249x Filetype XLSX File size 0.03 MB Source: www.business.govt.nz

COVID-19 wage subsidy scheme eligibility

This spreadsheet can help you better understand your eligibility for the COVID-19 wage subsidy scheme. This is a simplistic version to calculate eligibility. If you are unsure of the numbers, talk to your bank,

accountant or business advisor.

Businesses older than 12 months old: wage subsidies will be available for those who can show a 30% decline in revenue, attributable to COVID-19, for any four weeks between January and June 2020

compared to the year before. This includes forecasting future months.

Businesses less than 12 months old: the wage subsidy will be available for those who can show a 30% decline in revenue, attributable to COVID-19, against a similar time period (ie 30% loss of income

when comparing January 2020 to March 2020).

Businesses that have had a significant increase in revenue over the past year are eligible, where they can show a 30% decline in revenue, attributable to COVID-19, against a similar time period (ie

30% loss of income when comparing January 2020 to March 2020).

People who are self-employed and have variable monthly incomes are eligible if they can show a 30% decline in revenue, attributable to COVID-19, against the previous years’ monthly average (ie

30% loss of income comparing March 2020 to the average monthly income in the period March 2019 to March 2020).

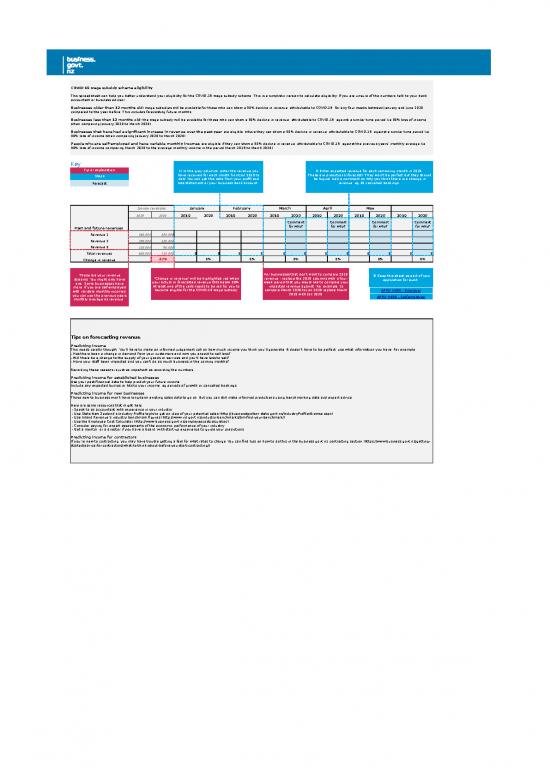

Key

Tip or explanation 1) In the grey columns, enter the revenue you 2) Enter expected revenue for each remaining month in 2020.

Steps have received for each month from Jan 2019 to These are predictions (forecast). They won't be perfect but they should

now. You can get this data from your profit and be logical. Add a comment on why you think there is a change in

Forecast loss statement or your business bank account. revenue, eg 20 cancelled bookings.

January (example) January February March April May

2019 2020 2019 2020 2019 2020 2019 2020 2019 2020 2019 2020 2019 2020

Comment Comment Comment Comment

Past and future revenues for why? for why? for why? for why?

Revenue 1 260,000 200,000

Revenue 2 190,000 120,000

Revenue 3 150,000 90,000

Total revenues 600,000 410,000 0 0 0 0 0 0 0 0 0 0 0 0

Change in revenue -32% 0% 0% 0% 0% 0% 0%

These are your revenue For businesses that don't want to compare 2019 3) Keep this sheet as part of your

streams. You might only have 'Change in revenue' will be highlighted red when revenue - replace the 2019 columns with a four- application for audit.

one. Some businesses have your actual or forecasted revenue falls below 30%. week period that you would like to compare your

more. If you are self-employed At least one of the cells needs to be red for you to impacted revenue against. For example, to

with variable monthly incomes, become eligible for the COVID-19 wage subsidy. compare March 2020 to Jan 2020 replace March APPLY HERE - Employer

you can use the previous years 2019 with Jan 2020.

APPLY HERE - Self-employed

monthly average as revenue.

Tips on forecasting revenue

Predicting income

This needs careful thought. You’ll have to make an informed judgement call on how much income you think you’ll generate. It doesn’t have to be perfect, use what information you have. For example:

- Has there been a change in demand from your customers and now you expect to sell less?

- Will there be a change to the supply of your goods or services and you'll have less to sell?

- Have your staff been impacted and you can't do as much business in the coming months?

Recording these reasons is just as important as recording the numbers.

Predicting income for established businesses

Use your past financial data to help predict your future income.

Include any expected bumps or hits to your income, eg periods of growth or cancelled bookings.

Predicting income for new businesses

Those new to business won’t have long-term existing sales data to go on. But you can still make informed predictions using benchmarking data and expert advice.

Here are some resources that might help:

- Speak to an accountant with experience in your industry.

- Use Stats New Zealand’s Industry Profile tools to get an idea of your potential sales (http://businesstoolbox.stats.govt.nz/IndustryProfilerBrowse.aspx).

- Use Inland Revenue’s industry benchmark figures (http://www.ird.govt.nz/industry-benchmarks/bm-find-your-benchmark/).

- Use the Employee Cost Calculator (http://www.business.govt.nz/employeecostcalculator/).

- Consider paying for expert assessments of the economic performance of your industry.

- Get a mentor, or a director if you have a board, with start-up experience to guide your predictions.

Predicting income for contractors

If you’re new to contracting, you may have trouble getting a feel for what rates to charge. You can find tips on how to do this in the business.govt.nz contracting section (https://www.business.govt.nz/getting-

started/advice-for-contractors/what-to-think-about-before-you-start-contracting/).

no reviews yet

Please Login to review.