199x Filetype XLSX File size 0.06 MB Source: www.taxassist.co.za

Sheet 1: Monthly Income

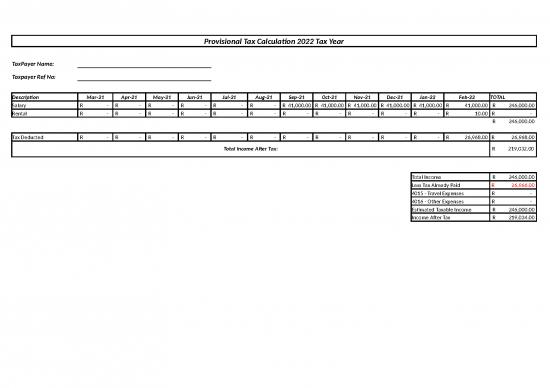

| Provisional Tax Calculation 2022 Tax Year | |||||||||||||

| TaxPayer Name: | |||||||||||||

| Taxpayer Ref No: | |||||||||||||

| Description | Mar-21 | Apr-21 | May-21 | Jun-21 | Jul-21 | Aug-21 | Sep-21 | Oct-21 | Nov-21 | Dec-21 | Jan-22 | Feb-22 | TOTAL |

| Salary | R - | R - | R - | R - | R - | R - | R 41,000.00 | R 41,000.00 | R 41,000.00 | R 41,000.00 | R 41,000.00 | R 41,000.00 | R 246,000.00 |

| Rental | R - | R - | R - | R - | R - | R - | R - | R - | R - | R - | R - | R 10.00 | R - |

| R 246,000.00 | |||||||||||||

| Tax Deducted | R - | R - | R - | R - | R - | R - | R - | R - | R - | R - | R - | R 26,968.00 | R 26,968.00 |

| Total Income After Tax: | R 219,032.00 | ||||||||||||

| Total Income | R 246,000.00 | ||||||||||||

| Less Tax Already Paid | R 26,966.00 | ||||||||||||

| 4015 - Travel Expenses | R - | ||||||||||||

| 4016 - Other Expenses | R - | ||||||||||||

| Estimated Taxable Income | R 246,000.00 | ||||||||||||

| Income After Tax | R 219,034.00 | ||||||||||||

| Vehicle Details | Tax year | 2022 | Expenses for the Production of Income | |||||||||||||

| Opening KM | 12000 | Private use of Cellphone Percentage | 20% | |||||||||||||

| Closing Km | 20000 | Rent Percentage use for Private | 90% | |||||||||||||

| Total Km | 8000 | Total m2 | 100 | |||||||||||||

| Business Km | 5000 | private use M2 | 90 | |||||||||||||

| % Business | 62.50% | |||||||||||||||

| Fuel / Oil / Parking / Toll | Insurance Vehicle | Maintanance & Repairs | Lease / HP | Bank Interest charges | Bank Charges | Cellular Phone | Entertainment | Internet Expenses | Marketing and Gifts | Postage and Stationary | Rent | Subscriptions / Education | Wages | Other | ||

| March | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| April | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| May | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| June | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| July | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| August | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| September | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| October | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| November | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| December | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| January | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| February | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| R 0.00 | R 0.00 | R 0.00 | R 0.00 | R 0.00 | R 0.00 | R 0.00 | R 0.00 | R 0.00 | R 0.00 | R 0.00 | R 0.00 | R 0.00 | R 0.00 | R 0.00 | ||

| Total Travel 4015 | R0.00 | Total Other 4016 | R0.00 | |||||||||||||

no reviews yet

Please Login to review.