290x Filetype XLSX File size 0.02 MB Source: www.exeter.ac.uk

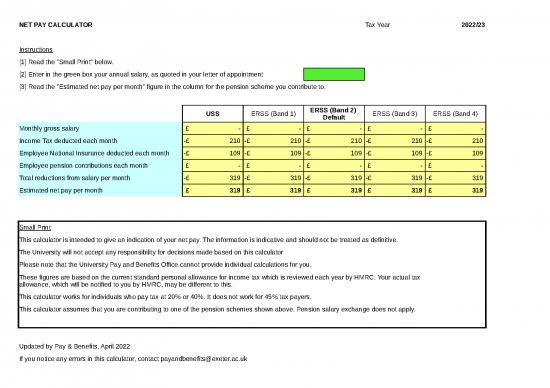

NET PAY CALCULATOR Tax Year 2022/23

Instructions

[1] Read the "Small Print" below.

[2] Enter in the green box your annual salary, as quoted in your letter of appointment

[3] Read the "Estimated net pay per month" figure in the column for the pension scheme you contribute to.

USS ERSS (Band 1) ERSS (Band 2) ERSS (Band 3) ERSS (Band 4)

Default

Monthly gross salary £ - £ - £ - £ - £ -

Income Tax deducted each month -£ 210 -£ 210 -£ 210 -£ 210 -£ 210

Employee National Insurance deducted each month -£ 109 -£ 109 -£ 109 -£ 109 -£ 109

Employee pension contributions each month £ - £ - £ - £ - £ -

Total reductions from salary per month -£ 319 -£ 319 -£ 319 -£ 319 -£ 319

Estimated net pay per month £ 319 £ 319 £ 319 £ 319 £ 319

Small Print

This calculator is intended to give an indication of your net pay. The information is indicative and should not be treated as definitive.

The University will not accept any responsibility for decisions made based on this calculator

Please note that the University Pay and Benefits Office cannot provide individual calculations for you.

These figures are based on the current standard personal allowance for income tax which is reviewed each year by HMRC. Your actual tax

allowance, which will be notified to you by HMRC, may be different to this.

This calculator works for individuals who pay tax at 20% or 40%. It does not work for 45% tax payers.

This calculator assumes that you are contributing to one of the pension schemes shown above. Pension salary exchange does not apply.

The "NIC" and "Income Tax" tabs are for calculation purposes only - you do not need to look at these!

Updated by Pay & Benefits, April 2022

If you notice any errors in this calculator, contact payandbenefits@exeter.ac.uk

N:\Pay and Grading\Oncosts and pay calculators

no reviews yet

Please Login to review.