297x Filetype XLSX File size 0.50 MB Source: assets.publishing.service.gov.uk

Sheet 1: New Homes Bonus

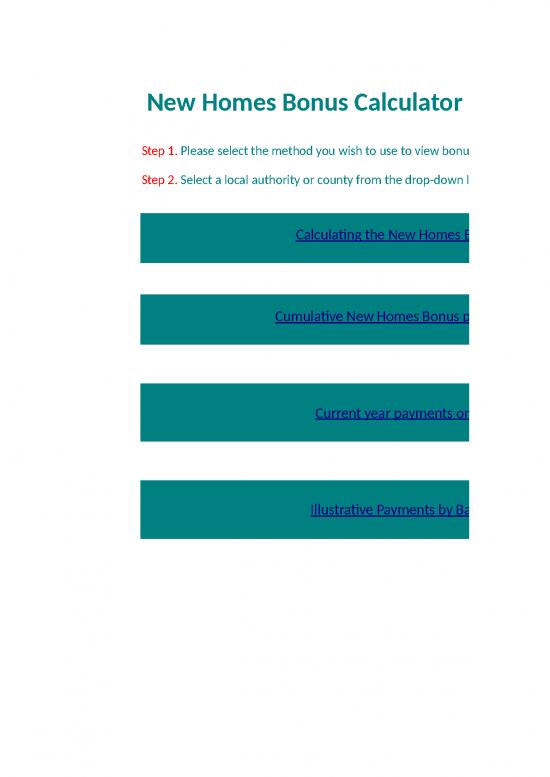

| New Homes Bonus Calculator | ||||||||||||||||||||||

| Step 1. Please select the method you wish to use to view bonus payments | ||||||||||||||||||||||

| Step 2. Select a local authority or county from the drop-down list | Analysis and Data Directorate, | |||||||||||||||||||||

| Ministry of Housing, Communities and Local Government | ||||||||||||||||||||||

| newhomesbonus@communities.gov.uk | ||||||||||||||||||||||

| Calculating the New Homes Bonus | ||||||||||||||||||||||

| Cumulative New Homes Bonus payments | ||||||||||||||||||||||

| Current year payments only | ||||||||||||||||||||||

| Illustrative Payments by Band | ||||||||||||||||||||||

| Return to homepage | ||||||||||||||||||||||||

| Calculation process | ||||||||||||||||||||||||

| Worked example | ||||||||||||||||||||||||

| Council tax band | Total | A | B | C | D | E | F | G | H | |||||||||||||||

| I | Weighting (Band D equivalence) | 6/9 | 7/9 | 8/9 | 9/9 | 11/9 | 13/9 | 15/9 | 18/9 | |||||||||||||||

| II | Previous year dwelling stock | 7,521 | 1,500 | 1,286 | 1,125 | 1,000 | 818 | 692 | 600 | 500 | ||||||||||||||

| III | …in band D equivalents (II x I) | 8,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | ||||||||||||||

| IV | Growth in dwelling stock* | 75 | 15 | 13 | 11 | 10 | 8 | 7 | 6 | 5 | ||||||||||||||

| V | …in band D equivalents (IV x I) | 80 | 10 | 10 | 10 | 10 | 10 | 10 | 10 | 10 | ||||||||||||||

| VI | National average Band D council tax rate | £1,671 | £1,060 | £1,237 | £1,414 | £1,671 | £1,944 | £2,297 | £2,651 | £3,181 | ||||||||||||||

| VII | Baseline = 0.4% of band D equivalent stock (III x 0.4%) | 32 | ||||||||||||||||||||||

| VIII | Units rewarded - Band D equivalents (V - VII) | 48 | ||||||||||||||||||||||

| IX | Payment for Band D equivalents (VIII x VI) | £80,230 | ||||||||||||||||||||||

| X | Affordable homes | 15 | ||||||||||||||||||||||

| XI | Affordable homes payment (X x £350) | £5,250 | ||||||||||||||||||||||

| XII | Annual payment (XI + IX) | £85,480 | ||||||||||||||||||||||

| The worked example above shows the method for calculating the New Homes Bonus in a hypothetical local authority. The calculation shows the outcome following a 1% growth in the housing stock, evenly split across the council tax bands and 15 new affordable homes. There is a baseline level of 0.4%, below which new homes are not rewarded with the Bonus and the national average Band D council tax rate of £1,671 is paid thereafter. *In practice the growth in the dwelling stock is calculated from DCLG Council Taxbase (CTB) statistics with the effective stock (i.e. after accounting for demolished or long term empty property, Line 1 minus Line 3 minus Line 18 on the CTB form) in the previous year subtracted from the latest year. |

||||||||||||||||||||||||

| From the 1st April 2019, the authorites below will be merging. The 'Cumulative New Homes Bonus payments' page of the calculator will not show payments for the pre-merger authorities for Year 9 onwards, since they will no longer exist. To calculate the Year 9 allocations for the new authorities, please add the Year 9 allocations of the pre-merger authorities from the 'Current year payments only' page. | ||||||||||||||||||||||||

| New Authorities | Pre-merger authorities | |||||||||||||||||||||||

| East Suffolk | Suffolk coastal, Waveney | |||||||||||||||||||||||

| West Suffolk | Forest heath, St Edmundsbury | |||||||||||||||||||||||

| Somerset West and Taunton | West Somerset, Taunton Deane | |||||||||||||||||||||||

| Dorset UA | Dorset county council, East Dorset, North Dorset, Purbeck, Weymouth and Portland, West Dorset | |||||||||||||||||||||||

| Bournemouth, Christchurch and Poole | Bournemouth UA, Christchurch, Poole UA | |||||||||||||||||||||||

| New Homes Bonus Calculator | Reform: | No | ||||||||||||||

|

|

Current housing stock (Oct 18): | - | ||||||||||||||

| Net change in stock (Oct 18)1,2: | - | |||||||||||||||

| Return to homepage | Affordable housing supply (17/18)3: | - | ||||||||||||||

| Stock of empty homes (Oct 18): | - | |||||||||||||||

| Year of Payment | ||||||||||||||||

| Cumulative Payments | 2011 / 12 | 2012 / 13 | 2013 / 14 | 2014 / 15 | 2015 / 16 | 2016 / 17 | 2017 / 18 | 2018 / 19 | 2019 / 20 | 2020 / 21 | 2021 / 22 | 2022 / 23 | ||||

| Payments for Year 1 | £0 | £0 | £0 | £0 | £0 | £0 | ||||||||||

| Payments for Year 2 | £0 | £0 | £0 | £0 | £0 | |||||||||||

| Year of Delivery | Payments for Year 3 | £0 | £0 | £0 | £0 | £0 | ||||||||||

| Payments for Year 4 | £0 | £0 | £0 | £0 | ||||||||||||

| Payments for Year 5 | £0 | £0 | £0 | £0 | ||||||||||||

| Payments for Year 6 | £0 | £0 | £0 | £0 | ||||||||||||

| Payments for Year 7 | £0 | £0 | £0 | £0 | ||||||||||||

| Payments for Year 8 | £0 | £0 | £0 | £0 | ||||||||||||

| Payments for Year 9 | #N/A | #N/A | #N/A | #N/A | ||||||||||||

| 2019/20: Total Payments | #N/A | |||||||||||||||

| £0 | £0 | £0 | £0 | £0 | £0 | £0.00 | £0 | |||||||||

| Total Payments (2019/20) | ||||||||||||||||

| Year 6 | £0 | |||||||||||||||

| Year 7 | £0 | |||||||||||||||

| Year 8 | £0 | |||||||||||||||

| Year 9 | #N/A | |||||||||||||||

| Total Payment: | #N/A | |||||||||||||||

| Notes: | ||||||||||||||||

| 1. Net additional dwellings are calculated by subtracting effective stock (total stock less long-term empty homes, and demolitions) as recorded on the CTB in one year from the previous year: See 'Calculating the New Homes Bonus' in the first page of this spreadsheet | ||||||||||||||||

| 2. Data taken from the Council Tax Base form: https://www.gov.uk/government/statistics/council-taxbase-2018-in-england | ||||||||||||||||

| 3. Data taken from Live Table 1008 - Affordable housing supply in England: 2017 to 2018: https://www.gov.uk/government/statistics/affordable-housing-supply-in-england-2017-to-2018 | ||||||||||||||||

no reviews yet

Please Login to review.