165x Filetype PDF File size 0.33 MB Source: wzr.ug.edu.pl

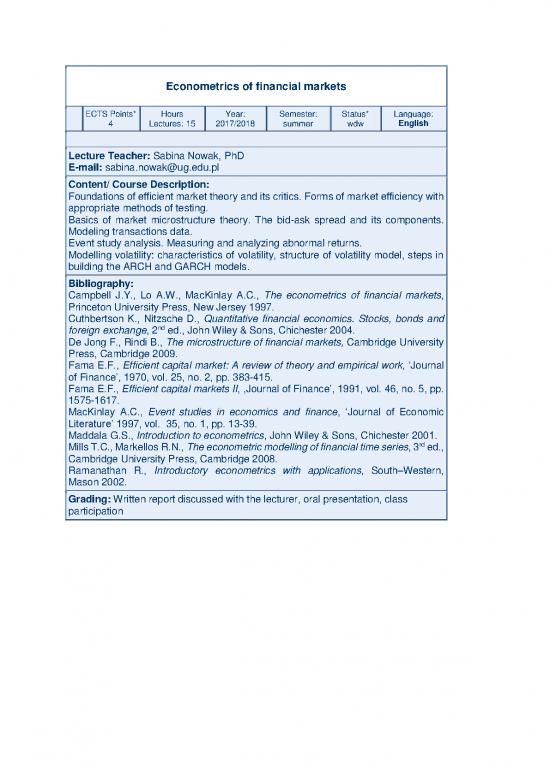

Econometrics of financial markets

ECTS Points* Hours Year: Semester: Status* Language:

4 Lectures: 15 2017/2018 summer wdw English

Lecture Teacher: Sabina Nowak, PhD

E-mail: sabina.nowak@ug.edu.pl

Content/ Course Description:

Foundations of efficient market theory and its critics. Forms of market efficiency with

appropriate methods of testing.

Basics of market microstructure theory. The bid-ask spread and its components.

Modeling transactions data.

Event study analysis. Measuring and analyzing abnormal returns.

Modelling volatility: characteristics of volatility, structure of volatility model, steps in

building the ARCH and GARCH models.

Bibliography:

Campbell J.Y., Lo A.W., MacKinlay A.C., The econometrics of financial markets,

Princeton University Press, New Jersey 1997.

Cuthbertson K., Nitzsche D., Quantitative financial economics. Stocks, bonds and

nd

foreign exchange, 2 ed., John Wiley & Sons, Chichester 2004.

De Jong F., Rindi B., The microstructure of financial markets, Cambridge University

Press, Cambridge 2009.

Fama E.F., Efficient capital market: A review of theory and empirical work, ‘Journal

of Finance’, 1970, vol. 25, no. 2, pp. 383-415.

Fama E.F., Efficient capital markets II, ,Journal of Finance’, 1991, vol. 46, no. 5, pp.

1575-1617.

MacKinlay A.C., Event studies in economics and finance, ‘Journal of Economic

Literature’ 1997, vol. 35, no. 1, pp. 13-39.

Maddala G.S., Introduction to econometrics, John Wiley & Sons, Chichester 2001.

rd

Mills T.C., Markellos R.N., The econometric modelling of financial time series, 3 ed.,

Cambridge University Press, Cambridge 2008.

Ramanathan R., Introductory econometrics with applications, South–Western,

Mason 2002.

Grading: Written report discussed with the lecturer, oral presentation, class

participation

Integrated product development

ECTS Points* Hours Year: Semester: Status* Language:

4 Lectures: 15 2017/2018 summer enrolled English

Lecture Teacher: Sylwia Badowska, PhD

E-mail: sylwia.badowska@ug.edu.pl

Content/ Course Description:

Introduction to the lecture - 1 h

Lecture - 6h

Definition of new product development

Strategy of new product development

Generating and screening ideas for new products

New product concept development and screening

Business analysis of new products

New product prototypes and market testing

Launching and commercialising new products

Workshop and tutorial – 6 h

Assignment - 2 h

Bibliography:

Ph. Kotler, G. Amstrong, Principles of Marketing (15th Edition),

Ph. Kotler, K. Keller, Marketing Management (14 th edition)

Ph. Kotler, H. Kartajaya, I. Setiawan, Marketing 3.0: From Products

to Customers to the Human Spirit

W. Chan Kim, R. Mauborgne, Blue Ocean Strategy: How to Create

Uncontested Market Space and Make Competition Irrelevant

A. Ries, J.Trout, Positioning

Grading:

Assignment: test and project report

Passing by receiving at least 50% of points

Introduction to Linux in Business

ECTS Points* Hours Year: Semester: Status* wdw Language:

4 Lectures: 15 2017/2018 summer English

Lecture Teacher: Jacek Maślankowski, Ph.D.

E-mail: jacek.maslankowski@ug.edu.pl

Content/ Course Description:

1. Security in Linux filesystem

2. System backup, working with users and groups

3. Configuration of network services and servers

4. IP Tables – firewall in Linux

5. Virtual Private Networks

6. Diagnostic and monitoring tools

7. Linux management

Bibliography:

Documentation of Linux Debian systems https://www.debian.org/doc

Petersen R., Linux: The Complete Reference, Sixth Edition, 2007

Nemeth E., Snyder G., Hein T.R., Whaley B., Unix and Linux System Administration

Handbook, 2010

Shotts W.E., The Linux Command Line: A Complete Introduction 1st Edition, 2013

Grading

Exercise (up to 20 minutes) based on the practical examples from lectures

Mergers and Acquisitions

ECTS Points* Hours Year: Semester: Status* wdw Language:

4 Lectures: 15 2017/2018 summer English

Lecture Teacher: Angelika Kędzierska-Szczepaniak, Ph.D.

E-mail: a.szczepaniak@ug.edu.pl

Content/ Course Description:

1. The development and the history of M&A - merger waves,

2. Types of M&A,

3. Forms of takeovers (friendly and hostile takeovers, horizontal, vertical,

concentric and conglomerate integration, leveraged buy-out (LBO),

defensive and aggressive takeovers, strategic and bargain),

4. Reasons of M&A for buyers and sellers,

5. The structure of the corporate control market (companies, holdings,

managers’ groups, venture capital, investments funds, banking sector),

6. International and national takeovers,

7. Examples of spectacular M&A.

Bibliography:

S. Sudarsanam: The Essence of Mergers and Acquisitions, Prentice Hall

Europe,1995

G.P. Baker, G.D. Smith: The New Financial Capitalists. KKR and the

Creation of Corporate Value, Cambridge University Press, Cambridge

1998;

R. Brealey, S. Myers: Fundamentals of Corporate Finance, McGraw-Hill,

New York, 1995;

J. C. Hooke: M&A. A Practical Guide to Doing the Deal; John Wiley &

Sons, 1999;

J. Marren: Mergers and Acquisitions. A Valuation Handbook, Irwin,

Chicago 1993; internet, np.:www.mergerstat.com; www.pwc.com

Grading

Assignment: activity during classes, test or project report

Passing by receiving at least 50% of points

no reviews yet

Please Login to review.