199x Filetype PDF File size 1.68 MB Source: www.casrilanka.com

Marginal and Absorption Costing

Marginal costing

Marginal costing is a costing method that uses only variable costs to calculate the costs of

production and excludes the fixed production overhead costs in the calculation of cost of

production i.e. it uses only the direct costs (which are also called variable costs, prime costs or

relevant costs) to calculate the cost of production.

The marginal costing method is based on the following fundamental principles:

Cost of production only includes all variable costs i.e. all costs that can be traced

directly to the production units, because without those costs production is not possible

and hence, those costs are very important to the goods produced.

Fixed overhead costs (also known as production overhead costs) are costs that must

be incurred with or without production activities, and are excluded when calculating

the cost of production because the overhead cost do not affect the production decision

on goods to be produced, especially in the short run.

Under marginal costing, the fixed production overhead costs are written off in full as an

overhead period expense, when preparing the profit or loss statement to derive the

profit or loss at the end of the period. See preparation of profit or loss statement later

The key element in marginal costing is the assertive treatment and clear distinction between

variable and fixed production overhead costs.

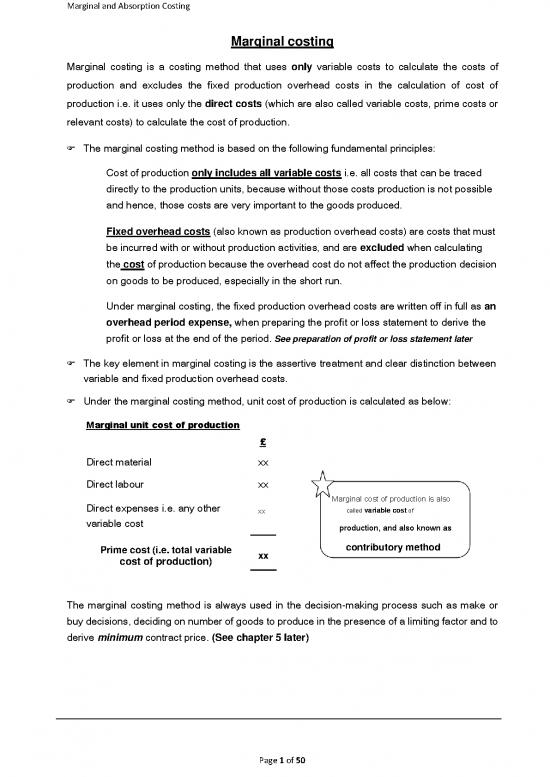

Under the marginal costing method, unit cost of production is calculated as below:

Marginal unit cost of production

£

Direct material xx

Direct labour xx

Direct expenses i.e. any other Marginal cost of production is also

called variable cost of

xx

variable cost

production, and also known as

Prime cost (i.e. total variable xx contributory method

cost of production)

The marginal costing method is always used in the decision-making process such as make or

buy decisions, deciding on number of goods to produce in the presence of a limiting factor and to

derive minimum contract price. (See chapter 5 later)

Page 1 of 50

Marginal and Absorption Costing

3.1 Illustrative Q

Azeez plc wishes to estimate the unit cost of a proposed new product based on the following

information

1. Estimated costs

Direct material 3.5 kg per unit at £4.00 per kg

Direct labour 0.45 hour per unit at £9.00 per hour

Other direct expenses £1.5 per unit

2. Fixed production overhead costs are budgeted at £80,000 for the next period with a

budgeted activity level of 7,500 direct labour hours.

Required:

Calculate the unit cost of the proposed new product using a marginal costing approach.

3.1b ACCA CAT Paper B2 Cost Accounting Systems J03

A company uses marginal costing. In valuing stocks of finished goods which of the following

would NOT be included in the valuation?

A. Machine operator’s wages

B. Factory rent

C. Royalty fees per unit

D. Raw materials

Page 2 of 50

Marginal and Absorption Costing

3.1 Solution

Estimated unit cost of the proposed new product under marginal costing

Unit

cost (£)

Direct material: (3.5 kg per unit at £4.00 per kg) 14.00

Direct labour: (0.45 hour per unit at £9.00 per hour) 4.05

Direct other expenses 1.50

Marginal cost per unit 19.55

Note

The marginal cost is also called prime cost and total variable cost

Also note the exclusion of the production overhead cost in the above calculation, even

though the question gave some information on the fixed production overhead cost, it is

always ignored at this stage of the calculation of the unit cost, until later, when calculating

profit or loss using marginal costing principles. (see later)

3.1b Solution

Machine operator’s wages, royalty fees per unit, raw materials are all direct costs and are included

in the valuation of the stocks of finished goods but the factory rent is an overhead and would NOT

be included in the valuation.

Option B is correct

Page 3 of 50

Marginal and Absorption Costing

Benefits of marginal costing method (advantages)

Helps in product decision making process: Marginal costing is useful in the short-term

decision-making on product, such as product mix decision, discontinued decision etc. All

these areas of decision are always based on analysis of costs that directly affect the

production of goods.

Useful in the calculation of the minimum price: It is very useful in calculating relevant

costs of a product when deriving minimum price charged for a product, as the calculation of

the minimum price is always based on the analysis of all direct costs of production

Usefulness in other areas of study: marginal costing method is useful in other areas of

study such as cost-volume-profit analysis (popularly known as CVP analysis). The analysis

makes use of contribution to calculate the breakeven sales i.e. a level of activity where

there is neither profit nor loss. In the analysis, contribution is calculated as “selling price

less variable costs” hence, knowledge of marginal costing will be of help in gathering the

variable costs elements.

Meeting profit target: marginal costing method is also useful when using CVP analysis to

calculate the volume of sales required to meet a target profit

Criticisms of marginal costing (disadvantages)

Planning and controlling of cost problem: Marginal costing places too much emphasis on

direct costs and pays cursory attention to the fixed production overhead costs which may not

be of help to the managers in planning and controlling of fixed production overhead costs

from the beginning of the production process. In reality, all costs must be planned and

controlled.

Problem of application in an automated production environment: marginal costing

method is not appropriate in an automated production system where fixed production

overhead costs are far higher than the direct costs. Since the method does not consider the

fixed production overhead cost at the beginning, when gathering the costs of production,

important costs may be considered too late.

Confusion on treatment of overhead cost: The management team may be under the

illusion that the marginal costing method completely ignores fixed production overhead costs,

which may lead to confusion and argument later when calculating the profit or loss at the end

of the period.

Price quotation problem: the marginal costing method may not be suitable for price

quotation of jobs or contracts that involve huge overhead cost, since the overhead costs are

ignored at the early stage of the calculation of the total costs

Page 4 of 50

no reviews yet

Please Login to review.