240x Filetype XLSX File size 0.04 MB Source: www.vasynod.org

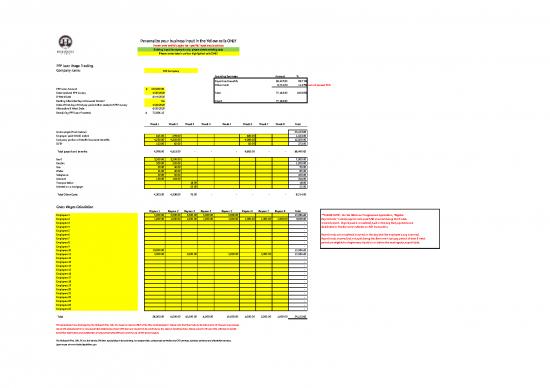

Personalize your business input in the Yellow cells ONLY

Hover over red triangles for specific input explanations

Existing input for example only, please delete existing data

Please enter data in yellow highlighted cells ONLY

PPP Loan Usage Tracking

Company name: XYZ Company

Spending Summary Amount %

Payroll and benefits 68,449.85 88.71%

Other Costs 8,714.00 11.29% cannot exceed 25%

PPP Loan Amount $ 150,000.00

Date received PPP money 4/20/2020 Total 77,163.85 100.00%

8 Week Date 6/14/2020

Electing Alternate Payroll Covered Period? Yes Check 77,163.85

Date of first day of first pay period after receipt of PPP money 4/26/2020

Alternative 8 Week Date 6/20/2020

Remaining PPP Loan Proceeds $ 72,836.15

Week 1 Week 2 Week 3 Week 4 Week 5 Week 6 Week 7 Week 8 Total

Gross wages (from below) 54,153.85

Employer paid 401(k) match 625.00 298.00 600.00 1,523.00

Company portion of health insurance benefits 4,250.00 4,250.00 4,000.00 12,500.00

SUTA 123.00 65.00 85.00 273.00

Total payroll and benefits 4,998.00 4,613.00 - - - 4,685.00 - - 68,449.85

Rent 3,500.00 3,500.00 7,000.00

Electric 500.00 550.00 1,050.00

Gas 50.00 40.00 90.00

Water 45.00 40.00 85.00

Telephone 50.00 50.00 100.00

Internet 158.00 158.00 316.00

Transportation 18.00 18.00

Interest on a mortgage 55.00 55.00

Total Other Costs 4,303.00 4,338.00 73.00 - - - - - 8,714.00

Gross Wages Calculation

Payrun 1 Payrun 2 Payrun 3 Payrun 4 Payrun 5 Payrun 6 Payrun 7 Payrun 8 Total

Employee 1 5,000.00 5,000.00 5,000.00 5,000.00 5,000.00 15,384.62 **PLEASE NOTE - Per the SBA Loan Foregiveness Application, "Eligible

Employee 2 1,000.00 1,000.00 1,000.00 1,000.00 1,000.00 1,000.00 1,000.00 1,000.00 8,000.00 Payroll Costs" include payroll costs paid AND incurred during the 8 week

Employee 3 - covered period. Payroll paid is considered paid on the day that paychecks are

Employee 4 - distributed or the Borrower initiates an ACH transaction.

Employee 5 -

Employee 6 - Payroll costs are considered incurred on the day that the employee's pay is earned.

Employee 7 - Payroll costs incurred but not paid during the Borrower's last pay period of their 8 week

Employee 8 - period are eligible for forgiveness if paid on or before the next regular payroll date.

Employee 9 -

Employee 10 18,000.00 15,384.62

Employee 11 4,000.00 4,000.00 4,000.00 4,000.00 15,384.62

Employee 12 -

Employee 13 -

Employee 14 -

Employee 15 -

Employee 16 -

Employee 17 -

Employee 18 -

Employee 19 -

Employee 20 -

Employee 21 -

Employee 22 -

Employee 23 -

Employee 24 -

Employee 25 -

Total 28,000.00 6,000.00 10,000.00 6,000.00 10,000.00 1,000.00 5,000.00 1,000.00 54,153.85

This spreadsheet was developed by The Hultquist Firm, CPA, PC, based on rules in effect at the time of development. Please note that final rules by the SBA and/or US Treasury may change.

Use of this spreadsheet in no way guarantees forgiveness of your PPP loan and should not be construed as tax, legal or banking advice. Please consult with your CPA, attorney or banker

for further information and clarification of rules surrounding PPP loans and the use of PPP loan proceeds.

The Hultquist Firm, CPA, PC is a full-service CPA firm specializing in tax planning, tax preparation, outsourced controller and CFO services, business advisory and attestation services.

Learn more at www.thehultquistfirm.com

no reviews yet

Please Login to review.