204x Filetype PDF File size 0.29 MB Source: assets.publishing.service.gov.uk

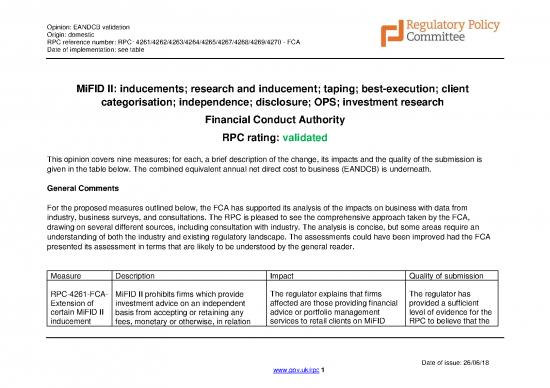

Opinion: EANDCB validation

O rigin: d omestic

-

RPC reference number: RPC 4261/4262/4263/4264/4265/4267/4268/4269/4270 - FCA

Date of implementation: see table

MiFID II: inducements; research and inducement; taping; best-execution; client

categorisation; independence; disclosure; OPS; investment research

Financial Conduct Authority

RPC rating: validated

This opinion covers nine measures; for each, a brief description of the change, its impacts and the quality of the submission is

given in the table below. The combined equivalent annual net direct cost to business (EANDCB) is underneath.

General Comments

For the proposed measures outlined below, the FCA has supported its analysis of the impacts on business with data from

industry, business surveys, and consultations. The RPC is pleased to see the comprehensive approach taken by the FCA,

drawing on several different sources, including consultation with industry. The analysis is concise, but some areas require an

understanding of both the industry and existing regulatory landscape. The assessments could have been improved had the FCA

presented its assessment in terms that are likely to be understood by the general reader.

Measure Description Impact Quality of submission

RPC-4261-FCA- MiFID II prohibits firms which provide The regulator explains that firms The regulator has

Extension of investment advice on an independent affected are those providing financial provided a sufficient

certain MiFID II basis from accepting or retaining any advice or portfolio management level of evidence for the

inducement fees, monetary or otherwise, in relation services to retail clients on MiFID RPC to believe that the

Date of issue: 26/06/18

www.gov.uk/rpc 1

Opinion: EANDCB validation

O rigin: d omestic

-

RPC reference number: RPC 4261/4262/4263/4264/4265/4267/4268/4269/4270 - FCA

Date of implementation: see table

provisions to to the services they provide to clients. instruments; the FCA estimate that quality of analysis for

firms providing The changes presented here extend there are 16,854 such firms. It this measure is fit for

investment this prohibition to firms which provide estimates total one-off familiarisation purpose. The

advice and investment advice on a restricted basis costs of £4.7 million. The regulator assessment uses a

portfolio i.e. advice restricted to certain products also estimates limited ongoing reasonable and

management to and/or providers. implementation costs, on the grounds proportionate approach

retail clients that the new rules mirror existing to analyse potential

Retail Distribution Review (RDR) costs to business.

Implementation rules and therefore will require no

date: 3rd material change to firms’ systems.

January 2018

RPC-4262-FCA- Under MiFID II, the ban on accepting or The FCA estimates that 311 firms will During the consultation,

Extension of the retaining any fees relating to the incur direct material costs from this the regulator noted that

MiFID II provision of services to clients, does discretionary policy decision, as it has some survey

research and not apply to research. Firms providing decided to exempt collective portfolio respondents were

inducements individual portfolio management are managers from the provision. The unsure of the precise

provisions to allowed to receive research without FCA states that the cost of external legal interpretation of

collective breaching the inducement rules, as research purchased by the firm some of the

portfolio long as the research is paid for directly should not be included as firms were requirements and that

managers already paying for research. The there is, therefore, some

from the firm’s resources or through a measures just changed the payment uncertainty survey

Implementation Research Payment Account (RPA). A method. It should be noted, however, responses. It argues

date: 3rd RPA is funded by separate charge to that any additional cost of paying for that the benefits of the

January 2018 the client and must be agreed and external research caused by the measure to consumers

disclosed. The changes presented here changes has been included in the will outweigh the costs

Date of issue: 26/06/18

www.gov.uk/rpc 2

Opinion: EANDCB validation

O rigin: d omestic

-

RPC reference number: RPC 4261/4262/4263/4264/4265/4267/4268/4269/4270 - FCA

Date of implementation: see table

extend the requirements to collective analysis. The regulator estimates, but does not present

portfolio managers (CPMs). based on survey results, that 33%- benefit estimates to

76% of affected firms do not delegate support this assertion.

investment management and will The RPC confirms that

therefore incur costs as a result of the approach adopted

these changes. The FCA estimates, by the FCA is

based on the same surveys, that total reasonable and

one-off costs are between £3.8 -£8.4 proportionate but

million and ongoing costs between £2 agrees that the

-£4.5 million. assessment could have

been improved had the

survey questions been

clearer. The RPC also

notes that the

assessment could have

been improved by

presenting appropriate

benefit estimates.

RPC-4263-FCA- Existing FCA rules require certain firms The FCA estimates a total of 1,184 The RPC believes that

Extending to record telephone and electronic firms will be impacted by the the approach taken by

MiFID II communications which relate to an proposed changes. The regulator the FCA is reasonable

requirements for agreement between the firm and the explains that some firms will be less and proportionate.

firms to record client. MiFID II introduced a similar affected than others due to existing

telephone obligation on an EU level and required taping requirements and will therefore

conversations or records to be kept for 5 years. The only incur familiarisation and gap

Date of issue: 26/06/18

www.gov.uk/rpc 3

Opinion: EANDCB validation

O rigin: d omestic

-

RPC reference number: RPC 4261/4262/4263/4264/4265/4267/4268/4269/4270 - FCA

Date of implementation: see table

electronic changes presented here extend analysis costs. It estimates these to

communications existing regulations to cover be one-off costs of £0.2 million. DIMs

discretionary investment managers who do not already tape, will incur

Implementation (DIMs), energy market participants one-off costs of installing the

date: 3rd (EMPs), oil market participants (OMPs), infrastructure and ongoing costs of

January 2018 and UK branches of third country firms. taping, storage, and conversation

retrieval. The FCA estimates costs

based on analysis from a previous

CBA which multiplies the increase in

yearly cost of storage per user by the

number of users and estimates

ongoing costs of £0.6 million from

year 5 onwards. On this basis, the

regulator estimates one-off costs of

between £2.5-£5 million and ongoing

costs of between £2.4-£4.7 million.

RPC-4264-FCA- MiFID II obligates firms to put in place The FCA explains that businesses The regulator has

Extending the arrangements and monitoring to make covered by the proposal include provided a proportionate

MiFID II best sure they are achieving best execution 2,439 financial advice firms and 81 level of evidence to

execution on behalf of their clients. More UCITS management companies. For support its assessment

requirements to specifically, MiFID II requires financial advice firms to read and of the measure. The

Article 3 retail investment firms that execute, transmit digest the changes and conduct gap FCA states that benefits

financial or place orders to: analysis to check their current to consumers are likely

advisers and practices against the new to exceed costs but

UCITS expectations, the regulator estimates does not include them

Date of issue: 26/06/18

www.gov.uk/rpc 4

no reviews yet

Please Login to review.