259x Filetype PDF File size 1.59 MB Source: kamarajcollege.ac.in

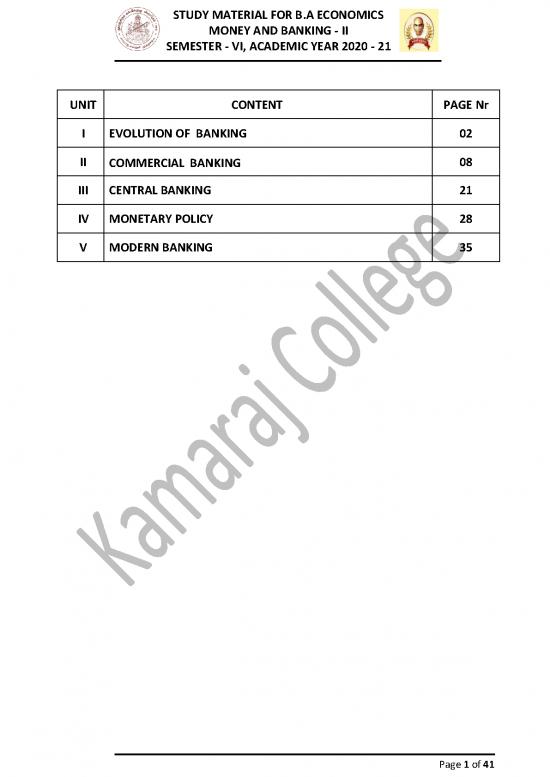

STUDY MATERIAL FOR B.A ECONOMICS

MONEY AND BANKING - II

SEMESTER - VI, ACADEMIC YEAR 2020 - 21

UNIT CONTENT PAGE Nr

I EVOLUTION OF BANKING 02

II COMMERCIAL BANKING 08

III CENTRAL BANKING 21

IV MONETARY POLICY 28

V MODERN BANKING 35

Page 1 of 41

STUDY MATERIAL FOR B.A ECONOMICS

MONEY AND BANKING - II

SEMESTER - VI, ACADEMIC YEAR 2020 - 21

UNIT - I

EVOLUTION OF BANKING

DEFINITION OF BANKING:

Banks are a very important part of the economy because they provide vital services for

both consumers and businesses. As financial service providers, they give you a safe place to

store your cash. Through a variety of account types such as checking and savings accounts,

and certificates of deposit (CDs), it helps to conduct routine banking transactions like deposits,

withdrawals, check writing, and bill payments. The money stored in most bank accounts is

federally insured by the Federal Deposit Insurance Corporation (FDIC)

Types of Banks:

Retail banks deal specifically with retail consumers. These banks offer services to the

general public and are also called personal or general banking institutions. Retail banks provide

services such as checking and savings accounts, loan and mortgage services, financing for

automobiles, and short-term loans like overdraft protection. Most retail banks also offer credit

card services to their customers, and may also supply their clients with foreign currency

exchange. These banks also cater to high-net-worth individuals, by giving them specialty

services such as private banking and wealth management. Examples of retail banks include TD

Bank and Citibank.

Commercial or corporate banks provide specialty services to their business clients from

small business owners to large, corporate entities. Along with day-to-day business banking,

these banks also provide their clients with other things such as credit services, cash

management, commercial real estate services, employer services, and trade finance. JPMorgan

Chase and Bank of America are two popular examples of commercial banks.

Investment banks focus on providing corporate clients with complex services and

financial transactions such as underwriting and assisting with merger and acquisition (M&A)

activity. As such, they are known primarily as financial intermediaries in most of these

transactions. Clients commonly range from large corporations, other financial institutions,

pension funds, governments, and hedge funds. Morgan Stanley and Goldman Sachs are

examples of U.S. investment banks.

Unlike the banks listed above, central banks are not market-based and don't deal

directly with the general public. Instead, they are primarily responsible for currency stability,

controlling inflation and monetary policy, and overseeing a country's money supply. They also

regulate the capital and reserve requirements of member banks. Some of the world's major

central banks include the U.S. Federal Reserve Bank, the European Central Bank, the Bank of

England, the Bank of Japan, the Swiss National Bank, and the People’s Bank of China.

Indian Banking System

Unit Bank is a type of bank under which the banking operations are carried by a single

branch with a single office and they limit their operations to a limited area. Normally, unit

banks may not have any branch or it may have one or two branches. This unit banking system

has its origin in United State of America (USA) and each unit bank has its own shareholders and

board of management.

According to Shapiro, Soloman and White,” An independent unit bank is a corporation

that operates one office and that is not related to other banks through either ownership or

Page 2 of 41

STUDY MATERIAL FOR B.A ECONOMICS

MONEY AND BANKING - II

SEMESTER - VI, ACADEMIC YEAR 2020 - 21

control.”

Advantages of Unit Banking:

Easy Management:

The management and control of unit banks is much easier and effective due to the small

size and operations of the banks. There are less chances of fraud and irregularities in the

financial management of the unit banks.

Localized Banking:

Unit banking is localized banking. The unit bank has the specialised knowledge of the

local problems and serves the requirements of the local people in a better manner than branch

banking. Since the bank officers of a unit bank are fully acquainted with the local needs, they

cannot neglect the requirements of local development.

Quick Decision:

A great advantage of unit banking is that there is no delay of any kind in taking decisions

on important problems concerning the unit bank.

No Monopolistic Tendencies:

Unit banks are generally of small size. Thus, there is no possibility of generating

monopolistic tendencies under unit banking system.

Promotes Regional Balance:

Under unit banking system, there is no transfer of resources from rural and backward

areas to the big industrial commercial centres. This tends to reduce regional in balance.

Initiative in Banking Business:

Unit banks have full knowledge of and greater involvement in the local problems. They

are in a position to take initiative to tackle these problems through financial help.

Flexibility in operation:

The unit banks are more flexible. The manager of the unit bank can use his discretion

and arrive at quick decision.

No Inefficient Branches:

Under unit banking system, weak and inefficient branches are automatically eliminated.

No protection is provided to such banks.

No diseconomies of Large Scale Operations:

Unit banking is free from the diseconomies and problems of large-scale operations

which are generally experienced by the branch banks.

Disadvantages of Unit Banking:

Limited Scope:

The scope of unit banking is limited. They do not get the benefits of large scale

operations.

No. Distribution of Risks:

Under unit banking, the bank operations are highly localized. Therefore, there is little

Page 3 of 41

STUDY MATERIAL FOR B.A ECONOMICS

MONEY AND BANKING - II

SEMESTER - VI, ACADEMIC YEAR 2020 - 21

possibility of distribution and diversification of risks in various areas and industries.

Inability to Face Crisis:

Limited resources of the unit banks also restrict their ability to face financial crisis. These

banks are not in a position to stand a sudden rush of withdrawals.

Lack of Specialization:

Unit banks, because of their small size, are not able to introduce, and get advantages of,

division of labor and specialization. Such banks cannot afford to employ highly trained and

specialized staff.

Operates only in urban areas and big towns:

Unit banks, because of their limits resources, cannot afford to open uneconomic

banking business is smaller towns and rural area. As such, these areas remain unbanked.

Costly Remittance of Funds:

A unit bank has no branches at other place. As a result, it has to depend upon the

correspondent banks for transfer of funds which is very expensive.

Difference in Interest Rates:

Since easy and cheap movement of does not exist under the unit banking system,

interest rates vary considerably at different places.

Local Pressures:

Since unit banks are highly localised in their business, local pressures and interferences

generally disrupt their normal functioning.

Undesirable Competition:

Unit banks are independently run by different managements. This results in undesirable

competition among different unit banks.

What Is Branch Banking?

Branch banking is the operation of storefront locations away from the institution's

home office for the convenience of customers.

In the U.S., branch banking has gone through significant changes since the 1980s in

response to a more competitive and consolidated financial services market. Most crucially,

since 1999 banks have been permitted to sell investments and insurance products as well as

banking services under the same roof.

More recent innovations including internet banking services and phone apps are

dramatically changing the banking landscape again.

Understanding Branch Banking

The Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 authorized well-

capitalized banks to acquire branch offices or open new ones anywhere in the United States,

including outside their home states. Most states had already passed laws enabling such

interstate branching.

Page 4 of 41

no reviews yet

Please Login to review.