318x Filetype XLSX File size 0.03 MB Source: softwaredevelopers.ato.gov.au

Sheet 1: Release note

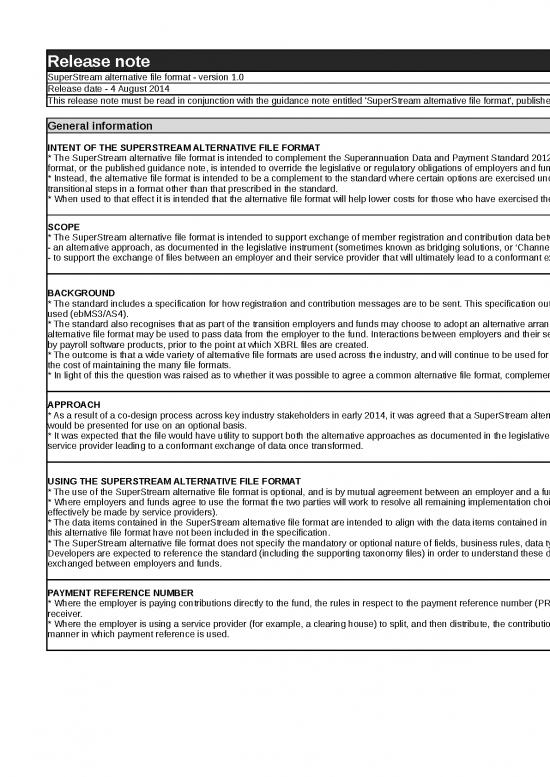

| Release note |

| SuperStream alternative file format - version 1.0 |

| Release date - 4 August 2014 |

| This release note must be read in conjunction with the guidance note entitled 'SuperStream alternative file format', published by the ATO. |

| General information |

| INTENT OF THE SUPERSTREAM ALTERNATIVE FILE FORMAT * The SuperStream alternative file format is intended to complement the Superannuation Data and Payment Standard 2012 (the 'standard'); it does not replace the standard. Nothing in the SuperStream alternative file format, or the published guidance note, is intended to override the legislative or regulatory obligations of employers and funds under the standard. * Instead, the alternative file format is intended to be a complement to the standard where certain options are exercised under the standard. This includes, for example, where data is exchanged in intermediate or transitional steps in a format other than that prescribed in the standard. * When used to that effect it is intended that the alternative file format will help lower costs for those who have exercised these options. |

| SCOPE * The SuperStream alternative file format is intended to support exchange of member registration and contribution data between employers and funds under either: - an alternative approach, as documented in the legislative instrument (sometimes known as bridging solutions, or ‘Channel B’), or - to support the exchange of files between an employer and their service provider that will ultimately lead to a conformant exchange of data, once transformed into XBRL and ebMS3/AS4 (‘Channel A’). |

| BACKGROUND * The standard includes a specification for how registration and contribution messages are to be sent. This specification outlines both the format for the data (XBRL), as well as the message exchange protocol to be used (ebMS3/AS4). * The standard also recognises that as part of the transition employers and funds may choose to adopt an alternative arrangement, subject to conditions detailed in the legislative instrument. Under this arrangement an alternative file format may be used to pass data from the employer to the fund. Interactions between employers and their service providers (such as clearing houses) also involve alternative file formats, often generated by payroll software products, prior to the point at which XBRL files are created. * The outcome is that a wide variety of alternative file formats are used across the industry, and will continue to be used for some time, requiring funds and employers (and the various service providers of both) to incur the cost of maintaining the many file formats. * In light of this the question was raised as to whether it was possible to agree a common alternative file format, complementing the standard, so as to reduce costs to all affected parties. |

| APPROACH * As a result of a co-design process across key industry stakeholders in early 2014, it was agreed that a SuperStream alternative file format would be described using a comma separated value (CSV) format. This file would be presented for use on an optional basis. * It was expected that the file would have utility to support both the alternative approaches as documented in the legislative instrument, as well as supporting the exchange of files between an employer and their service provider leading to a conformant exchange of data once transformed. |

| USING THE SUPERSTREAM ALTERNATIVE FILE FORMAT * The use of the SuperStream alternative file format is optional, and is by mutual agreement between an employer and a fund. * Where employers and funds agree to use the format the two parties will work to resolve all remaining implementation choices/details required (in practice this choice, and therefore resolution of details, will often effectively be made by service providers). * The data items contained in the SuperStream alternative file format are intended to align with the data items contained in the standard. Fields included in the standard that are constant, derivable, or not required for this alternative file format have not been included in the specification. * The SuperStream alternative file format does not specify the mandatory or optional nature of fields, business rules, data types and field lengths of data items where those items are described in the standard. Developers are expected to reference the standard (including the supporting taxonomy files) in order to understand these details. This is to ensure that there is a single source of truth underpinning the definition of data exchanged between employers and funds. |

| PAYMENT REFERENCE NUMBER * Where the employer is paying contributions directly to the fund, the rules in respect to the payment reference number (PRN) apply. This is to ensure the integrity of the reconciliation process for the sender and receiver. * Where the employer is using a service provider (for example, a clearing house) to split, and then distribute, the contribution file and payments it is up to the employer and their service provider to determine the manner in which payment reference is used. |

| NEGATIVE AMOUNTS * In general this file should not be used for passing negative amounts. This principle is applied to ensure alignment between this alternative file format and the standard, where the passing of negative values is out of scope (except in very limited circumstances where generic tuples are used for negative amounts by mutual agreement between employer and fund). * It is recognised that in some cases the exchange of negative values will be desired by both employer and fund. In those cases this file can support the requirement however the following principles must be followed: - the default position is that negative values are not supported - a choice can be made to support negative values in fields on an opt-in basis, to suit special, known requirements. This choice is exercised on the fund side - where a fund opts to allow negatives, the fund is responsible for specifying the rules governing where and how negative amounts can be added, and the implications for associated payments, and - where a fund opts to allow negatives, the fund is also responsible for working with their stakeholders - employers and other service providers (for example payroll software companies) - to implement that choice. * An indicator has been provided in the file header (that is, 'negatives supported') so that an explicit declaration is made as to whether negative values are supported in the instance of the file being sent. In line with the principles above, the default value for this indicator is 'false'. |

| Release specific information |

| Version 1.0 reflects the first production release of the SuperStream alternative file format. |

no reviews yet

Please Login to review.