237x Filetype PDF File size 2.15 MB Source: www.stmarysguwahati.org.in

Class 12

Banking : Notes

Unit -1

Commercial Banking in India

TOPIC – 1 : ORIGIN AND GROWTH OF BANKS IN INDIA

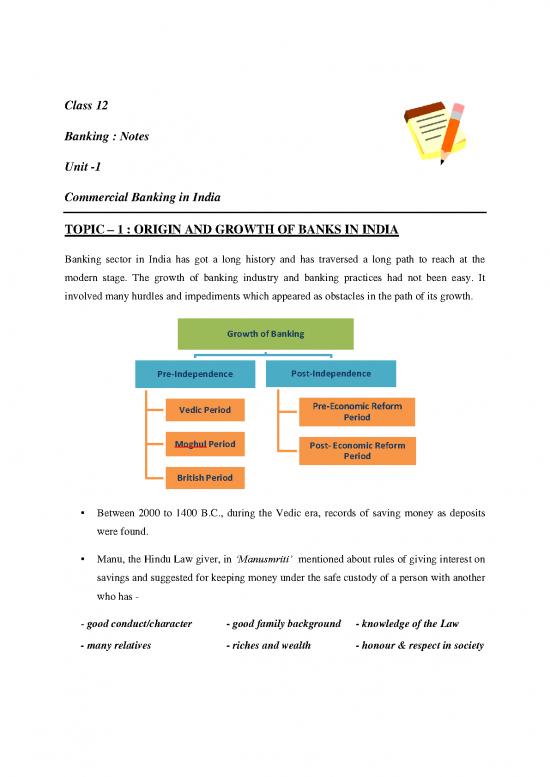

Banking sector in India has got a long history and has traversed a long path to reach at the

modern stage. The growth of banking industry and banking practices had not been easy. It

involved many hurdles and impediments which appeared as obstacles in the path of its growth.

Growth of Banking

Pre-Independence Post-Independence

Vedic Period Pre-Economic Reform

Period

MoghulPeriod Post- Economic Reform

Period

British Period

• Between 2000 to 1400 B.C., during the Vedic era, records of saving money as deposits

were found.

• Manu, the Hindu Law giver, in ‘Manusmriti’ mentioned about rules of giving interest on

savings and suggested for keeping money under the safe custody of a person with another

who has -

- good conduct/character - good family background - knowledge of the Law

- many relatives - riches and wealth - honour & respect in society

• In the ‘Artha-Shastra’ written by Chanakya or Kautilya also mentioned about rules and

need of saving money and earn income on it.

• During the period of Mahabharata, there was practices of using Hundis.

• Indigenous bankers were lending money and financing trade activities.

• Hundis were used as trade instruments.

• ‘The House of Jagat Seth’, was a famous indigenous banker during Moghul period..

• Indigenous bankers gradually lost their importance.

• With East India Company’s growth in business, the requirement of bank was felt.

• Agency Houses emerged as organizations supporting East India Company’s business as

well as providing the basic banking services to the British and the company.

• Agency Houses combined banking with other trade-supporting activities, and it was a

difficulty due to which these couldn’t sustain longer.

Growth of Pre- British Era

Banking Independence

Agency Houses during the colonial regime:

Year 1900

• M/sAlexander&Co.

• M/sFergussan &Co.

• First bank started in India

unedr British rule was

‘Bank of Hindostan’ in Year 2014

1770.

• This bank was

closed/liquidated in 1832.

• After the closure of Bank of Hindostan, the British Govt. established 3 PRESIDENCY

BANKS in India: Bank of Calcutta which later was renamed as Bank of Bengal (1906),

Bank of Bombay (1840), Bank of Madras (1843)

• Principle of Limited Liability was introduced in 1860. This resulted in the emergence of

many banks.

• Banks started operating as Joint Stock Banks.

• SWADESHI MOVEMENT further prompted many Indians to start their own banking

activities by establishing small banks to finance their own requirements and avoid taking

services of the banks established by the British.

• Bank of Baroda, Central Bank of India,

Indian Bank, Bank of India etc. were set up at

that time.

• British Government felt the need of a central bank.

th

• On 27 January, 1921, The Imperial Bank of

India was established by merging the

3 presidency banks.

no reviews yet

Please Login to review.