231x Filetype PDF File size 0.61 MB Source: pearson.com.au

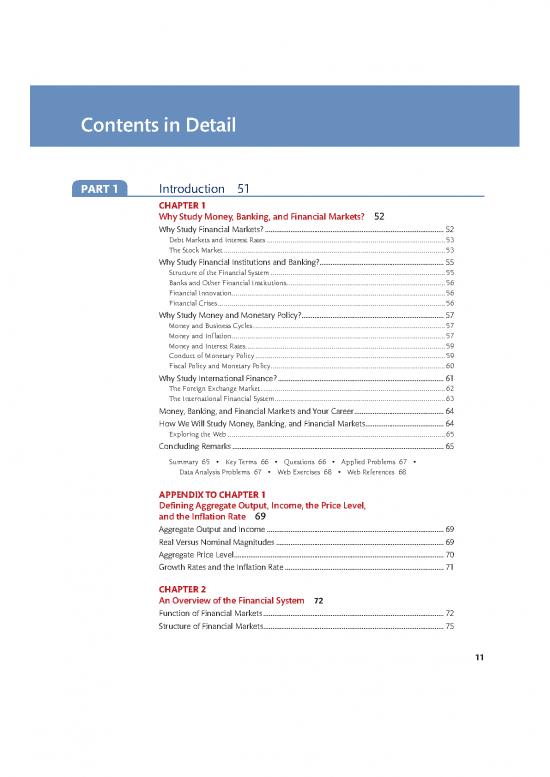

Contents in Detail

PART 1 Introduction 51

CHAPTER 1

Why Study Money, Banking, and Financial Markets? 52

Why Study Financial Markets? .................................................................................................. 52

Debt Markets and Interest Rates ...........................................................................................53

The Stock Market .................................................................................................................53

Why Study Financial Institutions and Banking? .................................................................... 55

Structure of the Financial System .........................................................................................55

Banks and Other Financial Institutions .................................................................................56

Financial Innovation.............................................................................................................56

Financial Crises ....................................................................................................................56

Why Study Money and Monetary Policy? .............................................................................. 57

Money and Business Cycles ..................................................................................................57

Money and Inflation .............................................................................................................57

Money and Interest Rates ......................................................................................................59

Conduct of Monetary Policy .................................................................................................59

Fiscal Policy and Monetary Policy .........................................................................................60

Why Study International Finance? ........................................................................................... 61

The Foreign Exchange Market ..............................................................................................62

The International Financial System .......................................................................................63

Money, Banking, and Financial Markets and Your Career ................................................. 64

How We Will Study Money, Banking, and Financial Markets ........................................... 64

Exploring the Web ...............................................................................................................65

Concluding Remarks .................................................................................................................... 65

Summary 65 • Key Terms 66 • Questions 66 • Applied Problems 67 •

Data Analysis Problems 67 • Web Exercises 68 • Web References 68

APPENDIX TO CHAPTER 1

Defining Aggregate Output, Income, the Price Level,

and the Inflation Rate 69

Aggregate Output and Income ................................................................................................. 69

Real Versus Nominal Magnitudes ............................................................................................ 69

Aggregate Price Level ................................................................................................................... 70

Growth Rates and the Inflation Rate ....................................................................................... 71

CHAPTER 2

An Overview of the Financial System 72

Function of Financial Markets ................................................................................................... 72

Structure of Financial Markets ................................................................................................... 75

11

A01_MISH8859_12_GE_FM.indd 11 30/07/18 5:28 PM

12 Contents in Detail

Debt and Equity Markets ......................................................................................................75

Primary and Secondary Markets ...........................................................................................75

Exchanges and Over-the-Counter Markets ............................................................................76

Money and Capital Markets ..................................................................................................77

Financial Market Instruments .................................................................................................... 77

Money Market Instruments ..................................................................................................77

Following the Financial News Money Market Rates 78

Capital Market Instruments ..................................................................................................79

Following the Financial News Capital Market Interest Rates 80

Internationalization of Financial Markets .............................................................................. 81

Global Are U.S. Capital Markets Losing Their Edge? 82

International Bond Market, Eurobonds, and Eurocurrencies ................................................82

World Stock Markets ............................................................................................................83

Function of Financial Intermediaries: Indirect Finance ...................................................... 83

Following the Financial News Foreign Stock Market Indexes 84

Transaction Costs .................................................................................................................84

Global The Importance of Financial Intermediaries Relative to Securities Markets:

An International Comparison 85

Risk Sharing .........................................................................................................................86

Asymmetric Information: Adverse Selection and Moral Hazard ............................................86

Economies of Scope and Conflicts of Interest .......................................................................88

Types of Financial Intermediaries ............................................................................................. 88

Depository Institutions .........................................................................................................88

Contractual Savings Institutions ...........................................................................................90

Investment Intermediaries ....................................................................................................91

Regulation of the Financial System .......................................................................................... 92

Increasing Information Available to Investors ........................................................................92

Ensuring the Soundness of Financial Intermediaries .............................................................93

Financial Regulation Abroad .................................................................................................95

Summary 95 • Key Terms 96 • Questions 96 • Applied Problems 97 •

Data Analysis Problems 98 • Web Exercises 98 • Web References 98

CHAPTER 3

What Is Money? 99

Meaning of Money ....................................................................................................................... 99

Functions of Money ...................................................................................................................100

Medium of Exchange ..........................................................................................................100

Unit of Account ..................................................................................................................101

Store of Value .....................................................................................................................102

Evolution of the Payments System .........................................................................................103

Commodity Money ............................................................................................................103

Fiat Money .........................................................................................................................103

A01_MISH8859_12_GE_FM.indd 12 30/07/18 5:28 PM

Contents in Detail 13

Checks ...............................................................................................................................103

Electronic Payment .............................................................................................................104

E-Money ............................................................................................................................104

FYI Are We Headed for a Cashless Society? 105

APPLICATION Will Bitcoin Become the Money of the Future? ...............................105

Measuring Money .......................................................................................................................106

The Federal Reserve’s Monetary Aggregates ........................................................................106

Following the Financial News The Monetary Aggregates 107

FYI Where Are All the U.S. Dollars? 108

Summary 109 • Key Terms 110 • Questions 110 • Applied Problems 111 • Data Analysis

Problems 112 • Web Exercises 112 • Web References 112

PART 2 Financial Markets 113

CHAPTER 4

The Meaning of Interest Rates 114

Measuring Interest Rates ..........................................................................................................114

Present Value ......................................................................................................................114

APPLICATION Simple Present Value .........................................................................116

APPLICATION How Much Is That Jackpot Worth? ..................................................116

Four Types of Credit Market Instruments ...........................................................................117

Yield to Maturity.................................................................................................................118

APPLICATION Yield to Maturity on a Simple Loan ..................................................118

APPLICATION Yield to Maturity and the Yearly Payment on a Fixed-Payment Loan ..120

APPLICATION Yield to Maturity and Bond Price for a Coupon Bond .....................121

APPLICATION Yield to Maturity on a Perpetuity .....................................................123

APPLICATION Yield to Maturity on a Discount Bond ..............................................124

The Distinction Between Interest Rates and Returns ........................................................125

Global Negative Interest Rates? Japan First, Then the United States, Then Europe 126

Maturity and the Volatility of Bond Returns: Interest-Rate Risk ...........................................128

Summary ............................................................................................................................129

The Distinction Between Real and Nominal Interest Rates ............................................130

APPLICATION Calculating Real Interest Rates .........................................................131

Summary 133 • Key Terms 133 • Questions 133 • Applied Problems 134 • Data Analysis

Problems 135 • Web Exercises 135 • Web References 135

CHAPTER 4 APPENDIX

Measuring Interest-Rate Risk: Duration

Go to MyLab Economics: www.pearson.com/mylab/economics

A01_MISH8859_12_GE_FM.indd 13 30/07/18 5:28 PM

14 Contents in Detail

CHAPTER 5

The Behavior of Interest Rates 136

Determinants of Asset Demand ..............................................................................................136

Wealth ................................................................................................................................137

Expected Returns ...............................................................................................................137

Risk ....................................................................................................................................137

Liquidity ............................................................................................................................138

Theory of Portfolio Choice .................................................................................................138

Supply and Demand in the Bond Market ............................................................................139

Demand Curve ...................................................................................................................139

Supply Curve .....................................................................................................................140

Market Equilibrium ............................................................................................................141

Supply and Demand Analysis .............................................................................................142

Changes in Equilibrium Interest Rates ..................................................................................142

Shifts in the Demand for Bonds ..........................................................................................143

Shifts in the Supply of Bonds..............................................................................................146

APPLICATION Changes in the Interest Rate Due to a Change in

Expected Inflation: The Fisher Effect ..............................................................148

APPLICATION Changes in the Interest Rate Due to a Business Cycle Expansion ....150

APPLICATION Explaining Current Low Interest Rates in Europe, Japan,

and the United States: Low Inflation and Secular Stagnation ..........................151

Supply and Demand in the Market for Money:

The Liquidity Preference Framework ............................................................................152

Changes in Equilibrium Interest Rates in the Liquidity Preference Framework ........155

Shifts in the Demand for Money .........................................................................................155

Shifts in the Supply of Money.............................................................................................155

APPLICATION Changes in the Equilibrium Interest Rate Due to

Changes in Income, the Price Level, or the Money Supply..............................156

Changes in Income .............................................................................................................157

Changes in the Price Level ..................................................................................................157

Changes in the Money Supply ............................................................................................157

Money and Interest Rates .........................................................................................................158

APPLICATION Does a Higher Rate of Growth of the Money Supply

Lower Interest Rates?........................................................................................160

Summary 163 • Key Terms 163 • Questions 163 • Applied Problems 164 •

Data Analysis Problems 165 • Web Exercises 166 • Web References 166

CHAPTER 5 APPENDIX 1

Models of Asset Pricing

Go to MyLab Economics, www.pearson.com/mylab/economics

CHAPTER 5 APPENDIX 2

Applying the Asset Market Approach to a Commodity Market: The Case of Gold

Go to MyLab Economics, www.pearson.com/mylab/economics

A01_MISH8859_12_GE_FM.indd 14 28/08/18 2:31 PM

no reviews yet

Please Login to review.