215x Filetype PDF File size 0.05 MB Source: insurance.kotak.com

List of Bhayankar Bimaari (Critical Illness) That Are

Covered in 37 Critical Illness

Most people want to live their lives to the fullest but are they aware of the uncertainties that are

marked along the journey? To overcome the unknown nature of life, you need to be ready for all

kinds of situations. This is what a Poora Plan does for you by completing your life insurance

plan with rider benefits. It secures you from circumstances like getting diagnosed with a major

illness and completes your adhoora insurance policy. Just the way having airbags in your car

provides you with that extra safety while driving.

What Is Critical Illness Rider?

A rider is an additional benefit that can be added to your base plan to increase the coverage

and secure yourself from unforeseen events. There are numerous riders that can be added to

an insurance policy out of which critical illness rider is one of them. Critical illness rider provides

coverage from a number of major illnesses and extends these perks beyond the insurance

policy benefits. Kotak Life Insurance gives you protection from thirty-seven major health

ailments and makes you eligible for a lump sum payout on the diagnosis of the illness. The

usage of the lump sum amount is not limited just to medical expenses and income replacement

but can also be used to pay for indirect expenses like home loans, bills, rent, etc. With the

ever-present ambiguity in life, this kind of rider benefit safeguards you and your family by

presenting you with Poora Plan which is a base plan with rider benefits.

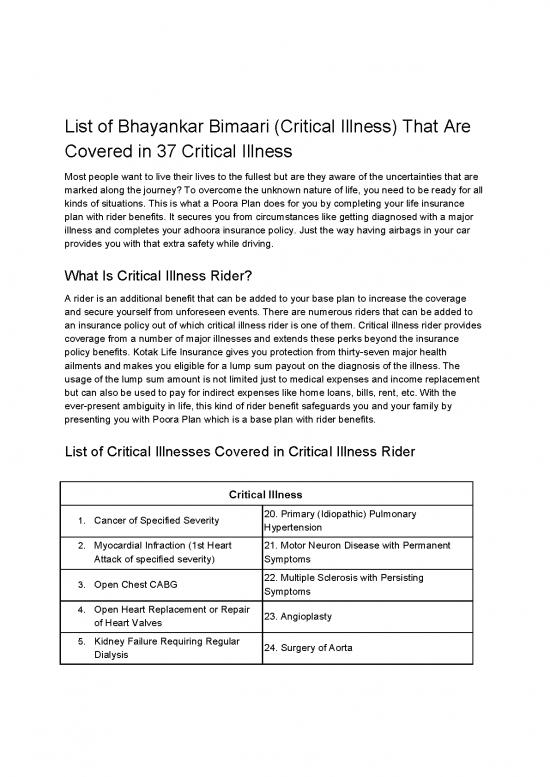

List of Critical Illnesses Covered in Critical Illness Rider

Critical Illness

20. Primary (Idiopathic) Pulmonary

1. Cancer of Specified Severity

Hypertension

2. Myocardial Infraction (1st Heart 21. Motor Neuron Disease with Permanent

Attack of specified severity) Symptoms

22. Multiple Sclerosis with Persisting

3. Open Chest CABG

Symptoms

4. Open Heart Replacement or Repair

23. Angioplasty

of Heart Valves

5. Kidney Failure Requiring Regular

24. Surgery of Aorta

Dialysis

6. Stroke resulting in Permanent

25. Apallic Syndrome

Symptoms

7. Major Organ/ Bone Marrow

26. Loss of Independent Existence

Transplant

8. Permanent Paralysis of limbs 27. Cardiomyopathy

9. Loss of Limbs 28.Brain Surgery

10. Third Degree Burns 29. Alzheimer’s Disease

11. Blindness 30. Parkinson’s Disease

12. End-Stage Liver Failure 31. Muscular Dystrophy

13. End-Stage Lung Failure 32. Poliomyelitis

14. Coma of Specified Severity 33. Medullary Cystic Disease

34. Systematic Lupus Erythematosus with

15. Major Head Trauma

Renal Involvement

16. Benign Brain Tumour 35. Aplastic Anaemia

17. Deafness 36. Bacterial Meningitis

18. Loss of Speech 37. Encephalitis

19. Fulminant Viral Hepatitis

Features of Critical Illness Rider

● Protection against thirty-seven major illnesses

● Lump-sum payout on diagnosis of critical illnesses

● Flexibility for payment of premiums

● Option of opting for rider benefit while buying the policy or on the policy anniversary

Benefits of Critical Illness Rider

Here are some benefits of buying a critical illness rider along with your base insurance plan:

● You can avail tax benefit under Section 80C and 80D of the Income Tax Act, 1961 with

the critical illness rider

● The rider covers some of the major illnesses which are not covered by a life insurance

policy

● The thirty-seven major illnesses include cancer, brain tumor, Alzheimer’s Disease,

Parkinson’s Disease, blindness, permanent paralysis of limbs, etc.

● Opting for the rider benefit enables you to use it for income replacement

● The rider can be availed to pay for medical expenses like treatment and medication

Get Poora Plan today and add rider benefits to enhance your life insurance policy because an

aadha plan results in an adhoora coverage. Kotak Life Insurance encourages the new

customers to buy a complete plan with riders that gives them 360-degree protection and the

existing customers to add riders to their plans.

no reviews yet

Please Login to review.