262x Filetype PDF File size 1.50 MB Source: cdn.cboe.com

Options on MSCI EAFE (MXEA)

and EM (MXEF) Indexes

Tools to Manage Global Equity Exposure

U.S. Options

Options on MXEA and MXEF Indexes

Options on the MSCI® EAFE® (MXEA) and MSCI Emerging Markets (MXEF) indexes offer investors the potential opportunity to manage

global equity exposure, mitigate portfolio risk, and generate additional options premium income.

Key features of the index options include:

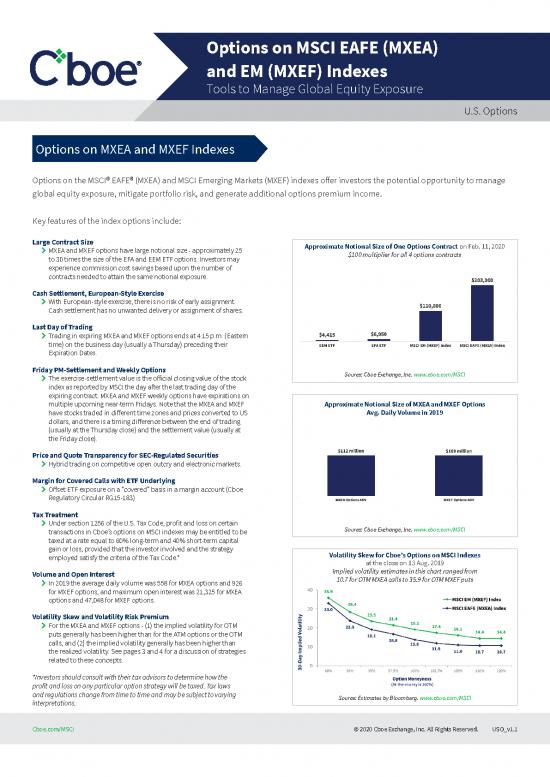

Large Contract Size Approximate Notional Size of One Options Contract on Feb. 11, 2020

MXEA and MXEF options have large notional size - approximately 25

> $100 multiplier for all 4 options contracts

to 30 times the size of the EFA and EEM ETF options. Investors may

experience commission cost savings based upon the number of

contracts needed to attain the same notional exposure.

Cash Settlement, European-Style Exercise

With European-style exercise, there is no risk of early assignment.

>

Cash settlement has no unwanted delivery or assignment of shares.

Last Day of Trading

Trading in expiring MXEA and MXEF options ends at 4:15 p.m. (Eastern

>

time) on the business day (usually a Thursday) preceding their

Expiration Dates.

Friday PM-Settlement and Weekly Options Source: Cboe Exchange, Inc. www.cboe.com/MSCI

The exercise-settlement value is the official closing value of the stock

>

index as reported by MSCI the day after the last trading day of the

expiring contract. MXEA and MXEF weekly options have expirations on

multiple upcoming near-term Fridays. Note that the MXEA and MXEF Approximate Notional Size of MXEA and MXEF Options

have stocks traded in different time zones and prices converted to US Avg. Daily Volume in 2019

dollars, and there is a timing difference between the end of trading

(usually at the Thursday close) and the settlement value (usually at

the Friday close).

Price and Quote Transparency for SEC-Regulated Securities

Hybrid trading on competitive open outcry and electronic markets.

>

Margin for Covered Calls with ETF Underlying

Offset ETF exposure on a “covered” basis in a margin account (Cboe

>

Regulatory Circular RG15-183)

Tax Treatment

Under section 1256 of the U.S. Tax Code, profit and loss on certain

> Source: Cboe Exchange, Inc. www.cboe.com/MSCI

transactions in Cboe’s options on MSCI indexes may be entitled to be

taxed at a rate equal to 60% long-term and 40% short-term capital

gain or loss, provided that the investor involved and the strategy Volatility Skew for Cboe’s Options on MSCI Indexes

employed satisfy the criteria of the Tax Code.* at the close on 13 Aug. 2019

Volume and Open Interest Implied volatility estimates in this chart ranged from

In 2019 the average daily volume was 558 for MXEA options and 926 10.7 for OTM MXEA calls to 35.9 for OTM MXEF puts

>

for MXEF options, and maximum open interest was 21,325 for MXEA

options and 47,048 for MXEF options.

Volatility Skew and Volatility Risk Premium

For the MXEA and MXEF options - (1) the implied volatility for OTM

>

puts generally has been higher than for the ATM options or the OTM

calls, and (2) the implied volatility generally has been higher than

the realized volatility. See pages 3 and 4 for a discussion of strategies

related to these concepts.

*Investors should consult with their tax advisors to determine how the

profit and loss on any particular option strategy will be taxed. Tax laws

and regulations change from time to time and may be subject to varying Source: Estimates by Bloomberg. www.cboe.com/MSCI

interpretations.

Cboe.com/MSCI © 2020 Cboe Exchange, Inc. All Rights Reserved. USO_v1.1

Options on MSCI EAFE (MXEA)

and EM (MXEF) Indexes

Tools to Manage Global Equity Exposure

Page 2 U.S. Options

MXEA and MXEF Stock Indexes

The MSCI EAFE® Index (ticker MXEA) is recognized as a pre-eminent benchmark in the United States to measure international equity

performance. It comprises the MSCI country indexes that represent developed markets in Europe, Australasia and the Far East.

The MSCI Emerging Markets Index (ticker MXEF) captures large- and mid-cap representation across 26 Emerging Markets (EM)

countries.

The MXEA and MXEF indexes experienced drawdowns and higher volatility during both February and December of 2018. During periods

of higher volatility, MXEA and MXEF options have the potential to hedge downside risk and generate more options premium income.

Global Stock Indexes and Implied Volatility

(Jan. 4, 2016 - Aug. 14, 2019). Daily closing values.

Sources: Bloomberg and Cboe Exchange, Inc. www.cboe.com/MSCI

In 2017, MSCI announced the first partial inclusion of China A shares in the MXEF Index.

Country Weights in MSCI EAFE® Index Country Weights in MSCI Emerging Markets Index (MXEF)

On 31 July 2019 the MSCI EAFE Index (MXEA) had a total market capitalization On 31 July 2019 the MXEF Index had a total capitalization of $5.43 trillion,

of $13.8 trillion, with 923 constituent stocks. Source: MSCI with 1,193 constituent stocks from 26 countries. Source: MSCI

Cboe.com/MSCI © 2020 Cboe Exchange, Inc. All Rights Reserved. USO_v1.1

Options on MSCI EAFE (MXEA)

and EM (MXEF) Indexes

Tools to Manage Global Equity Exposure

Page 3 U.S. Options

Strategies and Benchmark Indexes

Strategies Cboe’s options on MSCI indexes are designed to provide investors ways to efficiently gain exposure to the global equity

markets and execute risk management, hedging, asset allocation and income generation strategies. www.cboe.com/strategies

Some of the many index options strategies include:

“Low-cost” Combination Income Generation

Hedge Downside Hedging Iron Condors and Buy-Writes and

Protective Puts Collars and Iron Butterflies Cash-Secured Put-Writes

Put-Spread Collars

Implied Volatility Risk Premium (IVRP) The implied volatility generally has exceeded the subsequent realized volatility for MXEA

and MXEF index options.

30-Day Volatility for MSCI EAFE (MXEA) Index 30-Day Volatility for MSCI EM (MXEF) Index

The averages were higher for implied volatilities than for realized volatility The averages were higher for implied volatilities than for realized volatility

(Jan. 3, 2017 - July 2, 2019). Daily closing values. (Jan. 3, 2017 - July 2, 2019). Daily closing values.

Sources: Bloomberg estimates and Cboe Exchange, Inc. www.cboe.com/MSCI Sources: Bloomberg estimates and Cboe Exchange, Inc. www.cboe.com/MSCI

The IVRP has facilitated strong risk-adjusted returns by certain options-selling benchmark indexes (see below).

Benchmark Indexes In 2019, Cboe began dissemination of 12 new options-based strategy benchmark indexes that track the

performance of hypothetical strategies that sell covered MXEA or MXEF options every month:

Cboe MSCI Emerging Markets BuyWrite Index (BXEF) Cboe MSCI EAFE BuyWrite Index (BXEA)

> >

Cboe MSCI Emerging Markets 2% OTM BuyWrite Index (BYEF) Cboe MSCI EAFE 2% OTM BuyWrite Index (BYEA)

> >

Cboe MSCI Emerging Markets 20-Delta BuyWrite Index (BDEF) Cboe MSCI EAFE 20-Delta BuyWrite Index (BDEA)

> >

Cboe MSCI Emerging Markets PutWrite Index (PXEF) Cboe MSCI EAFE PutWrite Index (PXEA)

> >

Cboe MSCI Emerging Markets 2% OTM PutWrite Index (PYEF) Cboe MSCI EAFE 2% OTM PutWrite Index (PYEA)

> >

Cboe MSCI Emerging Markets 20-Delta PutWrite Index (PDEF) Cboe MSCI EAFE 20-Delta PutWrite Index (PDEA)

> >

Benchmark Indexes Since March 2006

BXEF and PXEF had higher returns and lower volatility than the two MSCI stock indexes

(March 31, 2006 - July 31, 2019)

Sources: Bloomberg and Cboe Exchange, Inc. Past performance is not predictive of future results. Please read important disclosures at www.cboe.com/benchmarks

Cboe.com/MSCI © 2020 Cboe Exchange, Inc. All Rights Reserved. USO_v1.1

Options on MSCI EAFE (MXEA)

and EM (MXEF) Indexes

Tools to Manage Global Equity Exposure

Page 4 U.S. Options

Higher Returns and Lower Volatility

Annualized Returns Standard Deviations

(March 31, 2006 - July 31, 2019) (March 31, 2006 - July 31, 2019)

BXEF and PXEF had higher returns than the other 4 indexes in this chart The 4 option-writing indexes had lower volatility than the 2 stock indexes

Less Severe Drawdowns and Higher Risk-Adjusted Returns The options-based BXEF and PXEF indexes had less severe

maximum drawdowns and higher risk-adjusted returns (as measured by the Sharpe and Sortino indexes) than the MSCI EAFE and EM

indexes.

Other Metrics for Six Benchmark Indexes

(March 31, 2006 - July 31, 2019) Maximum Drawdown Beta vs. S&P 500 Sharpe Ratio Sortino Ratio Skewness

(MAR = 0%)

BXEF - Cboe MSCI Emerging Markets BuyWrite Index -40.3% 0.80 0.36 0.59 -1.23

PXEF -Cboe MSCI Emerging Markets PutWrite Index -37.0% 0.67 0.35 0.57 -1.69

BXEA - Cboe MSCI EAFE BuyWrite Index -43.6% 0.73 0.13 0.26 -1.15

PXEA - Cboe MSCI EAFE PutWrite Index -38.4% 0.62 0.12 0.29 -1.55

MSCI Emerging Markets Index (US$) -61.6% 1.16 0.16 0.31 -0.5

MSCI EAFE Index (US$) -56.7% 1.04 0.12 0.26 -0.69

Sources: Zephyr StyleAdvisor and Cboe Exchange Inc.

Monthly Options Income

Monthly Gross Premiums for Cboe MSCI PutWrite Indexes

Gross amount* received as a % of the underlying

The average monthly gross premium received was 2.5% for PXEF and 1.8% for PXEA

(April 2008 - May 2019).

Source: Cboe Options Exchange.

*Please note that these are gross amounts, and the net returns usually were less (and could be negative) with an option-writing strategy. www.cboe.com/benchmarks

Please visit Cboe.com/MSCI for more details.

Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies are

available from your broker or from The Options Clearing Corporation, One North Wacker Drive, Suite 500, Chicago, Illinois 60606. The information in this document is provided solely for general

education and information purposes. No statement within this document should be construed as a recommendation to buy or sell a security or to provide investment advice. Supporting

documentation for any claims, comparisons, statistics or other technical data in this document is available from Cboe upon request. Visit www.cboe.com/MSCI for more information. Cboe®

and LEAPS® are registered trademarks of Cboe Exchange, Inc. MSCI and the MSCI index names are service marks of MSCI Inc. (“MSCI”) or its affiliates and have been licensed for use by Cboe.

Options contracts on any MSCI index (“Index Contracts”) are not sponsored, guaranteed or endorsed by MSCI, its affiliates or any other party involved in, or related to, making or compiling such

MSCI index. Neither MSCI, its affiliates nor any other party involved in, or related to, making or compiling any MSCI index makes any representations regarding the advisability of investing in such

Index Contracts. Neither MSCI, its affiliates nor any other party involved in, or related to, making or compiling any MSCI index makes any warranty, express or implied, or bears any liability as to

the results to be obtained by any person or any entity from the use of any such MSCI index or any data included therein. No purchaser, seller or holder of any Index Contract, or any other person

or entity, should use or refer to any MSCI trade name, trademark or service mark to sponsor, endorse, market or promote this security without first contacting MSCI to determine whether MSCI’s

permission is required. All other trademarks and service marks are the property of their respective owners. © 2020 Cboe Exchange, Inc. All Rights Reserved.

Cboe.com/MSCI © 2020 Cboe Exchange, Inc. All Rights Reserved. USO_v1.1

no reviews yet

Please Login to review.