182x Filetype XLS File size 0.05 MB Source: www.stocktradersalmanac.com

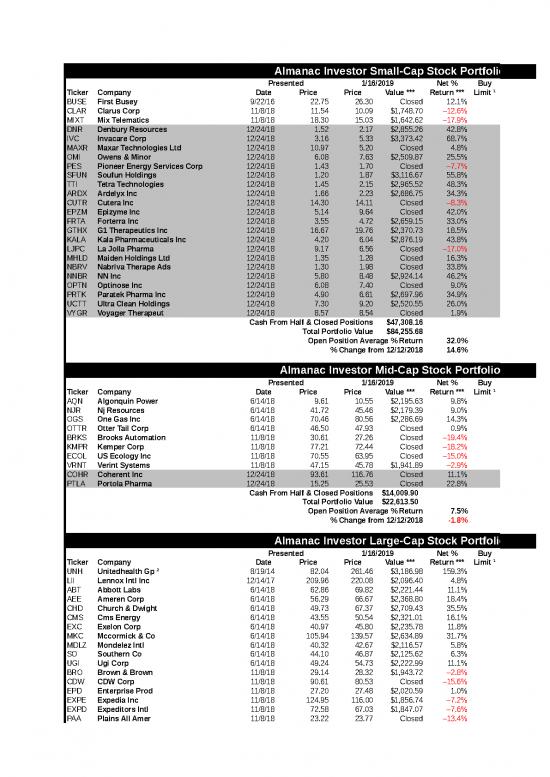

Almanac Investor Small-Cap Stock Portfolio

Presented 1/16/2019 Net % Buy

Ticker Company Date Price Price Value *** Return *** Limit ¹

BUSE First Busey 9/22/16 22.75 26.30 Closed 12.1%

CLAR Clarus Corp 11/8/18 11.54 10.09 $1,748.70 –12.6%

MIXT Mix Telematics 11/8/18 18.30 15.03 $1,642.62 –17.9%

DNR Denbury Resources 12/24/18 1.52 2.17 $2,855.26 42.8%

IVC Invacare Corp 12/24/18 3.16 5.33 $3,373.42 68.7%

MAXR Maxar Technologies Ltd 12/24/18 10.97 5.20 Closed 4.8%

OMI Owens & Minor 12/24/18 6.08 7.63 $2,509.87 25.5%

PES Pioneer Energy Services Corp 12/24/18 1.43 1.70 Closed –7.7%

SFUN Soufun Holdings 12/24/18 1.20 1.87 $3,116.67 55.8%

TTI Tetra Technologies 12/24/18 1.45 2.15 $2,965.52 48.3%

ARDX Ardelyx Inc 12/24/18 1.66 2.23 $2,686.75 34.3%

CUTR Cutera Inc 12/24/18 14.30 14.11 Closed –8.3%

EPZM Epizyme Inc 12/24/18 5.14 9.64 Closed 42.0%

FRTA Forterra Inc 12/24/18 3.55 4.72 $2,659.15 33.0%

GTHX G1 Therapeutics Inc 12/24/18 16.67 19.76 $2,370.73 18.5%

KALA Kala Pharmaceuticals Inc 12/24/18 4.20 6.04 $2,876.19 43.8%

LJPC La Jolla Pharma 12/24/18 9.17 6.56 Closed –17.0%

MHLD Maiden Holdings Ltd 12/24/18 1.35 1.28 Closed 16.3%

NBRV Nabriva Therape Ads 12/24/18 1.30 1.98 Closed 33.8%

NNBR NN Inc 12/24/18 5.80 8.48 $2,924.14 46.2%

OPTN Optinose Inc 12/24/18 6.08 7.40 Closed 9.0%

PRTK Paratek Pharma Inc 12/24/18 4.90 6.61 $2,697.96 34.9%

UCTT Ultra Clean Holdings 12/24/18 7.30 9.20 $2,520.55 26.0%

VYGR Voyager Therapeut 12/24/18 8.57 8.54 Closed 1.9%

Cash From Half & Closed Positions $47,308.16

Total Portfolio Value $84,255.68

Open Position Average % Return 32.0%

% Change from 12/12/2018 14.6%

Almanac Investor Mid-Cap Stock Portfolio

Presented 1/16/2019 Net % Buy

Ticker Company Date Price Price Value *** Return *** Limit ¹

AQN Algonquin Power 6/14/18 9.61 10.55 $2,195.63 9.8%

NJR Nj Resources 6/14/18 41.72 45.46 $2,179.39 9.0%

OGS One Gas Inc 6/14/18 70.46 80.56 $2,286.69 14.3%

OTTR Otter Tail Corp 6/14/18 46.50 47.93 Closed 0.9%

BRKS Brooks Automation 11/8/18 30.61 27.26 Closed –19.4%

KMPR Kemper Corp 11/8/18 77.21 72.44 Closed –18.2%

ECOL US Ecology Inc 11/8/18 70.55 63.95 Closed –15.0%

VRNT Verint Systems 11/8/18 47.15 45.78 $1,941.89 –2.9%

COHR Coherent Inc 12/24/18 93.61 116.76 Closed 11.1%

PTLA Portola Pharma 12/24/18 15.25 25.53 Closed 22.8%

Cash From Half & Closed Positions $14,009.90

Total Portfolio Value $22,613.50

Open Position Average % Return 7.5%

% Change from 12/12/2018 -1.8%

Almanac Investor Large-Cap Stock Portfolio

Presented 1/16/2019 Net % Buy

Ticker Company Date Price Price Value *** Return *** Limit ¹

UNH Unitedhealth Gp ² 8/19/14 82.04 261.46 $3,186.98 159.3%

LII Lennox Intl Inc 12/14/17 209.96 220.08 $2,096.40 4.8%

ABT Abbott Labs 6/14/18 62.86 69.82 $2,221.44 11.1%

AEE Ameren Corp 6/14/18 56.29 66.67 $2,368.80 18.4%

CHD Church & Dwight 6/14/18 49.73 67.37 $2,709.43 35.5%

CMS Cms Energy 6/14/18 43.55 50.54 $2,321.01 16.1%

EXC Exelon Corp 6/14/18 40.97 45.80 $2,235.78 11.8%

MKC Mccormick & Co 6/14/18 105.94 139.57 $2,634.89 31.7%

MDLZ Mondelez Intl 6/14/18 40.32 42.67 $2,116.57 5.8%

SO Southern Co 6/14/18 44.10 46.87 $2,125.62 6.3%

UGI Ugi Corp 6/14/18 49.24 54.73 $2,222.99 11.1%

BRO Brown & Brown 11/8/18 29.14 28.32 $1,943.72 –2.8%

CDW CDW Corp 11/8/18 90.61 80.53 Closed –15.6%

EPD Enterprise Prod 11/8/18 27.20 27.48 $2,020.59 1.0%

EXPE Expedia Inc 11/8/18 124.95 116.00 $1,856.74 –7.2%

EXPD Expeditors Intl 11/8/18 72.58 67.03 $1,847.07 –7.6%

PAA Plains All Amer 11/8/18 23.22 23.77 Closed –13.4%

Cash From Half & Closed Positions -$12,734.11

Total Portfolio Value $21,173.93

Open Position Average % Return 19.7%

% Change from 12/12/2018 -6.9%

Almanac Investor Stock Portfolios Since Inception — July 2001 Through January 16, 2019

Cash From Half & Closed Positions $48,583.95

Total Portfolio Value $128,043.11

Open Position Average % Return 23.4%

% Change from 12/12/2018 7.3%

Portfolio % Gain Since Inception - July 2001 482.0%

S&P 500 Since - July 2001 115.4%

¹ STANDARD POLICY: SELL HALF ON A DOUBLE, Buy Limits good til cancel, Stop only if closed below Stop Loss

² Half position, * Adjusted, ** Canadian Dollars, (S) = Short Trade

*** Based on $1000 or $2000 initial investment in each stock, Net % Return includes half & closed positions, Value is open position value

Almanac Investor Small-Cap Stock Portfolio

Stop

Loss ¹ Current Advice ¹

25.50 Stopped Out 12/14 @ 25.50

8.89 Hold

14.09 Hold

2.11 Hold

4.90 Hold

Stopped Out 1/4 @ 11.50

7.02 Hold

Stopped Out 12/28 @ 1.32

1.80 Hold

2.13 Hold

2.22 Hold

Stopped Out 1/8 @ 13.12

Stopped Out 1/4 @ 7.30

4.34 Hold

18.85 Hold

5.85 Hold

Stopped Out 1/7 @ 7.61

Stopped Out 1/7 @ 1.57

Stopped Out 1/10 @ 1.74

7.98 Hold

Stopped Out 1/2 @ 6.63

6.08 Hold

8.68 Hold

Stopped Out 1/16 @ 8.73

Almanac Investor Mid-Cap Stock Portfolio

Stop

Loss ¹ Current Advice ¹

8.85 Hold

42.16 Hold

72.19 Hold

Stopped Out 1/14 @ 46.90

Stopped Out 12/19, Closed @ 24.66

Stopped Out 12/21, Closed @ 63.18

Stopped Out 12/21 @ 59.97

40.38 Hold

Stopped Out 1/4 @ 103.98

Stopped Out 1/4 @ 18.73

Almanac Investor Large-Cap Stock Portfolio

Stop

Loss ¹ Current Advice ¹

230.04 Hold

187.55 Hold

61.65 Hold

59.36 Hold

57.66 Hold

44.82 Hold

39.86 Hold

131.66 Hold

37.46 Hold

40.42 Hold

49.67 Hold

24.91 Hold

Stopped Out 12/21, Closed @ 76.49

23.29 Hold

106.80 Hold

62.03 Hold

Stopped Out 12/24 @ 20.10

Almanac Investor Stock Portfolios Since Inception — July 2001 Through January 16, 2019

¹ STANDARD POLICY: SELL HALF ON A DOUBLE, Buy Limits good til cancel, Stop only if closed below Stop Loss

² Half position, * Adjusted, ** Canadian Dollars, (S) = Short Trade

*** Based on $1000 or $2000 initial investment in each stock, Net % Return includes half & closed positions, Value is open position value

no reviews yet

Please Login to review.