218x Filetype XLSX File size 0.14 MB Source: www.hcd.ca.gov

DEPARTMENT OF HOUSING AND COMMUNITY DEVELOPMENT

STATE OF CALIFORNIA DIVISION OF FINANCIAL ASSISTANCE

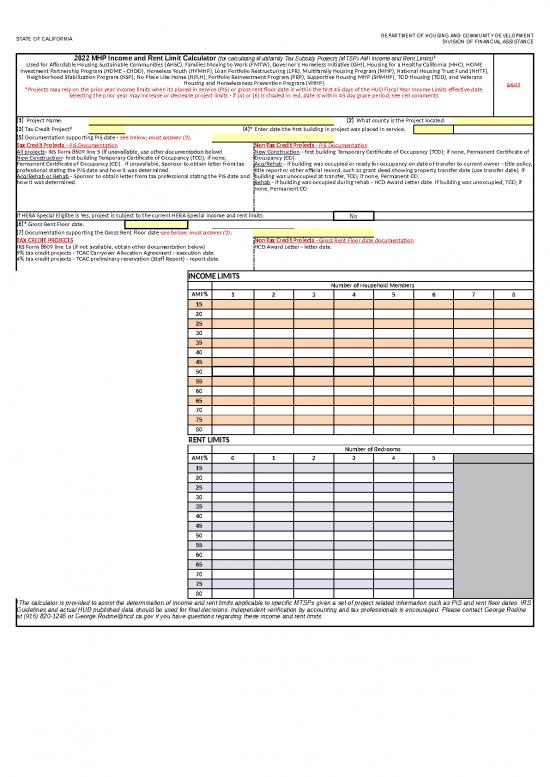

2022 MHP Income and Rent Limit Calculator (for calculating Multifamily Tax Subsidy Projects (MTSP) AMI Income and Rent Limits)1

Used for Affordable Housing Sustainable Communities (AHSC), Families Moving to Work (FMTW), Governor's Homeless Initiative (GHI), Housing for a Healthy California (HHC), HOME

Investment Partnership Program (HOME - CHDO), Homeless Youth (HYMHP), Loan Portfolio Restructuring (LPR), Multifamily Housing Program (MHP), National Housing Trust Fund (NHTF),

Neighborhood Stabilization Program (NSP), No Place Like Home (NPLH), Portfolio Reinvestment Program (PRP), Supportive Housing MHP (SHMHP), TOD Housing (TOD), and Veterans

Housing and Homelessness Prevention Program (VHHP). 5/5/22

*Projects may rely on the prior year income limits when its placed in service (PIS) or gross rent floor date is within the first 45 days of the HUD Fiscal Year Income Limits effective date.

Selecting the prior year may increase or decrease project limits - if (4) or (6) is shaded in red, date is within 45 day grace period; see cell comments.

(1) Project Name: (2) What county is the Project located:

(3) Tax Credit Project? (4)* Enter date the first building in project was placed in service:

(5) Documentation supporting PIS date - see below; must answer (3): Butte

Tax Credit Projects - PIS Documentation Non-Tax Credit Projects - PIS Documentation

All projects- IRS Form 8609 line 5 (if unavailable, use other documentation below) New Construction - first building Temporary Certificate of Occupancy (TCO); if none, Permanent Certificate of

New Construction- first building Temporary Certificate of Occupancy (TCO); if none, Occupancy (CO).

Permanent Certificate of Occupancy (CO). If unavailable, Sponsor to obtain letter from tax Acq/Rehab - if building was occupied or ready for occupancy on date of transfer to current owner - title policy,

professional stating the PIS date and how it was determined. title report or other official record, such as grant deed showing property transfer date (use transfer date). If

Acq/Rehab or Rehab - Sponsor to obtain letter from tax professional stating the PIS date and building was unoccupied at transfer, TCO; if none, Permanent CO.

how it was determined. Rehab - if building was occupied during rehab - HCD Award Letter date. If building was unoccupied, TCO; if

none, Permanent CO.

If HERA Special Eligilbe is Yes, project is subject to the current HERA Special income and rent limits: No Colusa

(6)* Gross Rent Floor date: Contra Costa

(7) Documentation supporting the Gross Rent Floor date-see below; must answer (3): Del Norte

TAX CREDIT PROJECTS Non-Tax Credit Projects - Gross Rent Floor date documentation No_1

IRS Form 8609 line 1a (if not available, obtain other documentation below) HCD Award Letter - letter date.

9% tax credit projects - TCAC Carryover Allocation Agreement - execution date.

4% tax credit projects - TCAC preliminary reservation (Staff Report) - report date.

El Dorado

INCOME LIMITS based on INCOME LIMITS USED FOR RENTS

Number of Household Members

AMI % 1 2 3 4 5 6 7 8

15

20

25

30

35

40

45

50

55

60

65

70

75

80

RENT LIMITS based on Monterey

Number of Bedrooms

AMI % 0 1 2 3 4 5 Nevada

15 Orange

20 Placer

25 Plumas

30 Riverside

35 Sacramento

40 San Benito

45 San Bernardino

50 San Diego

55 San Francisco

60 San Joaquin

65 San Luis Obispo

70 San Mateo

75 Santa Barbara

80 Santa Clara

1

The calculator is provided to assist the determination of income and rent limits applicable to specific MTSPs given a set of project related information such as PIS and rent floor dates. IRS

Guidelines and actual HUD published data should be used for final decisions. Independent verification by accounting and tax professionals is encouraged. Please contact George Rodine

at (916) 820-1245 or George.Rodine@hcd.ca.gov if you have questions regarding these income and rent limits.

no reviews yet

Please Login to review.