207x Filetype PDF File size 0.27 MB Source: www.ira.go.ke

INSURANCE REGULATORY AUTHORITY

P.O. BOX 43505 - 00100 NAIROBI • ZEP–RE PLACE OFF LONGONOT ROAD – UPPER HILL, NAIROBI

TEL: (254) – 020 - 4996000, 0727 563110 • MOBILE: (245) – 0719 047000 • FAX: (254) – 020 - 2710126

“Bima bora kwa Taifa”

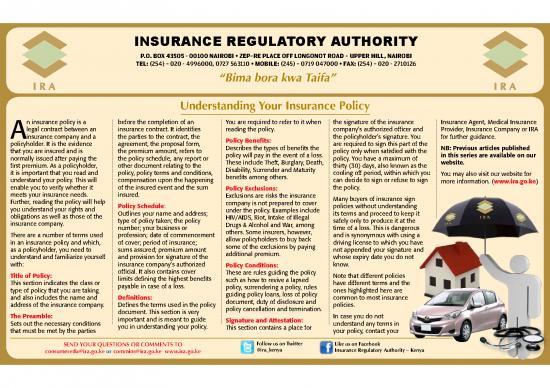

Understanding Your Insurance Policy

n insurance policy is a before the completion of an You are required to refer to it when the signature of the insurance Insurance Agent, Medical Insurance

legal contract between an insurance contract. It identifies reading the policy. company’s authorized officer and Provider, Insurance Company or IRA

Ainsurance company and a the parties to the contract, the Policy Benefits: the policyholder’s signature. You for further guidance.

policyholder. It is the evidence agreement, the proposal form, Describes the types of benefits the are required to sign this part of the NB: Previous articles published

that you are insured and is the premium amount, refers to policy will pay in the event of a loss. policy only when satisfied with the in this series are available on our

normally issued after paying the the policy schedule, any report or These include Theft, Burglary, Death, policy. You have a maximum of website.

first premium. As a policyholder, other document relating to the Disability, Surrender and Maturity thirty (30) days, also known as the

it is important that you read and policy, policy terms and conditions, benefits among others. cooling off period, within which you You may also visit our website for

understand your policy. This will compensation upon the happening can decide to sign or refuse to sign more information. (www.ira.go.ke)

enable you to verify whether it of the insured event and the sum Policy Exclusions: the policy.

meets your insurance needs. insured. Exclusions are risks the insurance Many buyers of insurance sign

Further, reading the policy will help Policy Schedule: company is not prepared to cover policies without understanding

you understand your rights and Outlines your name and address; under the policy. Examples include its terms and proceed to keep it

obligations as well as those of the type of policy taken; the policy HIV/AIDS, Riot, Intake of Illegal safely only to produce it at the

insurance company. number; your business or Drugs & Alcohol and War, among time of a loss. This is dangerous

There are a number of terms used profession; date of commencement others. Some insurers, however, and is synonymous with using a

in an insurance policy and which, of cover; period of insurance; allow policyholders to buy back driving license to which you have

as a policyholder, you need to sums assured; premium amount some of the exclusions by paying not appended your signature and

understand and familiarize yourself and provision for signature of the additional premium. whose expiry date you do not

with: insurance company’s authorized Policy Conditions: know.

Title of Policy: official. It also contains cover These are rules guiding the policy Note that different policies

This section indicates the class or limits defining the highest benefits such as how to revive a lapsed have different terms and the

type of policy that you are taking payable in case of a loss. policy, surrendering a policy, rules ones highlighted here are

and also includes the name and Definitions: guiding policy loans, loss of policy common to most insurance

address of the insurance company. Defines the terms used in the policy document, duty of disclosure and policies.

document. This section is very policy cancellation and termination.

The Preamble: important and is meant to guide Signature and Attestation: In case you do not

Sets out the necessary conditions you in understanding your policy. This section contains a place for understand any terms in

that must be met by the parties your policy, contact your

Send YoUR qUeSTIonS oR commenTS To Follow us on Twitter Like us on Facebook

consumeredu@ira.go.ke or commins@ira.go.ke www.ira.go.ke @ira_kenya Insurance Regulatory Authority – Kenya

no reviews yet

Please Login to review.