226x Filetype PDF File size 0.79 MB Source: www.careratings.com

Press Release

Royal Sundaram General Insurance Co. Limited

August 23, 2021

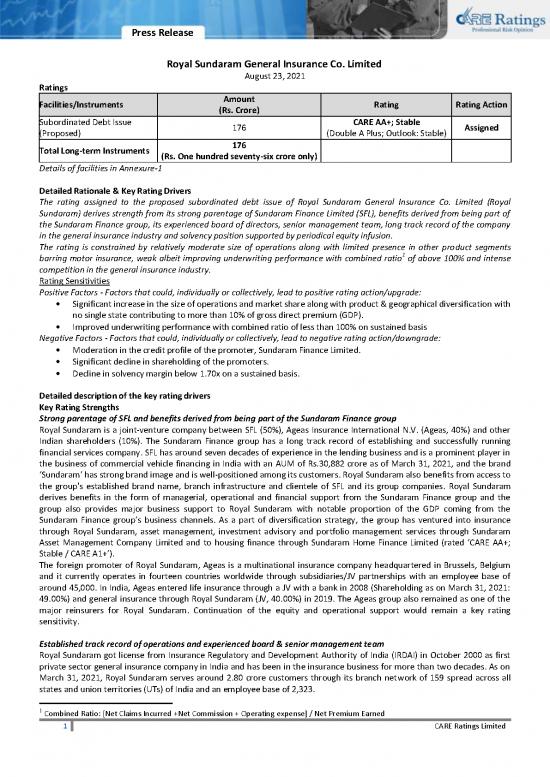

Ratings

Facilities/Instruments Amount Rating Rating Action

(Rs. Crore)

Subordinated Debt Issue 176 CARE AA+; Stable Assigned

(Proposed) (Double A Plus; Outlook: Stable)

Total Long-term Instruments 176

(Rs. One hundred seventy-six crore only)

Details of facilities in Annexure-1

Detailed Rationale & Key Rating Drivers

The rating assigned to the proposed subordinated debt issue of Royal Sundaram General Insurance Co. Limited (Royal

Sundaram) derives strength from its strong parentage of Sundaram Finance Limited (SFL), benefits derived from being part of

the Sundaram Finance group, its experienced board of directors, senior management team, long track record of the company

in the general insurance industry and solvency position supported by periodical equity infusion.

The rating is constrained by relatively moderate size of operations along with limited presence in other product segments

barring motor insurance, weak albeit improving underwriting performance with combined ratio1 of above 100% and intense

competition in the general insurance industry.

Rating Sensitivities

Positive Factors - Factors that could, individually or collectively, lead to positive rating action/upgrade:

Significant increase in the size of operations and market share along with product & geographical diversification with

no single state contributing to more than 10% of gross direct premium (GDP).

Improved underwriting performance with combined ratio of less than 100% on sustained basis

Negative Factors - Factors that could, individually or collectively, lead to negative rating action/downgrade:

Moderation in the credit profile of the promoter, Sundaram Finance Limited.

Significant decline in shareholding of the promoters.

Decline in solvency margin below 1.70x on a sustained basis.

Detailed description of the key rating drivers

Key Rating Strengths

Strong parentage of SFL and benefits derived from being part of the Sundaram Finance group

Royal Sundaram is a joint-venture company between SFL (50%), Ageas Insurance International N.V. (Ageas, 40%) and other

Indian shareholders (10%). The Sundaram Finance group has a long track record of establishing and successfully running

financial services company. SFL has around seven decades of experience in the lending business and is a prominent player in

the business of commercial vehicle financing in India with an AUM of Rs.30,882 crore as of March 31, 2021, and the brand

‘Sundaram’ has strong brand image and is well-positioned among its customers. Royal Sundaram also benefits from access to

the group's established brand name, branch infrastructure and clientele of SFL and its group companies. Royal Sundaram

derives benefits in the form of managerial, operational and financial support from the Sundaram Finance group and the

group also provides major business support to Royal Sundaram with notable proportion of the GDP coming from the

Sundaram Finance group’s business channels. As a part of diversification strategy, the group has ventured into insurance

through Royal Sundaram, asset management, investment advisory and portfolio management services through Sundaram

Asset Management Company Limited and to housing finance through Sundaram Home Finance Limited (rated ‘CARE AA+;

Stable / CARE A1+’).

The foreign promoter of Royal Sundaram, Ageas is a multinational insurance company headquartered in Brussels, Belgium

and it currently operates in fourteen countries worldwide through subsidiaries/JV partnerships with an employee base of

around 45,000. In India, Ageas entered life insurance through a JV with a bank in 2008 (Shareholding as on March 31, 2021:

49.00%) and general insurance through Royal Sundaram (JV, 40.00%) in 2019. The Ageas group also remained as one of the

major reinsurers for Royal Sundaram. Continuation of the equity and operational support would remain a key rating

sensitivity.

Established track record of operations and experienced board & senior management team

Royal Sundaram got license from Insurance Regulatory and Development Authority of India (IRDAI) in October 2000 as first

private sector general insurance company in India and has been in the insurance business for more than two decades. As on

March 31, 2021, Royal Sundaram serves around 2.80 crore customers through its branch network of 159 spread across all

states and union territories (UTs) of India and an employee base of 2,323.

1

Combined Ratio: [Net Claims Incurred +Net Commission + Operating expense] / Net Premium Earned

1 CARE Ratings Limited

Press Release

Mr MS Sreedhar is the managing director of Royal Sundaram for the last 6 years and he handles the day-to-day operations of

the company. He serves in the top management of the company since inception and he is ably assisted by a team of senior

management in various functions, who bring in considerable experience.

As on March 31, 2021, the board of Royal Sundaram consists of ten directors with extensive experience in financial services

industry including three representatives from SFL, two representatives from Ageas, four independent directors and managing

director.

Solvency position supported by periodical equity infusion

During FY21 (refers to the period April 1 to March 31), with moderation in GDP and retention of profits, solvency margin

stood at 1.87x as on March 31, 2021 as against 1.69x as on March 31, 2020, and is well above the regulatory requirement of

1.50x. It is to be noted that the company has an outstanding subordinated debt of Rs.100 crore (raised during FY17). The

company has raised equity in the past as and when required and the latest being in FY18 of Rs.295 crore from the Sundaram

Finance group. Also, the company has been continuously making profits (PAT) since FY12 and the internal accruals helped in

improving the capital and solvency position.

As on June 30, 2021, the solvency ratio stood at 1.97x. With the company’s plan to raise additional subordinated debt,

solvency ratio is expected to improve further and aid the planned growth for the next few years. Also, SFL is expected to

support Royal Sundaram to provide timely capital support on need basis.

Key Rating Weaknesses

Moderate size of operations along with limited presence in other product segments barring motor segment

Despite having a track record of more than two decades, size of Royal Sundaram continues to be relatively moderate. The

share of Royal Sundaram (in terms of GDP) among private general insurance players was continuously moderating from 6.6%

in FY11 to 2.9% in FY21. However, on absolute terms, GDP has improved.

Motor (Own Damage + Third Party) continues to be the major product segment for Royal Sundaram with its share increasing

from 56.77% in FY20 to 70.11% in FY21. Royal Sundaram started providing crop insurance during FY19 under Pradhan Mantri

Fasal Bima Yojana (PMFBY) in the states of Assam, Jharkhand, Tripura and Odisha, and the share of Crop insurance

significantly increased to 12.61% in FY19 and 20.75% in FY20. The company consciously reduced the crop exposure and the

crop exposure moderated to 2.02% in FY21. This was also due to non-realisation of premium subsidy in some of its exposure.

The share of top three products increased from 88% (Motor, Crop & Health) in FY20 to 92% (Motor, Health & Fire) in FY21.

GDP has grown at a CAGR of 18.50% over the 5 years ended FY20. However, with the Covid-19 pandemic-led slowdown and

the company’s conscious effort to reduce the crop insurance exposure, GDP declined 23% Y-o-Y from Rs.3,667 crore during

FY20 to Rs.2,822 crore in FY21. Excluding crop insurance, GDP moderated by 4.85% y-o-y from Rs.2,906 crore during FY20 to

Rs.2,765 crore during FY21. During Q1FY22, GDP stood at Rs.619 crore as against Rs.584 crore during Q1FY21 and the share

of motor during Q1FY22 stood at 58.55%.

Royal Sundaram uses multiple distribution channels such as brokers, agents, corporate agents, etc., to reach the clients.

Brokers remained as the key channel for the company with 46% of the GDP sourced through this channel followed by

individual agents (26%), corporate agents (14%) and direct business (14%).

Despite Royal Sundaram having presence across India, Tamil Nadu continues to be the top contributing state with 19.17%

share of total GDP during FY21 (PY:15.36%) majorly because of the Sundaram Finance group’s strong hold. During FY21, top

three states contributed 46.97% (Tamil Nadu, Maharashtra, Karnataka) as against 43.36% in FY20 (Tamil Nadu, Odisha,

Maharashtra).

Weak albeit improving underwriting performance

Combined ratio continues to remain above 100%, which is similar for peers in the industry and investment income remains

the key source of profitability. The combined ratio was above 100% majorly due to higher loss ratio (Net Claims Incurred /Net

Premium Earned) in the motor segment as compared to the other segment. Loss ratio of Motor stood high at 88% (PY: 92%)

followed by Health at 72% (68%) and Fire at 60% (52%) during FY21. Investment income during FY21 stood at Rs.473 crore as

against Rs.415 crore during FY20. Operating profit has improved during FY21 despite moderation in GDP majorly due to the

lower reinsurance ceding and lower loss ratio especially in the motor segment because of Covid-19 lockdown. With the lower

Ceding, risk retention ratio has increased to 74.18% during FY21 from 63.35% during FY20. Net profit remained lower in FY20

due to write-off of Rs.65 crore and provisions of Rs.23 crore on its exposure to one of the investments which had become

NPA. The company also made provision of Rs.17 crore and written-off another Rs.10 crore during FY21 for the same

exposure.

During FY21, Royal Sundaram reported a PAT of Rs.158 crore on a GDP of Rs.2,822 crore and operating profit of Rs.166 crore

as against a PAT of Rs.25 crore on a GDP of Rs.3,667 crore and operating profit of Rs.65 crore during FY20. During Q1FY22,

Royal Sundaram reported a PAT of Rs.61 crore on a GDP of Rs.619 crore and operating profit of Rs.56 crore.

The company is looking at improving the loss ratio by improving share of non-motor segments with increasing its focus in

retail health and commercial segments.

2 CARE Ratings Limited

Press Release

Industry Outlook

Despite the manifold challenges present in the current scenario, the non-life industry ended FY21 on a positive note with a

single-digit growth of 5.2% during FY21. The growth was driven by the private sector who grew at a much faster pace

compared to the public sector. Within the various segments, fire and retail health has contributed to the growth in the

industry, however, the growth momentum was pulled by the fall in motor insurance premiums. In FY22, along with the

expected uptick in the health segment, any increase in the premium levels of the Motor TP segment, which was held steady

in FY21, could drive the non-life premiums.

Impact of Covid-19

During Q1FY21, GDP of general insurers has degrown 6.7% Y-o-Y majorly because of the pandemic-led lockdown due to

Covid-19. Despite the second wave of Covid-19, GDP has grown 11% Y-o-Y in Q1FY22. In trend with the industry, GDP of

Royal Sundaram has degrown 18.6% in Q1FY21 and grown at 6.0% in Q1FY22.

During Q1FY22, loss ratio and combined ratio stood at 86.06% and 112.50% as against 66.82% and 93.60% during Q1FY21,

respectively. Loss ratio was significantly lower during Q1FY21 majorly due to the lower claims in motor segment because of

Covid-19 lockdown.

Liquidity: Adequate

As on March 31, 2021, Royal Sundaram holds Rs.74 crore cash for the daily operations and total investment of Rs.6,484 crore

as on March 31, 2021, out of which Rs.5,797 crore is invested in debt securities. As on March 31, 2021, the company has

11.36% of the debt portfolio with residual tenure of less than 1-year. Of the investments, 43.89% was rated AAA and 48.21%

are issued by central and state governments. It is to be noted that significant portion of debt securities is readily marketable

in nature and offers sufficient liquidity cushion to the company.

Analytical approach: Standalone approach along with factoring in the linkages with promoter, Sundaram Finance Limited

(SFL).

Applicable Criteria

Criteria on assigning ‘Outlook’ and ‘Credit Watch’ to Credit Ratings

CARE’s Policy on Default Recognition

Financial Ratios - Insurance Sector

CARE's Rating Methodology for Insurance Companies

Rating Methodology: Notching by Factoring Linkages in Ratings

About the Company

Royal Sundaram General Insurance Co. Limited (formerly known as Royal Sundaram Alliance Insurance Company Limited) was

incorporated in August 2000 and got license from IRDAI in October 2000 as first private sector general insurance company in

India. The company offers complete bouquet of general insurance products like fire, marine, health, personal accident,

liability, travel, etc., while, Motor (OD + TP) remained as the major product with 70.11% of GDP during FY21. During FY21, the

company has a market share of 2.9% among private general insurance players.

As on March 31, 2021, Royal Sundaram serves around 2.80 crore customers through its branch network of 159 spread across

all states and UTs of India and an employee base of 2,323 and Tamil Nadu contributed 19.17% of the total GDP during FY21.

As on March 31, 2021, Sundaram Finance Limited holds 50.00%, Ageas Insurance International N.V. holds 40.00% and the

other Indian shareholders hold the remaining 10.00% in Royal Sundaram.

Brief Financials (Rs. Crore) FY20 (A) FY21 (A)

Gross Direct Premium 3,667 2,822

PAT 25 158

Total Assets 6,730 7,469

Tangible Networth 1,022 1,337

Net NPA (%) 1.53 0.93

Solvency Ratio 1.69 1.87

A: Audited;

Status of non-cooperation with previous CRA: Not Applicable

Any other information: Not Applicable

Rating History for last three years: Please refer Annexure-2

Complexity level of various instruments rated for this company: Please refer Annexure-3

Covenants of rated instrument / facility: Not Applicable

3 CARE Ratings Limited

Press Release

Annexure-1: Details of Instruments/Facilities

Name of the ISIN Date of Coupon Maturity Size of the Issue Rating assigned along

Instrument Issuance Rate Date (Rs. crore) with Rating Outlook

Debt-Subordinate Debt - - - - 176.00 CARE AA+; Stable

Annexure-2: Rating History of last three years

Current Ratings Rating history

Sr. Name of the Amount Date(s) & Date(s) & Date(s) & Date(s) &

No. Instrument/Bank Type Rating Rating(s) Rating(s) Rating(s) Rating(s)

Facilities Outstanding

(Rs. crore) assigned in assigned in assigned in assigned in

2021-2022 2020-2021 2019-2020 2018-2019

1. Debt-Subordinate Debt LT 176.00 CARE AA+; Stable - - - -

Annexure-3: Complexity level of various instruments rated for this company

Sr. No. Name of the Instrument Complexity Level

1. Debt-Subordinate Debt Complex

Note on complexity levels of the rated instrument: CARE has classified instruments rated by it on the basis of complexity. This

classification is available at www.careratings.com. Investors/market intermediaries/regulators or others are welcome to write

to care@careratings.com for any clarifications.

4 CARE Ratings Limited

no reviews yet

Please Login to review.