226x Filetype XLSX File size 0.23 MB Source: www.excel-skills.com

Sheet 1: Instructions

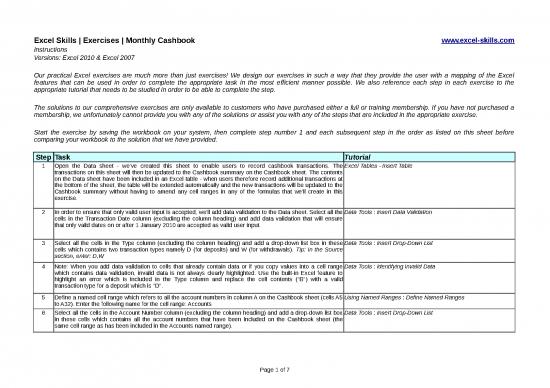

| Excel Skills | Exercises | Monthly Cashbook | www.excel-skills.com | |

| Instructions | ||

| Versions: Excel 2010 & Excel 2007 | ||

| Our practical Excel exercises are much more than just exercises! We design our exercises in such a way that they provide the user with a mapping of the Excel features that can be used in order to complete the appropriate task in the most efficient manner possible. We also reference each step in each exercise to the appropriate tutorial that needs to be studied in order to be able to complete the step. | ||

| The solutions to our comprehensive exercises are only available to customers who have purchased either a full or training membership. If you have not purchased a membership, we unfortunately cannot provide you with any of the solutions or assist you with any of the steps that are included in the appropriate exercise. | ||

| Start the exercise by saving the workbook on your system, then complete step number 1 and each subsequent step in the order as listed on this sheet before comparing your workbook to the solution that we have provided. | ||

| Step | Task | Tutorial |

| 1 | Open the Data sheet - we've created this sheet to enable users to record cashbook transactions. The transactions on this sheet will then be updated to the Cashbook summary on the Cashbook sheet. The contents on the Data sheet have been included in an Excel table - when users therefore record additional transactions at the bottom of the sheet, the table will be extended automatically and the new transactions will be updated to the Cashbook summary without having to amend any cell ranges in any of the formulas that we'll create in this exercise. | Excel Tables - Insert Table |

| 2 | In order to ensure that only valid user input is accepted, we'll add data validation to the Data sheet. Select all the cells in the Transaction Date column (excluding the column heading) and add data validation that will ensure that only valid dates on or after 1 January 2010 are accepted as valid user input. | Data Tools : Insert Data Validation |

| 3 | Select all the cells in the Type column (excluding the column heading) and add a drop-down list box in these cells which contains two transaction types namely D (for deposits) and W (for withdrawals). Tip: In the Source section, enter: D,W | Data Tools : Insert Drop-Down List |

| 4 | Note: When you add data validation to cells that already contain data or if you copy values into a cell range which contains data validation, invalid data is not always clearly highlighted. Use the built-in Excel feature to highlight an error which is included in the Type column and replace the cell contents ("B") with a valid transaction type for a deposit which is "D". | Data Tools : Identifying Invalid Data |

| 5 | Define a named cell range which refers to all the account numbers in column A on the Cashbook sheet (cells A5 to A32). Enter the following name for the cell range: Accounts | Using Named Ranges : Define Named Ranges |

| 6 | Select all the cells in the Account Number column (excluding the column heading) and add a drop-down list box in these cells which contains all the account numbers that have been included on the Cashbook sheet (the same cell range as has been included in the Accounts named range). | Data Tools : Insert Drop-Down List |

| 7 | Add conditional formatting to the same cell range in the Account Number column which will highlight all invalid account numbers (account numbers which are not included on the Cashbook sheet) with a red cell background and a white text colour. Tip: Select the formulas conditional formatting option and enter a formula which combines the ISNA and Match functions in order to determine whether the appropriate account number is included on the Cashbook sheet. | Conditional Formatting : Using Formulas |

| 8 | Our default data includes one invalid account number - change this account number to IS-100 and note how the conditional formatting is removed automatically. | Conditional Formatting : Using Formulas |

| 9 | Select all the cells in the Transaction Date column (excluding the column heading) and define the following name for the selected cell range: CBDate Tip: The Refers To section should contain the following structured cell reference: =Transact[Transaction Date] | Using Named Ranges : Define Named Ranges |

| 10 | Select all the cells in the Type column (excluding the column heading) and define the following name for the selected cell range: CBType | Using Named Ranges : Define Named Ranges |

| 11 | Select all the cells in the Amount column (excluding the column heading) and define the following name for the selected cell range: CBAmount | Using Named Ranges : Define Named Ranges |

| 12 | Select all the cells in the Account column (excluding the column heading) and define the following name for the selected cell range: CBAccount | Using Named Ranges : Define Named Ranges |

| 13 | We'll now include the named ranges that we've just defined in a single formula which can be used to calculate the monthly cashbook totals for each of the accounts that have been included on the Cashbook sheet. Select cell C5 on the Cashbook sheet and enter a SUMIFS formula which contains the following function arguments: | Statistical Functions : Sum Based on Multiple Criteria |

| 13.1 | Enter the CBAmount named range in the sum range function argument. | Statistical Functions : Sum Based on Multiple Criteria |

| 13.2 | Enter the CBDate named range in the first criteria range function argument. | Statistical Functions : Sum Based on Multiple Criteria |

| 13.3 | We now want to include all transactions with dates that are greater than or equal to the first day of the appropriate month. We therefore need to base the first criteria on a DATE function which is linked to the date in the month column heading and include an absolute row reference in the cell reference because we want to copy the formula to all the other rows as well. Tip: The first criteria should therefore be entered as: ">="&DATE(YEAR(C$4),MONTH(C$4),1) | Statistical Functions : Sum Based on Multiple Criteria |

| 13.4 | Also enter the CBDate named range in the second criteria range function argument. | Statistical Functions : Sum Based on Multiple Criteria |

| 13.5 | We now want to include all transactions with dates that are less than or equal to the last day of the appropriate month. We therefore need to base the second criteria on the date in the month column heading and include an absolute row reference in the cell reference because we want to copy the formula to all the other rows as well. Note that all the dates in the column heading row are month end dates which is why we are able to use only the cell reference without the need to convert the dates to month end dates. | Statistical Functions : Sum Based on Multiple Criteria |

| 13.6 | The transactions on the Data sheet include positive values for both deposits and withdrawals. We therefore need to deduct the withdrawal totals from the deposit totals in order to calculate a net total. We therefore need to include the transaction type as a criteria range - enter the named range that refers to this column in the next function argument (CBType). | Statistical Functions : Sum Based on Multiple Criteria |

| 13.7 | Enter the following criteria in order to include only deposit type transactions: "D" | Statistical Functions : Sum Based on Multiple Criteria |

| 13.8 | The cashbook summary is compiled for each account number and we therefore also need to specify the account number named range as a criteria range in the next function argument (you therefore need to enter the CBAccount named range in the next function argument). | Statistical Functions : Sum Based on Multiple Criteria |

| 13.9 | The criteria for the account number needs to refer to the account number in column A and you need to use an absolute column reference because the formula will be copied to all the other monthly columns as well. | Statistical Functions : Sum Based on Multiple Criteria |

| 14 | The SUMIFS formula that we've just entered includes all deposit type transactions but we also need to deduct all withdrawal type transactions from the total that we just calculated. Copy the SUMIFS formula that you just entered, add a minus sign after the closing bracket of the function and paste the copied formula (the function result should therefore be a nil value). | Edit Data : Edit Data |

| 15 | In the second SUMIFS function arguments, change the transaction type from "D" to "W" (the transaction type is specified in the criteria 3 function argument just after the CBType named range). | Edit Data : Edit Data |

| 16 | Copy the formula in cell C5 to all the cells that require a monthly cashbook total (the cell range from cell C5 to cell N32. | Copy & Paste Data : Paste Cells (normal) |

| 17 | Select cell O5 and use the Auto Sum feature to add an annual total in row 5 on the Cashbook sheet. Copy the formula in this cell to all the rows that contain an account number in column A. | Copy & Paste Data : Paste Cells (normal) |

| 18 | Select cell C33 and use the Auto Sum feature to add a monthly total in row 33 for the first month that is included on the Cashbook sheet. Copy the formula in this cell to all the cells in row 33 which require a total (column C to O). | Copy & Paste Data : Paste Cells (normal) |

| 19 | Select cell C5 and copy the formula in this cell to cell C35. | Copy & Paste Data : Paste Formulas |

| 20 | The opening cashbook balance in the first month that is included on the cashbook summary needs to be based on all transactions with dates that are before the first day of this month. The SUMIFS formula that has been copied into cell C35 therefore needs to be amended as follows: | Statistical Functions : Sum Based on Multiple Criteria |

| 20.1 | Change the mathematical operator in the criteria 1 function argument (third function argument) from greater than or equal to (">=") to less than ("<"). | Statistical Functions : Sum Based on Multiple Criteria |

| 20.2 | Remove the criteria range 2 (CBDate) and criteria 2 ("<="&C$4) function arguments. | Statistical Functions : Sum Based on Multiple Criteria |

| 20.3 | Also remove the criteria range 4 (CBAccount) and criteria 4 ($A35) function arguments. | Statistical Functions : Sum Based on Multiple Criteria |

| 20.4 | Apply the same changes to the second SUMIFS function that is included in the formula in cell C35. | Edit Data : Edit Data |

| 21 | Select cell C37 and enter a formula which adds the opening cashbook balance in cell C35 to the monthly cashbook total in cell C33. Copy this formula to all the other columns including the Total column (columns D to O). | Copy & Paste Data : Paste Cells (normal) |

| 22 | Select cell D35 and link the cell to the closing cashbook balance of the previous month (cell C37). | Formulas & Links : Create a Link |

| 23 | Copy the formula in cell D35 to all the other columns except for the Total column (columns E to N). | Copy & Paste Data : Paste Cells (normal) |

| 24 | Select cell O35 and link the cell to cell C35. The opening cashbook balance in the Total column therefore needs to be linked to the opening cashbook balance of the first month and the closing cashbook balance in the Total column should therefore agree to the closing cashbook balance of the last month (Feb-2012). | Formulas & Links : Create a Link |

| 25 | Save the workbook and compare your workbook to the solution that we've provided. | |

| Example Limited | ||||||

| Cashbook Transactions | ||||||

| Transaction Date | Type | Customer / Supplier | Reference | Description | Amount | Account Number |

| 2/28/2011 | D | Opening | O/B | Opening Bank Statement Balance | 3,400.00 | IS-100 |

| 3/2/2011 | W | XY Solutions | Invoice EXP09 | Internet Service Provider | 165.30 | IS-380 |

| 3/5/2011 | W | Hollard | Debit Order | Insurance | 364.80 | IS-340 |

| 3/10/2011 | D | WS Wholesale | INV0052 | Consulting Services | 17,100.00 | IS-100 |

| 3/15/2011 | W | ABSA | Bank Statement | Service Fees | 57.00 | IS-315 |

| 3/26/2011 | W | Payroll | Payroll | Salaries | 8,000.00 | IS-365 |

| 3/26/2011 | W | PR Properties | Debit Order | Rent | 5,700.00 | IS-350 |

| 3/26/2011 | W | SQ Financial Services | Debit Order | Interest paid | 100.00 | IS-500 |

| 3/31/2011 | W | XY Solutions | Invoice EXP10 | Internet Service Provider | 165.30 | IS-380 |

| 4/2/2011 | W | IAS Accountants | Invoice | Bookkeeping | 912.00 | IS-305 |

| 4/5/2011 | W | Hollard | Debit Order | Insurance | 364.80 | IS-340 |

| 4/10/2011 | B | Waltons | Invoice | Paper | 228.00 | IS-325 |

| 4/13/2011 | D | GP Accountants | INV0054 | Consulting Services | 9,291.00 | IS-150 |

| 4/14/2011 | D | TRF Solutions | INV0053 | Consulting Services | 12,768.00 | IS-100 |

| 4/15/2011 | W | ABSA | Bank Statement | Service Fees | 57.00 | IS-315 |

| 4/24/2011 | W | Waltons | Invoice | Paper | 228.00 | IS-325 |

| 4/26/2011 | W | Payroll | Payroll | Salaries | 8,000.00 | IS-365 |

| 4/26/2011 | W | PR Properties | Debit Order | Rent | 5,700.00 | IS-350 |

| 4/26/2011 | W | SQ Financial Services | Debit Order | Interest paid | 100.00 | IS-500 |

| 4/27/2011 | D | WC Financial Advisors | INV0056 | Taxation Services | 7,980.00 | IS-100 |

| 4/27/2011 | D | WC Financial Advisors | INV0056 | Accounting Services | 3,762.00 | IS-100 |

| 4/27/2011 | D | WC Financial Advisors | INV0056 | Consulting Services | 37,777.32 | IS-100 |

| 5/1/2011 | W | XY Solutions | Invoice EXP11 | Internet Service Provider | 165.30 | IS-380 |

| 5/3/2011 | W | IAS Accountants | Invoice | Bookkeeping | 912.00 | IS-305 |

| 5/5/2011 | W | Hollard | Debit Order | Insurance | 364.80 | IS-340 |

| 5/8/2011 | D | ABC Limited | INV0055 | Accounting Services | 17,100.00 | IS-100 |

| 5/8/2011 | W | Waltons | Invoice | Paper | 228.00 | IS-325 |

| 5/15/2011 | W | ABSA | Bank Statement | Service Fees | 57.00 | IS-315 |

| 5/22/2011 | W | PQW Parking | TR5674 | Parking | 641.82 | IS-390 |

| 5/22/2011 | W | Waltons | Invoice | Paper | 228.00 | IS-325 |

| 5/26/2011 | W | Payroll | Payroll | Salaries | 13,000.00 | IS-365 |

| 5/26/2011 | W | PR Properties | Debit Order | Rent | 5,700.00 | IS-350 |

| 5/26/2011 | W | SQ Financial Services | Debit Order | Interest paid | 100.00 | IS-500 |

| 5/27/2011 | D | LS Retail | X9987 | Commission Received | 5,962.20 | IS-200 |

| 5/31/2011 | W | XY Solutions | Invoice EXP12 | Internet Service Provider | 165.30 | IS-380 |

| 6/2/2011 | W | IAS Accountants | Invoice | Bookkeeping | 912.00 | IS-305 |

| 6/5/2011 | W | Hollard | Debit Order | Insurance | 364.80 | IS-340 |

| 6/5/2011 | W | Waltons | Invoice | Paper | 228.00 | IS-325 |

| 6/10/2011 | D | SQ Financial Services | Statement | Loan Received | 8,100.00 | BS-700 |

| 6/11/2011 | D | XX Building Supplies | INV0057 | Accounting Services | 4,560.00 | IS-100 |

| 6/15/2011 | W | ABSA | Bank Statement | Service Fees | 57.00 | IS-315 |

| 6/15/2011 | W | Finance Week | Bank Statement | Annual Subscription | 1,368.00 | IS-375 |

| 6/19/2011 | W | Waltons | Invoice | Paper | 228.00 | IS-325 |

| 6/25/2011 | W | XR Supplies | Invoice | Computer equipment | 5,700.00 | BS-100 |

| 6/26/2011 | W | Payroll | Payroll | Salaries | 13,000.00 | IS-365 |

| 6/26/2011 | W | PR Properties | Debit Order | Rent | 5,700.00 | IS-350 |

| 6/26/2011 | W | SQ Financial Services | Debit Order | Capital repayment | 220.00 | BS-700 |

| 6/26/2011 | W | SQ Financial Services | Debit Order | Interest paid | 100.00 | IS-500 |

| 6/26/2011 | D | TRF Solutions | INV0058 | Accounting Services | 15,276.00 | IS-100 |

| 7/1/2011 | D | WW Retail | INV0059 | Taxation Services | 5,130.00 | IS-100 |

| 7/1/2011 | W | XY Solutions | Invoice EXP13 | Internet Service Provider | 165.30 | IS-380 |

| 7/3/2011 | W | IAS Accountants | Invoice | Bookkeeping | 912.00 | IS-305 |

| 7/3/2011 | W | Waltons | Invoice | Paper | 250.17 | IS-325 |

| 7/5/2011 | W | Hollard | Debit Order | Insurance | 364.80 | IS-340 |

| 7/11/2011 | W | PQW Parking | TR5982 | Parking | 229.14 | IS-390 |

| 7/15/2011 | W | ABSA | Bank Statement | Service Fees | 57.00 | IS-315 |

| 7/17/2011 | W | SPAR | IN1123 | Consumables | 111.72 | IS-325 |

| 7/23/2011 | D | DF Manufacturing | INV0060 | Accounting Services | 3,192.00 | IS-100 |

| 7/26/2011 | W | Payroll | Payroll | Salaries | 13,000.00 | IS-365 |

| 7/26/2011 | W | PR Properties | Debit Order | Rent | 5,700.00 | IS-350 |

| 7/26/2011 | W | SQ Financial Services | Debit Order | Capital repayment | 220.00 | BS-700 |

| 7/26/2011 | W | SQ Financial Services | Debit Order | Interest paid | 100.00 | IS-500 |

| 7/31/2011 | D | DF Manufacturing | INV0062 | Consulting Services | 25,080.00 | IS-100 |

| 7/31/2011 | W | XY Solutions | Invoice EXP14 | Internet Service Provider | 165.30 | IS-380 |

| 8/2/2011 | W | IAS Accountants | Invoice | Bookkeeping | 912.00 | IS-305 |

| 8/4/2011 | D | Digicom | INV0061 | Consulting Services | 36,480.00 | IS-100 |

| 8/5/2011 | W | Hollard | Debit Order | Insurance | 364.80 | IS-340 |

| 8/15/2011 | W | ABSA | Bank Statement | Service Fees | 57.00 | IS-315 |

| 8/26/2011 | W | Payroll | Payroll | Salaries | 13,000.00 | IS-365 |

| 8/26/2011 | W | PR Properties | Debit Order | Rent | 5,700.00 | IS-350 |

| 8/26/2011 | W | SQ Financial Services | Debit Order | Capital repayment | 220.00 | BS-700 |

| 8/26/2011 | W | SQ Financial Services | Debit Order | Interest paid | 100.00 | IS-500 |

| 8/27/2011 | W | MM Brokers | O/B S77782 | Investment in Shares | 5,100.00 | BS-200 |

| 8/30/2011 | W | PQW Parking | TR6290 | Parking | 202.92 | IS-390 |

| 8/31/2011 | W | XY Solutions | Invoice EXP15 | Internet Service Provider | 204.06 | IS-380 |

| 9/2/2011 | W | IAS Accountants | Invoice | Bookkeeping | 912.00 | IS-305 |

| 9/3/2011 | D | FS Financial Services | INV0063 | Consulting Services | 26,220.00 | IS-100 |

| 9/5/2011 | W | Hollard | Debit Order | Insurance | 364.80 | IS-340 |

| 9/6/2011 | W | RT Office Supplies | T2518536 | Office chair | 1,821.72 | IS-345 |

| 9/12/2011 | D | PTY Consultants | INV0064 | Consulting Services | 13,680.00 | IS-100 |

| 9/15/2011 | W | ABSA | Bank Statement | Service Fees | 57.00 | IS-315 |

| 9/21/2011 | W | Town Council | Statement | Rates | 4,752.00 | IS-395 |

| 9/26/2011 | W | Payroll | Payroll | Salaries | 13,000.00 | IS-365 |

| 9/26/2011 | W | PR Properties | Debit Order | Rent | 5,700.00 | IS-350 |

| 9/26/2011 | W | SQ Financial Services | Debit Order | Capital repayment | 220.00 | BS-700 |

| 9/26/2011 | W | SQ Financial Services | Debit Order | Interest paid | 100.00 | IS-500 |

| 10/1/2011 | W | XY Solutions | Invoice EXP16 | Internet Service Provider | 204.06 | IS-380 |

| 10/3/2011 | W | IAS Accountants | Invoice | Bookkeeping | 912.00 | IS-305 |

| 10/4/2011 | W | SPAR | IN1145 | Consumables | 59.28 | IS-325 |

| 10/5/2011 | W | Hollard | Debit Order | Insurance | 364.80 | IS-340 |

| 10/9/2011 | D | IT Solutions | INV0065 | Consulting Services | 20,520.00 | IS-100 |

| 10/15/2011 | W | ABSA | Bank Statement | Service Fees | 57.00 | IS-315 |

| 10/19/2011 | W | PQW Parking | TR6598 | Parking | 3,420.00 | IS-390 |

| 10/21/2011 | D | DF Manufacturing | INV0066 | Consulting Services | 15,390.00 | IS-100 |

| 10/26/2011 | W | Payroll | Payroll | Salaries | 13,000.00 | IS-365 |

| 10/26/2011 | W | PR Properties | Debit Order | Rent | 5,700.00 | IS-350 |

| 10/26/2011 | W | SQ Financial Services | Debit Order | Capital repayment | 220.00 | BS-700 |

| 10/26/2011 | W | SQ Financial Services | Debit Order | Interest paid | 100.00 | IS-500 |

| 10/31/2011 | W | XY Solutions | Invoice EXP17 | Internet Service Provider | 204.06 | IS-380 |

| 11/2/2011 | W | GF Training | Invoice | Course | 769.50 | IS-385 |

| 11/2/2011 | W | IAS Accountants | Invoice | Bookkeeping | 912.00 | IS-305 |

| 11/3/2011 | D | GP Accountants | INV0067 | Accounting Services | 3,762.00 | IS-100 |

| 11/3/2011 | D | GP Accountants | INV0067 | Taxation Services | 2,451.00 | IS-100 |

| 11/3/2011 | D | GP Accountants | INV0067 | Secretarial Services | 1,026.00 | IS-100 |

| 11/5/2011 | W | Hollard | Debit Order | Insurance | 364.80 | IS-340 |

| 11/7/2011 | W | Economist | 628054 | Subscription | 516.71 | IS-375 |

| 11/15/2011 | W | ABSA | Bank Statement | Service Fees | 57.00 | IS-315 |

| 11/26/2011 | W | Payroll | Payroll | Salaries | 13,000.00 | IS-365 |

| 11/26/2011 | W | PR Properties | Debit Order | Rent | 5,700.00 | IS-350 |

| 11/26/2011 | W | SQ Financial Services | Debit Order | Capital repayment | 220.00 | BS-700 |

| 11/26/2011 | W | SQ Financial Services | Debit Order | Interest paid | 100.00 | IS-500 |

| 11/30/2011 | D | CC Supplies | INV0068 | Accounting Services | 3,762.00 | IS-100 |

| 12/1/2011 | W | XY Solutions | Invoice EXP18 | Internet Service Provider | 204.06 | IS-380 |

| 12/3/2011 | W | IAS Accountants | Invoice | Bookkeeping | 912.00 | IS-305 |

| 12/5/2011 | W | Hollard | Debit Order | Insurance | 364.80 | IS-340 |

| 12/5/2011 | D | TRF Solutions | INV0069 | Consulting Services | 17,100.00 | IS-100 |

| 12/8/2011 | W | PQW Parking | TR6906 | Parking | 228.00 | IS-390 |

| 12/15/2011 | W | ABSA | Bank Statement | Service Fees | 57.00 | IS-315 |

| 12/22/2011 | W | SPAR | IN1149 | Consumables | 59.28 | IS-325 |

| 12/26/2011 | W | Payroll | Payroll | Salaries | 13,000.00 | IS-365 |

| 12/26/2011 | W | PR Properties | Debit Order | Rent | 5,700.00 | IS-350 |

| 12/26/2011 | W | SQ Financial Services | Debit Order | Capital repayment | 220.00 | BS-700 |

| 12/26/2011 | W | SQ Financial Services | Debit Order | Interest paid | 100.00 | IS-500 |

| 12/30/2011 | D | ABC Limited | INV0070 | Consulting Services | 16,986.00 | IS-100 |

| 12/31/2011 | W | XY Solutions | Invoice EXP19 | Internet Service Provider | 204.06 | IS-380 |

| 1/2/2012 | W | IAS Accountants | Invoice | Bookkeeping | 912.00 | IS-305 |

| 1/4/2012 | D | EC Estate Agents | INV0071 | Taxation Services | 9,311.52 | IS-100 |

| 1/5/2012 | W | Hollard | Debit Order | Insurance | 387.60 | IS-340 |

| 1/15/2012 | W | ABSA | Bank Statement | Service Fees | 57.00 | IS-315 |

| 1/25/2012 | D | DF Manufacturing | O/B INV0051 | Consulting Services | 9,120.00 | IS-100 |

| 1/25/2012 | D | The Paint Shop | INV0072 | Taxation Services | 2,793.00 | IS-100 |

| 1/26/2012 | W | Payroll | Payroll | Salaries | 13,000.00 | IS-365 |

| 1/26/2012 | W | PR Properties | Debit Order | Rent | 5,700.00 | IS-350 |

| 1/26/2012 | D | PTY Consultants | INV0074 | Consulting Services | 21,888.00 | IS-100 |

| 1/26/2012 | W | SQ Financial Services | Debit Order | Capital repayment | 220.00 | BS-700 |

| 1/26/2012 | W | SQ Financial Services | Debit Order | Interest paid | 100.00 | IS-500 |

| 1/27/2012 | W | Qantas | SA8234 | Travel | 1,273.38 | IS-390 |

| 1/27/2012 | D | WW Retail | INV0073 | Consulting Services | 20,520.00 | IS-100 |

| 1/31/2012 | W | XY Solutions | Invoice EXP20 | Internet Service Provider | 204.06 | IS-380 |

| 2/2/2012 | W | IAS Accountants | Invoice | Bookkeeping | 912.00 | IS-305 |

| 2/5/2012 | W | Hollard | Debit Order | Insurance | 387.60 | IS-340 |

| 2/15/2012 | W | ABSA | Bank Statement | Service Fees | 57.00 | IS-315 |

| 2/17/2012 | W | SPAR | IN1156 | Consumables | 111.72 | IS-325 |

| 2/18/2012 | D | WS Wholesale | INV0075 | Consulting Services | 19,365.18 | IS-100 |

| 2/26/2012 | W | Payroll | Payroll | Salaries | 13,000.00 | IS-365 |

| 2/26/2012 | W | PR Properties | Debit Order | Rent | 5,700.00 | IS-350 |

| 2/26/2012 | W | SQ Financial Services | Debit Order | Capital repayment | 220.00 | BS-700 |

| 2/26/2012 | W | SQ Financial Services | Debit Order | Interest paid | 100.00 | IS-500 |

| 2/28/2012 | W | XY Solutions | Invoice EXP21 | Internet Service Provider | 351.12 | IS-380 |

no reviews yet

Please Login to review.