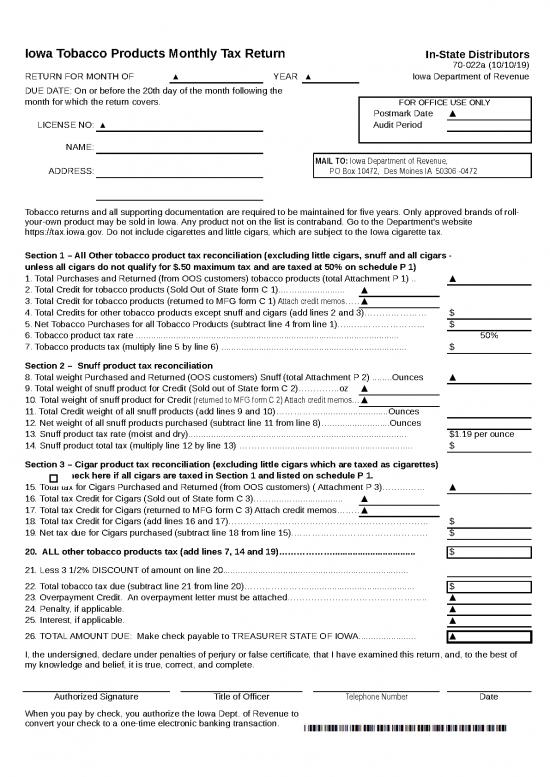

| Iowa Tobacco Products Monthly Tax Return | In-State Distributors | |||||||||

| 70-022a (10/10/19) | ||||||||||

| RETURN FOR MONTH OF | ▲ | YEAR | ▲ | Iowa Department of Revenue | ||||||

| DUE DATE: On or before the 20th day of the month following the | ||||||||||

| month for which the return covers. | FOR OFFICE USE ONLY | |||||||||

| Postmark Date | ▲ | |||||||||

| LICENSE NO: | ▲ | Audit Period | ||||||||

| NAME: | ||||||||||

| MAIL TO: Iowa Department of Revenue, PO Box 10472, Des Moines IA 50306 -0472 |

||||||||||

| ADDRESS: | ||||||||||

| Tobacco returns and all supporting documentation are required to be maintained for five years. Only approved brands of roll-your-own product may be sold in Iowa. Any product not on the list is contraband. Go to the Department's website https://tax.iowa.gov. Do not include cigarettes and little cigars, which are subject to the Iowa cigarette tax. | ||||||||||

| Section 1 – All Other tobacco product tax reconciliation (excluding little cigars, snuff and all cigars - | ||||||||||

| unless all cigars do not qualify for $.50 maximum tax and are taxed at 50% on schedule P 1) | ||||||||||

| 1. Total Purchases and Returned (from OOS customers) tobacco products (total Attachment P 1) .. | ▲ | |||||||||

| 2. Total Credit for tobacco products (Sold Out of State form C 1)....…................... | ▲ | |||||||||

| 3. Total Credit for tobacco products (returned to MFG form C 1) Attach credit memos……………………. | ▲ | |||||||||

| 4. Total Credits for other tobacco products except snuff and cigars (add lines 2 and 3)………………… | $ | |||||||||

| 5. Net Tobacco Purchases for all Tobacco Products (subtract line 4 from line 1)…...…………………… | $ | |||||||||

| 6. Tobacco product tax rate ......................................................................................................... | 50% | |||||||||

| 7. Tobacco products tax (multiply line 5 by line 6) .......................................................................... | $ | |||||||||

| Section 2 – Snuff product tax reconciliation | ||||||||||

| 8. Total weight Purchased and Returned (OOS customers) Snuff (total Attachment P 2) ........Ounces | ▲ | |||||||||

| 9. Total weight of snuff product for Credit (Sold out of State form C 2)…………..oz | ▲ | |||||||||

| 10. Total weight of snuff product for Credit (returned to MFG form C 2) Attach credit memos..............oz | ▲ | |||||||||

| 11. Total Credit weight of all snuff products (add lines 9 and 10)……………...........................Ounces | ||||||||||

| 12. Net weight of all snuff products purchased (subtract line 11 from line 8)…........................Ounces | ||||||||||

| 13. Snuff product tax rate (moist and dry)....................................................................................... | $1.19 per ounce | |||||||||

| 14. Snuff product total tax (multiply line 12 by line 13) …………....................................................... | $ | |||||||||

| Section 3 – Cigar product tax reconciliation (excluding little cigars which are taxed as cigarettes) | ||||||||||

| Check here if all cigars are taxed in Section 1 and listed on schedule P 1. | ||||||||||

| 15. Total tax for Cigars Purchased and Returned (from OOS customers) ( Attachment P 3)……...…… | ▲ | |||||||||

| 16. Total tax Credit for Cigars (Sold out of State form C 3)…….....….................... | ▲ | |||||||||

| 17. Total tax Credit for Cigars (returned to MFG form C 3) Attach credit memos……......….................... | ▲ | |||||||||

| 18. Total tax Credit for Cigars (add lines 16 and 17)…………………………………………………………. | $ | |||||||||

| 19. Net tax due for Cigars purchased (subtract line 18 from line 15).……………………………………… | $ | |||||||||

| 20. ALL other tobacco products tax (add lines 7, 14 and 19)………………................................. | $ | |||||||||

| 21. Less 3 1/2% DISCOUNT of amount on line 20.......................................................................... | ||||||||||

| 22. Total tobacco tax due (subtract line 21 from line 20)…………………........................................... | $ | |||||||||

| 23. Overpayment Credit. An overpayment letter must be attached……………………………………….. | ▲ | |||||||||

| 24. Penalty, if applicable. | ▲ | |||||||||

| 25. Interest, if applicable. | ▲ | |||||||||

| 26. TOTAL AMOUNT DUE: Make check payable to TREASURER STATE OF IOWA....................... | ▲ | |||||||||

| I, the undersigned, declare under penalties of perjury or false certificate, that I have examined this return, and, to the best of my knowledge and belief, it is true, correct, and complete. | ||||||||||

| Authorized Signature | Title of Officer | Telephone Number | Date | |||||||

| When you pay by check, you authorize the Iowa Dept. of Revenue to convert your check to a one-time electronic banking transaction. | ||||||||||

| Must attach Schedules P 1, P 2, P 3, C 1, C 2, C 3 unless zero for that schedule | ||||||||||

| IOWA Schedule P 1 - Purchases & Returns of Tobacco Products | 70-022b (10/10/19) | ||||||

| (Ret'd from Out Of State) OTP other than Little Cigars, Snuff or Cigars | Iowa Department of Revenue | ||||||

| RETURN FOR MONTH OF | YEAR | NAME | |||||

| Invoice | Invoice | Purchased & Returned (Out Of State customers) From: | Tobacco wholesale sales price | ||||

| Number | Date | Name | City | State | (excluding LC, Snuff, Cigars) | ||

| Wholesale Sales Price TOTALS - Enter This Total on LINE 1 of form 70-022a | |||||||

| Attach to Iowa In State Distributors Tobacco Products Return Form 70-022a | |||||||

| IOWA Schedule P 2 - Purchases & Returns (Out of State customers) of Snuff Products | Iowa Department of Revenue | 70-022c (10/10/19) | |||||||

| RETURN FOR MONTH OF | YEAR | NAME | |||||||

| If you have more than one brand with the same weight and they are on the same invoice, you may combine them for one entry (list all brands). | |||||||||

| Invoice | Invoice | Purchased & Returned (Out of State customers) From: | Brand | Weight Each | Total Weight | ||||

| Number | Date | Name | City | State | Name(s) | Quantity | (in ounces) | (quantity X ounces) | |

| TOTAL Weight of Snuff Products. Enter This Total on LINE 8 of form 70-022a. | |||||||||

| Attach to Iowa In State Distributors Tobacco Products Return Form 70-022a | |||||||||

no reviews yet

Please Login to review.