235x Filetype XLSX File size 0.15 MB Source: wbpay.in

Sheet 1: Home

| ALL IN ONE INCOME TAX CALCULATOR 2019-20 | ||||||||||||||||

| Click here to visit www.wbpay.in | Email us: admin@wbpay.in | |||||||||||||||

| Details of Financial Year | How to use this utility? (Video: /wbifmshelp) | |||||||||||||||

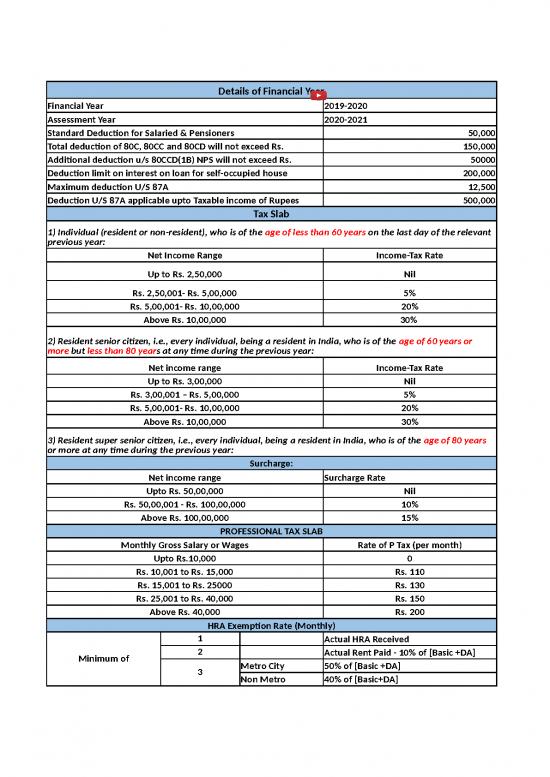

| Financial Year | 2019-2020 | Individual Use (for Employee/ Pensioners): | ||||||||||||||

| Assessment Year | 2020-2021 | |||||||||||||||

| Standard Deduction for Salaried & Pensioners | 50,000 | |||||||||||||||

| Total deduction of 80C, 80CC and 80CD will not exceed Rs. | 150,000 | |||||||||||||||

| Additional deduction u/s 80CCD(1B) NPS will not exceed Rs. | 50000 | |||||||||||||||

| Deduction limit on interest on loan for self-occupied house | 200,000 | |||||||||||||||

| Maximum deduction U/S 87A | 12,500 | |||||||||||||||

| Deduction U/S 87A applicable upto Taxable income of Rupees | 500,000 | |||||||||||||||

| Tax Slab | ||||||||||||||||

| 1) Individual (resident or non-resident), who is of the age of less than 60 years on the last day of the relevant previous year: | Office use for (Employer): | |||||||||||||||

| Net Income Range | Income-Tax Rate | |||||||||||||||

| Up to Rs. 2,50,000 | Nil | |||||||||||||||

| Rs. 2,50,001- Rs. 5,00,000 | 5% | |||||||||||||||

| Rs. 5,00,001- Rs. 10,00,000 | 20% | |||||||||||||||

| Above Rs. 10,00,000 | 30% | |||||||||||||||

| 2) Resident senior citizen, i.e., every individual, being a resident in India, who is of the age of 60 years or more but less than 80 years at any time during the previous year: | ||||||||||||||||

| Net income range | Income-Tax Rate | What are the uses of this utility? | ||||||||||||||

| Up to Rs. 3,00,000 | Nil | 1) A salaried individual (Employee/Pensioner) can calculate his/her income tax liability. | ||||||||||||||

| Rs. 3,00,001 – Rs. 5,00,000 | 5% | 2) Both individuals and senior citizens can use this utility. | ||||||||||||||

| Rs. 5,00,001- Rs. 10,00,000 | 20% | 3) Individual/ Senior citizens can generate yearly salary statements. | ||||||||||||||

| Above Rs. 10,00,000 | 30% | 4) User can also print Salary Statement, Computation details, HRA rebate details. | ||||||||||||||

| 3) Resident super senior citizen, i.e., every individual, being a resident in India, who is of the age of 80 years or more at any time during the previous year: | 5) An employer can use this utility to generate Form 16. | |||||||||||||||

| Surcharge: | ||||||||||||||||

| Net income range | Surcharge Rate | Some important note about FY 2019-20, AY 2020-21 | ||||||||||||||

| Upto Rs. 50,00,000 | Nil | 1) Standard deduction for all salaried individuals and pensioners is Rs. 50000/- | ||||||||||||||

| Rs. 50,00,001 - Rs. 100,00,000 | 10% | 2) Medical Reimbursement and Conveyance/Transport Allowance is included in the standard deduction and can not be claimed separately. | ||||||||||||||

| Above Rs. 100,00,000 | 15% | |||||||||||||||

| Social: | PROFESSIONAL TAX SLAB | 3) Total admissible deduction u/s 80C is Rs. 150000/- | ||||||||||||||

| Monthly Gross Salary or Wages | Rate of P Tax (per month) | 4) Exemption of Savings Bank Interest [u/s 80TTA] is upto Rs. 10000/- | ||||||||||||||

| GROUP: WBIFMS HELP | Upto Rs.10,000 | 0 | 5) u/s 80TTA is not applicable for Senior Citizen from FY 2018-19. From FY 2018-19 a new section 80TTB is introduced for senior citizens only. Section 80TTB can be applied in case of savings accounts, term deposits, fixed deposits or recurring deposits. | |||||||||||||

| Rs. 10,001 to Rs. 15,000 | Rs. 110 | |||||||||||||||

| Rs. 15,001 to Rs. 25000 | Rs. 130 | |||||||||||||||

| Rs. 25,001 to Rs. 40,000 | Rs. 150 | 6) Senior citizens can claim the exemption on upto Rs. 50000/- under section 80TTB. | ||||||||||||||

| About: | Above Rs. 40,000 | Rs. 200 | 7) Mediclaim Insurance Premium for self, spouse, children [u/s 80D] can be claimed upto Rs 25000/- for age below 60 years and upto Rs 50000 for above 60 years of age. | |||||||||||||

| I TAX 19-20 | HRA Exemption Rate (Monthly) | |||||||||||||||

| Version: 0.1 (Beta) | Minimum of | 1 | Actual HRA Received | 8) Mediclaim Insurance Premium for parents [u/s 80D] can be claimed upto Rs 25000/- for age below 60 years and upto Rs 50000 for above 60 years of age. | ||||||||||||

| Developer: | 2 | Actual Rent Paid - 10% of [Basic +DA] | ||||||||||||||

| WBPAY.IN Team | 3 | Metro City | 50% of [Basic +DA] | |||||||||||||

| © www.wbpay.in | Non Metro | 40% of [Basic+DA] | ||||||||||||||

| SALARY ENTRY SHEET | ||||||||||||||||||||||||||

| Click here to visit www.wbpay.in | Please fill Yellow cells only, other cells are also editable | Email us: admin@wbpay.in | ||||||||||||||||||||||||

| Months | Rate of DA | Rate of NPA | Band Pay | Grade Pay | Basic Pay | N.P.P./ N.P.A. | D.A. | M.A. | H.R.A. | Other Allowances | Recovery of Overdrawal | Recovery of Festival Advance | GROSS SALARY | DEDUCTIONS | NET SALARY | |||||||||||

| Total Amount | Exempted amount | G.P.F./P.F | G.I.S. | P.TAX | I.TAX | |||||||||||||||||||||

| Subscription | Refund | |||||||||||||||||||||||||

| Mar-19 | 125 | 25 | 19680 | 5400 | 25080 | 6270 | 39188 | 0 | 4703 | 400 | 0 | 0 | 0 | 75641 | 20000 | 0 | 80 | 200 | 1000 | 54361 | ||||||

| Apr-19 | 125 | 25 | 19680 | 5400 | 25080 | 6270 | 39188 | 0 | #NAME? | 400 | 0 | 0 | 0 | #NAME? | 20000 | 0 | 80 | #NAME? | 1000 | #NAME? | ||||||

| May-19 | 125 | 25 | 19680 | 5400 | 25080 | 6270 | 39188 | 0 | #NAME? | 400 | 0 | 0 | 0 | #NAME? | 20000 | 0 | 80 | #NAME? | 1000 | #NAME? | ||||||

| Jun-19 | 125 | 25 | 19680 | 5400 | 25080 | 6270 | 39188 | 0 | #NAME? | 400 | 0 | 0 | 0 | #NAME? | 20000 | 0 | 80 | #NAME? | 1000 | #NAME? | ||||||

| Jul-19 | 125 | 25 | 20440 | 5400 | 25840 | 6460 | 40375 | 0 | #NAME? | 400 | 0 | 0 | 0 | #NAME? | 20000 | 0 | 80 | #NAME? | 1000 | #NAME? | ||||||

| Aug-19 | 125 | 25 | 20440 | 5400 | 25840 | 6460 | 40375 | 0 | #NAME? | 400 | 0 | 0 | 0 | #NAME? | 20000 | 0 | 80 | #NAME? | 2000 | #NAME? | ||||||

| Sep-19 | 125 | 25 | 20440 | 5400 | 25840 | 6460 | 40375 | 0 | #NAME? | 400 | 0 | 0 | 0 | #NAME? | 20000 | 0 | 80 | #NAME? | 2000 | #NAME? | ||||||

| Oct-19 | 125 | 25 | 20440 | 5400 | 25840 | 6460 | 40375 | 0 | #NAME? | 400 | 0 | 0 | 0 | #NAME? | 20000 | 0 | 80 | #NAME? | 2000 | #NAME? | ||||||

| Nov-19 | 125 | 25 | 20440 | 5400 | 25840 | 6460 | 40375 | 0 | #NAME? | 400 | 0 | 0 | 0 | #NAME? | 20000 | 0 | 80 | #NAME? | 2000 | #NAME? | ||||||

| Dec-19 | 125 | 25 | 20440 | 5400 | 25840 | 6460 | 40375 | 0 | #NAME? | 400 | 0 | 0 | 0 | #NAME? | 20000 | 0 | 80 | #NAME? | 2000 | #NAME? | ||||||

| Jan-20 | 0 | 20 | 73200 | 14640 | 0 | 0 | 8784 | 400 | 0 | 0 | 0 | 97024 | 20000 | 0 | 80 | 200 | 2000 | 74744 | ||||||||

| Feb-20 | 0 | 20 | 73200 | 14640 | 0 | 0 | 8784 | 400 | 0 | 0 | 0 | 97024 | 20000 | 0 | 80 | 200 | 76744 | |||||||||

| 0 | ||||||||||||||||||||||||||

| Arrear | 0 | 0 | ||||||||||||||||||||||||

| Arrear | 0 | 0 | ||||||||||||||||||||||||

| Arrear | 0 | 0 | ||||||||||||||||||||||||

| Arrear | 0 | 0 | ||||||||||||||||||||||||

| Bonus | 0 | 0 | ||||||||||||||||||||||||

| F. Adv | 0 | 0 | ||||||||||||||||||||||||

| Total | 201360 | 54000 | 401760 | 93120 | 399002 | 0 | #NAME? | 4800 | 0 | 0 | 0 | #NAME? | 240000 | 0 | 960 | #NAME? | 17000 | #NAME? | ||||||||

| INPUT DATA | ||||||||

| Visit www.wbpay.in for more | All in one income tax calculator 2019-20 | Email us: admin@wbpay.in | ||||||

| Details of Office | ||||||||

| Name of Office: | BASANTAPUR JMB BPHC | |||||||

| Office Address: | BASANTAPUR, HOOGHLY | |||||||

| Details of the Employee | ||||||||

| Name of the Employee: | ANUP KUMAR DUTTA | |||||||

| Designation: | DEMO | |||||||

| Group: | A | Select from list | ||||||

| Sex: | Male | Select from list | ||||||

| Category: | Below 60 Yrs | Select from list | ||||||

| PAN: | DNSPD4526P | |||||||

| Address: | Udaypur, Kumarsai, Hooghly | |||||||

| Income from other sources | Amount | |||||||

| Interest Earned on deposits in savings account: | 5000 | |||||||

| Interest Earned on deposits in FD/RD/Term/Infrabonds: | 6000 | |||||||

| Profits and Gains of Business or Profession: | ||||||||

| Other Income: | ||||||||

| Exemptions | Amount | |||||||

| Interest Paid on House Building Loan (u/s 24b)[Max Rs. 2 lakh]: | ||||||||

| Loss from house property [u/s 57]: | ||||||||

| Any other exemptions (Not from salary) | ||||||||

| Deductions u/s 80C (Max 1.5 lakh) | Amount | |||||||

| Life Insurance Premium (LICI,PLI,etc) | 60000 | |||||||

| House Building Loan Repayment (Principal) | ||||||||

| Public Provident Fund/PPF | ||||||||

| National Savings Certificates/NSC | ||||||||

| Unit Linked Insurance Plan/ULIP | ||||||||

| Tax Saving Fixed Deposits (Min 5 years lock period) | ||||||||

| Tuition Fees of Children- Max Rs. 1.5 lakh (for 2 children) | ||||||||

| Stamp Duty and Registration Charges for House Property | ||||||||

| Any other deductions u/s 80C (Not from salary) (Please Specify) | ||||||||

| Deductions u/s 80CCD(1B) | Amount | |||||||

| National Pensions Scheme/NPS (Max Rs. 50000) [u/s 80CCD(1B)] | ||||||||

| Other Deductions u/s 80D, 80DD, 80DDB etc | Select | Amount | ||||||

| Mediclaim Insurance Premium for self, spouse, children [u/s 80D] | Age below 60 | |||||||

| Mediclaim Insurance Premium for parents [u/s 80D] | Age above 60 | |||||||

| Medical Treatment of serious disease of dependent [u/s 80DDB] | Age below 60 | |||||||

| Medical treatment of handicapped dependent [u/s 80DD] | Not Claimed | 0 | ||||||

| Disability allowances for self [u/s 80U] | Not Claimed | 0 | ||||||

| Repayment of loan interest for higher education [u/s 80E] | ||||||||

| Deductions for donation u/s 80G | Amount | |||||||

| Donations to Charitable Institutions [u/s 80 G] | ||||||||

| Donations to Political Parties [u/s 80 GGC] | ||||||||

| Deduction for scientific research [u/s 80GGA] | ||||||||

| Tax already paid | Amount | |||||||

| Tax already paid or deducted at source (Not from salary) | ||||||||

| Relief | Amount | |||||||

| Relief u/s 89(1) [attach Form 10E] | ||||||||

| Deduction u/s 10(13A) for House Rent Paid. | Select | Calculation | ||||||

| Are you entitled to get the deduction? (Yes/No) | No | |||||||

| For use of Employer (Purpose of form 16) | ||||||||

| Name of D.D.O: | Dr Subrata Dhara | |||||||

| Son of: | Amal Dhara | |||||||

| Name and address of Employer: | BMOH, BASANTAPUR JMB BPHC | |||||||

| PAN of Deductor: | XYZKH1234D | |||||||

| TAN of Deductor: | CALD05323D | |||||||

| TDS Circle/Address of CIT (TDS): | Kolkata | |||||||

| Designation of the D.D.O.: | BMOH | |||||||

| Date of Signature in Form 16: | 02/12/2020 | |||||||

| Place: | Hooghly | |||||||

| Details of TDS Receipt Numbers (Office use) | ||||||||

| Quarter | TDS Receipt Numbers | |||||||

| Q1 | QWGDHDJJ | |||||||

| Q2 | QHDGDVBB | |||||||

| Q3 | QSDHFDHH | |||||||

| Q4 | QGGFDHGU | |||||||

no reviews yet

Please Login to review.