310x Filetype XLSX File size 0.02 MB Source: assets.ctfassets.net

HOURLY RATE CALCULATION

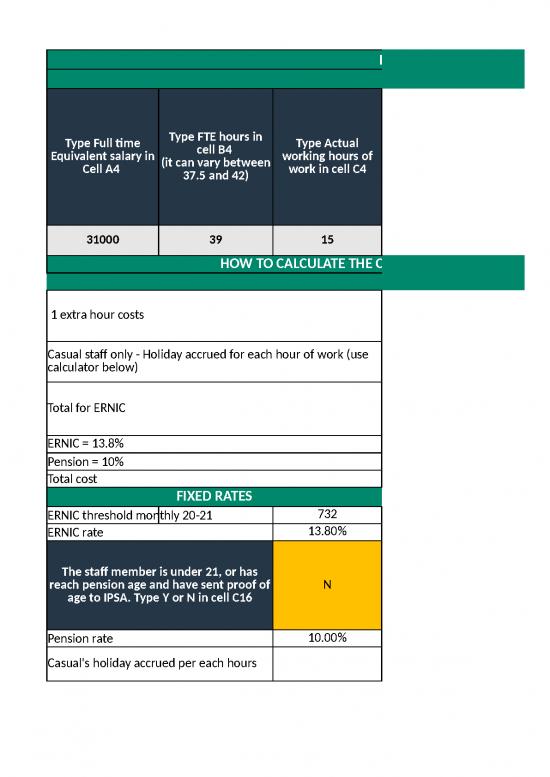

Type Full time Type FTE hours in Type Actual

Equivalent salary in cell B4 working hours of

Cell A4 (it can vary between work in cell C4

37.5 and 42)

31000 39 15

HOW TO CALCULATE THE COST CHARGED TO THE BUDGET OF ONE EXTRA HOUR

1 extra hour costs

Casual staff only - Holiday accrued for each hour of work (use

calculator below)

Total for ERNIC

ERNIC = 13.8%

Pension = 10%

Total cost

FIXED RATES

ERNIC threshold monthly 20-21 732

ERNIC rate 13.80%

The staff member is under 21, or has

reach pension age and have sent proof of N

age to IPSA. Type Y or N in cell C16

Pension rate 10.00%

Casual's holiday accrued per each hours

Type the annual leave entitlement stated

on the casual contract in cell C18 (It can 29

vary between 28 and 33)

Accrual rate: % of hours worked 12.55

Hours worked 1

Holiday accrued in hours 0.13

HOURLY RATE CALCULATION

PART TIME STAFF FULL TIME STAFF

Standard or basic hourly

rate : Full time salary Overtime rate (Standard rate

divided by 52 divided by x 1.5)

Full time hours

15.29 22.93

HOW TO CALCULATE THE COST CHARGED TO THE BUDGET OF ONE EXTRA HOUR

CALC1 CALC2

15.29 22.93

0.00 0.00

15.29 22.93

2.11 3.16

1.53 0.00

18.92 26.09

HOURLY RATE CALCULATION

CASUAL

Type the rate of pay in cell F4

(below) - The rate can be taken from

the staff contract or it can be

calcualted in the same way as the

standard rate, providing the full time

equivalent salary and hours used to

calculate the rate are known

15.00

HOW TO CALCULATE THE COST CHARGED TO THE BUDGET OF ONE EXTRA HOUR

CALC3

15.00

1.88

16.88

2.33

1.50

20.71

no reviews yet

Please Login to review.