280x Filetype PDF File size 1.73 MB Source: www.starhealth.in

STAR HEALTH AND ALLIED INSURANCE COMPANY LIMITED

Regd. & Corporate Office: 1, New Tank Street, Valluvar Kottam High Road, Nungambakkam,

Chennai - 600 034. « Phone : 044 - 28288800 « Email : support@starhealth.in

Website : www.starhealth.in « CIN : L66010TN2005PLC056649 « IRDAI Regn. No. : 129

PROSPECTUS - STAR COMPREHENSIVE INSURANCE POLICY

Unique Identification No.: SHAHLIP22028V072122

The Specific Feature of this policy is it offers Health Cover, Delivery and New born cover,

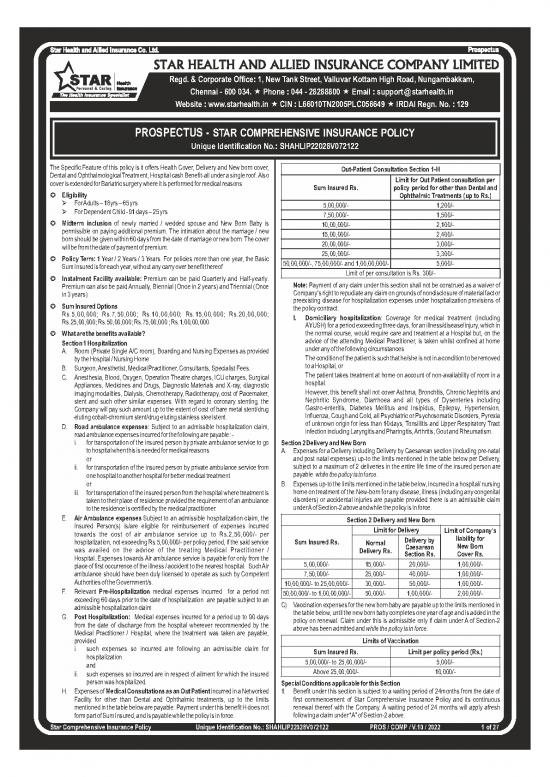

Out-Patient Consultation Section 1-H

Dental and Ophthalmological Treatment, Hospital cash Benefit-all under a single roof. Also

Limit for Out Patient consultation per

cover is extended for Bariatric surgery where it is performed for medical reasons

Sum Insured Rs. policy period for other than Dental and

µ Eligibility Ophthalmic Treatments (up to Rs.)

Ø For Adults – 18yrs – 65 yrs

5,00,000/- 1,200/-

Ø For Dependent Child - 91 days – 25 yrs

7,50,000/- 1,500/-

µ Midterm inclusion of newly married / wedded spouse and New Born Baby is

10,00,000/- 2,100/-

permissible on paying additional premium. The intimation about the marriage / new

15,00,000/- 2,400/-

born should be given within 60 days from the date of marriage or new born. The cover

20,00,000/- 3,000/-

will be from the date of payment of premium.

25,00,000/- 3,300/-

µ Policy Term: 1 Year / 2 Years / 3 Years. For policies more than one year, the Basic

50,00,000/-, 75,00,000/- and 1,00,00,000/- 5,000/-

Sum Insured is for each year, without any carry over benefit thereof

Limit of per consultation is Rs. 300/-

µ Instalment Facility available: Premium can be paid Quarterly and Half-yearly.

Note: Payment of any claim under this section shall not be construed as a waiver of

Premium can also be paid Annually, Biennial (Once in 2 years) and Triennial (Once

Company's right to repudiate any claim on grounds of nondisclosure of material fact or

in 3 years)

preexisting disease for hospitalization expenses under hospitalization provisions of

µ Sum Insured Options

the policy contract.

Rs.5,00,000; Rs.7,50,000; Rs.10,00,000; Rs.15,00,000; Rs.20,00,000;

I. Domiciliary hospitalization: Coverage for medical treatment (including

Rs.25,00,000; Rs.50,00,000; Rs.75,00,000 ; Rs.1,00,00,000

AYUSH) for a period exceeding three days, for an illness/disease/injury, which in

µ What are the benefits available? the normal course, would require care and treatment at a Hospital but, on the

advice of the attending Medical Practitioner, is taken whilst confined at home

Section 1 Hospitalization

under any of the following circumstances

A. Room (Private Single A/C room), Boarding and Nursing Expenses as provided

by the Hospital / Nursing Home The condition of the patient is such that he/she is not in a condition to be removed

to a Hospital, or

B. Surgeon, Anesthetist, Medical Practitioner, Consultants, Specialist Fees.

The patient takes treatment at home on account of non-availability of room in a

C. Anesthesia, Blood, Oxygen, Operation Theatre charges, ICU charges, Surgical

hospital.

Appliances, Medicines and Drugs, Diagnostic Materials and X-ray, diagnostic

However, this benefit shall not cover Asthma, Bronchitis, Chronic Nephritis and

imaging modalities, Dialysis, Chemotherapy, Radiotherapy, cost of Pacemaker,

Nephritic Syndrome, Diarrhoea and all types of Dysenteries including

stent and such other similar expenses. With regard to coronary stenting, the

Gastro-enteritis, Diabetes Mellitus and Insipidus, Epilepsy, Hypertension,

Company will pay such amount up to the extent of cost of bare metal stent/drug

Influenza, Cough and Cold, all Psychiatric or Psychosomatic Disorders, Pyrexia

eluting cobalt-chromium stent/drug eluting stainless steel stent.

of unknown origin for less than 10 days, Tonsillitis and Upper Respiratory Tract

D. Road ambulance expenses: Subject to an admissible hospitalization claim,

infection including Laryngitis and Pharingitis, Arthritis, Gout and Rheumatism.

road ambulance expenses incurred for the following are payable :-

i. for transportation of the insured person by private ambulance service to go Section 2 Delivery and New Born

to hospital when this is needed for medical reasons A. Expenses for a Delivery including Delivery by Caesarean section (including pre-natal

or and post natal expenses) up-to the limits mentioned in the table below per Delivery,

subject to a maximum of 2 deliveries in the entire life time of the insured person are

ii. for transportation of the insured person by private ambulance service from

payable while the policy is in force.

one hospital to another hospital for better medical treatment

or B. Expenses up-to the limits mentioned in the table below, incurred in a hospital/ nursing

home on treatment of the New-born for any disease, illness (including any congenital

iii. for transportation of the insured person from the hospital where treatment is

disorders) or accidental injuries are payable provided there is an admissible claim

taken to their place of residence provided the requirement of an ambulance

under A of Section-2 above and while the policy is in force.

to the residence is certified by the medical practitioner.

E. Air Ambulance expenses Subject to an admissible hospitalization claim, the

Section 2 Delivery and New Born

Insured Person(s) is/are eligible for reimbursement of expenses incurred

Limit for Delivery Limit of Company's

towards the cost of air ambulance service up to Rs.2,50,000/- per

liability for

Delivery by

hospitalization, not exceeding Rs.5,00,000/- per policy period, if the said service Sum Insured Rs.

Normal

New Born

Caesarean

was availed on the advice of the treating Medical Practitioner /

Delivery Rs.

Section Rs. Cover Rs.

Hospital..Expenses towards Air ambulance service is payable for only from the

5,00,000/- 15,000/- 20,000/- 1,00,000/-

place of first occurrence of the illness / accident to the nearest hospital. Such Air

ambulance should have been duly licensed to operate as such by Competent 7,50,000/- 25,000/- 40,000/- 1,00,000/-

Authorities of the Government/s.

10,00,000/- to 25,00,000/- 30,000/- 50,000/- 1,00,000/-

F. Relevant Pre-Hospitalization medical expenses incurred for a period not

50,00,000/- to 1,00,00,000/- 50,000/- 1,00,000/- 2,00,000/-

exceeding 60 days prior to the date of hospitalization are payable subject to an

C) Vaccination expenses for the new born baby are payable up to the limits mentioned in

admissible hospitalization claim

the table below, until the new born baby completes one year of age and is added in the

G. Post Hospitalization: Medical expenses incurred for a period up to 90 days

policy on renewal. Claim under this is admissible only if claim under A of Section-2

from the date of discharge from the hospital wherever recommended by the

above has been admitted and while the policy is in force.

Medical Practitioner / Hospital, where the treatment was taken are payable,

provided Limits of Vaccination

no reviews yet

Please Login to review.