268x Filetype XLSX File size 0.10 MB Source: das.iowa.gov

Sheet 1: BW Salary

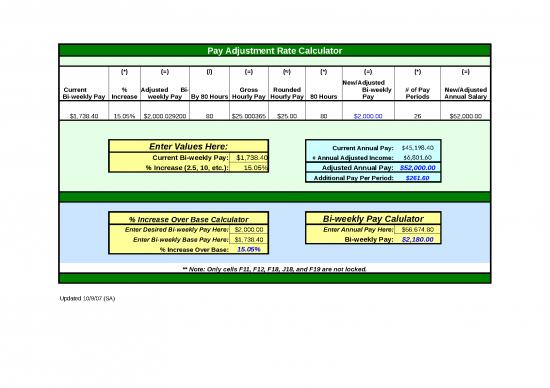

| Pay Adjustment Rate Calculator | |||||||||

| (*) | (=) | (/) | (=) | (≈) | (*) | (=) | (*) | (=) | |

| Current Bi-weekly Pay | % Increase | Adjusted Bi-weekly Pay | By 80 Hours | Gross Hourly Pay | Rounded Hourly Pay | 80 Hours | New/Adjusted Bi-weekly Pay | # of Pay Periods | New/Adjusted Annual Salary |

| $1,738.40 | 15.05% | $2,000.029200 | 80 | $25.000365 | $25.00 | 80 | $2,000.00 | 26 | $52,000.00 |

| Enter Values Here: | Current Annual Pay: | $45,198.40 | |||||||

| Current Bi-weekly Pay: | $1,738.40 | + Annual Adjusted Income: | $6,801.60 | ||||||

| % Increase (2.5, 10, etc.): | 15.05% | Adjusted Annual Pay: | $52,000.00 | ||||||

| Additional Pay Per Period: | $261.60 | ||||||||

| % Increase Over Base Calculator | Bi-weekly Pay Calulator | ||||||||

| Enter Desired Bi-weekly Pay Here: | $2,000.00 | Enter Annual Pay Here: | $56,674.80 | ||||||

| Enter Bi-weekly Base Pay Here: | $1,738.40 | Bi-weekly Pay: | $2,180.00 | ||||||

| % Increase Over Base: | 15.05% | ||||||||

| ** Note: Only cells F11, F12, F18, J18, and F19 are not locked. | |||||||||

| Updated 10/9/07 (SA) | |||||||||

| Regular Pay Increase | ||||||||||||||||||||||||||

| Use this calculator for all increases except past-due increases owed prior to an Across-the-Board increase that were not given on time. | ||||||||||||||||||||||||||

| See Instructions tab for a more detailed explanation of when/how to use this calculator. | ||||||||||||||||||||||||||

| Current Pay Grade Max | Current Biweekly Pay | Percent Increase | New Hourly Rate | New Biweekly Rate | ||||||||||||||||||||||

| x | = | $0.00 | ||||||||||||||||||||||||

| If the employee is owed back pay: | ||||||||||||||||||||||||||

| New Biweekly Rate | Old Biweekly Rate | Diff. per Pay Period | # of Pay Periods | Back Pay Owed | ||||||||||||||||||||||

| - | $0.00 | = | x | = | ||||||||||||||||||||||

| OR | ||||||||||||||||||||||||||

| New Hourly Rate | Old Hourly Rate | Diff. per Hour | # of Hours | Back Pay Owed | ||||||||||||||||||||||

| - | $0.00 | = | x | = | ||||||||||||||||||||||

| Pay Increase Due Prior to an ATB / Multiple Increases | ||||||||||||||||||||||||||

| Use this calculator when an employee was due a pay increase prior to an ATB and the employee is receiving back pay, or if the employee missed multiple increases. See Instructions tab for a more detailed explanation of when/how to use this calculator. | ||||||||||||||||||||||||||

| Current Pay Grade Max: | $4,175.20 | (only need to enter if EE is close to max) | MX & ATBS | |||||||||||||||||||||||

| Date | Type of Increase | Biweekly Rate Was | Percent Increase | Biweekly Rate S/H/B | $51.67 | Prior to | 07/06/12 | |||||||||||||||||||

| 07/06/12 | merit | $4,078.40 | x | 4.50% | = | $4,133.60 | $50.98 | $53.27 | $51.67 | As of | 07/06/12 | |||||||||||||||

| 12/21/12 | atb | $4,119.20 | x | 1.00% | = | $4,175.20 | $53.80 | $52.19 | As of | 12/21/12 | ||||||||||||||||

| x | = | $53.80 | $52.19 | As of | 12/30/99 | |||||||||||||||||||||

| x | = | $53.80 | $52.19 | = Current Max | ||||||||||||||||||||||

| Back pay owed to employee: | ||||||||||||||||||||||||||

| Difference Per | Number of | |||||||||||||||||||||||||

| Date Range | Pay Period | Hour | PPs | OR | Hours | Back Pay Owed | Total Back Pay Owed | |||||||||||||||||||

| 07/06/12 | - | 12/20/12 | $55.20 | $0.69 | x | 12 | = | $662.40 | $1,054.40 | |||||||||||||||||

| 12/21/12 | - | present | $56.00 | $0.70 | x | 7 | = | $392.00 | ||||||||||||||||||

| - | x | = | ||||||||||||||||||||||||

| - | x | = | ||||||||||||||||||||||||

| • If the employee will be receiving the increase on their current rate of pay, use the Regular Pay Increase Calculator. • If the employee should have received the increase on an old rate of pay, use the Pay Increase Due Prior to an ATB/Multiple Increases calculator. For example: The current pay period is 07/20/2012. There was an Across-the-Board increase on 06/22/2012. Depending on the employee's step increase date and whether or not the employee is receiving back pay, the calculator and P1 type you want to use may differ. See table below: |

||||||||||||||||||||

| Step Increase Date | EE Receiving Back Pay? | Calculator to Use | P1 Type to Use | Example | ||||||||||||||||

| 06/08/12 | Yes | Pay Incr Due Prior to an ATB | 636 Pay Incr Due for Past PP | 1 | ||||||||||||||||

| 06/08/12 | No | Regular Pay Increase | 619 Non-Contract EE Incr | 2 | ||||||||||||||||

| ATB | 06/22/12 | Yes or No | Regular Pay Increase | 636 (Back Pay); 619 (No Back Pay) | 2 | |||||||||||||||

| 07/06/12 | Yes or No | Regular Pay Increase | 636 (Back Pay); 619 (No Back Pay) | 2 | ||||||||||||||||

| Current Pay Period | 07/20/12 | No | Regular Pay Increase | 619 Non-Contract EE Incr | 2 | |||||||||||||||

| Note that there are other possible scenarios aside from the ones described in these instructions. These instructions cover some of the most common situations we encounter; if you have any questions about how an employee's increase should be calculated, please don't hesitate to contact one of us. | ||||||||||||||||||||

| Example 1: | ||||||||||||||||||||

| • An employee's step increase date was 06/08/2012, but the employee is not receiving the increase until the 07/20/2012 pay period. Between 06/08 and 07/20, there was a 2% ATB increase in the 06/22/2012 pay period. • The department is giving the employee back pay to the 06/08 pay period, so the increase must be figured on the employee's rate of pay prior to the 06/22 ATB. |

||||||||||||||||||||

| Calculator Steps for Example 1: • If the employee is close to the max of the pay grade, fill out the "Current Pay Grade Max" box, otherwise you can leave this field blank. • In the first row, enter the date the employee should have received the step increase, the Type of Increase is "Merit Increase", and the "Biweekly Rate Was" is the employee's rate of pay prior to the 2% ATB on 06/22/12. The Percent Increase is the increase amount the employee is receiving. • In the second row, enter the date of the ATB, the Type of Increase is "ATB", and the "Biweekly Rate Was" is the employee's rate of pay after receiving the ATB. The Percent Increase is 2% since that was the ATB amount. • The employee was making $1282.40 biweekly prior to the ATB, and $1308.00 after the 2% ATB on 06/22/12. When everything is entered into the calculator, we see that his current salary should be $1373.60 biweekly. |

||||||||||||||||||||

| Current Pay Grade Max: | (only need to enter if EE is close to max) | |||||||||||||||||||

| Date | Type of Increase | Biweekly Rate Was | Percent Increase | Biweekly Rate S/H/B | ||||||||||||||||

| 06/08/12 | Merit Increase | $1,282.40 | x | 5.00% | = | $1,346.40 | ||||||||||||||

| 06/22/12 | ATB | $1,308.00 | x | 2.00% | = | $1,373.60 | ||||||||||||||

| See next page for back pay calculator instructions and Example 2. | ||||||||||||||||||||

| Back Pay Calculator Steps • All of the fields in the back pay calculator will populate except for the "Number of PPs or Hours" field which you will need to complete. ◦ If the employee worked 80 hours per pay period, enter the number of pay periods within the date range listed (do not count the current pay period we are in). ◦ If the employee worked less than 80 hours per pay period, enter the total number of hours worked during the date range instead of the number of pay periods. ◦ If you enter data in both the "PPs" and "Hours" columns within the same row, you will get an error - you can only enter the total number of pay periods or total hours worked within a date range. ◦ The calculator will tell you the back pay owed for the specific date range, and the total back pay owed to the employee. • Up to six pay periods of back pay can be paid on a P1; any back pay owed beyond the past six pay periods will have to be submitted to the State Appeal Board. |

||||||||||||||||||||

| Back pay owed to employee: | ||||||||||||||||||||

| Difference Per | Number of | |||||||||||||||||||

| Date Range | Pay Period | Hour | PPs | OR | Hours | Back Pay Owed | Total Back Pay Owed | |||||||||||||

| 06/08/12 | - | 06/21/12 | $64.00 | $0.80 | x | 1 | = | $64.00 | $195.20 | |||||||||||

| 06/22/12 | - | present | $65.60 | $0.82 | x | 2 | = | $131.20 | ||||||||||||

| Note: If the employee had overtime, back pay would be owed on that too. You could either calculate the additional OT owed separately, or use the back pay calculator above. For example, if the EE had 1.5 OT hours in the 06/08 pay period and gets time-and-a-half for OT, you would enter 82.25 (80 + (1.5*1.5)) in the hours column, which would come to $65.80 owed for 06/08 - 06/21/12. | ||||||||||||||||||||

| Example 2 | ||||||||||||||||||||

| • The current pay period is 07/20/2012. The employee's step increase date was 06/08/12, 06/22/12, 07/06/12 or 07/20/12. Between 06/08 and 07/20, there was a 2% ATB increase in the 06/22/2012 pay period. ◦ If the employee's step increase date was 06/08/12 and the department is not giving the employee back pay, you would use the Regular Pay Increase Calculator because when an employee does not receive back pay it means their increase is effective in the current pay period, in this case 07/20/12. ◦ If the employee's step increase date was 06/22/12 or 07/06/12 you would use the Regular Pay Increase Calculator because these pay periods are the pay period in which the ATB occurred and the pay period after, so the employee's rate of pay for these pay periods would be the same as the employee's current rate of pay in the 07/20/12 pay period. Whenever the increase is given on the employee's current rate of pay, the Regular Pay Increase Calculator should be used. ◦ If the employee's step increase date is 07/20/12, you will use the Regular Pay Increase Calculator because 07/20 is the current pay period. |

||||||||||||||||||||

| Calculator Steps for Example 2: • If the employee is close to the max of the pay grade, fill out the "Current Pay Grade Max" box, otherwise you can leave this field blank. • Enter the employee's current biweekly pay and the percent increase amount. • The employee's new salary should be $1373.60 biweekly. |

||||||||||||||||||||

| Current Pay Grade Max | Current Biweekly Pay | Percent Increase | New Hourly Rate | New Biweekly Rate | ||||||||||||||||

| $1,308.00 | x | 5.00% | = | $17.17 | $1,373.60 | |||||||||||||||

| See next page for back pay calculator instructions and Example 2. | ||||||||||||||||||||

| Back Pay Calculator Steps • All of the fields in the back pay calculator will populate except for the "Number of PPs or Hours" field which you will need to complete. ◦ If the employee worked 80 hours per pay period, enter the number of pay periods the employee is owed back pay for (do not count the current pay period). ◦ If the employee worked less than 80 hours per pay period, or had any overtime, enter the total number of hours instead of the number of pay periods. ◦ The calculator will tell you the back pay owed to the employee. • Up to six pay periods of back pay can be paid on a P1; any back pay owed beyond the past six pay periods will have to be submitted to the State Appeal Board. • For the example below, the employee's step increase date was 06/22/12 and the employee is receiving the increase in the 07/20/12 pay period. This means the employee is owed two pay periods of back pay (for 07/06 and 06/22). |

||||||||||||||||||||

| If the employee is owed back pay: | ||||||||||||||||||||

| New Biweekly Rate | Old Biweekly Rate | Diff. per Pay Period | # of Pay Periods | Back Pay Owed | ||||||||||||||||

| $1,373.60 | - | $1,308.00 | = | $65.60 | x | 2 | = | $131.20 | ||||||||||||

| OR | ||||||||||||||||||||

| New Hourly Rate | Old Hourly Rate | Diff. per Hour | # of Hours | Back Pay Owed | ||||||||||||||||

| $17.17 | - | $16.35 | = | $0.82 | x | = | ||||||||||||||

no reviews yet

Please Login to review.