183x Filetype PDF File size 0.26 MB Source: biostrat.dk

Financial valuation methods for biotechnology

Financial valuation theory is all well and good, but knowing real world valuation

practices is what makes a successful transaction professional. Get insight into how

biotechnology valuations are practiced by executives and top-level decision

makers.

Nicolaj Hoejer Nielsen, M.Sc., MBA

- Managing Director of Biostrat Biotech Consulting and Associate Professor at Copenhagen Business School

Introduction discount rates used by different stakeholders The majority of respondents to the survey have

The biotech industry is one of the growth when making valuations of biotechnology significant to extensive frontline biotechnology

engines in the development of a knowledge projects and firms. valuation experience:

economy. The economic importance of the

industry, its capital intensive character and the Top-quality respondents

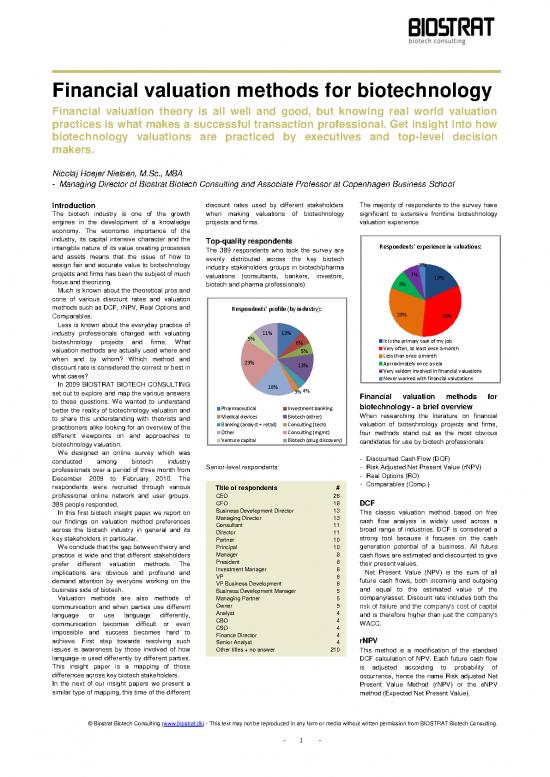

intangible nature of its value creating processes The 389 respondents who took the survey are Respondents' experience in valuations:

and assets means that the issue of how to evenly distributed across the key biotech

assign fair and accurate value to biotechnology industry stakeholders groups in biotech/pharma 3%

projects and firms has been the subject of much valuations (consultants, bankers, investors, 7% 19%

focus and theorizing. biotech and pharma professionals): 9%

Much is known about the theoretical pros and

cons of various discount rates and valuation

methods such as DCF, rNPV, Real Options and Respondents' profile (by industry):

Comparables. 29% 33%

Less is known about the everyday practice of

industry professionals charged with valuating 11% 12%

biotechnology projects and firms. What 5% 6% It is the primary task of my job

valuation methods are actually used where and 5% Very often, at least once a month

when and by whom? Which method and Less than once a month

discount rate is considered the correct or best in 23% 13% Aprroximately once a year

what cases? Very seldom involved in financial valuations

Never worked with financial valutations

In 2009 BIOSTRAT BIOTECH CONSULTING 18%

set out to explore and map the various answers 3%4% Financial valuation methods for

to these questions. We wanted to understand biotechnology - a brief overview

better the reality of biotechnology valuation and Pharmaceutical Investment banking

to share this understanding with theorists and Medical devices Biotech (other) When researching the literature on financial

practitioners alike looking for an overview of the Banking (analyst + retail) Consulting (tech) valuation of biotechnology projects and firms,

different viewpoints on and approaches to Other Consulting (mgmt) four methods stand out as the most obvious

biotechnology valuation. Venture capital Biotech (drug discovery) candidates for use by biotech professionals:

We designed an online survey which was

conducted among biotech industry - Discounted Cash Flow (DCF)

professionals over a period of three month from Senior-level respondents: - Risk Adjusted Net Present Value (rNPV)

December 2009 to February 2010. The - Real Options (RO)

respondents were recruited through various Title of respondents # - Comparables (Comp.)

professional online network and user groups. CEO 26

389 people responded. CFO 16 DCF

In this first biotech insight paper we report on Business Development Director 13 This classic valuation method based on free

our findings on valuation method preferences Managing Director 13 cash flow analysis is widely used across a

across the biotech industry in general and its Consultant 11 broad range of industries. DCF is considered a

key stakeholders in particular. Director 11 strong tool because it focuses on the cash

Partner 10

We conclude that the gap between theory and Principal 10 generation potential of a business. All future

practice is wide and that different stakeholders Manager 8 cash flows are estimated and discounted to give

prefer different valuation methods. The President 8 their present values.

implications are obvious and profound and Investment Manager 6 Net Present Value (NPV) is the sum of all

demand attention by everyone working on the VP 6 future cash flows, both incoming and outgoing

business side of biotech. VP Business Development 6 and equal to the estimated value of the

Business Development Manager 5

Valuation methods are also methods of Managing Partner 5 company/asset. Discount rate includes both the

communication and when parties use different Owner 5 risk of failure and the company’s cost of capital

language or use language differently, Analyst 4 and is therefore higher than just the company’s

communication becomes difficult or even CBO 4 WACC.

impossible and success becomes hard to CSO 4

achieve. First step towards resolving such Finance Director 4 rNPV

Senior Analyst 4

issues is awareness by those involved of how Other titles + no answer 210 This method is a modification of the standard

language is used differently by different parties. DCF calculation of NPV. Each future cash flow

This insight paper is a mapping of those is adjusted according to probability of

differences across key biotech stakeholders. occurrence, hence the name Risk adjusted Net

In the next of our insight papers we present a Present Value Method (rNPV) or the eNPV

similar type of mapping, this time of the different method (Expected Net Present Value).

© Biostrat Biotech Consulting (www.biostrat.dk) - This text may not be reproduced in any form or media without written permission from BIOSTRAT Biotech Consulting.

- 1 -

In the rNPV method the two “discount factors” Management consultants 18

– the average cost of capital and the success All respondents Investment banking 8

rate of the project – are calculated separately. - valutation methods used: Banking – retail/analysts 6

The discount rate used should therefore be 250 Venture capital 6

64%

equal to the company’s WACC. Risk of failure is 62% 58% Pharmaceutical companies 6

calculated separately. 200

It has been argued that the rNPV method is 150 Biotech companies 6

now the defacto standard in the valuation of 100 Private equity 3

biotechnology companies/assets. 13% 17% Asset management 3

50 Other industries 10

For more information on the rNPV method see

for example: Stewart (2002) and Bogdan & 0

Villiger (2008). DCF rNPV RO Comp. Other One obvious and interesting question to explore

and answer is if respondents in this grouping

Real Options The majority of respondents (approximately 60 favours the more advanced Real Options

It has been argued that the DCF and even the percent) have previously employed either the approach compared to other groupings of

rNPV/eNPV valuation methods are not DCF, rNPV or Comparables method. respondents?

sufficiently robust when valuing high risk Interestingly only 13 percent of respondents

projects, such as biotech. Real Options said they had ever used the Real Options for The answer is no.

addresses these objections by including valuating biotech projects. Though the Real

valuation of the future management flexibility of Options approach is seen by theorists to Instead the rNPV method again turned out as

the investment. The build-in assumption in the provide the most accurate valuation, in practice method of choice. 54 percent of the

Real Options method is that management can it is not the method of choice. respondents stated that this was their

actively modify the project after initial primary/preferred valuation method. Only 5

investment decision is taken should then need Other valuation methods used percent of the valuation experts answered that

or want to. This flexibility can increase the value 17 percent of respondents answered that they Real Options was their primary valuation

of the asset, and supporters of Real Options have also been using other financial valuation method.

argue this flexibility is very important for long- methods than those suggested in the survey.

term, multi phase investment decisions - which The following methods were mentioned: Valuation experts

is the norm with most biotech investments. - Amount spend to build the company/assets - primary valuation method:

Consequently, Real Options is seen as superior - Monte Carlo simulations

to the DCF/rNPV methods. - Soft /qualitative factors (management etc.)

For a theoretical discussion see for example: - Hybrid of different methods 35 54%

Kellogg et al (2000). 30

PRIMARY VALUATION METHOD 25

Comparables 20

The respondents were also asked about their 15 19% 14%

Other authors argue that all of the above primary/preferred method used when valuing 10 7%

mentioned financial valuation methods biotech projects/firms. Their responses clearly 5 5%

(DCF,rNPV, Real Options) suffer from too much showed that the rNPV method is valuation 0

theory and not enough practice. It is argued that method of choice: DCF rNPV RO Comp. Other

none of the methods reflects or respects market

value and that market value is real value.

Comparables is obviously a pragmatic, All respondents Biotech/Pharma Professionals

market practitioners approach to valuation: - primary valutation method: This grouping is made up of respondents who

What something is worth is what (another) answered that they work inside a biotech or

business is willing to pay for it. Supporters of 160 43% pharmaceutical company and for whom

this method therefore argue that in order to 140 financial valuation is a primary/regular task in

value a biotechnology investment opportunity, 120 32% their job.

100

you have to compare it to transactions that are 80 18%

similar in kind. 60 This grouping consists of 69 respondents:

Therefore it is argued that Comparables is the 40 4%

right method for estimating what an asset is 20 2% Pharmaceutical companies 25

currently worth and what its future value may 0 Biotech - drug discovery 20

be. DCF rNPV RO Comp. Other Biotech - other companies 19

Medtech companies 5

Financial valuation methods for

biotechnology in practice Financial valuation methods of choice

We asked what financial valuation methods by different stakeholder groups In terms of profession the majority of the

respondents had used in the past when valuing We sorted answers to the survey question respondents work in:

biotech projects and/or firms and which method about primary valuation method according to Business development 31

they considered their primary. These are the stakeholder group. The motivation was of General management 15

answers we got: course to map and see if different stakeholder Finance 10

groups prefer different financial valuation Strategic Planning 6

methods. This is the picture we got: Other 7

Valuation experts Again the question we wanted to explore and

The term 'valuation experts' covers respondents answer was that of preferred/primary financial

who answered that making financial valuations valuation method. Again the answers was

is a primary task in their job. This grouping rNPV.

consist of 66 respondents from a broad range of

industries:

© Biostrat Biotech Consulting (www.biostrat.dk) - This text may not be reproduced in any form or media without written permission from BIOSTRAT Biotech Consulting.

- 2 -

Almost 50 percent of respondents in this Venture Capital Investors Venture capital companies clearly have a

grouping said that the rNPV method was their 14 - primary valuation method: preference for the Comparables method. More

preferred/primary. The sorting also revealed 12 than 50 percent of respondents answered that

that the classical DCF method is used more 10 54% this method was their primary valuation method.

often by biotech and pharma professionals than 36% This compared to biotech/pharma where only

by valuation experts in general. 8 approx. 10 percent of those experienced in

6 making financial valuation answered that

4 Comparables was their primary valuation

Biotech/Pharma Professionals method.

- primary valuation method: 2 5% 4,5%

0%

30 48% 0

25 36% DCF rNPV RO Comp. Other Next: Discount rates

20 In our next biotech insight paper we report on

15 the use of different discount rates by different

10 10% CONCLUSIONS stakeholders when making valuations of

5 5% rNPV is the primary/preferred valuation method biotechnology projects and firms. We found that

0 for most industry professionals involved in there are significant differences and the

biotech valuations implications are obviously profound when taking

DCF rNPV RO Comp. account of the long-term nature of most

Real Options is only used by approximately 10 biotechnology projects and investments.

percent of the respondents, and when asked

Venture Capital Investors about their primary valuation method only 4

25 of the survey respondents answered that percent mentioned Real Options.

they are professionals working in venture

capital firms and indicated that they have Even among financial valuations experts very

significant financial valuation experience few (5 percent) use Real Options as primary

(complete at least one evaluation per month). valuation method.

This important stakeholder group stand out

from the other groups in terms of Sources:

Among all but one of the stakeholder groupings D. Kellogg, JM. Charnes, Real-options valuation for a

preferred/primary method when valuating the classic DCF analysis is still a widely used biotechnology company, Financial Analysts Journal,

biotechnology projects and firms. More than 50 method when performing biotech valuations - 2000.

percent said that Comparables was their except venture capital companies. Not one B. Bogdan, R. Villiger, Valuation in Life Sciences: A

primary method. None of the respondents use Practical Guide, Springer, 2008.

respondent from this grouping answered that st

the classical DCF method as primary. JJ. Stewart, Biotechnology Valuations for the 21

DCF was their primary method. century, Milken Instittue, 2002.

Newsletter

If you have found this biotech insight paper useful and would like to receive future insight papers or subscribe to our newsletter,

please visit http://www.biostrat.dk/newsletter to register.

LinkedIN Group on Biotech Valuation

Feel free to join our free LinkedIN group on biotech valuation: http://www.linkedin.com/groups?gid=2515601

About Biostrat Biotech Consulting

BIOSTRAT provides strategic decision making services to pharmaceutical, life sciences, and biotech companies. Operating in a

highly competitive and one of the most capital and research intensive industries significantly increases the importance for these

companies to make the right strategic choices. BIOSTRAT specialises in assisting companies in making strategic decisions with

regards to corporate strategy, partnering, licensing, fundraising and M&A. Read more at www.biostrat.dk.

Nicolaj Hoejer Nielsen (nhn@biostrat.dk) is the founder and Managing Director of BIOSTRAT Biotech Consulting. Mr. Nielsen has

a background as corporate manager within the biotech industry. Mr. Nielsen holds an MBA from INSEAD and an M.Sc. in Business

from Copenhagen Business School and University of Texas. Mr. Nielsen is an Associate Professor at Copenhagen Business

School, where he teaches business strategy and strategic marketing on postgraduate courses.

Biostrat Biotech Consulting Aps.

Ole Maaloees Vej 3

DK-2200 Copenhagen N

Denmark

Phone: (+45) 25 46 25 80

E-mail: info@biostrat.dk

Web: www.biostrat.dk

© Biostrat Biotech Consulting (www.biostrat.dk) - This text may not be reproduced in any form or media without written permission from BIOSTRAT Biotech Consulting.

- 3 -

no reviews yet

Please Login to review.