154x Filetype PDF File size 0.36 MB Source: mastermindsindia.com

No.1 for CA/CWA & MEC/CEC MASTER MINDS

15. MARGINAL COSTING

SOLUTIONS TO ASSIGNMENT PROBLEMS

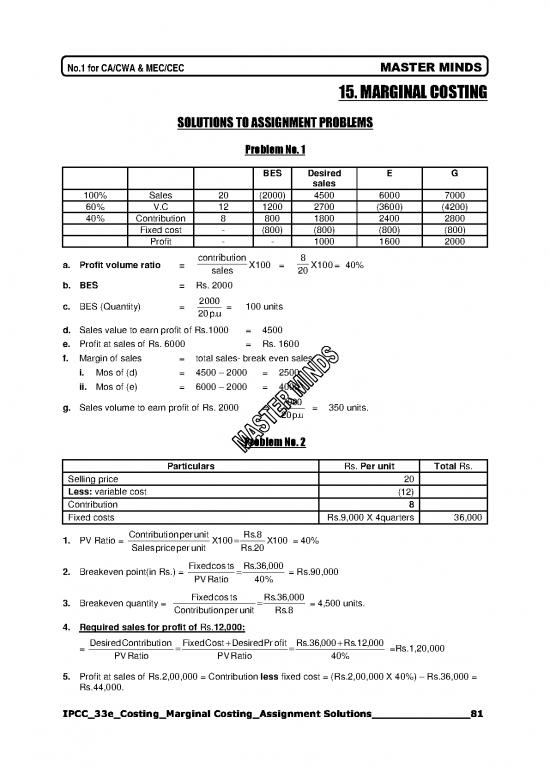

Problem No. 1

BES Desired E G

sales

100% Sales 20 (2000) 4500 6000 7000

60% V.C 12 1200 2700 (3600) (4200)

40% Contribution 8 800 1800 2400 2800

Fixed cost - (800) (800) (800) (800)

Profit - - 1000 1600 2000

a. Profit volume ratio = contribution X100 = 8 X100= 40%

sales 20

b. BES = Rs. 2000

2000

c. BES (Quantity) = = 100 units

20p.u

d. Sales value to earn profit of Rs.1000 = 4500

e. Profit at sales of Rs. 6000 = Rs. 1600

f. Margin of sales = total sales- break even sales

i. Mos of (d) = 4500 – 2000 = 2500

ii. Mos of (e) = 6000 – 2000 = 4000

g. Sales volume to earn profit of Rs. 2000 = 7000 = 350 units.

20p.u

Problem No. 2

Particulars Rs. Per unit Total Rs.

Selling price 20

Less: variable cost (12)

Contribution 8

Fixed costs Rs.9,000 X 4quarters 36,000

1. PV Ratio = Contributionperunit X100= Rs.8 X100 = 40%

Salespriceperunit Rs.20

2. Breakeven point(in Rs.) = Fixedcosts =Rs.36,000 = Rs.90,000

PVRatio 40%

3. Breakeven quantity = Fixedcosts =Rs.36,000 = 4,500 units.

Contributionperunit Rs.8

4. Required sales for profit of Rs.12,000:

= DesiredContribution =FixedCost+DesiredProfit =Rs.36,000+Rs.12,000 =Rs.1,20,000

PVRatio PVRatio 40%

5. Profit at sales of Rs.2,00,000 = Contribution less fixed cost = (Rs.2,00,000 X 40%) – Rs.36,000 =

Rs.44,000.

IPCC_33e_Costing_Marginal Costing_Assignment Solutions_______________81

Ph: 98851 25025/26 www.mastermindsindia.com

6. Margin of safety:

For (4) above, margin of safety = total sales - breakeven sales = 1,20,000 – 90,000 = Rs.30,000.

For (5) above, margin of safety = total sales – breakeven sales = 2,00,000 – 90,000 = Rs.1,10,000.

Problem No. 3

a. Calculation of profit:

BES % Calculation of Profit

Sales 160000 100% 2,00,000

V.C 1,20,000 75% 1,50,000

Contribution 40,000 25% 50,000

Fixed cost (40,000) (40,000)

Profit - 10,000

P/v ratio = 40,000 X 100 = 25%, Profit = Rs. 10,000

1,60,000

b. Calculation of sales:

BES Calculation of Sales

Sales 40,000 60,000 100%

V.C 20,000 30,000 50%

Contribution 20,000 30,000 50%

Fixed cost (20,000) (20,000)

Profit - 10,000

P/v ratio = 30,000 X 100 = 50%, Sales = Rs. 60,000

60,000

Problem No. 4

Note.1: Present selling price per unit = Rs.1,50,000 = Rs.10 per unit.

15,000

Note.2: present contribution per unit = selling price per unit – variable cost per unit = Rs.10 –Rs.6 =

Rs.4 per unit.

Note.3: in the following calculations

PVR = Contributionperunit X100

Salespriceperunit

BEQ = FixedCosts

ContributionPerUnit

Computation of PVR, BEP, and MOS

BES = MOS(Qtty) = MOS (Rs.) =

Particulars PVR = see note BEQ = see note BEQ X SP p.u. Total Sales - MOS X SP p.u.

BEQ

Data given 106 =40% Rs.34,000 = 8,500 8,500 X 10 = 15,000 – 8,500 = 6,500 X 10 =

10 Rs.4 Rs.85,000 6,500 units Rs.65,000

units

10% decrease in 96 =33.33% Rs.34,000 = 11,333 X 9 = 15,000 – 11,333 = 3,667 X 9 =

selling price 9 Rs.3 Rs.1,01,997 3,667 units Rs.33,003

11,333 units

IPCC_33e_Costing_Marginal Costing_Assignment Solutions_______________82

No.1 for CA/CWA & MEC/CEC MASTER MINDS

10% increase in 106.6 =34% Rs.34,000 = 10,000 X 10 = 15,000 – 10,000 = 5,000 X 10 =

variable costs 10 Rs.3.4 Rs.1,00,000 5,000 units Rs.50,000

10,000 units

Sales Increase by 106 =40% Rs.34,000 = 8,500 8,500 X 10 = 17,000 – 8,500 = 8,500 X 10 =

2,000 units 10 Rs.4 Rs.85,000 8,500 units Rs.85,000

units

Rs.6,000 increase 106 =40% Rs.40,000 = 10,000 X 10 = 15,000 – 10,000 = 5,000 X 10 =

in fixed costs 10 Rs.4 Rs.1,00,000 5,000 units Rs.50,000

10,000 units

Problem No. 5

Selling price to earn same

Particulars Present Proposed Contribution

Sales (let) 100 80 20 = 40

160

80 = ?

Less: Variable cost (60) (60)* (120)

Contribution 40 20 40

Therefore if selling price is reduced by 20% selling price has to be increased by 60% i.e. from Rs. 100

to Rs. 160.

* Variable cost will not change for change in selling price.

Problem No. 6

a)

1. % of margin of safety = Margin of safety

Total sales

Total sales = Margin of safety

%ofMargin of safety

= 2,40,000

40%

= 6,00,000

Break even sales = Total sales – Margin of Safety sales

= 6,00,000 – 2,40,000

= 3,60,000

2. Profit = [Total sales – Break even sales] x P/V Ratio

= (9,00,000 – 3,60,000) x 30%

= 1,62,000

b) Fixed cost = Contribution – Profit

= 2,00,000 – 1,50,000

= 50,000 Rs.

P/V Ratio = Contribution = 2,00,000 = 25%

sales 8,00,000

BEP = Fixedcost = 50,000 = 2,00,000

P/VRatio 25%

Margin of safety = Total sales – BEP

= 8,00,000 – 2,00,000

= 6,00,000

IPCC_33e_Costing_Marginal Costing_Assignment Solutions_______________83

Ph: 98851 25025/26 www.mastermindsindia.com

Problem No. 7

P/V ratio = Contribution X100=1,50,000 X100=50%

Sales 3,00,000

i. If in the next period company suffered a loss of Rs. 30,000, then

Contribution = Fixed Cost - Profit

= Rs. 90,000 – Rs. 30,000 (as it is a loss)

= Rs. 60,000.

Then Sales = Contributionor 60,000 =Rs.1,20,000

P/VRatio 0.50

So, there will be loss of Rs. 30,000 at sales of Rs. 1,20,000.

ii. safety = Profit or 90,000 =Rs.1,80,000

PVratio 0.50

Problem No. 8

i. In the First half year:

Contribution = Fixed cost + Profit = 4,50,000 + 3,00,000 = Rs. 7,50,000

P/V ratio =ContributionX100 = 7,50,000 X 100 = 50%

sales 15,00,000

Fixed cost 4,50,000

Break-even point = P/V ratio = 50% = Rs. 9,00,000

Margin of safety = Actual sales – Break-even point = 15,00,000 – 9,00,000 = Rs. 6,00,000

ii. In the second half year:

Contribution = Fixed cost – Loss = 4,50,000 – 1,50,000 = Rs. 3,00,000

Expected sales volume = Fixed cost -loss = 3,00,000 = Rs. 6,00,000

P/V ratio 50%

iii. For the whole year:

B.E. point = Fixed cost = 4,50,000X2 = Rs.18,00,000

P/V ratio 50%

Margin of safety = PROFIT = 3,00,000 . 1,50,000 = Rs. 3,00,000.

P/V ratio 50%

Problem No. 9

1. Marginal cost sheet for the given data is prepared as under –

Particulars Rs.

Sales (given) 3,00,000

Less: variable cost (balancing figure) 1,20,000

Contribution (fixed cost + profit) 1,80,000

Less: fixed cost (given) 90,000

Profit (given) 90,000

IPCC_33e_Costing_Marginal Costing_Assignment Solutions_______________84

no reviews yet

Please Login to review.