233x Filetype PDF File size 0.15 MB Source: digital.hungamatech.com

Tata AIA Life Insurance Navkalyan Yojana to: (i) A written application from the Policyholder for reinstatement / Insurance Act, 1938, Section 45 • This product brochure should be read along with sales

Modal loading is as follows: revival; (ii) Current health certificate and other evidence of insurability Illustration.

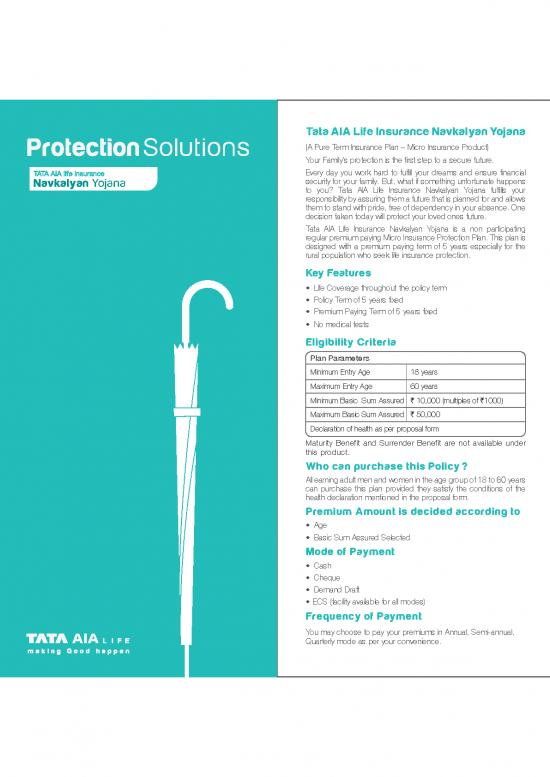

(A Pure Term Insurance Plan – Micro Insurance Product) Annual Premium Rate : No loading No policy of life insurance effected before the commencement of

satisfactory to Us; (iii) Payment of all overdue premiums with interest. this Act shall after the expiry of two years from the date of • This product is underwritten by Tata AIA Life Insurance

Your Family’s protection is the first step to a secure future. Semi-Annual Premium Rate : Multiply Annual Premium Rate by 0.51 Any - revival shall only cover loss or Insured event which occurs after commencement of this Act and no policy of life insurance effected Company Ltd.

Every day you work hard to fulfill your dreams and ensure financial Quarterly Premium Rate : Multiply Annual Premium Rate by 0.26 the -revival. after the coming into force of this Act shall, after the expiry of two • Insurance is the subject matter of the solicitation.

Navkalyan Yojana security for your family. But, what if something unfortunate happens Indicative Premium Rates Please note any revival can take place only within the policy term. years from the date on which it was effected be called in question by • Insurance cover is available under this product.

to you? Tata AIA Life Insurance Navkalyan Yojana fulfills your an insurer on the ground that statement made in the proposal or in

responsibility by assuring them a future that is planned for and allows Sample annual premium rates for Basic Sum Assured of R 10000 Free Look Period any report of a medical officer, or referee, or friend of the insured, or • This product will be offered only to standard lives

them to stand with pride, free of dependency in your absence. One Entry Premium Death If You are not satisfied with the terms & conditions/ features of the in any other document leading to the issue of the policy, was • Taxes will be applicable as per governing laws. Tata AIA life

decision taken today will protect your loved ones future. policy, you have the right to cancel the Policy by providing written inaccurate or false, unless the insurer shows that such statement Insurance Company Limited reserves the right to deduct from the

Tata AIA Life Insurance Navkalyan Yojana is a non participating Age Benefit was on a material matter or suppressed facts which it was material policyholder, any levies and duties (including TDS), as imposed by

regular premium paying Micro Insurance Protection Plan. This plan is 18 116 10000 notice to the Company and receive a refund of all premiums paid the government from time to time.

designed with a premium paying term of 5 years especially for the without interest after deducting a) Proportionate risk premium for the to disclose and that it was fraudulently made by the policy holder

rural population who seek life insurance protection. 25 120 10000 period on cover, b) Stamp duty and medical examination costs and that the policy holder knew at the time of making it that the

35 131 10000 which have been incurred for issuing the Policy. Such notice must statement was false or that it suppressed facts which it was material

Key Features 45 187 10000 be signed by you and received directly by the Company within 15 to disclose.

days after you or person authorised by You receive the Policy Provided that nothing in this section shall prevent the insurer from

• Life Coverage throughout the policy term 55 346 10000 Document. The said period of 15 days shall stand extended to 30 calling for proof of age at any time if he is entitled to do so, and no

• Policy Term of 5 years fixed 60 488 10000 days, if the policy is sourced through distance marketing mode policy shall be deemed to be called in question merely because the

• Premium Paying Term of 5 years fixed which includes solicitation through any means of communication terms of the policy are adjusted on subsequent proof that the age of

Policy Benefits other than in person. the life insured was incorrectly stated in the proposal.

• No medical tests Death Benefit Exclusion

Eligibility Criteria The Nominee /Legal heir will be paid the Death Benefit i.e Sum In case of death due to suicide by the Insured, whether sane or About Tata AIA Life

Plan Parameters Assured on Death, in the event of unfortunate death of the Insured insane, within 12 months from the date of commencement/ Tata AIA Life Insurance Company Limited (Tata AIA Life) is a joint

during the term of the Policy, provided the Policy is in force on the Revival the nominee shall be entitled to “Total Premiums Paid”, venture company, formed by Tata Sons and AIA Group Limited

Minimum Entry Age 18 years date of death of the Life Insured provided the Policy is in force. (AIA). Tata AIA Life combines Tata’s pre-eminent leadership position

Maximum Entry Age 60 years “Sum Assured on death” shall be defined as the highest Policy Loan in India and AIA’s presence as the largest, independent listed

of the following: Policy Loan not available under this product pan-Asia life insurance group in the world spanning 17 markets in

Minimum Basic Sum Assured R 10,000 (multiples of r1000) Asia Pacific. Tata Sons holds a majority stake (74 per cent) in the

Maximum Basic Sum Assured R 50,000 • Basic Sum Assured Nomination and Assignment company and AIA holds (26 per cent) through an AIA Group

• 10 times the Annualised Premium As per Section 39 of the Insurance Act, 1938, you may nominate a company. Tata AIA Life Insurance Company Limited was licensed to

Declaration of health as per proposal form • 105% of the Total Premiums Paid operate in India on February 12, 2001 and started operations on

Maturity Benefit and Surrender Benefit are not available under person as the Nominee and where the nominee is a minor, you are April 1, 2001.

The Policy will terminate upon death of the insured and no other required to appoint an Appointee by giving a written notice in

this product. benefit under the policy shall be payable. prescribed format to the Company. Such nomination is valid only if Force Majeure

Who can purchase this Policy ? “Annualised Premium” shall be the premium paid in a year with recorded by the Company and endorsed on this policy. As per

All earning adult men and women in the age group of 18 to 60 years respect to the basic sum assured chosen by the policy holder, Section 38 of the Insurance Act, 1938 you may also assign this If the performance by the Company of any of its obligations herein

can purchase this plan provided they satisfy the conditions of the excluding the underwriting extra premiums and loading for modal policy by giving a written notice in prescribed format to the company, shall be in any way prevented or hindered in consequence of any

health declaration mentioned in the proposal form. premiums, if any. before the maturity of the policy. Assignment of policy shall act of God or State, Strike, Lock out, Legislation or restriction of

Premium Amount is decided according to “Total Premiums Paid" means amount equal to the total premiums automatically cancel a nomination. any Government or other authority or any other circumstances

paid during the premium paying term of the policy. Such amount Insurance Act, 1938, Section 41 (Prohibition of Rebates) beyond the anticipation or control of the Company, the

• Age should be excluding interest, tax, underwriting extra premiums and performance of this contract with prior approval of IRDA shall be

• Basic Sum Assured Selected loading for modal premiums, if any 1. No person shall allow or offer to allow, either directly or indirectly, wholly or partially suspended during the continuance of the

as an inducement to any person to take out or renew or continue FORCE MAJEURE EVENT AND THE COMPANY WILL RESUME

Mode of Payment Grace Period an insurance in respect of any kind of risk relating to lives or THE CONTRACT TERMS AND CONDITIONS WHEN SUCH

• Cash A Grace Period of thirty (30) days, from the due date will be allowed property in India, any rebate of the whole or part of the EVENT CEASE TO EXIST.

• Cheque for payment of each subsequent premium. The Policy will remain in commission payable or any rebate of the premium shown on the

force during this period. If any premium remains unpaid at the end of policy, nor shall any person taking out or renewing or continuing a Disclaimer

• Demand Draft its Grace Period, the Policy shall lapse and have no further value. policy accept any rebate, except such rebate as may be allowed • The brochure is not a contract of insurance. The precise terms

• ECS (facility available for all modes) Revival in accordance with the published prospectuses or tables of and conditions of this plan are specified in the policy contract.

Frequency of Payment the insurer. • Buying a Life Insurance policy is a long-term commitment. An

If a premium is in default beyond the Grace Period and subject to the 2. If any person fails to comply with sub regulation (1) above, he shall early termination of the policy usually involves high costs and the

You may choose to pay your premiums in Annual, Semi-annual, Policy not having been surrendered, it may be revived, at the be liable to payment of a fine which may extend to rupees surrender value payable may be less than the total premium paid.

Quarterly mode as per your convenience. absolute discretion of Tata AIA Life Insurance Company Limited, five hundred.

within two years after the due date of the premium in default subject

Tata AIA Life Insurance Navkalyan Yojana to: (i) A written application from the Policyholder for reinstatement / Insurance Act, 1938, Section 45 • This product brochure should be read along with sales

Modal loading is as follows: revival; (ii) Current health certificate and other evidence of insurability Illustration.

(A Pure Term Insurance Plan – Micro Insurance Product) Annual Premium Rate : No loading satisfactory to Us; (iii) Payment of all overdue premiums with interest. No policy of life insurance effected before the commencement of

Semi-Annual Premium Rate : Multiply Annual Premium Rate by 0.51 this Act shall after the expiry of two years from the date of • This product is underwritten by Tata AIA Life Insurance

Your Family’s protection is the first step to a secure future. Any - revival shall only cover loss or Insured event which occurs after commencement of this Act and no policy of life insurance effected Company Ltd.

Every day you work hard to fulfill your dreams and ensure financial Quarterly Premium Rate : Multiply Annual Premium Rate by 0.26 the -revival. after the coming into force of this Act shall, after the expiry of two • Insurance is the subject matter of the solicitation.

security for your family. But, what if something unfortunate happens Indicative Premium Rates Please note any revival can take place only within the policy term. years from the date on which it was effected be called in question by • Insurance cover is available under this product.

to you? Tata AIA Life Insurance Navkalyan Yojana fulfills your an insurer on the ground that statement made in the proposal or in

responsibility by assuring them a future that is planned for and allows Sample annual premium rates for Basic Sum Assured of R 10000Free Look Period any report of a medical officer, or referee, or friend of the insured, or • This product will be offered only to standard lives

them to stand with pride, free of dependency in your absence. One Entry Premium Death If You are not satisfied with the terms & conditions/ features of the in any other document leading to the issue of the policy, was • Taxes will be applicable as per governing laws. Tata AIA life

decision taken today will protect your loved ones future. policy, you have the right to cancel the Policy by providing written inaccurate or false, unless the insurer shows that such statement Insurance Company Limited reserves the right to deduct from the

Tata AIA Life Insurance Navkalyan Yojana is a non participating Age Benefit was on a material matter or suppressed facts which it was material policyholder, any levies and duties (including TDS), as imposed by

regular premium paying Micro Insurance Protection Plan. This plan is 18 116 10000 notice to the Company and receive a refund of all premiums paid the government from time to time.

designed with a premium paying term of 5 years especially for the without interest after deducting a) Proportionate risk premium for the to disclose and that it was fraudulently made by the policy holder

rural population who seek life insurance protection. 25 120 10000 period on cover, b) Stamp duty and medical examination costs and that the policy holder knew at the time of making it that the

35 131 10000 which have been incurred for issuing the Policy. Such notice must statement was false or that it suppressed facts which it was material

Key Features 45 187 10000 be signed by you and received directly by the Company within 15 to disclose.

days after you or person authorised by You receive the Policy Provided that nothing in this section shall prevent the insurer from

• Life Coverage throughout the policy term 55 346 10000 Document. The said period of 15 days shall stand extended to 30 calling for proof of age at any time if he is entitled to do so, and no

• Policy Term of 5 years fixed 60 488 10000 days, if the policy is sourced through distance marketing mode policy shall be deemed to be called in question merely because the

• Premium Paying Term of 5 years fixed which includes solicitation through any means of communication terms of the policy are adjusted on subsequent proof that the age of

Policy Benefits other than in person. the life insured was incorrectly stated in the proposal.

• No medical tests Death Benefit Exclusion

Eligibility CriteriaThe Nominee /Legal heir will be paid the Death Benefit i.e Sum In case of death due to suicide by the Insured, whether sane or About Tata AIA Life

Plan Parameters Assured on Death, in the event of unfortunate death of the Insured insane, within 12 months from the date of commencement/ Tata AIA Life Insurance Company Limited (Tata AIA Life) is a joint

during the term of the Policy, provided the Policy is in force on the Revival the nominee shall be entitled to “Total Premiums Paid”, venture company, formed by Tata Sons and AIA Group Limited

Minimum Entry Age 18 years date of death of the Life Insured provided the Policy is in force. (AIA). Tata AIA Life combines Tata’s pre-eminent leadership position

Maximum Entry Age 60 years “Sum Assured on death” shall be defined as the highest Policy Loan in India and AIA’s presence as the largest, independent listed

of the following: Policy Loan not available under this product pan-Asia life insurance group in the world spanning 17 markets in

Minimum Basic Sum Assured R 10,000 (multiples of r1000) Asia Pacific. Tata Sons holds a majority stake (74 per cent) in the

Maximum Basic Sum Assured R 50,000• Basic Sum Assured Nomination and Assignment company and AIA holds (26 per cent) through an AIA Group

• 10 times the Annualised Premium As per Section 39 of the Insurance Act, 1938, you may nominate a company. Tata AIA Life Insurance Company Limited was licensed to

Declaration of health as per proposal form • 105% of the Total Premiums Paid operate in India on February 12, 2001 and started operations on

Maturity Benefit and Surrender Benefit are not available under person as the Nominee and where the nominee is a minor, you are April 1, 2001.

The Policy will terminate upon death of the insured and no other required to appoint an Appointee by giving a written notice in

this product.benefit under the policy shall be payable. prescribed format to the Company. Such nomination is valid only if Force Majeure

Who can purchase this Policy ?“Annualised Premium” shall be the premium paid in a year with recorded by the Company and endorsed on this policy. As per

All earning adult men and women in the age group of 18 to 60 years respect to the basic sum assured chosen by the policy holder, Section 38 of the Insurance Act, 1938 you may also assign this If the performance by the Company of any of its obligations herein

can purchase this plan provided they satisfy the conditions of the excluding the underwriting extra premiums and loading for modal policy by giving a written notice in prescribed format to the company, shall be in any way prevented or hindered in consequence of any

health declaration mentioned in the proposal form.premiums, if any. before the maturity of the policy. Assignment of policy shall act of God or State, Strike, Lock out, Legislation or restriction of

Premium Amount is decided according to“Total Premiums Paid" means amount equal to the total premiums automatically cancel a nomination. any Government or other authority or any other circumstances

paid during the premium paying term of the policy. Such amount Insurance Act, 1938, Section 41 (Prohibition of Rebates) beyond the anticipation or control of the Company, the

• Age should be excluding interest, tax, underwriting extra premiums and performance of this contract with prior approval of IRDA shall be

• Basic Sum Assured Selected loading for modal premiums, if any 1. No person shall allow or offer to allow, either directly or indirectly, wholly or partially suspended during the continuance of the

as an inducement to any person to take out or renew or continue FORCE MAJEURE EVENT AND THE COMPANY WILL RESUME

Mode of Payment Grace Period an insurance in respect of any kind of risk relating to lives or THE CONTRACT TERMS AND CONDITIONS WHEN SUCH

• Cash A Grace Period of thirty (30) days, from the due date will be allowed property in India, any rebate of the whole or part of the EVENT CEASE TO EXIST.

• Chequefor payment of each subsequent premium. The Policy will remain in commission payable or any rebate of the premium shown on the

force during this period. If any premium remains unpaid at the end of policy, nor shall any person taking out or renewing or continuing a Disclaimer

• Demand Draft its Grace Period, the Policy shall lapse and have no further value. policy accept any rebate, except such rebate as may be allowed • The brochure is not a contract of insurance. The precise terms

• ECS (facility available for all modes)Revival in accordance with the published prospectuses or tables of and conditions of this plan are specified in the policy contract.

Frequency of Payment the insurer. • Buying a Life Insurance policy is a long-term commitment. An

If a premium is in default beyond the Grace Period and subject to the 2. If any person fails to comply with sub regulation (1) above, he shall early termination of the policy usually involves high costs and the

You may choose to pay your premiums in Annual, Semi-annual, Policy not having been surrendered, it may be revived, at the be liable to payment of a fine which may extend to rupees surrender value payable may be less than the total premium paid.

Quarterly mode as per your convenience.absolute discretion of Tata AIA Life Insurance Company Limited, five hundred.

within two years after the due date of the premium in default subject

Tata AIA Life Insurance Navkalyan Yojanato: (i) A written application from the Policyholder for reinstatement / Insurance Act, 1938, Section 45• This product brochure should be read along with sales

Modal loading is as follows:revival; (ii) Current health certificate and other evidence of insurability Illustration.

(A Pure Term Insurance Plan – Micro Insurance Product) Annual Premium Rate : No loadingNo policy of life insurance effected before the commencement of

satisfactory to Us; (iii) Payment of all overdue premiums with interest.this Act shall after the expiry of two years from the date of • This product is underwritten by Tata AIA Life Insurance

Your Family’s protection is the first step to a secure future.Semi-Annual Premium Rate : Multiply Annual Premium Rate by 0.51Any - revival shall only cover loss or Insured event which occurs after commencement of this Act and no policy of life insurance effected Company Ltd.

Every day you work hard to fulfill your dreams and ensure financial Quarterly Premium Rate : Multiply Annual Premium Rate by 0.26 the -revival.after the coming into force of this Act shall, after the expiry of two • Insurance is the subject matter of the solicitation.

security for your family. But, what if something unfortunate happens Indicative Premium RatesPlease note any revival can take place only within the policy term.years from the date on which it was effected be called in question by • Insurance cover is available under this product.

to you? Tata AIA Life Insurance Navkalyan Yojana fulfills your an insurer on the ground that statement made in the proposal or in

responsibility by assuring them a future that is planned for and allows Sample annual premium rates for Basic Sum Assured of R 10000Free Look Periodany report of a medical officer, or referee, or friend of the insured, or • This product will be offered only to standard lives

them to stand with pride, free of dependency in your absence. One Entry Premium Death If You are not satisfied with the terms & conditions/ features of the in any other document leading to the issue of the policy, was • Taxes will be applicable as per governing laws. Tata AIA life

decision taken today will protect your loved ones future.policy, you have the right to cancel the Policy by providing written inaccurate or false, unless the insurer shows that such statement Insurance Company Limited reserves the right to deduct from the

Tata AIA Life Insurance Navkalyan Yojana is a non participating Age Benefitwas on a material matter or suppressed facts which it was material policyholder, any levies and duties (including TDS), as imposed by

regular premium paying Micro Insurance Protection Plan. This plan is 18 116 10000notice to the Company and receive a refund of all premiums paid the government from time to time.

designed with a premium paying term of 5 years especially for the without interest after deducting a) Proportionate risk premium for the to disclose and that it was fraudulently made by the policy holder

rural population who seek life insurance protection. 25 120 10000period on cover, b) Stamp duty and medical examination costs and that the policy holder knew at the time of making it that the

35 131 10000which have been incurred for issuing the Policy. Such notice must statement was false or that it suppressed facts which it was material

Key Features 45 187 10000be signed by you and received directly by the Company within 15 to disclose.

days after you or person authorised by You receive the Policy Provided that nothing in this section shall prevent the insurer from

• Life Coverage throughout the policy term 55 346 10000Document. The said period of 15 days shall stand extended to 30 calling for proof of age at any time if he is entitled to do so, and no

• Policy Term of 5 years fixed 60 488 10000days, if the policy is sourced through distance marketing mode policy shall be deemed to be called in question merely because the

• Premium Paying Term of 5 years fixedwhich includes solicitation through any means of communication terms of the policy are adjusted on subsequent proof that the age of

Policy Benefits other than in person. the life insured was incorrectly stated in the proposal.

• No medical tests Death Benefit Exclusion

Eligibility CriteriaThe Nominee /Legal heir will be paid the Death Benefit i.e Sum In case of death due to suicide by the Insured, whether sane or About Tata AIA Life

Plan Parameters Assured on Death, in the event of unfortunate death of the Insured insane, within 12 months from the date of commencement/ Tata AIA Life Insurance Company Limited (Tata AIA Life) is a joint

during the term of the Policy, provided the Policy is in force on the Revival the nominee shall be entitled to “Total Premiums Paid”, venture company, formed by Tata Sons and AIA Group Limited

Minimum Entry Age 18 years date of death of the Life Insured provided the Policy is in force.(AIA). Tata AIA Life combines Tata’s pre-eminent leadership position

Maximum Entry Age 60 years “Sum Assured on death” shall be defined as the highest Policy Loanin India and AIA’s presence as the largest, independent listed

of the following:Policy Loan not available under this product pan-Asia life insurance group in the world spanning 17 markets in

Minimum Basic Sum Assured R 10,000 (multiples of r1000)Asia Pacific. Tata Sons holds a majority stake (74 per cent) in the

Maximum Basic Sum Assured R 50,000• Basic Sum AssuredNomination and Assignmentcompany and AIA holds (26 per cent) through an AIA Group

• 10 times the Annualised PremiumAs per Section 39 of the Insurance Act, 1938, you may nominate a company. Tata AIA Life Insurance Company Limited was licensed to

Declaration of health as per proposal form • 105% of the Total Premiums Paidoperate in India on February 12, 2001 and started operations on

Maturity Benefit and Surrender Benefit are not available under person as the Nominee and where the nominee is a minor, you are April 1, 2001.

The Policy will terminate upon death of the insured and no other required to appoint an Appointee by giving a written notice in

this product.benefit under the policy shall be payable.prescribed format to the Company. Such nomination is valid only if Force Majeure

Who can purchase this Policy ?“Annualised Premium” shall be the premium paid in a year with recorded by the Company and endorsed on this policy. As per

All earning adult men and women in the age group of 18 to 60 years respect to the basic sum assured chosen by the policy holder, Section 38 of the Insurance Act, 1938 you may also assign this If the performance by the Company of any of its obligations herein

can purchase this plan provided they satisfy the conditions of the excluding the underwriting extra premiums and loading for modal policy by giving a written notice in prescribed format to the company, shall be in any way prevented or hindered in consequence of any

health declaration mentioned in the proposal form.premiums, if any.before the maturity of the policy. Assignment of policy shall act of God or State, Strike, Lock out, Legislation or restriction of

Premium Amount is decided according to“Total Premiums Paid" means amount equal to the total premiums automatically cancel a nomination.any Government or other authority or any other circumstances

paid during the premium paying term of the policy. Such amount Insurance Act, 1938, Section 41 (Prohibition of Rebates)beyond the anticipation or control of the Company, the

• Age should be excluding interest, tax, underwriting extra premiums and performance of this contract with prior approval of IRDA shall be

• Basic Sum Assured Selected loading for modal premiums, if any1. No person shall allow or offer to allow, either directly or indirectly, wholly or partially suspended during the continuance of the

as an inducement to any person to take out or renew or continue FORCE MAJEURE EVENT AND THE COMPANY WILL RESUME

Mode of Payment Grace Period an insurance in respect of any kind of risk relating to lives or THE CONTRACT TERMS AND CONDITIONS WHEN SUCH

• CashA Grace Period of thirty (30) days, from the due date will be allowed property in India, any rebate of the whole or part of the EVENT CEASE TO EXIST.

• Chequefor payment of each subsequent premium. The Policy will remain in commission payable or any rebate of the premium shown on the

force during this period. If any premium remains unpaid at the end of policy, nor shall any person taking out or renewing or continuing a DisclaimerBeware of Spurious Phone calls and Fictitious/Fraudulent offers:

• Demand Draft its Grace Period, the Policy shall lapse and have no further value. policy accept any rebate, except such rebate as may be allowed • The brochure is not a contract of insurance. The precise terms IRDA clarifies to public that

• ECS (facility available for all modes)Revival in accordance with the published prospectuses or tables of and conditions of this plan are specified in the policy contract.• IRDA or its officials do not involve in activities like sale of any kind

Frequency of Payment the insurer.• Buying a Life Insurance policy is a long-term commitment. An of insurance or financial products nor invest premiums.

If a premium is in default beyond the Grace Period and subject to the 2. If any person fails to comply with sub regulation (1) above, he shall early termination of the policy usually involves high costs and the

You may choose to pay your premiums in Annual, Semi-annual, Policy not having been surrendered, it may be revived, at the be liable to payment of a fine which may extend to rupees surrender value payable may be less than the total premium paid.• IRDA does not announce any bonus. Public receiving such phone

Quarterly mode as per your convenience.absolute discretion of Tata AIA Life Insurance Company Limited, five hundred. calls are requested to lodge a police complaint along with details of

within two years after the due date of the premium in default subject phone call, number.

Tata AIA Life Insurance Company Limited

(IRDA Regn. No.110) CIN - U66010MH2000PLC128403

Registered & Corporate Office

14th Floor, Tower A, Peninsula Business Park,

Senapati Bapat Marg, Lower Parel, Mumbai - 400013

For any information including cancellation, claims and complaints,

please contact our Insurance advisor or visit Tata AIA Life’s nearest

branch office or call 1-800-267-9966 (toll free) and 1-860-266-9966

(wherein local charges would apply) or write to us at

customercare@tataaia.com.

Visit us at: www.tataaia.com or SMS 'LIFE’ to 58888

Unique Reference Number: L&C/Advt/2014/Jan/025

UIN: 110N115V01 PRBR00919

no reviews yet

Please Login to review.